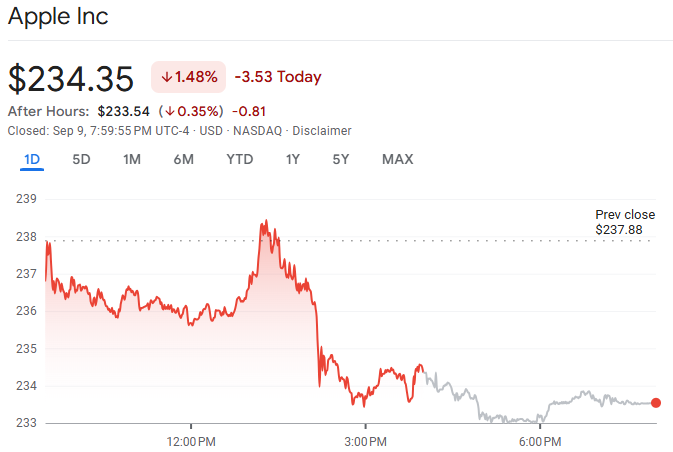

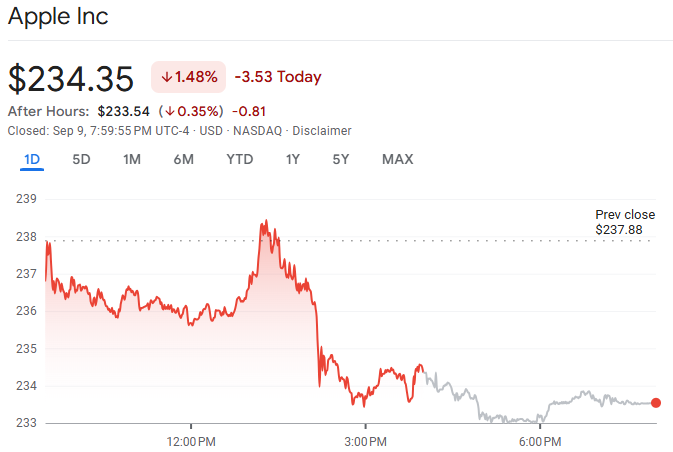

Apple's share price slipped about 1–1.6% around the iPhone 17 launch because the updates looked incremental and much was already priced in, so near‑term choices hinge on early demand data, steady pricing, and the services margin path rather than launch‑day buzz.

As of 9 September 2025, Apple closed near $234.35 with recent prints in the $230s to $240s, which offers a sensible baseline for expectations over the next few weeks while fresh pre‑order information comes through.

Apple's New Product Launch And Market Reaction

Apple unveiled the iPhone 17 line and a new ultra‑thin iPhone Air alongside Apple Watch and AirPods updates, with a clear focus on design changes and iterative feature refinements rather than sweeping pricing moves at launch.

Shares fell roughly 1–1.6% during and after the showcase, a familiar “sell‑the‑news” response when features confirm expectations and the market prefers evidence from real orders and guidance before any re‑rating. [1]

Is Apple Stock Now A Buy?

For most everyday savers, it is reasonable to wait for early order colour, shipping lead times, and the first guidance updates, since these tend to drive the next leg more than launch‑day marketing headlines.

Look for pre‑order momentum and shipping estimates that point to a healthy holiday quarter before drawing firm conclusions on demand.

Watch for steady service margins if device pricing remains level through the cycle, as this supports more stable profits across seasons.

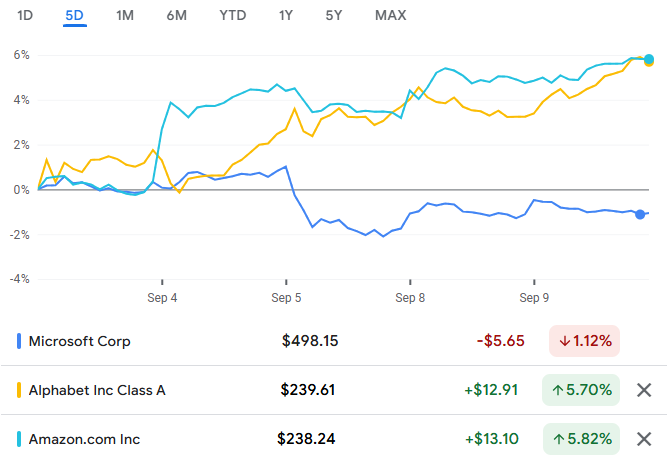

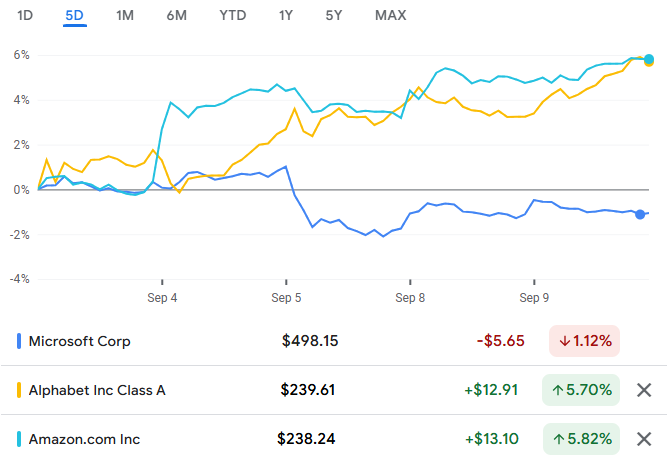

Compare today's valuation with large‑cap tech peers to judge room for multiple expansion once demand and margin signals are clearer.

Apple Competitors And Alternatives

Apple is set against both smartphone rivals and platform peers like Microsoft, Alphabet, and Amazon that shape how investors compare growth, AI progress, and valuation across mega‑cap technology names in any given quarter. [2]

Samsung is the core hardware rival, though investor comparisons often hinge on software and services momentum at platform peers beyond phone features alone.

A clearer on‑device AI roadmap could narrow perceived gaps against faster‑moving software‑led peers in the next product cycles.

Macro swings that move the Nasdaq can spill over to Apple's multiple even when company news is quiet, which is why index context matters in the short run.

3 To 12 Months Outlook

The next few quarters will be shaped by early pre‑order traction, holiday‑quarter mix, and the services line that smooths results when hardware cycles are steady rather than dramatic.

Pre‑orders and lead times are early reads on demand and can influence the first revenue revisions of the season.

Holding prices helps volumes but puts more weight on mix and services to support revenue per user and overall margins in the near term.

Broader index moves around inflation and policy can overshadow single‑name news over short stretches, especially in large‑cap technology.

12 To 24 Months Outlook

Longer‑term drivers include the installed base, services growth and margins, on‑device AI features that people use daily, and steady capital returns through buybacks and dividends.

Services can lift the quality of margins and make results less dependent on any one device cycle, as engagement remains strong.

Practical AI features across the line‑up may pull upgrades forward if they deliver clear value in everyday tasks beyond demos and keynotes.

Regular buybacks and dividends can support per‑share measures and temper volatility during incremental hardware years.

Apple Stock Forecasts And Price Targets

Recent round‑ups show price targets clustering in a modest band, which indicates cautious optimism and a preference for data before a larger re‑rating on the back of this launch cycle.

| Source Range |

Average 12-Month Target |

Spread/Dispersion |

Notes |

| Major Aggregators |

Mid-$230s range |

Narrow to moderate |

Implies modest upside from recent closes |

| Pre-Event Views |

Mixed around mid-$200s |

Moderate |

Limited room for a pop after summer gains |

A tighter spread hints at fair agreement on the short‑term path, while the lack of a bold upside skew shows the market is still waiting for confirmation from pre‑orders, mix, and services margins before lifting the range.

Apple Stock Price Zones To Watch

Using very recent trading near $234 with early‑September highs around $240, the ranges below give simple, plain‑English reference points that everyday readers can follow.

Confirm the live price on Apple's investor relations page or a major quote service before acting, as levels can shift quickly on new information.

Recent peak reclaimed: About $239–$241, anchored by early‑September highs and closes; a firm close back above this band on solid news would suggest fresh confidence.

Last base or shelf: About $229–$232, reflecting the late‑August to early‑September floor where the prior rise found support; if the wider market is steady, this area often draws interest again.

Round‑number waypoints: $230 and $240 are the nearby handles that traders and media often reference, while $250 sits as the next round figure overhead that Apple approached late last year.

Live‑price reminder: Recent closes were in the $230s with a 9 September mark near $234.35; check the latest print before relying on any fixed number.

What Could Change The Story

Stronger than expected pre‑orders or early shipping estimates into the holiday quarter that lift unit and revenue expectations.

A clearer on‑device AI timeline that resonates with reviewers and broad users rather than only early adopters or enthusiasts. [3]

Margin surprises in services or an adjustment to device pricing later in the cycle if component costs move materially.

A softer macro backdrop that pulls large‑cap technology lower regardless of company‑specific updates or product notes.

FAQs

1. Why did Apple's stock dip after the event?

Launches that confirm expectations often trigger “sell the news” until demand and margins are clearer in the following weeks.

2. Does holding prices help or hurt?

It helps volumes but puts more weight on product mix and services to support revenue per user and margins.

3. Are analysts still positive overall?

Consensus shows modest average upside over the next 12 months, which signals patience rather than a rush to re‑rate.

Bottom Line

The products look solid, but the share price reaction was muted because much was anticipated and prices held steady, so the next move likely depends on real‑world demand, mix, and service margins into the holiday period rather than event headlines alone.

For most people, the clearer decision point is after early order data and the next earnings update confirms how this cycle is shaping up relative to recent forecasts and the modest target range.

Apple stock CFD can also be traded on EBC Financial Group’s platform for those who see an opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Source

[1] https://www.cnbc.com/2025/09/09/live-updates-apple-event-iphone17-airpods-ios26.html

[2] https://finance.yahoo.com/news/apple-450-billion-rally-faces-110028430.html

[3] https://edition.cnn.com/business/live-news/keynote-apple-release-event-iphone-09-09-25