Klarna, the Swedish fintech giant known for its "buy now, pay later" (BNPL) services, is officially moving forward with its long-awaited initial public offering (IPO).

After years of speculation and delays, Klarna has revived its U.S. listing plans, targeting a September 2025 debut on the Nasdaq under the ticker symbol KLAR.

This article provides a guide to Klarna's IPO, covering its timeline, valuation, financials, risks, and key factors for investors to monitor as the company enters public markets.

Klarna IPO Timeline: Where Things Stand

Klarna first signalled IPO ambitions back in 2021, but volatile markets and tariff concerns under the Trump administration delayed the process. As of September 2, 2025, the company has officially resumed IPO proceedings.

IPO Date: Targeting September 2025 listing

Ticker: KLAR (Nasdaq)

Offer Size: ~34.3 million shares

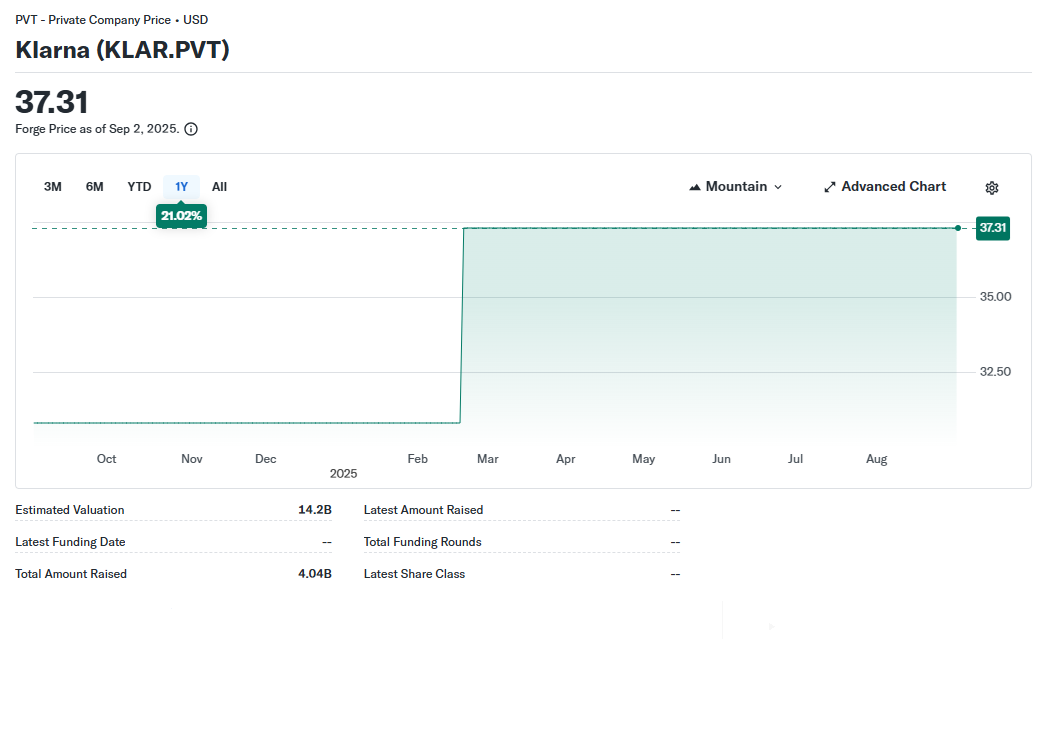

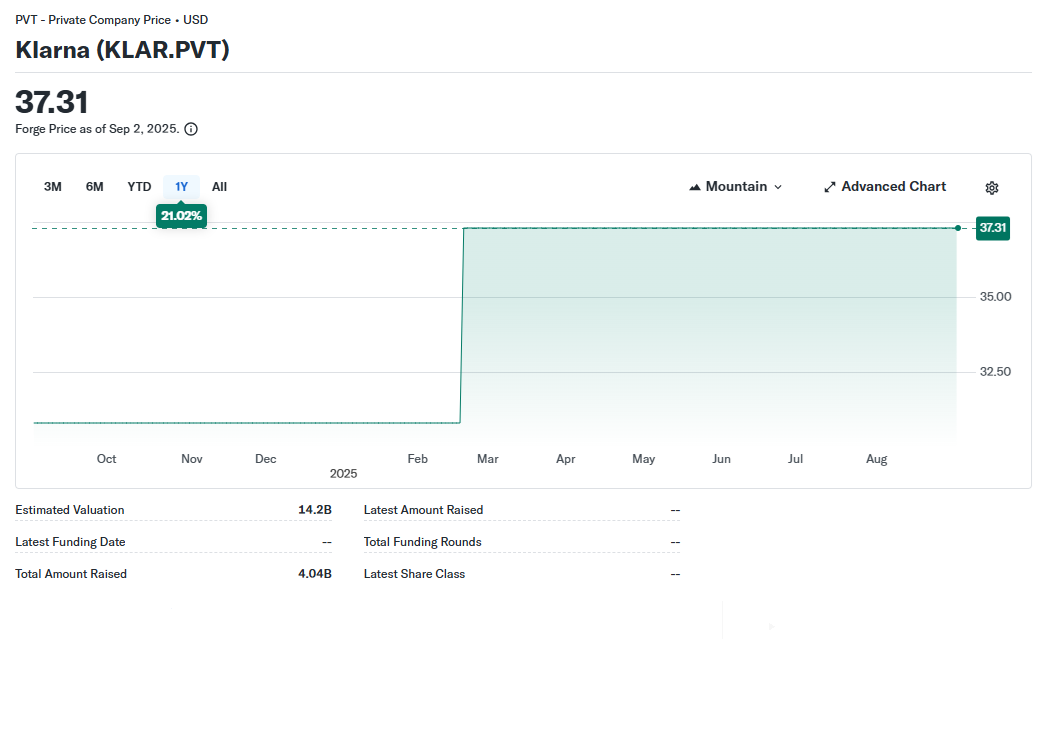

Pricing Range: $35–$37 per share (Reuters)

Capital Raise: ~$1.27 billion

The IPO is being managed by a group of top underwriters, including Goldman Sachs, JPMorgan, and Morgan Stanley.

Klarna Valuation and Financials

At its peak in 2021, Klarna commanded a private valuation of around $45 billion. But after tightening credit conditions and restructuring, its valuation dipped as low as $6.7 billion in 2022.

Now, Klarna's IPO is expected to value the company at around $13 to $14 billion. It marks a significant recovery, but still represents a steep discount from its pandemic-era highs. (Crunchbase News)

Additionally, recent performance shows Klarna is working toward financial stability:

2024 Profitability: Klarna reported a $21 million profit, reversing a $244 million loss in 2023.

2024 Revenue: ~$2.8 billion.

User Growth: Over 93 million users worldwide.

Gross Merchandise Volume (GMV): ~$105 billion in 2024.

H1 2025 Results: $1.52 billion in revenue but a net loss of $153 million, reflecting that recovery is still uneven.

It marks a significant recovery, but still represents a steep discount from its pandemic-era highs.

Klarna IPO Risks and Investor Sentiment

Klarna's listing is being closely watched as a bellwether for fintech IPOs in late 2025. With the IPO market reviving after years of drought, Klarna's debut could influence confidence in similar listings across payments, lending, and digital banking.

If successful, it may pave the way for other high-profile fintechs to follow suit. However, while Klarna's IPO has generated excitement, several concerns remain:

1) Credit Losses:

Klarna reported losses of approximately $310 million in its latest filings, reflecting a 40% year-over-year rise.

2) Profitability Question:

Despite 2024 profits, H1 2025 has slipped back into losses, raising questions about sustainability.

3) Valuation Scepticism:

Analysts caution that the $13–14 billion goal may still be overly optimistic considering the present margins.

4) Competition:

Klarna faces heavy competition from PayPal, Affirm, Apple Pay, and conventional banks that are entering the BNPL space.

That said, Klarna's global brand strength, large user base, and diversified fintech platform continue to attract bullish investors.

Frequently Asked Questions

1. When Is Klarna's IPO Date?

Klarna has officially resumed IPO plans and is expected to list in September 2025 on the NASDAQ under the ticker KLAR.

2. What Is Klarna's IPO Price Range?

The company is offering 34.3 million shares at a price range of $35 to $37 each, to generate up to $1.27 billion.

3. Who Are Klarna's IPO Underwriters?

Klarna's IPO is being led by Goldman Sachs, JPMorgan, and Morgan Stanley, positioning it among the most high-profile fintech listings of 2025.

Conclusion

Klarna's IPO marks a pivotal moment not just for the company, but for fintech as a whole. With profitability achieved in 2024 and a strong global presence, the listing shows promise. However, challenges around credit losses and valuation loom large.

For investors, Klarna represents both opportunity and risk: a chance to buy into one of the world's most recognisable BNPL brands, but also a test of whether fintech's pandemic-era hype can translate into long-term market success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.