Google's parent company, Alphabet (GOOG), reports fourth-quarter and full-year 2025 earnings today, and expectations are high. The setup is unusually sensitive because the stock is already priced for a near-flawless print.

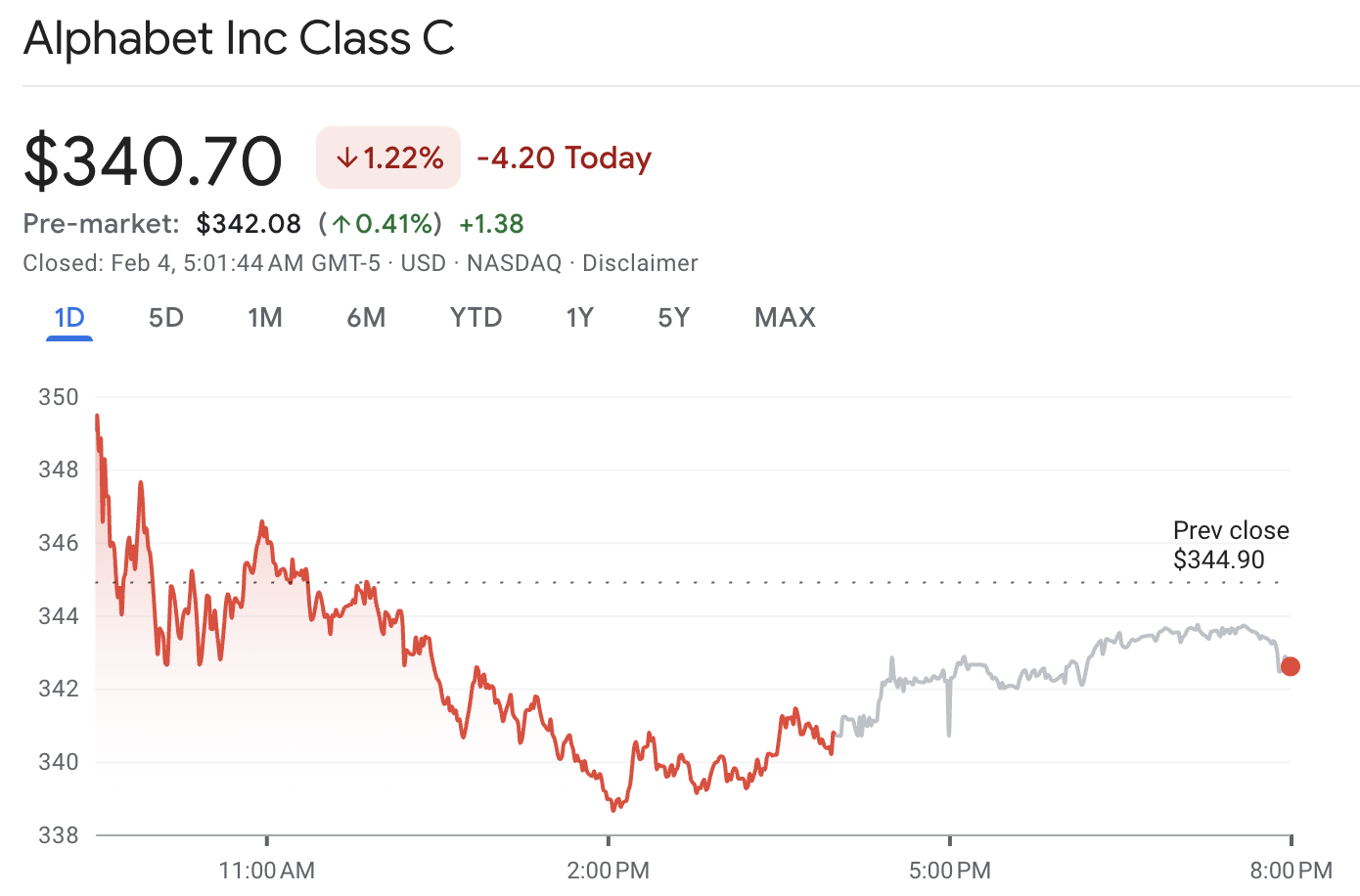

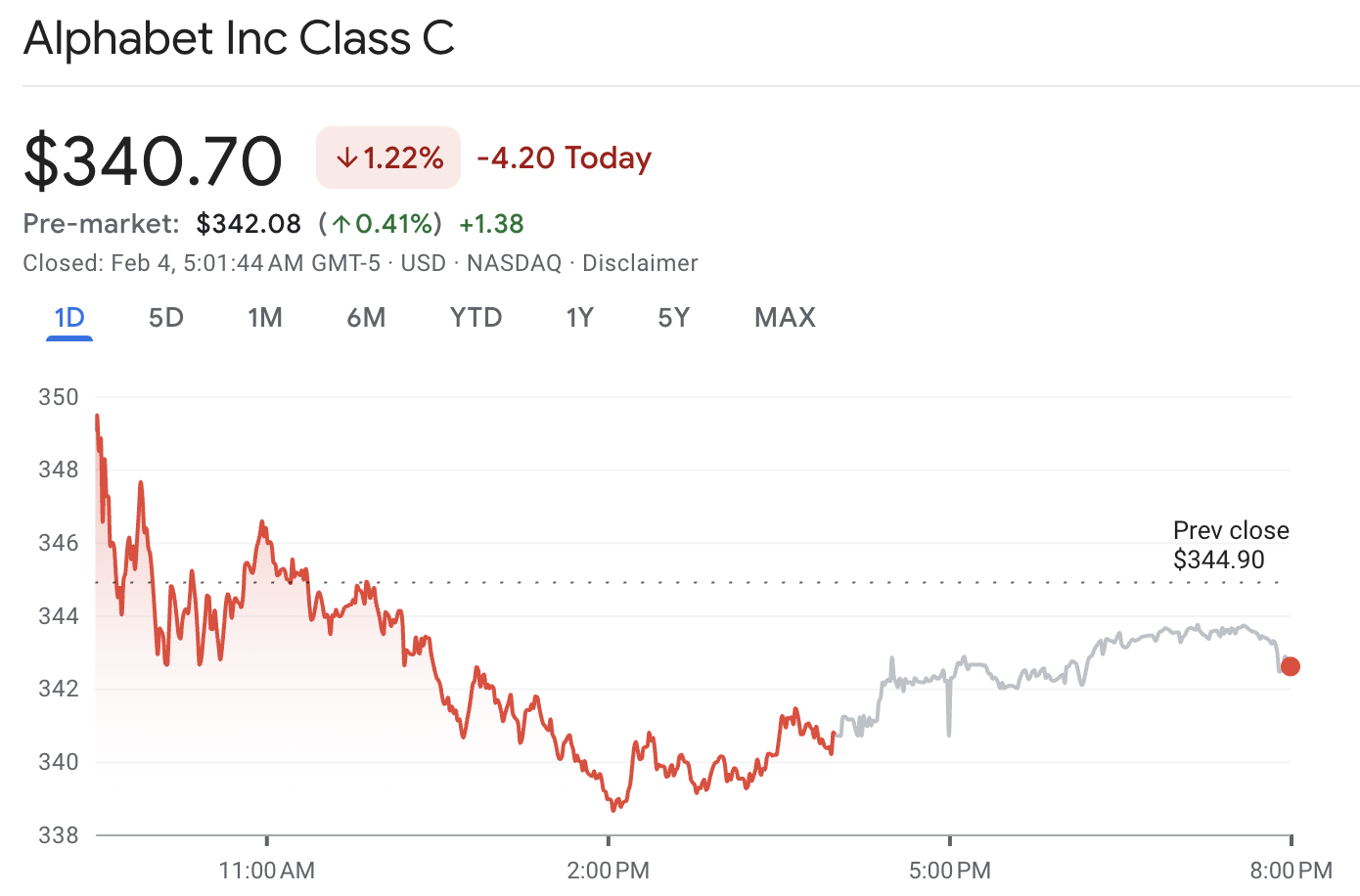

Going into the release, GOOG stock closed at approximately $340.70, with after-hours trading showing a slight increase to around $342.10 after a strong multi-month run that has lifted expectations across Search, YouTube, and Cloud at the same time.

However, this is not a quarter where a small beat on headline EPS automatically means a higher stock price tomorrow.

The market is seeking clear evidence that AI is improving Google's core advertising business, that Google Cloud is expanding while maintaining its profit margins, and that capital expenditures are increasing for valid reasons, not just due to competitive pressures in the infrastructure sector.

What Time Are Google Earnings Today?

| Event |

Pacific Time |

Eastern Time |

| Earnings release (posted before the call) |

Before 1:30 p.m. PT |

Before 4:30 p.m. ET |

| Earnings call |

1:30 p.m. PT |

4:30 p.m. ET |

Alphabet will hold its earnings conference call today at 1:30 p.m. Pacific Time, which is 4:30 p.m. Eastern Time. Alphabet also stated that the earnings release will be available on its Investor Relations site before the conference call.

Google Earnings Expectations

| Item |

Market focus |

Why it matters for GOOG |

| Revenue |

Around $111.3B |

Sets the “beat or miss” headline |

| EPS |

Around $2.63 |

Signals cost control and margin health |

| Google Cloud |

Around $16.2B expected |

AI demand is pushing Cloud into the spotlight |

| Capex guidance |

2026 spending expectations |

Too high can scare investors, even if growth is strong |

Expectations going into today's report are:

That is a solid growth profile for a company of this size. It also means a small miss or a cautious outlook can still knock the stock lower.

Why This Google Earnings Print Can Move More Than Usual?

1) GOOG Stock Has Become the "Proof Trade" in Big Tech

GOOG has outperformed sharply in recent months, and that matters because robust price action tightens the tolerance band for any disappointment.

For example, the stock has risen more than 80% over the past six months, which is the kind of move that can turn an otherwise solid quarter into a "sell the news" event if guidance tone is even slightly cautious.

2) Investors Are Watching Capex as Closely as Revenue

AI demand is clearly lifting Cloud and infrastructure buildouts, but the market is increasingly wary of what that means for free cash flow and future depreciation.

Analysts are debating whether 2026 capital expenditures will be closer to $116 billion or $130 billion, or even reach $139 to $140 billion.

If management signals a number at the high end of that range without a clear monetization pathway, it can weigh on the stock even if the quarter is strong.

Four Results That Could Move GOOG Stock Next

1) Google Search and Ads

Alphabet's advertising business remains the anchor, accounting for about three-quarters of revenue, with growth led mainly by Search.

Investors will listen for two things:

Alphabet has informed investors that changes in AI for Search are intended to increase query volume. In its Q3 2025 materials, the company pointed to the rollout of AI Overviews and AI Mode in Search as part of its push to "ship at speed."

2) YouTube Ads and Shorts

YouTube has two simultaneous tests. It needs to show steady ad growth and convince investors that Shorts monetization is progressing without cannibalizing higher-value formats.

This is why we are prioritizing YouTube Shorts monetization this quarter.

3) Google Cloud

Cloud is the business line most closely tied to the AI investment cycle. In Q3 2025, Google Cloud revenue rose 34% to $15.2 billion, and operating income rose to $3.6 billion. That same release also stated that Cloud ended the quarter with $155 billion in backlog, which speaks to demand visibility.

For today's report, market coverage suggests revenue is expected to be around $16.2 billion, implying roughly 35% year-over-year growth.

This quarter is also about capacity. If management implies that demand is outstripping the supply of compute, the market will accept higher capex more easily. But it will still want a timeline for capacity additions and margin outcomes.

4) Capital Spending and AI Costs

This is the tension at the heart of the GOOG story right now. Investors want Alphabet to win in AI. Investors expect Alphabet to demonstrate financial discipline as AI-related expenses continue to rise.

Alphabet stated in Q3 2025 that it expected 2025 capital expenditures in a range of $91 billion to $93 billion, reflecting demand across the business, including Cloud. Ahead of today's earnings, analysts are openly discussing the possibility of a significant increase in 2026 capex, suggesting a range of $139 to $140 billion.

In summary, capital expenditure (capex) is the determining factor. A quarter can beat on revenue and EPS, and the stock can still drop if capex guidance comes in much higher than the market expected. That has been a common pattern across mega-cap tech when investors fear spending will outrun returns.

What the Options Market Implies for GOOG's Stock Post-Earnings Move

Options pricing suggests traders are bracing for a meaningful move.

Options implied a move of more than 5% from around $345, which frames a rough range near $328 to $362 into the end of the week.

OptionSlam lists an implied move of 6.23% for the weekly expiry (Feb 6) and 7.81% for the monthly expiry (Feb 20).

These are not forecasts of direction. They reflect market estimates of magnitude and often widen when capital expenditure guidance is the main factor.

GOOG Stock Technical Analysis: Levels Traders Are Watching

| Indicator |

Level |

What it suggests into earnings |

| RSI (14) |

51.348 |

Momentum is balanced, so the earnings gap can set the next trend leg. |

| MACD (12,26) |

1.31 |

Trend momentum is mildly positive. |

| MA20 |

341.59 |

The stock is near short-term trend reference levels. |

| MA50 |

337.39 |

This is a practical "trend support" level if results disappoint but the uptrend holds. |

| MA200 |

326.66 |

This is the longer-term bull trend line, and it matters if the reaction becomes risk-off. |

| Classic pivot |

339.88 |

This is the nearest decision level for the first post-earnings consolidation. |

GOOG is sitting on a tight technical setup ahead of earnings, with the price close to short-term moving averages and well above the longer-term trend lines.

If results are strong and GOOG stock holds above the pivot area, momentum traders often look for continuation. If the stock breaks below the support zone after a weak outlook, selling can feed on itself because many traders will be managing risk around the same levels.

Frequently Asked Questions

1. What Time Does GOOG Report Earnings Today?

Alphabet's earnings call is scheduled for 1:30 p.m. PT (4:30 p.m. ET) on February 4, 2026.

2. What Are Analysts Expecting From Google's Earnings Report?

Market coverage widely expects around $111.3 billion in revenue and about $2.63 in EPS for Q4 2025.

3. How Much Could GOOG Stock Move After Earnings?

Options pricing implied a move of over 5%, suggesting a wide post-earnings range.

4. What Is the Biggest Driver for GOOG Stock After Earnings?

While advertising remains a key driver, Google Cloud and capital expenditure guidance may overshadow ad performance if investors worry that spending will increase too quickly.

Conclusion

In conclusion, today's Google earnings are less about one key number and more about whether Alphabet can demonstrate three things simultaneously: consistent ad growth, strong momentum in its Cloud services, and a credible plan to finance AI development without excessive spending.

If Alphabet reports precise positive results and maintains a disciplined approach to capital expenditures, the stock could continue its upward trend. If the report is solid but spending guidance jumps, investors may still take profits because the stock has already priced in a lot of good news.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.