South Korea's stock benchmark touched the 5,000 target for the first time in

January and have risen further since then, fuelled by AI‑driven demand in the

tech‑heavy market.

The rally highlights the Asian country's shift from a cyclical export market

to a major beneficiary of the global AI boom, thanks to its dominance in memory

chips critical for data centres.

President Lee Jae Myung outlined his vision to usher in the era of "5,000"

within his term during a meeting with executives of securities firms in

September. Apparently his policies have delivered earlier than expected.

Jeong Eun Bo, CEO at the Korea Exchange, said benchmark index can reach

6,000, given local firm's competiveness and efforts to improve shareholder

returns – a similar stock playbook in Japan for the past few years.

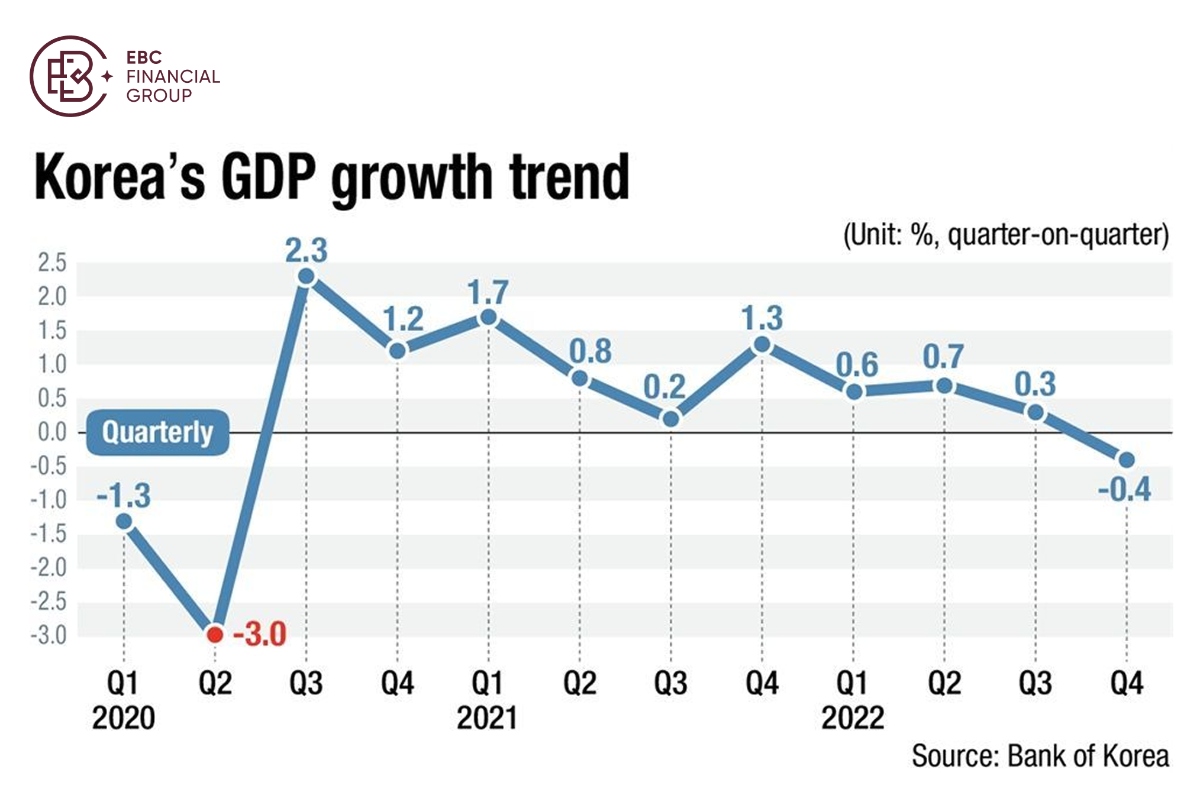

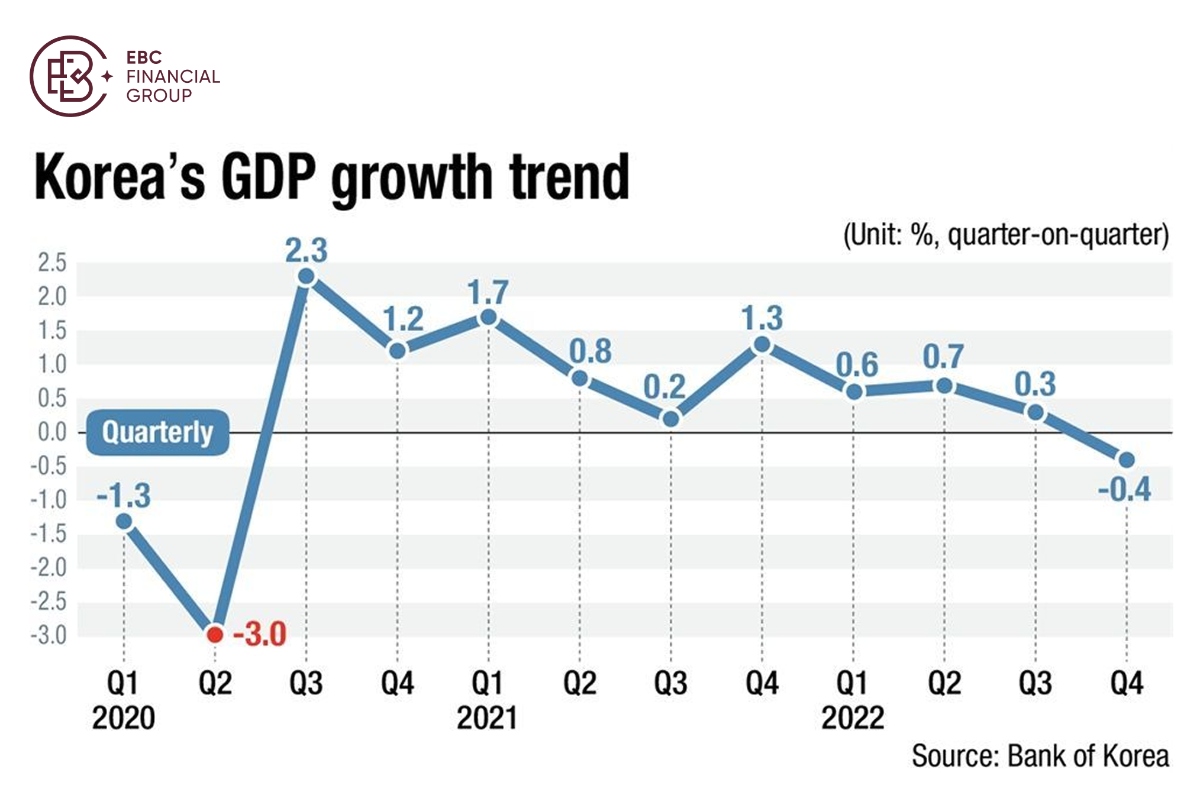

However, South Korea logged its slowest growth in half a decade in 2025,

despite increasing exports. A decline in construction investment widened, inked

to persistent trouble in the real estate market.

On a positive note, the Bank of Korea projected in its November report that

the economy would grow 1.8 % this year, citing "a recovery in domestic demand

and a robust semiconductor cycle".

An around 10 trillion won in fresh fiscal stimulus is due as early as March

to address uneven recovery, with support expected for sectors including culture

and the arts, Citigroup said in a report.

Seesaw struggle

South Korea's exports rose in January for an eighth consecutive month and at

the fastest pace in four and a half years, as demand for AI-servers continues to

power the country's chip sales, government data showed.

Destination-wise, exports to China logged the sharpest exports increase,

while exports to the US also jumped. Industry minister Kim said more discussion

with the US is needed on a trade deal reached last year.

Trump said last month he would restore tariffs on cars and other imports from

South Korea due to a delay in enacting the agreement to make huge investments in

US business projects in return for tariff cuts.

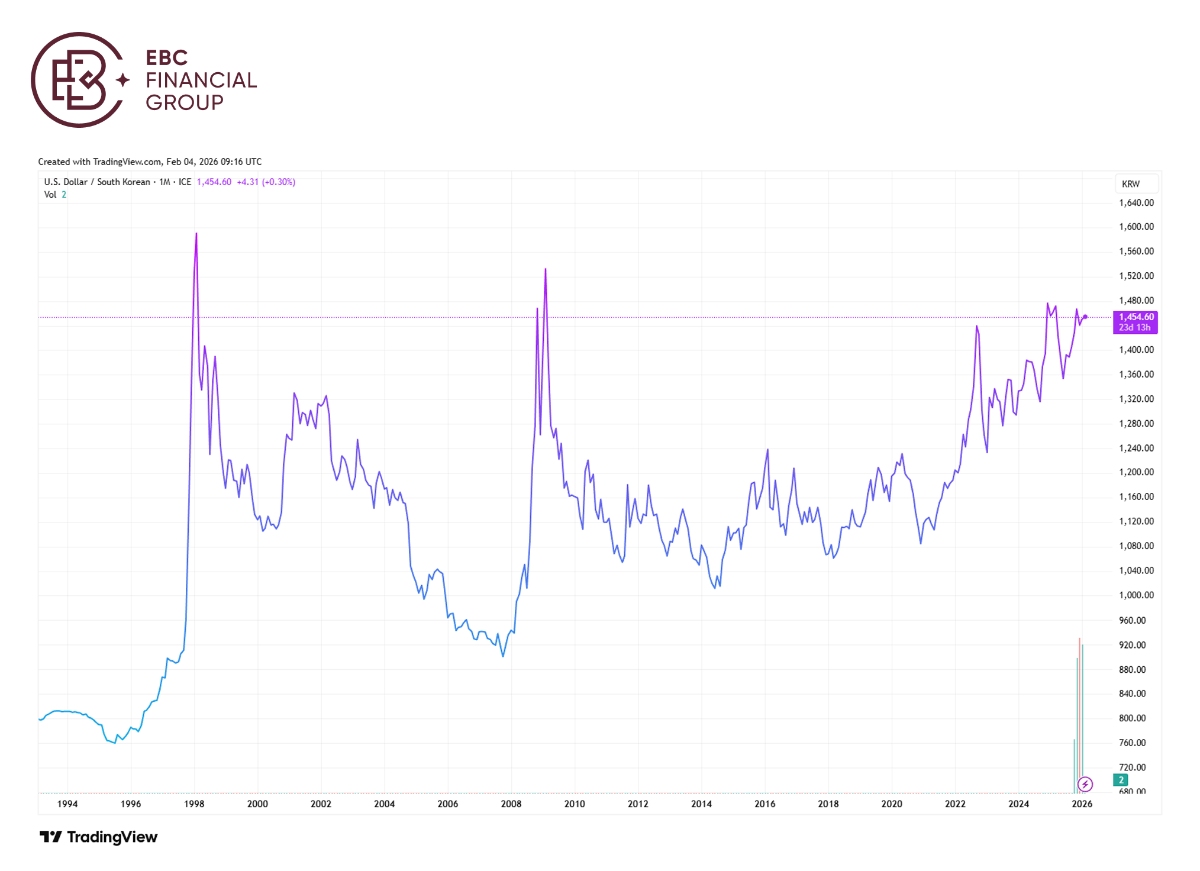

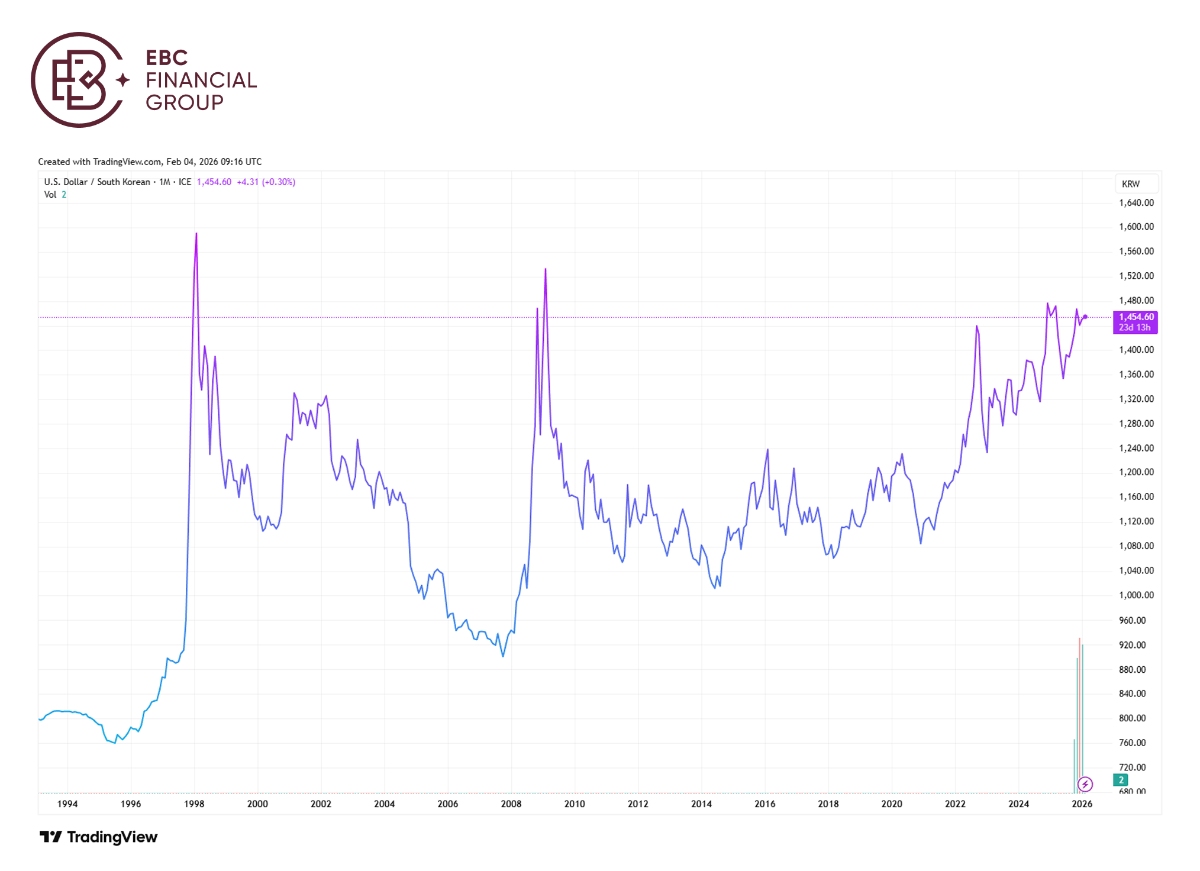

The won slumped to levels unseen since the global financial crisis from 2007

to 2009. The dollar demand in Korea remains strong, fuelled by appetite for US

equities and importers seeking the greenback for payments.

Trade minister Yeo Han-koo failed to hold a face-to-face meeting with his US

counterpart during his weeklong stay in Washington, after last week's bilateral

talk made little headway.

Hyundai Motor's revenue took a serious hit last year, suffering a

double-digit decline in operating profit; Kia's operating profit was down 28.3%

despite of record annual sales.

The two carmakers represent significant weightings in benchmark index. If the

Lee administration does not please Trump soon enough, a knee-jerk sell-off is

inevitable.

Chip shortage

Samsung Electronics reported an over threefold surge in Q4 profits, hitting a

new record and beating analysts' estimates, as a memory chip shortage and strong

demand for AI servers lifted earnings.

The race to build AI infrastructure has prompted chipmakers to divert

manufacturing capacity toward HBM for AI server, which has resulted in cost

pressures on Samsung's mobile and display business.

Likewise, SK Hynix reported its quarterly profit more than doubled, hitting a

record high and beating forecasts. It benefited from both HBM division and

surging prices for DRAM and NAND chips.

SK Hynix, a leading chip supplier for Nvidia, led the HBM chip market last

year with a 61% share, followed by Samsung at 19% and Micron at 20%, according

to Macquarie Equity Research.

Samsung said it was already producing its next-generation HBM chips, or

HBM4, and plans to ship them in February. It expected overall HBM revenue to

more than triple this year, painting a rosy picture.

Large-scale production of SK Hynix's next-generation HBM is also underway to

meet client demand. Separately, it announced cancellation of its treasury

shares, equivalent to 2.1% of total shares outstanding.

iShares MSCI South Korea ETF has increased 27% in 2026, building on its

strong momentum last year. Even so, the fund is trading at a multiple of around

18%, indicating ample room for more gains.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.