In options trading, the term OTM, or "Out‑of‑the‑Money", plays a crucial role in defining the potential of an option at any given moment.

While investors often focus on At‑the‑Money (ATM) and In‑the‑Money (ITM) options, understanding OTM is essential, especially for traders seeking high leverage, low cost, or speculative upside.

In this detailed guide, you'll learn what OTM means for both calls and puts, how it influences option pricing, and when it might fit into your trading strategy.

OTM Meaning in Options Trading Explained

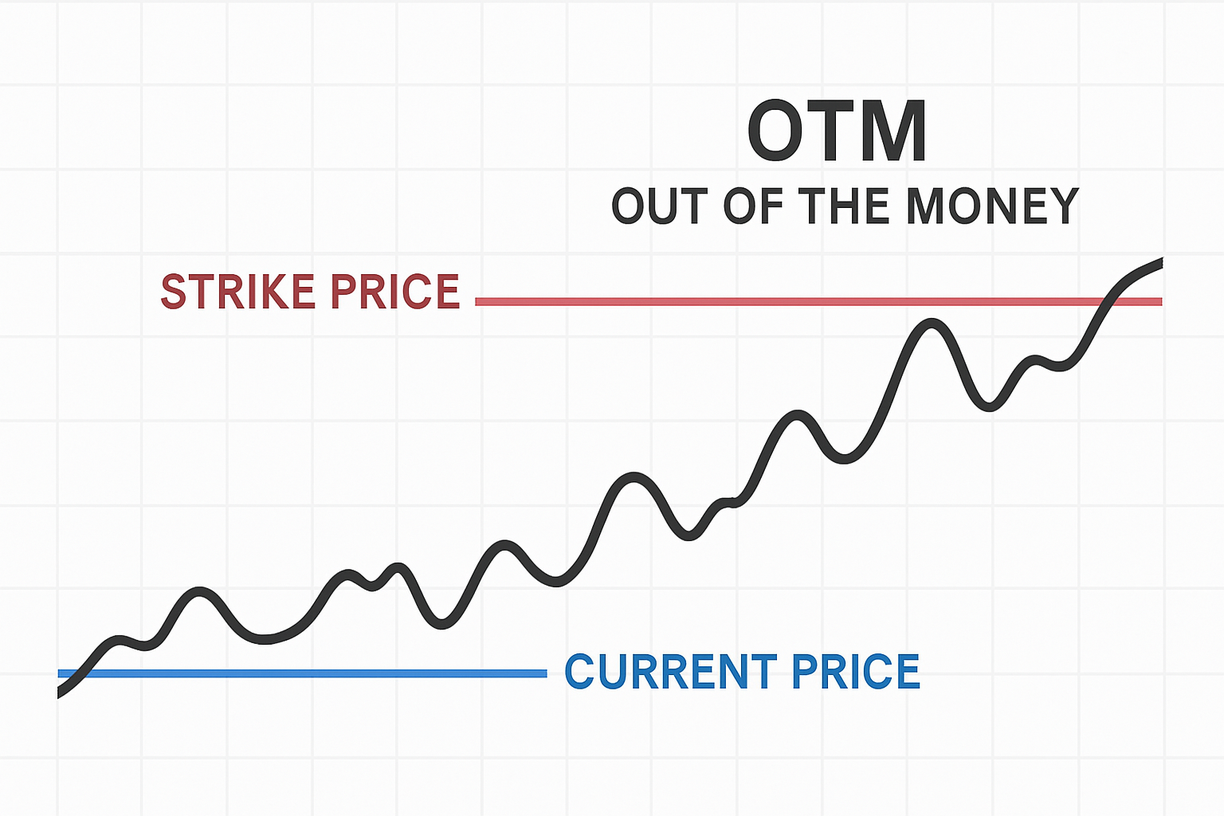

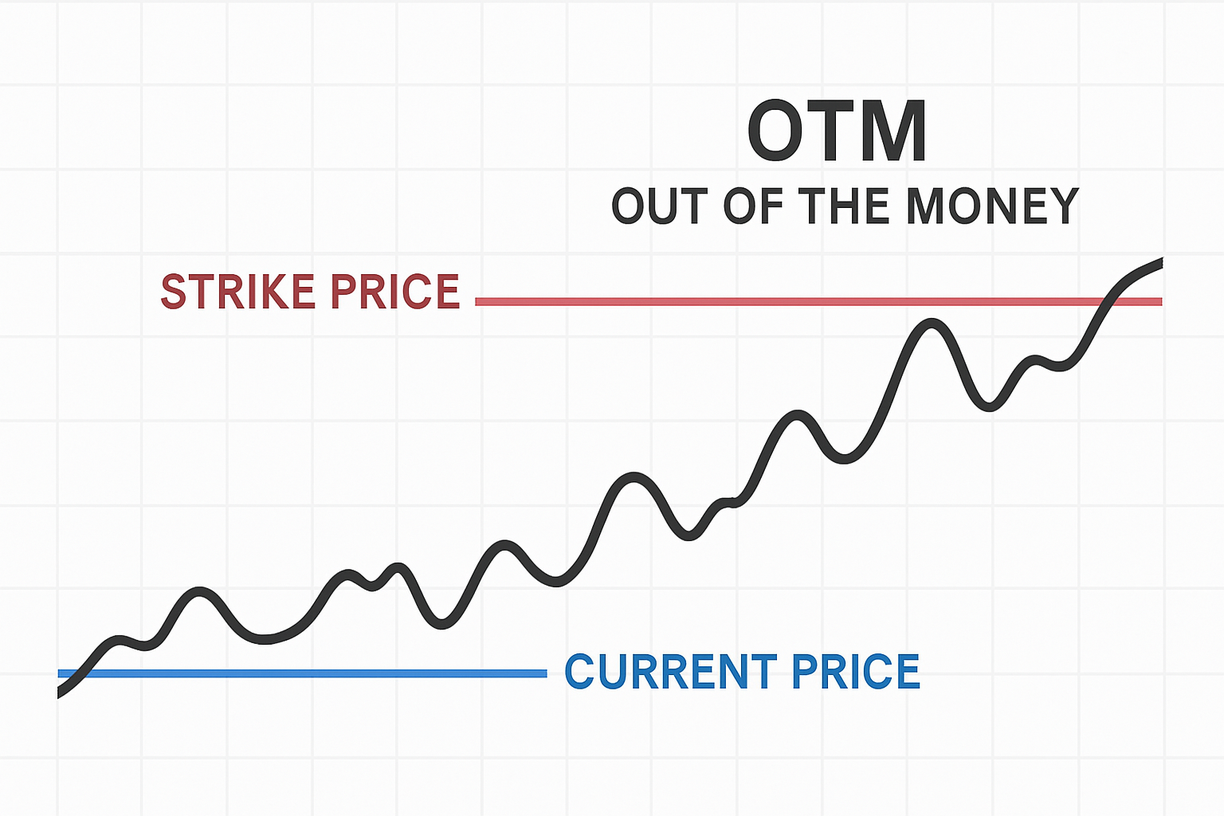

OTM stands for "Out‑of‑the‑Money", an option with no intrinsic value. It's a central concept in "moneyness," which describes the relationship between an option's strike price and the current price of the underlying asset.

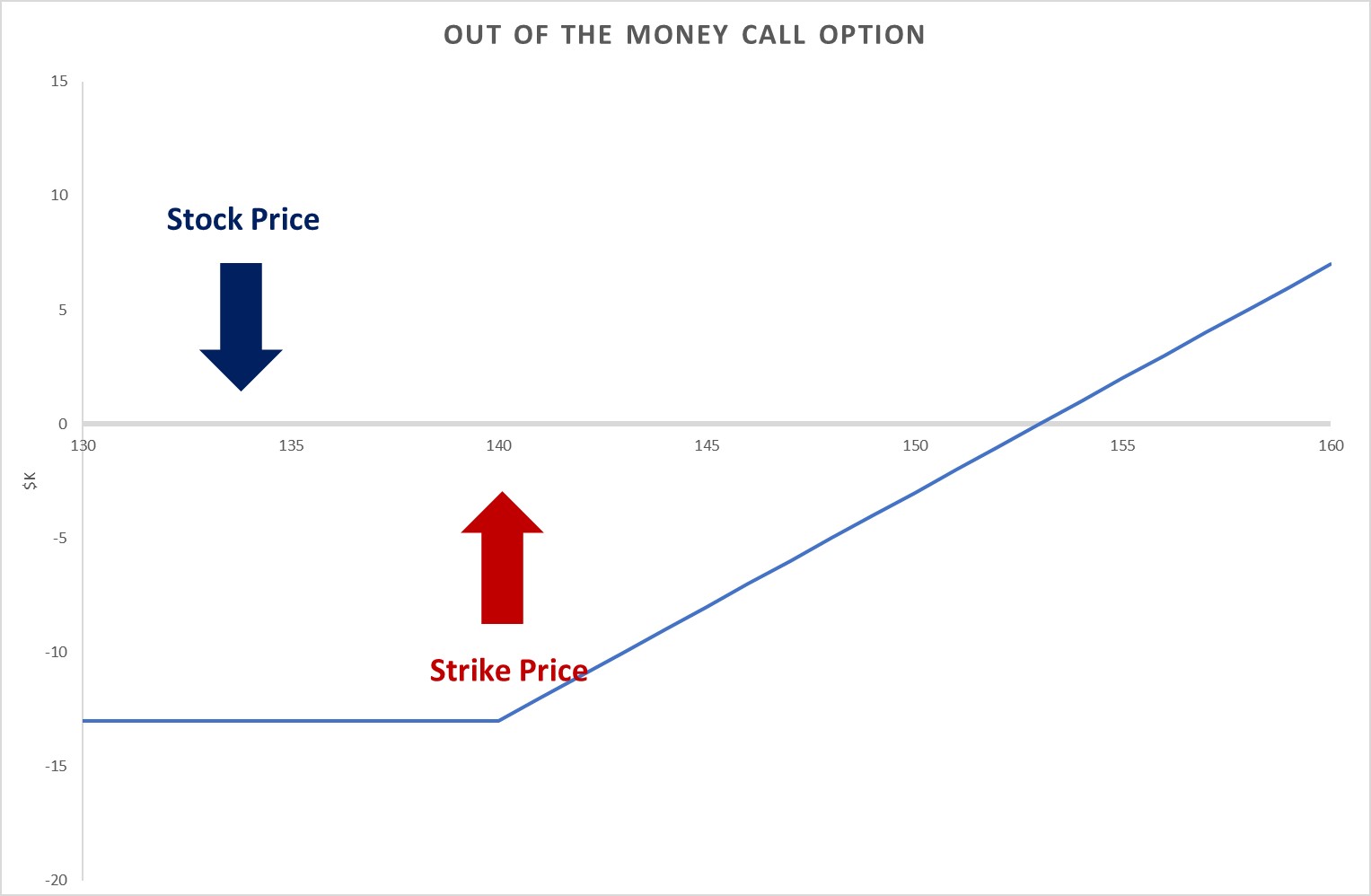

Call options are labelled OTM when the strike is above the current market price, and put options are OTM when the strike is below the current price.

Exercising this option in real-time would not yield profits, as its value is based on extrinsic factors such as time value and implied volatility.

How OTM Influences Option Pricing

An OTM option usually costs less than ATM or ITM contracts because you aren't paying for intrinsic value. Instead, you pay only for extrinsic value, which includes:

Time value—the longer until expiration, the greater the chance the underlying might move favourably.

Implied volatility—OTM option prices react significantly to changes in volatility, especially if the underlying experiences large swings.

It makes OTM options attractive to traders looking for speculative returns. However, they carry a high risk of expiring worthless unless the underlying asset moves enough to cross the strike.

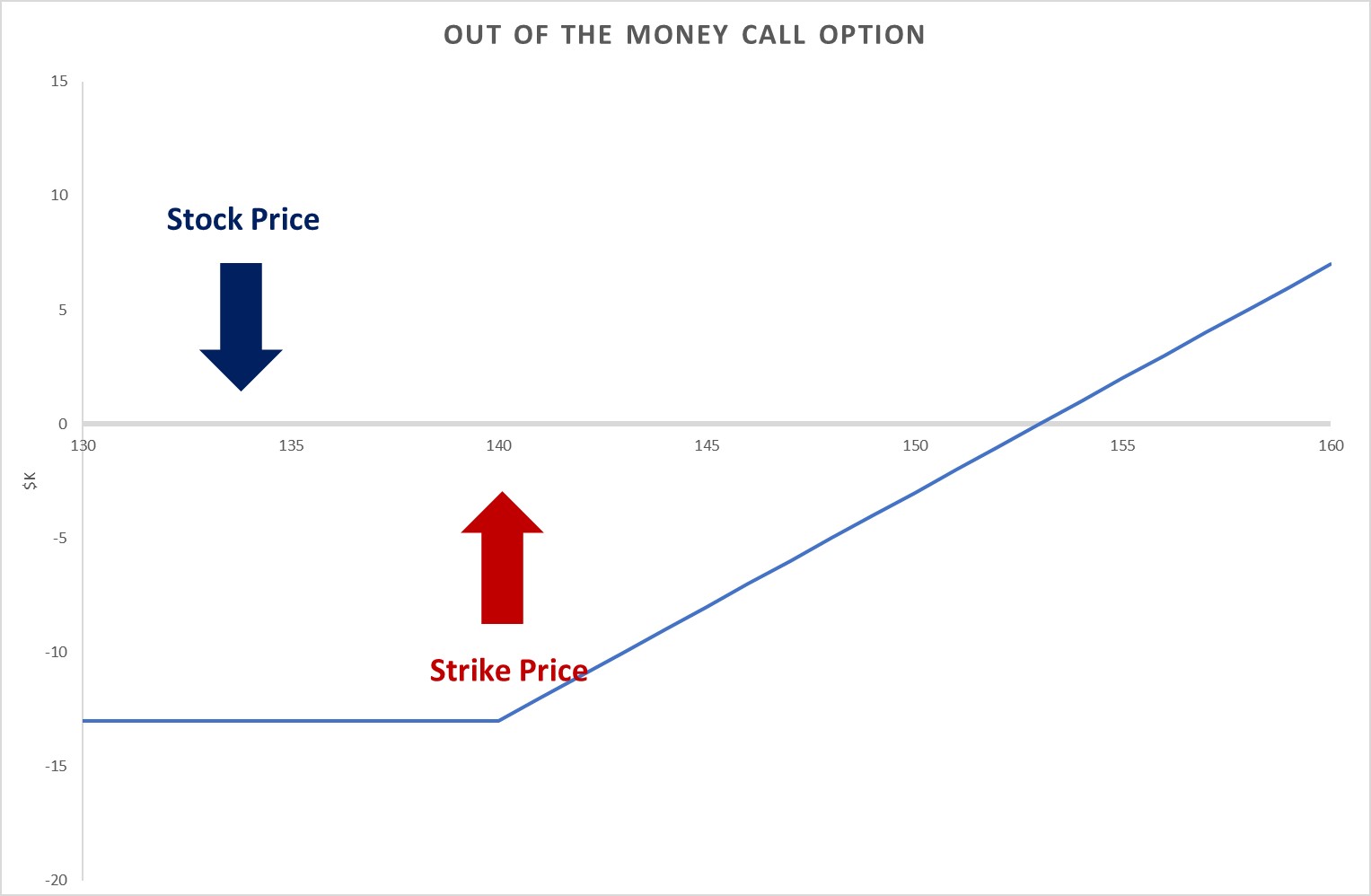

Examples: OTM Calls and Puts

A call option is OTM when the asset trades below its strike price. For example, Apple stock trading at $145 with a $150 strike call is OTM; exercising would cost more than buying shares outright.

A put option is OTM when the strike is below the underlying price, say a put with a $150 strike when Apple is at $155. Exercising such a put offers no advantage.

Traders often choose OTM options to leverage low premiums and potentially high percentage gains, albeit with the risk of total loss.

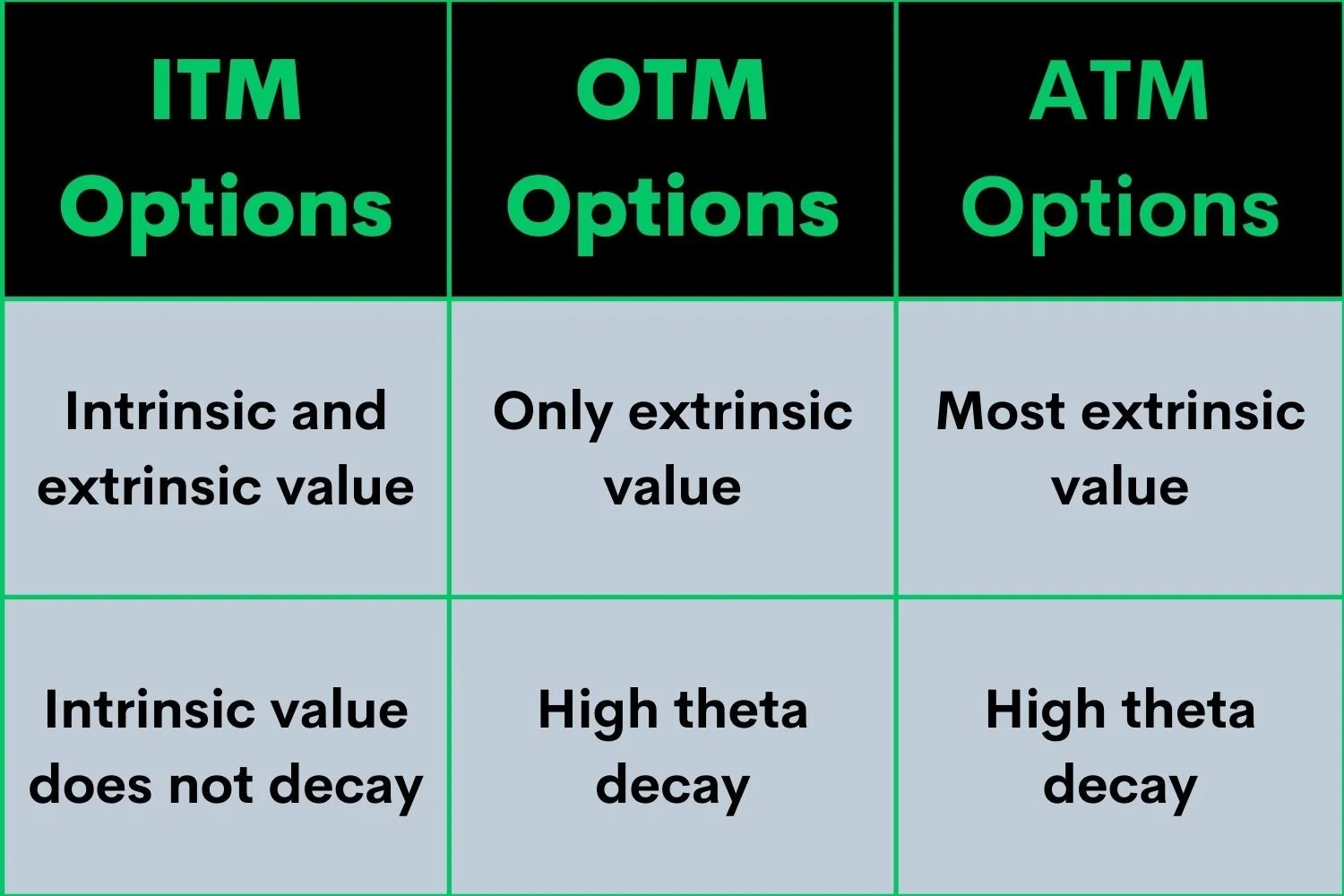

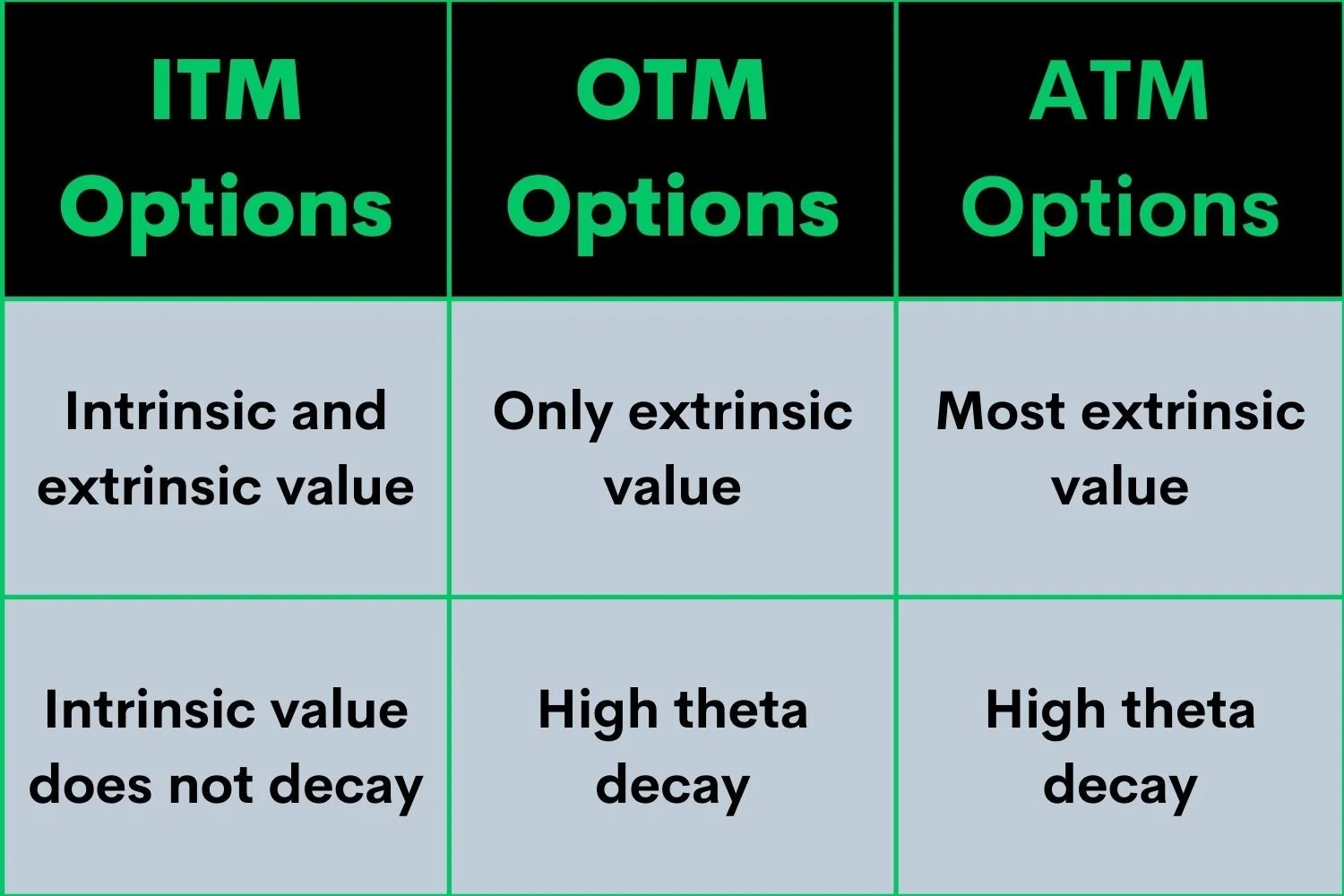

How Does OTM Differ from ITM and ATM?

To fully understand OTM, it helps to contrast it with other moneyness states:

ITM (In‑the‑Money): Call options have intrinsic value when the strike is below the market price; put options have intrinsic value when the strike is above the market price.

ATM (At‑the‑Money): The strike price equals the underlying asset's current price, giving the option neither intrinsic nor negative value.

In contrast, OTM options possess no intrinsic value, and their full premium consists solely of time value, as exercising an OTM option yields no immediate profit.

How Traders Use OTM Options in Strategy?

Speculative Upside

Traders expecting big price swings may buy OTM calls (bullish) or OTM puts (bearish). The entry cost is minimal, and the percentage gains are massive if the strike is breached significantly.

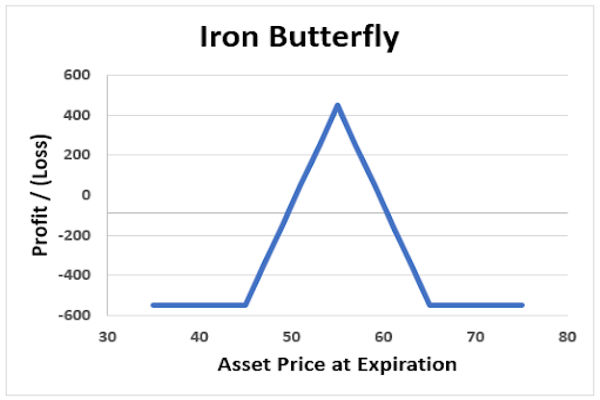

Risk Reversal and Spread Strategies

A risk reversal involves selling an OTM put while buying an OTM call, creating a synthetic long position funded by the put premium. Butterfly or other spread strategies may also use OTM strikes to define limited-risk, low-cost directional bets.

Defined Risk, Lower Cost Entries

OTM options necessitate a smaller capital investment and establish definite loss boundaries; the highest loss is the premium spent.

Volatility Plays

Following a volatility spike, OTM options often rise rapidly in implied volatility, allowing optionality even if the underlying hasn't yet moved. Traders may enter OTM XOPs anticipating further continuation.

Benefits vs Risks

| Benefits |

Risks |

|

Lower Premium Cost – OTM options are cheaper than ATM or ITM options |

High Probability of Expiry Worthless – Most OTM options expire with no value |

|

High Leverage Potential – Small price moves can yield large returns |

Time Decay (Theta) – Value erodes quickly as expiration approaches |

|

Defined Risk – Maximum loss is limited to the premium paid |

Low Probability of Profit – Requires significant price movement to be profitable |

|

Ideal for Speculative Trades – Useful for big directional bets |

No Intrinsic Value – Purely reliant on price movement and volatility |

|

Flexibility in Strategy – Can be used in spreads, hedges, or directional trades |

Volatility Sensitivity – Prone to rapid price swings based on implied volatility |

Best Practices to Keep in Mind

Grasp time decay and choose expirations that provide adequate time for changes.

Monitor delta and how it changes as the option moves closer to the ATM.

Steer clear of deep OTM unless substantial volatility or a strong directional shift.

Use position sizing to limit exposure and treat OTM trades like high-risk bets.

Factor in liquidity and bid-ask spreads, particularly for distant strikes that have minimal open interest.

Use analytics like implied volatility rank/percentile to gauge if OTM options are cheaply priced.

Frequently Asked Questions

1. What Does OTM Mean in Options Trading?

OTM stands for Out-of-the-Money. It refers to options that have no intrinsic value. A call option is OTM when the strike price is above the current market price, and a put option is OTM when the strike price is below the market price.

2. Are OTM Options Riskier Than ITM or ATM Options?

Yes, OTM options are generally riskier because they have a lower chance of expiring in the money. If the underlying asset doesn't move favourably, the option may expire worthless, resulting in a 100% loss of the premium paid.

3. When Should I Consider Buying OTM Options?

OTM options are best considered when you expect a large price movement due to events like earnings releases, major news, or economic data. They're ideal for speculative trades with limited upfront cost and defined risk.

Conclusion

In conclusion, navigating OTM options requires both precision and patience. While they carry no intrinsic value and are prone to decay, they offer low-cost, high-leverage opportunities for traders expecting significant moves.

When applied carefully, OTM contracts can yield significant returns, provided that traders regulate their expectations, limit losses, and make strategic choices.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.