Investors increasingly seek sustainable income and risk-efficient equity exposure. Covered call exchange-traded funds (ETFs), also known as "buy-write" ETFs, have emerged as a popular tool for achieving that balance in 2025.

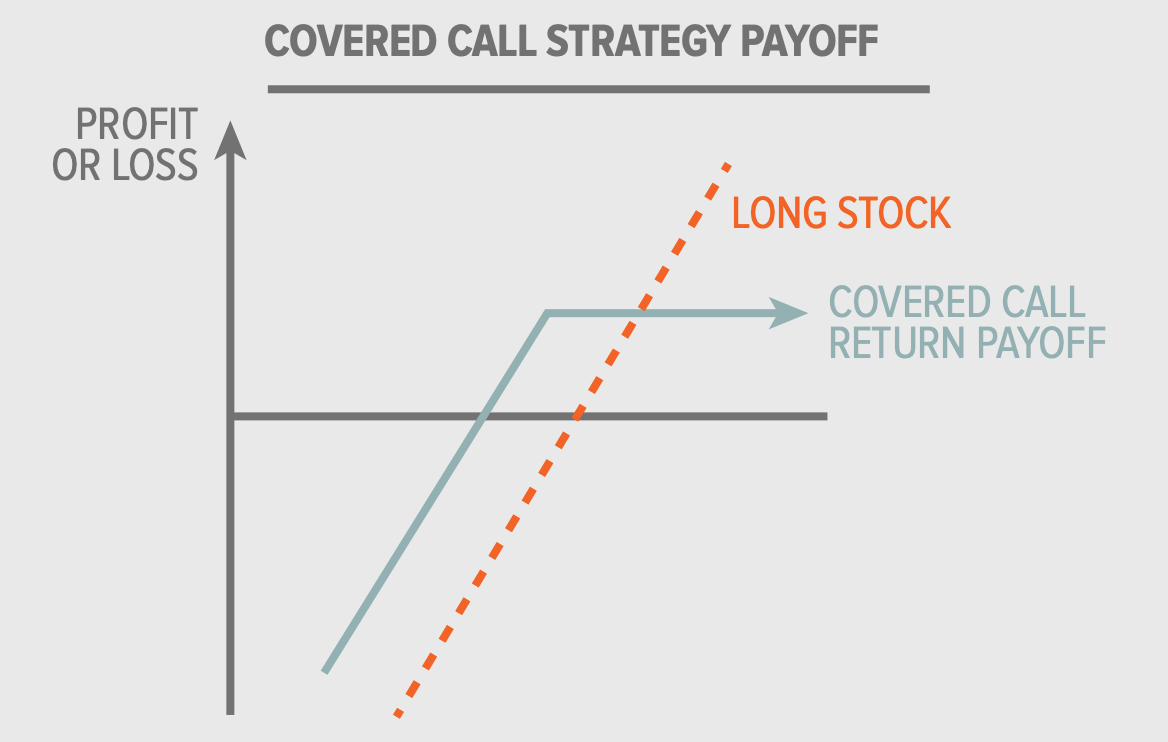

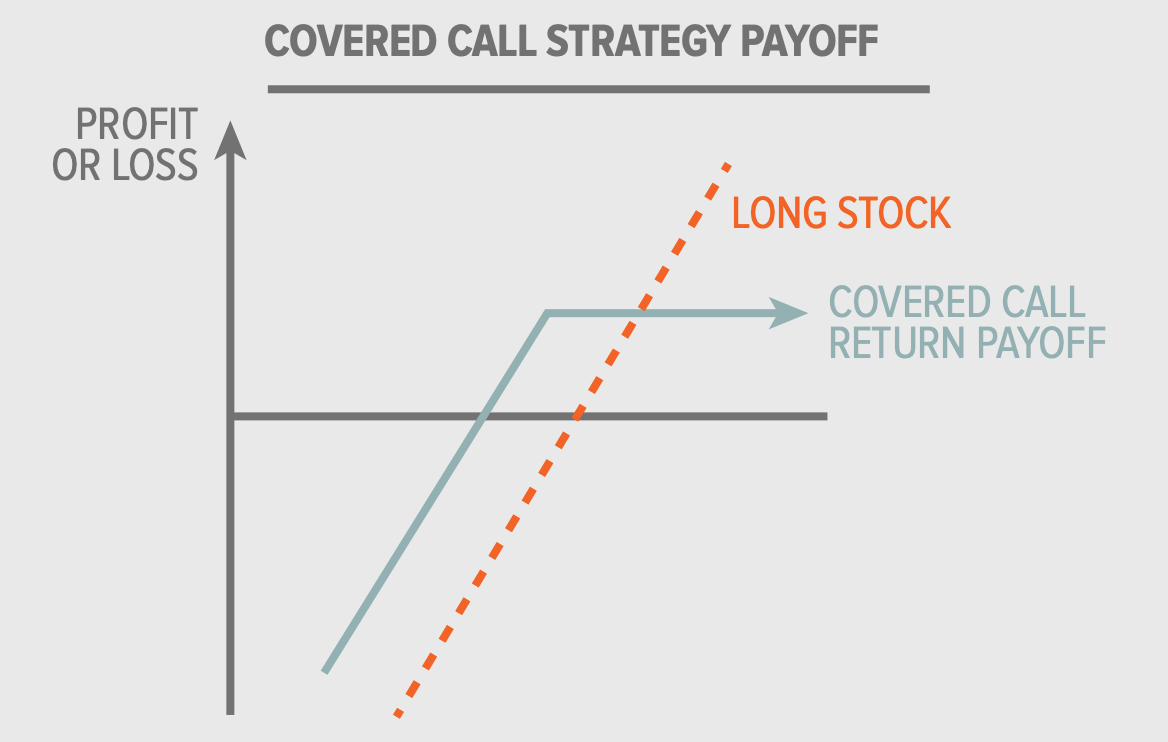

These funds hold stock portfolios and sell call options on those holdings to generate premiums, which are then distributed to investors as monthly income. But the trade-off is capped upside potential.

Let's explore how covered call ETFs work, where they shine, and which ones stand out this year.

What Is a Covered Call ETF & How It Works

A covered call ETF owns a bundle of stocks and writes (sells) call options against them. When investors buy these options, the ETF collects a premium.

If the option expires worthless (because the stock price does not reach the strike price), the ETF keeps the premium as income. If exercised, the ETF sells the stock at the strike price, keeping the premium but forgoing any further upside.

This strategy smooths returns by generating income, reduces portfolio volatility slightly, and acts as a partial hedge in flat or mildly declining markets. But it also caps gains in strong bull runs and does not fully protect against downturns.

Why Covered Call ETFs Matter in Modern Investing

In 2025, investors, particularly retirees and risk-averse savers, are facing low yields on fixed income. Covered call ETFs provide 7% to 13% distribution yields, far above the 10-year Treasury yield (~4.4%).

For context, inflows reached $31.5 billion in the first half, elevating total assets to an unprecedented $145 billion by mid-July 2025. These assets have become attractive as alternatives to taxable income and means to address volatility in the face of geopolitical and tariff unpredictability.

Many Covered Call ETFs mimic structured products but offer better liquidity, lower costs, and easier access through brokerage platforms.

Key Benefits and Risk Trade-Offs

| Key Benefits |

Risk Trade-Offs |

|

High Monthly Income: Yields typically range from 7–13%, ideal for income-focused investors. |

Limited Upside: Gains are capped due to call options; underperformance in strong bull markets. |

|

Volatility Cushion: Option premiums provide partial protection in flat/down markets. |

Downside Exposure Remains: They still incur losses during sharp market selloffs. |

|

Simplified Access to Options Strategy: No need for direct options trading experience. |

Tax Complexity: Premiums often taxed as ordinary income; may reduce after-tax returns. |

|

Potential Tax Efficiency: Some use 60/40 tax treatment (e.g., SPYI), reducing tax burden. |

Return of Capital Risk: Some distributions may erode NAV over time. |

|

Ideal for Sideways Markets: Outperform during range-bound periods with consistent income. |

Misaligned with Growth Objectives: Not suitable for long-term capital appreciation goals. |

Best Covered Call ETFs in 2025

| ETF Symbol |

Strategy |

Yield (Est.) |

Upside Participation |

Ideal Use Case |

| JEPI |

S&P low-vol large caps + options via ELNs |

8–9% |

Partial |

Income with modest growth |

| SPYI |

S&P 500 + active overlays |

~12% |

None |

High income & tax-efficient |

| QYLD |

Nasdaq-100 ATM covered calls |

11–12% |

None |

Aggressive yield seekers |

| XYLD |

S&P 500 ATM covered calls |

~10% |

None |

Core income from large-cap market |

| RYLD |

Russell 2000 ATM covered calls |

12–13% |

None |

Income from small-cap exposure |

1) JEPI – JPMorgan Equity Premium Income ETF

Strategy: Actively managed, invests in low-volatility S&P 500 stocks, sells out-of-the-money (otm) calls using ELNs

Yield: ~8.4–8.5% annually, paid monthly

Benefits: Allows some upside participation; smoother volatility

Track record: $41B AUM; ~10% annualised return over three years, with lower drawdown

Risks: Expense ratio ~0.35%, option counterparty risk via ELNs

2) SPYI – NEOS S&P 500 High Income ETF

Strategy: S&P 500 stock portfolio with index call overlays; active and tax-loss harvesting

Yield: ~12.1% annually, monthly distributions

Benefits: Tax-advantaged 60/40 split on gains; outperformed XYLD by 1 ppt over a recent year

Risks: Expense $930M, but solid performance

3) QYLD – Global X Nasdaq-100 Covered Call ETF

Strategy: Sells ATM monthly calls over 100% of Nasdaq-100 holdings

Yield: ~11–12%

Benefits: Highest income among majors, very liquid

Risks: Caps all upside beyond strike; NAV return ~7.9% over 10 years; high fees (~0.61%); return of capital concerns

4) XYLD – Global X S&P 500 Covered Call ETF

Strategy: ATM calls on 100% of S&P 500 portfolio

Yield: ~10–11%

Benefits: Broad diversification

Risks: Limited upside, expense ~0.60%; delivered ~6.7% NAV return over 10 years

5) RYLD – Global X Russell 2000 Covered Call ETF

Strategy: ATM calls across the Russell 2000 small-cap index

Yield: ~12–13%

Benefits: High premiums due to volatility

Risks: Small-cap risk, high volatility, upside limits

Who Should Use Covered Call ETFs?

Ideal Candidates

Covered call ETFs are ideal for investors seeking consistent monthly income, particularly in flat or slightly volatile market conditions.

Retirees and conservative investments gain from prioritising income, and they excel in portfolios that yield more than cash or bonds.

Not Suitable For

Growth investors rely on the long-term increase in capital value. Additionally, they are less suited for bull markets, as they consistently lag behind total-market ETFs during upward equity trends.

Strategy Tips for Investors

Diversify: Don't allocate entire equity exposure to covered call funds, blend with pure index or dividend ETFs.

Keep in taxable accounts: Minimises the impact of ordinary income tax.

Time entry: These ETFs perform best in flat or sideways markets, not at the market's peak.

Watch option writing style: ATM vs OTM calls change both yield and upside risk.

Monitor distribution consistency: Reduced premiums might lead to lower monthly disbursements.

Outlook for Covered Call ETFs in 2026 and Beyond

As equity market volatility persists amid geopolitical uncertainty and inflation concerns, covered call ETFs are expected to continue strong inflows.

According to experts, investors are increasingly eyeing funds like JEPI, JEPQ, and SPYI as "target income" solutions that provide yields between 7% and 15% while exhibiting reduced drawdown risk.

However, analysts warn that in the long run, high-yield covered call strategies might underperform buy-and-hold equity returns, particularly when bull markets benefit from complete exposure to price increases.

Over time, investors may view covered calls better as income supplements rather than a primary growth avenue.

Conclusion

In conclusion, covered call ETFs deliver powerful income streams and a smoother ride for income-focused investors, especially amid sideways or mildly bearish markets. Funds like JEPI, SPYI, and QYLD dominate due to scale, yield levels, and accessibility, but each comes with specific strategy trade-offs.

These ETFs limit upside potential, may underperform in strong bull markets, and come with tax or structural caveats. That said, when used thoughtfully, e.g. in mixed portfolios with growth equities, they offer a sustainable layer of cash flow.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.