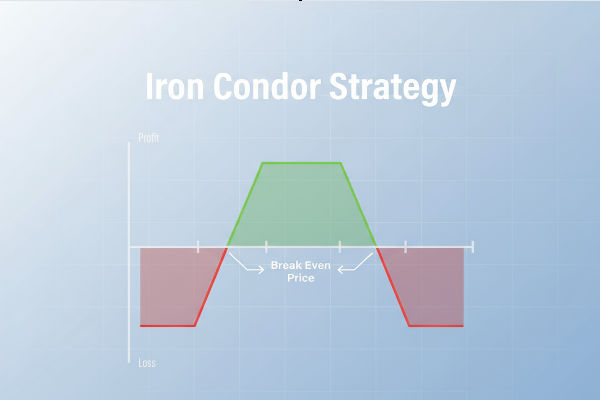

In options trading, strategies can range from simple calls and put to complex structures involving multiple legs. Among these, the Iron Butterfly strategy is a popular advanced approach used by traders who expect minimal movement in the underlying asset's price.

This strategy combines elements of both income generation and risk control, making it appealing to those who seek limited risk and defined rewards.

This guide breaks down the Iron Butterfly strategy in detail, explaining how it works, when to use the strategy and how to manage each step effectively.

What Is the Iron Butterfly Options Strategy?

The Iron Butterfly is an advanced options trading strategy that involves four options contracts with the same expiration date but three different strike prices.

The trader's belief that the asset's price will stay near the middle strike at expiration makes it a limited risk, limited reward strategy that performs best in neutral market circumstances.

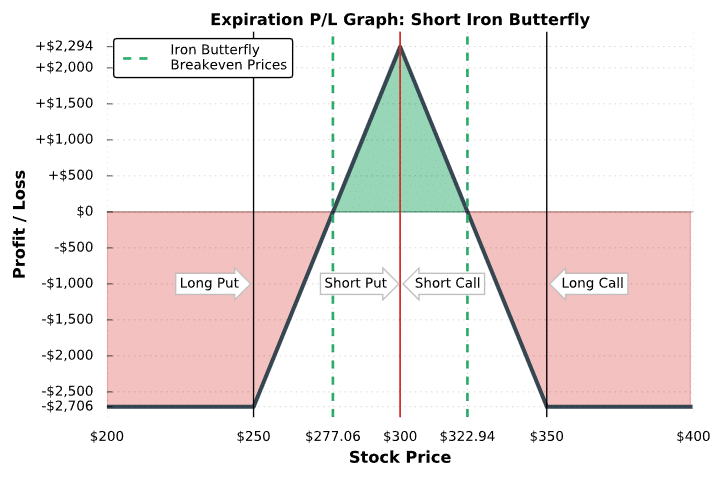

This strategy involves:

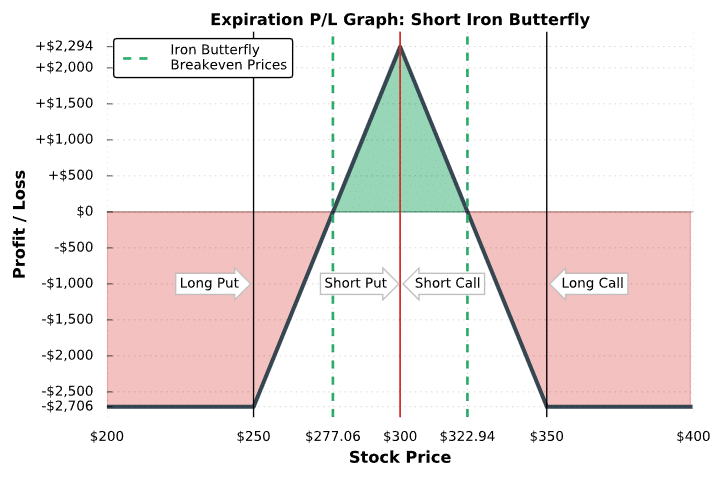

Selling an at-the-money (ATM) call

Selling an ATM put

Buying an out-of-the-money (otm) call (higher strike)

Buying an OTM put (lower strike)

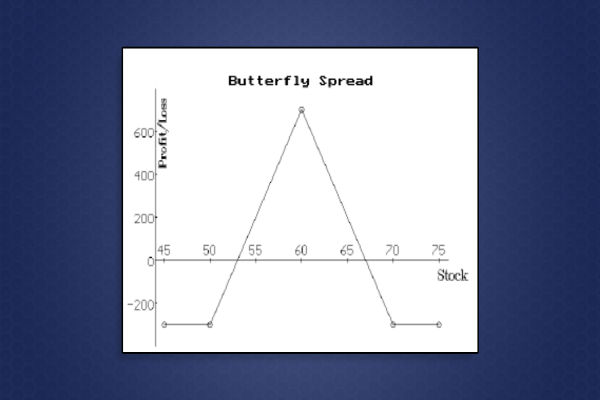

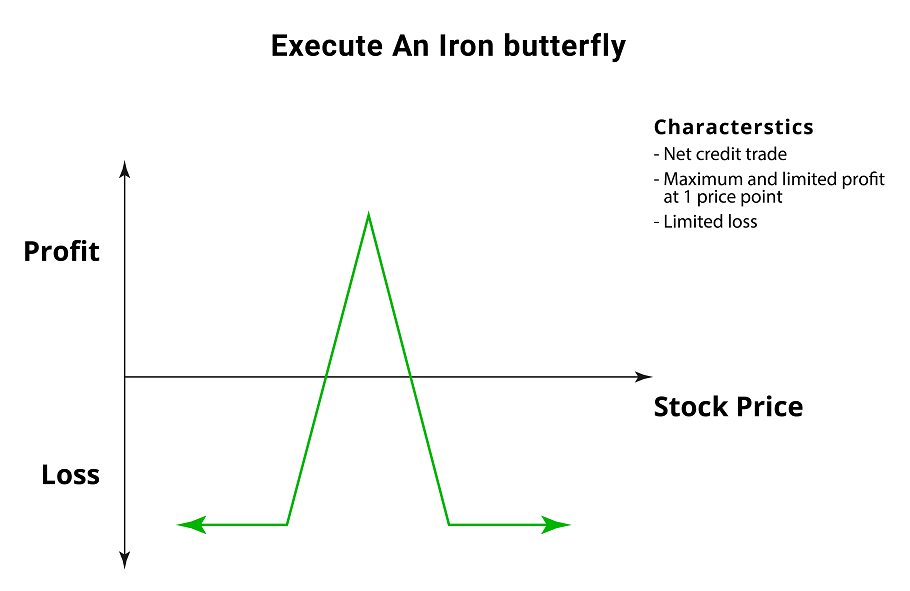

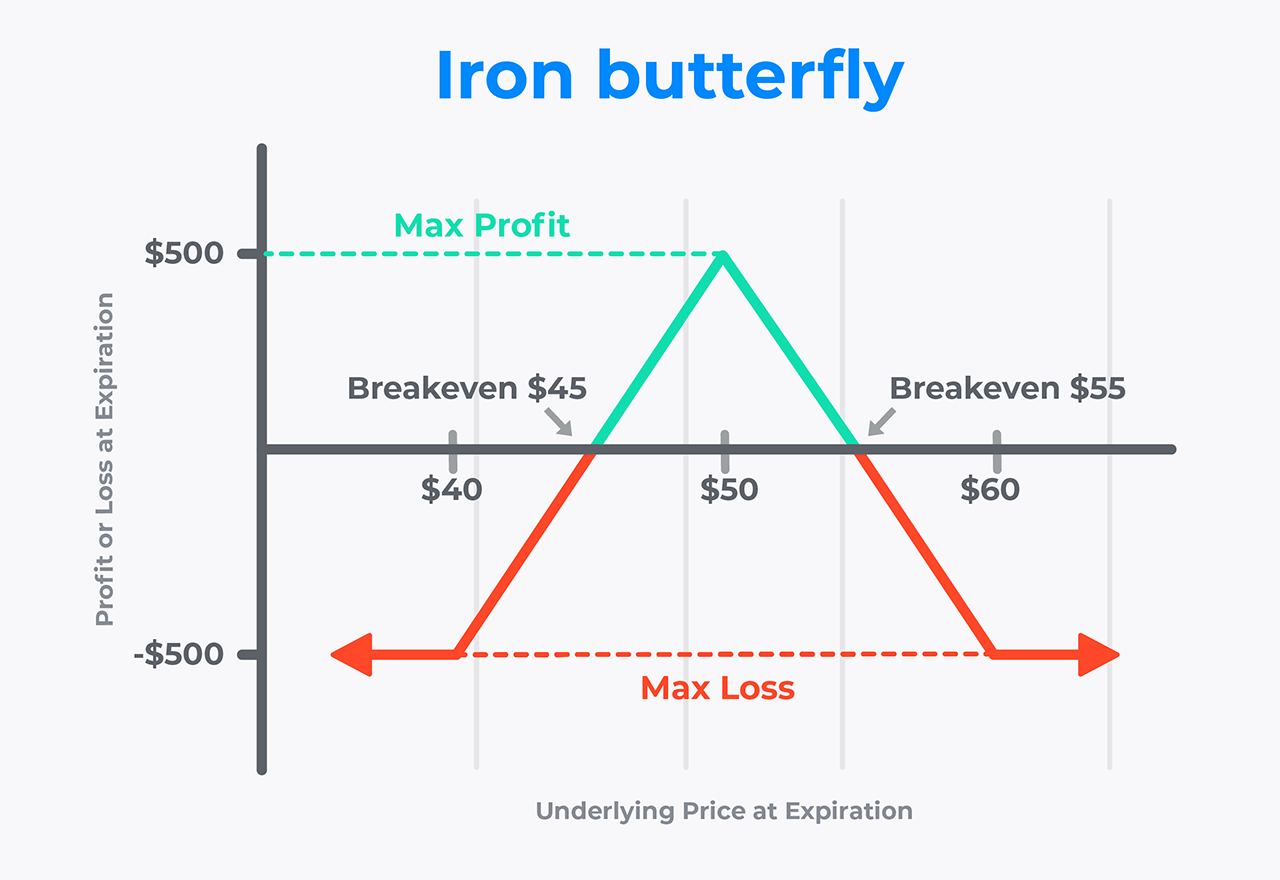

Together, these four legs create a position that profits most when the underlying price closes at or very near the ATM strike, which forms the body of the "butterfly." The outer strikes form the wings.

How the Iron Butterfly Works

The Iron Butterfly profits from time decay and a lack of movement in the underlying stock. Since you're collecting premiums from selling both a call and a put, your maximum profit occurs when the asset stays right at the strike price of the short options until expiration.

The long options serve as a protective hedge to cap the maximum loss if the market moves significantly in either direction.

Here's how the structure breaks down in a practical example:

Assume stock XYZ is trading at $100. You could:

Sell one $100 call (ATM)

Sell one $100 put (ATM)

Buy one $105 call (OTM)

Buy one $95 put (OTM)

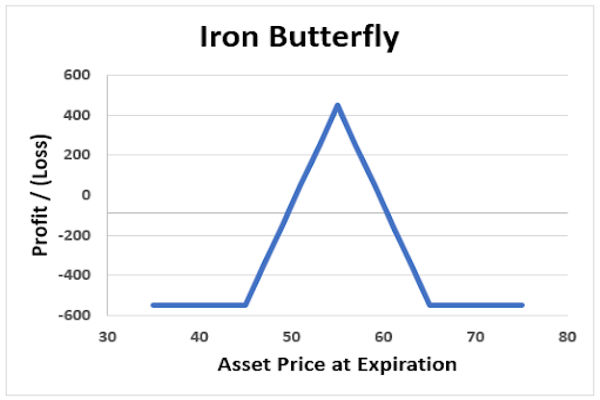

It creates a symmetrical payoff structure where:

Losses are limited beyond those breakeven points due to the protective legs

When to Use

This strategy is ideal for sideways markets or assets with upcoming catalysts, such as earnings reports, if you believe implied volatility will drop after the event and the stock won't move dramatically.

It's also useful for income generation with defined risk, especially when market movement is expected to be minimal.

Iron Butterflies tend to work best when:

Volatility is high but expected to decline

There's strong resistance/support near the ATM strike

Time decay (theta) can work in your favour

Iron Butterfly Options Strategy: Step-by-Step Guide

Step 1: Choose the Right Stock or Index

When the underlying asset is anticipated to trade inside a small range until expiration, an Iron Butterfly approach performs best. Therefore, selecting stocks or indices with low expected volatility is key.

Also, ensure the asset has good liquidity, tight bid-ask spreads, and sufficient volume in the relevant options.

Step 2: Select an Expiration Date

The expiration date determines the time value of the options. Shorter expirations offer quicker time decay (which benefits the strategy) but increase the risk of sudden price moves.

Many traders use expirations ranging from 14 to 45 days out to strike a balance between profit potential and risk control.

Step 3: Identify the Strike Prices

This is the Iron Butterfly's core. Both a put and a call will be sold at the same striking price, which is typically the stock's current price (ATM). You will then purchase one put at a lower strike and one call at a higher strike. The distance between the wings and the body determines your maximum loss.

For example, with XYZ at $100:

This setup creates a $5-wide Iron Butterfly.

Step 4: Execute the Trade as a Single Order

Most brokers allow you to place Iron Butterfly trades as a single multi-leg order. It helps you avoid execution risk or price slippage between legs.

Place the trade using a net credit, which represents the maximum profit you can make if the underlying closes at the middle strike at expiration.

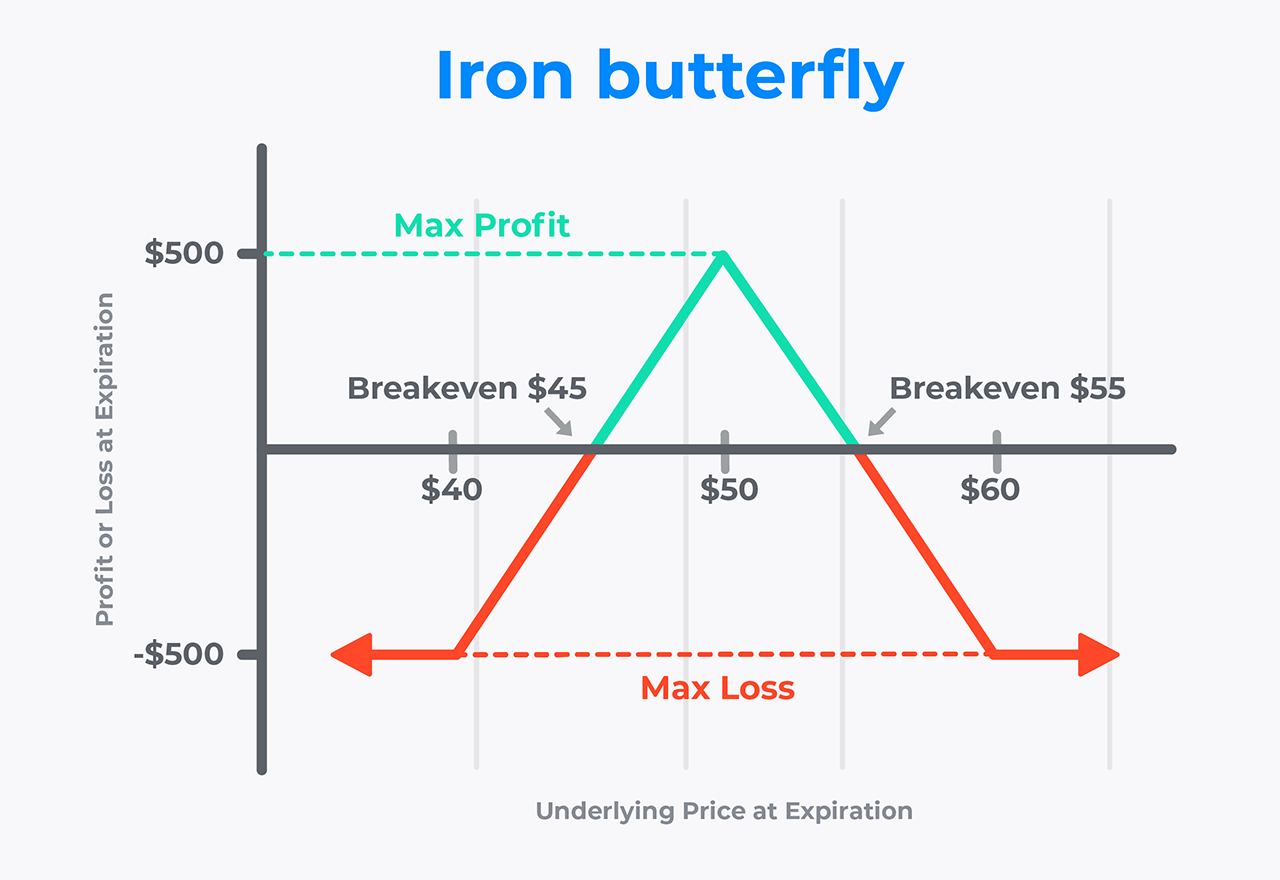

Profit and Loss Potential

Maximum Profit

The maximum profit is achieved when the underlying stock closes exactly at the short strike price at expiration. At this point, both the short call and short put expire worthless, and the premiums collected become your profit. The long options also expire worthless but serve their role as insurance.

Maximum Profit = Net Credit Received.

Maximum Loss

Your worst-case scenario occurs when the stock moves beyond one of the outer strikes. In this case, either the long call or the long put will offset the losses from the corresponding short option. The long option's gain caps your loss.

Maximum Loss = Width of Wings – Net Credit Received

In the $5-wide wing example with a $2 net credit, the maximum loss would be $3 per share or $300 per contract.

Breakeven Points

There are two breakeven points in the Iron Butterfly:

Iron Butterfly Options Benefits

One of the biggest advantages of this strategy is its defined risk and reward. Unlike naked option selling, Iron Butterflies use protective legs to cap potential losses. It makes it a more secure alternative for traders who prefer non-directional strategies.

Another benefit is that it performs well in low-volatility environments, which are often less risky. You can also adjust or roll the strategy if the market moves against you before expiration.

Additionally, this strategy allows for time decay to work in your favour. The closer the stock stays to the short strike, the faster the options lose value—resulting in potential profit as early as a few days before expiration.

Risks and Challenges

Despite the limited loss feature, Iron Butterflies aren't risk-free. The main challenge is the narrow profit zone. Since you're aiming for the stock to stay near the ATM strike, even a modest move can turn a profitable position into a losing one.

Slippage and execution costs can also be higher due to the number of legs involved. Traders need to be attentive to bid-ask spreads and use limit orders when placing trades.

Moreover, the risk of assignment on the short options if they're in the money close to expiration. It could result in unexpected stock positions. Close or roll trades before expiration to avoid this.

Conclusion

In conclusion, the Iron Butterfly options strategy is a sophisticated yet accessible tool for traders who anticipate low market volatility. By combining both calls and puts into a well-structured risk-defined setup, this strategy allows you to benefit from time decay and stable price action.

Success with the Iron Butterfly requires a solid understanding of market conditions, strike selection, and risk management. While the profit zone is narrow, the rewards can be significant when executed correctly.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.