Stripe, one of the world's most influential fintech companies, has long been the subject of ipo speculation. As of October 2025, Stripe remains privately held, but recent developments suggest that a public offering might be on the horizon.

If you're considering investing in Stripe or simply want to understand what's next for this payments giant, here's what you need to know about the Stripe IPO.

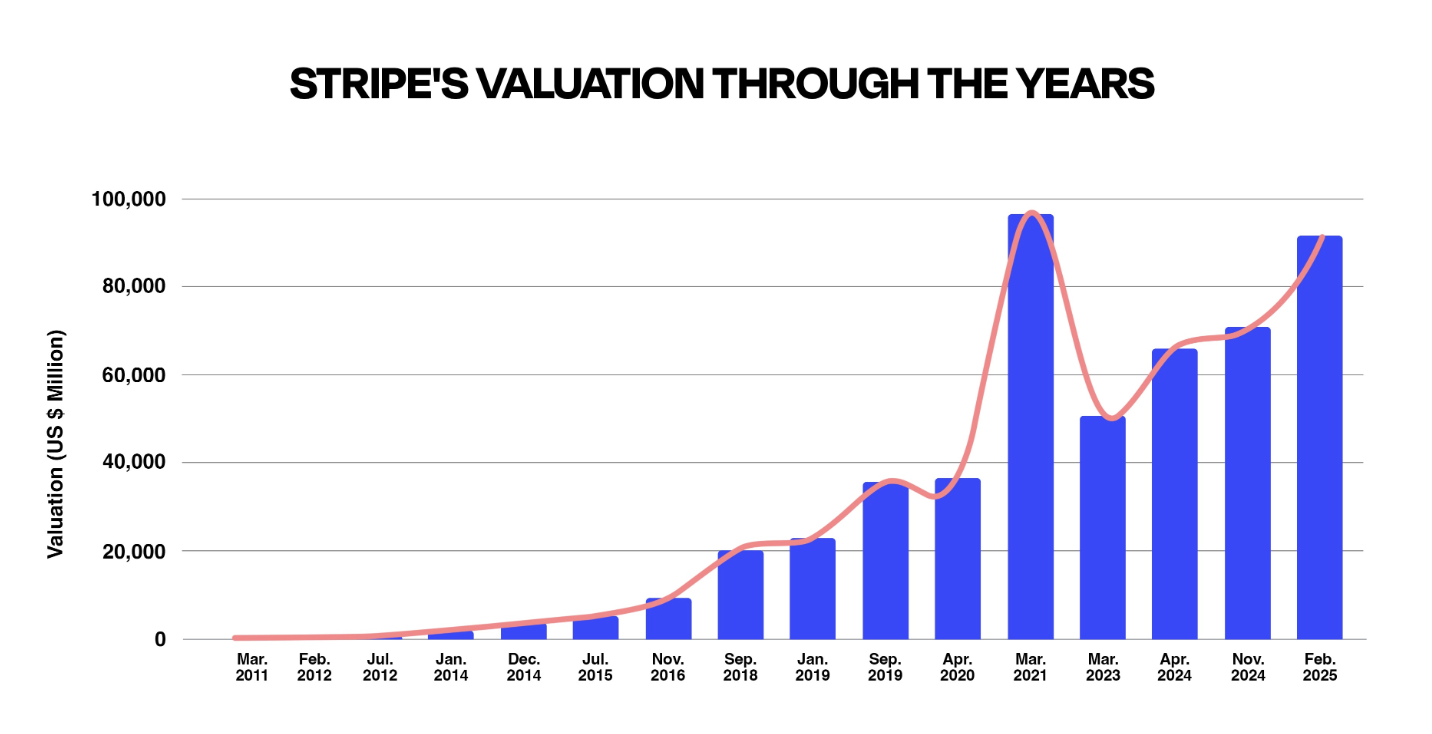

Stripe's Latest Valuation and Private Market Activity

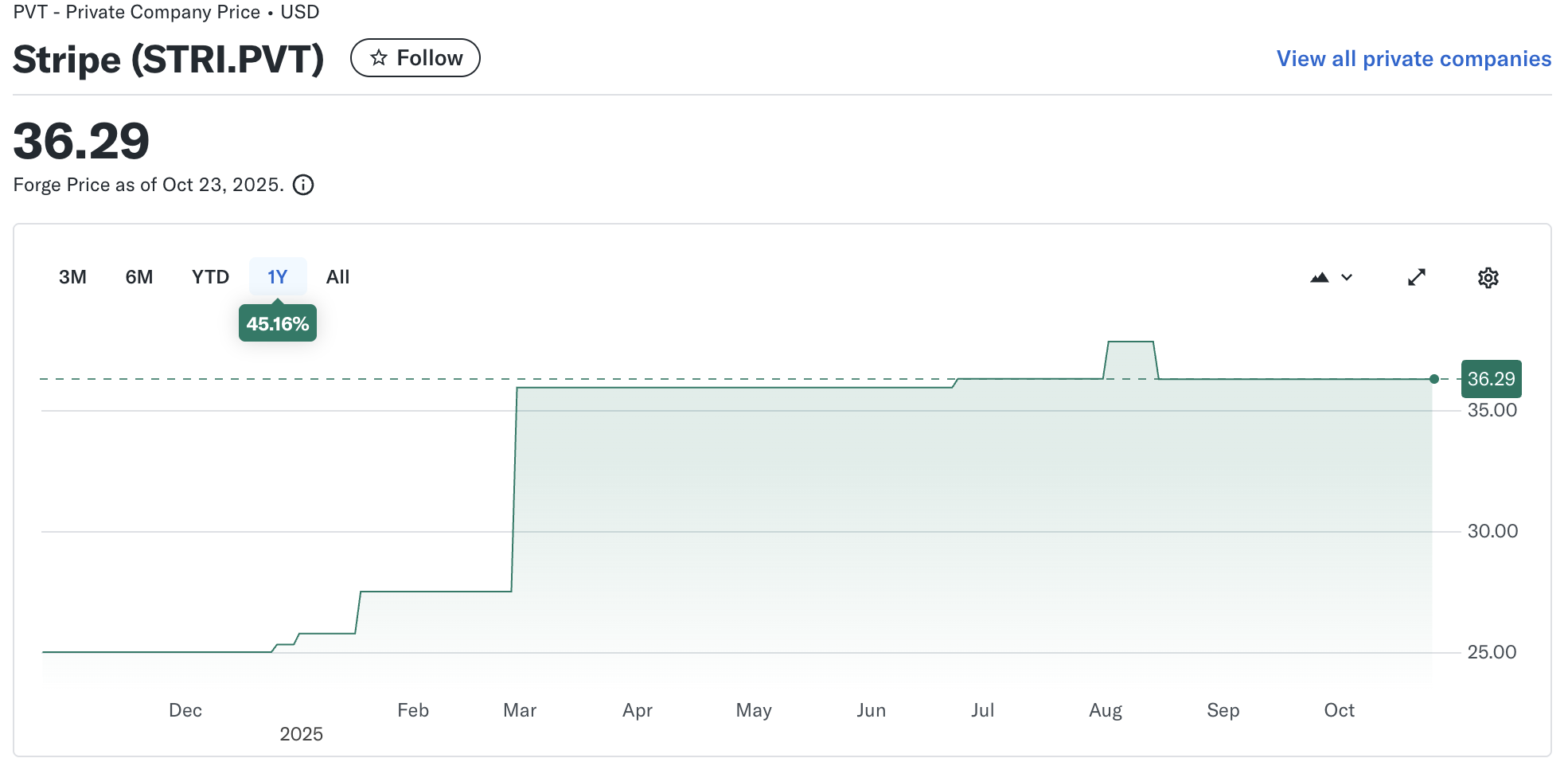

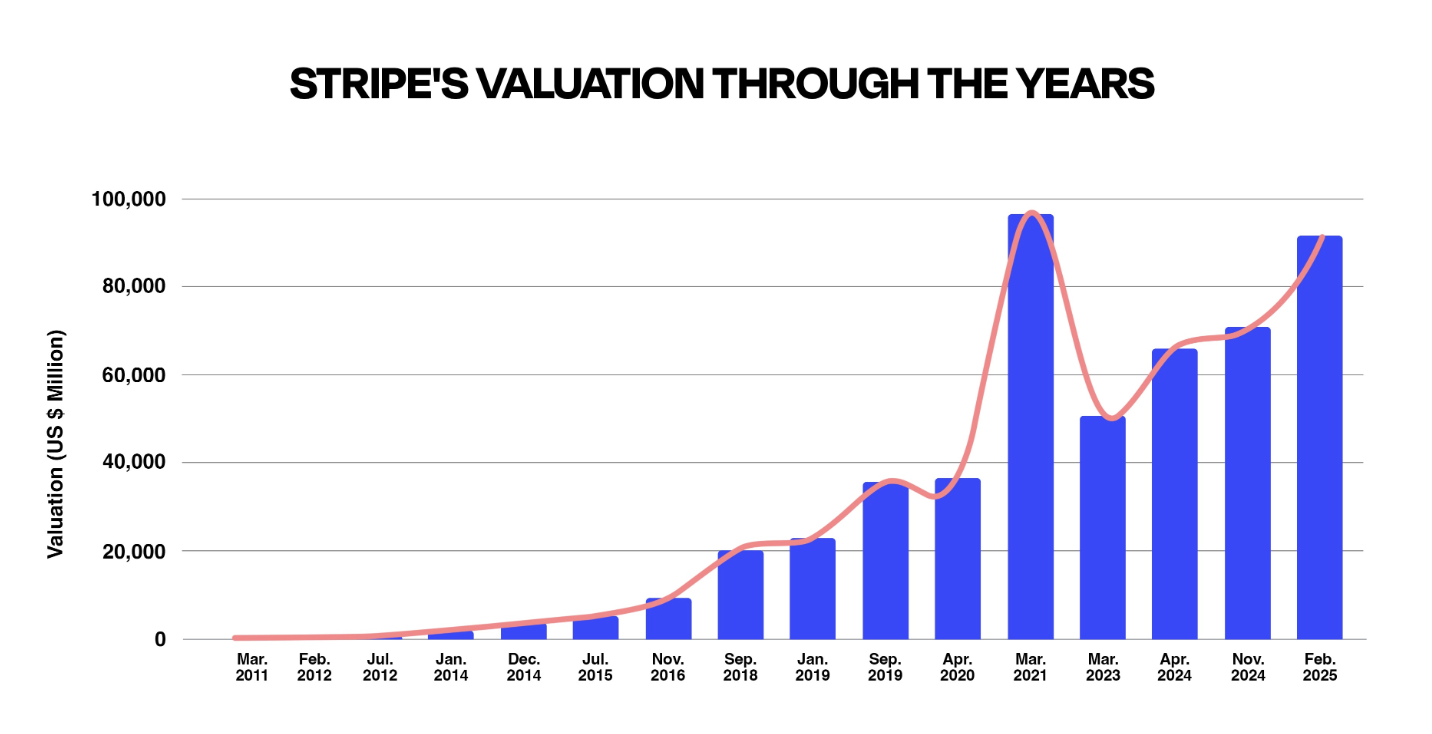

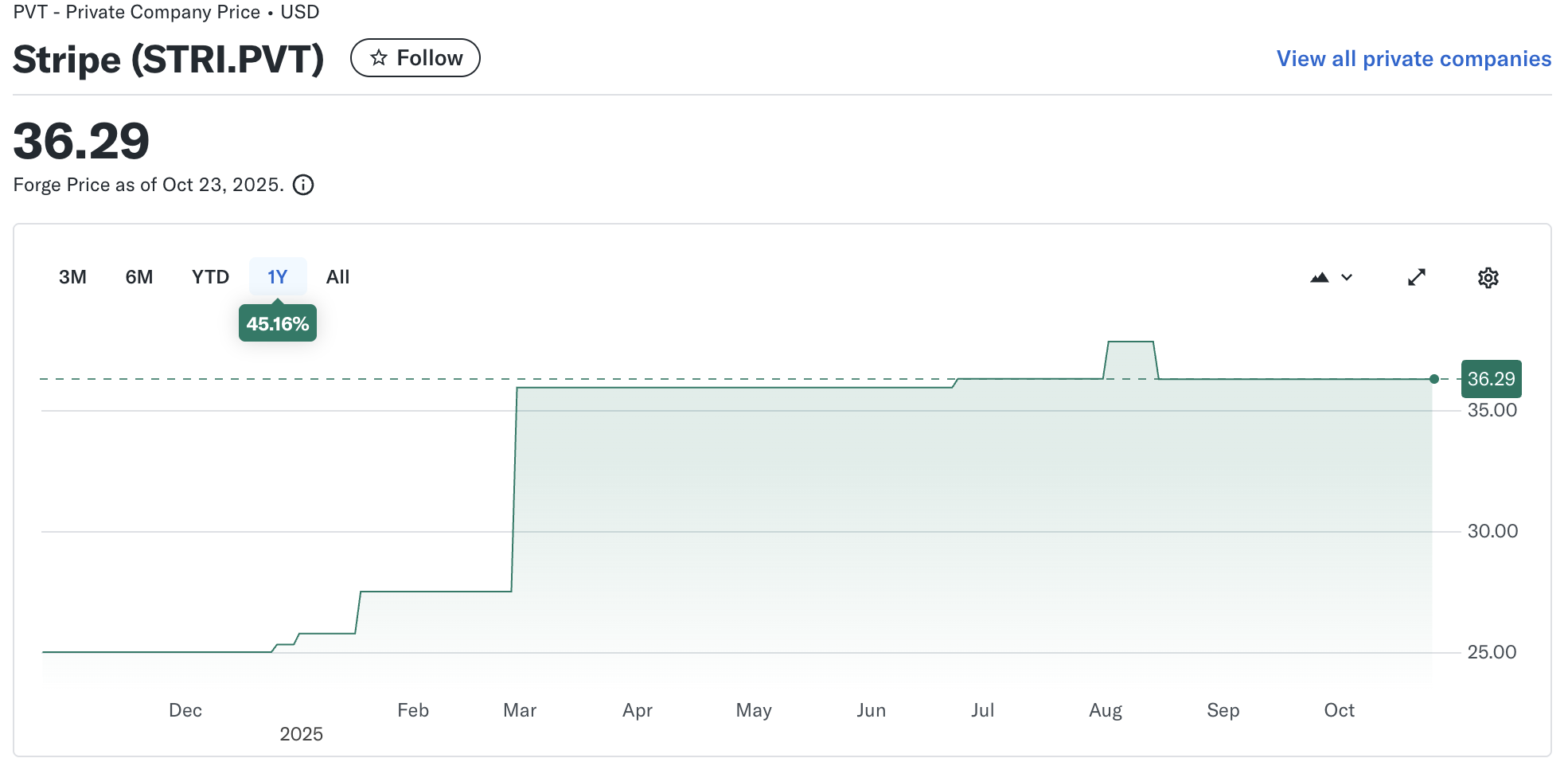

In September 2025, Stripe's valuation reached $106.7 billion through a tender offer, allowing employees and early investors to sell shares and providing liquidity without a public listing.

This marks a significant rebound from its 2023 low of $50 billion and brings it close to its 2021 peak of $106.7 billion.

| Date |

Valuation |

Notes |

| March 2023 |

$50 billion |

Post-IPO market correction |

| March 2025 |

$91.5 billion |

Following a tender offer for employee and investor liquidity |

| October 2025 |

$106.7 billion |

After Series I funding round |

Stripe’s valuation has more than doubled since its 2023 low, reaching $106.7 billion in October 2025, a clear sign of renewed investor confidence.

This growth was driven by its Series I funding round in July 2025, which drew backing from major venture capital firms.

Despite the surge in value, Stripe has yet to announce any IPO plans and continues to favor private liquidity options over going public.

The tender offer allowed employees and early investors to sell shares, providing liquidity without a public listing. Stripe's leadership has emphasised that these liquidity events are a priority while the company remains private.

Is Stripe Publicly Traded In 2025?

No, Stripe is not currently a publicly traded company. Despite years of anticipation, Stripe has not filed for an initial public offering (IPO) and has not set any official timeline for going public.

The company's shares are not listed on any public exchange, and there has been no roadshow or formal IPO process initiated as of October 2025.

Why Hasn't Stripe Gone Public Yet?

Stripe's founders and leadership have repeatedly stated that they are focused on long-term growth rather than the short-term pressures of public markets.

The company is “defiantly agnostic” about going public, preferring to provide liquidity through private tenders and secondary sales.

This approach mirrors a broader trend among top private tech firms that are delaying IPOs despite strong fundamentals and high valuations.

What Could Influence Stripe’s IPO Timing?

Several factors will shape when or if Stripe decides to go public:

1. Market Conditions:

Stripe is likely waiting for stronger IPO sentiment. Analysts expect more favorable conditions by late 2025 or early 2026 as tech valuations stabilize and investor demand for new listings rises.

2. Private Liquidity Options:

The company continues to provide liquidity through tender offers and secondary sales, allowing employees and investors to cash out without a public listing. This reduces the pressure for an immediate IPO.

3. Regulatory Landscape:

Changing SEC disclosure requirements and tightening global fintech rules may influence how Stripe structures any future IPO. The company may delay until it has full regulatory clarity.

4. Financial Strength:

With strong profitability and cash flow, Stripe isn’t reliant on public markets for funding, giving it flexibility to time its debut strategically.

5. Leadership Philosophy:

Founders Patrick and John Collison remain focused on long-term growth over market hype, preferring controlled expansion and operational stability before going public.

What Would a Stripe IPO Mean for Investors?

If Stripe eventually lists on the public market, it could become one of the largest IPOs in fintech history, reshaping how investors value payment technology companies.

With its market reach, profitability, and strong growth trajectory, Stripe’s debut would mark a major shift for both institutional and retail investors.

Access to Shares

Right now, Stripe shares are restricted to insiders only such as employees, early investors, and accredited buyers through private tenders. An IPO would finally open access to retail investors, allowing them to own a stake in one of the most profitable fintechs globally.

However, going public would also expose Stripe to market volatility and regulatory obligations that private firms can avoid. The transition from private valuation to public scrutiny could test whether investors are willing to maintain its lofty valuation.

Growth Potential Of Stripe

Stripe’s financial performance and market positioning make it a strong candidate for long-term growth.

The company processed over $1.4 trillion in payments in 2024, remained profitable, and continues to expand its offerings from AI-driven payment solutions to digital asset infrastructure for clients like OpenAI and Anthropic.

Public capital could fuel faster expansion into underpenetrated regions, particularly Asia-Pacific and Latin America, and strengthen its product pipeline. Still, investors will be watching how Stripe manages profitability amid rising competition and tighter capital markets.

Market Impact

A Stripe IPO would send ripples across the global fintech sector. Its listing could reset valuations for competitors like PayPal, Block (Square), and Adyen, and possibly revive broader investor confidence in tech IPOs after a slow 2024.

A strong debut would likely boost sector sentiment, while a disappointing one could pressure peers and temper enthusiasm for future listings. In either scenario, Stripe’s performance would become a new benchmark for fintech growth and investor expectations.

The Bigger Picture For Investors

For investors, a Stripe IPO would present both high opportunity and high scrutiny.

Its dominance in global payments, diversified revenue base, and innovation track record support long-term confidence, but only if public markets sustain its near-$100 billion valuation.

Ultimately, Stripe’s decision to go public will influence not just its own trajectory, but also the future of fintech investment and how markets value scalable, profitable tech companies in the post-IPO era.

How Can You Invest in Stripe Before an IPO?

At present, Stripe shares are only available through private transactions, such as employee equity sales or secondary markets, and are typically restricted to accredited investors. There is no public stock price or ticker symbol for Stripe.

If you want exposure to the digital payments sector, consider investing in publicly traded competitors like PayPal, Visa, Mastercard, or Block (Square).

Stripe vs Other Competitors

While Stripe continues to dominate private fintech valuations, it operates in a highly competitive ecosystem alongside major public players.

Comparing Stripe with its peers helps investors understand how its private-market strength stacks up against listed rivals in terms of valuation, scale, and innovation.

| Company |

Valuation (Oct 2025) |

IPO Status |

Key Strengths |

| Stripe |

$106.7 billion |

Private |

AI-powered payments, profitability |

| PayPal |

$300 billion |

Public |

Established brand, global reach |

| Block (Square) |

$120 billion |

Public |

Innovative fintech solutions |

| Adyen |

$50 billion |

Public |

Strong European presence |

Stripe’s ability to remain private while maintaining a valuation close to major listed competitors highlights its unique position.

The company’s AI integration, expanding global network, and strong profitability continue to make it one of the most closely watched fintechs ahead of a potential IPO.

Key Takeaways for Investors

Still Private (as of Oct 2025): No IPO filing or confirmed timeline yet.

Valuation Near Record Highs: Surpassed $100B after the July 2025 Series I round, signaling strong investor confidence.

Private Liquidity Model: Employees and early investors sell shares through private tenders; retail access remains closed.

Consistent Financial Growth: Profitable, processing over $1.4T in 2024 with continued expansion in 2025.

High IPO Potential: A future listing could be among the largest fintech IPOs globally.

Bottom Line: Stripe’s solid fundamentals and market leadership position it as a top candidate once conditions favor a public debut.

Frequently Asked Questions (FAQ)

1. When will Stripe go public?

As of October 2025, Stripe has not announced an official IPO date.

2. How can I invest in Stripe?

Stripe shares are currently available through private transactions for accredited investors.

3. What is Stripe's current valuation?

The latest reported valuation for Stripe is about $106.7 billion as of September 2025.

4. What are some alternatives to investing in Stripe?

Investors might consider publicly traded fintech companies like PayPal, Visa, Mastercard, or Block (Square).

Final Thoughts

The Stripe IPO remains one of the most anticipated events in global finance, but as of May 2025, the company is still private and focused on long-term growth. Investors should monitor Stripe's announcements and broader market trends for any updates on a potential IPO.

Until then, opportunities to invest in Stripe are limited to private markets, and those seeking exposure to the digital payments space may consider established public companies as alternatives.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.