As technology continues to drive global innovation and economic growth, savvy investors are increasingly focusing on tech‑heavy exchange-traded funds (ETFs) to tap into the sector's potential.

Among these, the Vanguard Information Technology ETF (VGT) has gained strong attention for its diversified exposure to leading tech companies, robust performance, and low-cost structure.

But is it truly the best tech investment? This is an in-depth examination of its framework, effectiveness, possible risks, and its role in your investment strategy.

What Is VGT ETF?

The Vanguard Information Technology ETF (VGT) was launched in January 2004 to track the performance of the MSCI US Investable Market Information Technology 25/50 Index.

VGT offers broad exposure to U.S. tech firms, including hardware, software, semiconductors, and IT services, with a focus on large- and mid-cap companies.

Key features include:

Over 300 tech‑focused holdings

Heavily weighted in U.S. large-caps

Expense ratio of just 0.10%—among the lowest in its category

VGT transforms the fast-paced tech sector into a portfolio asset you can hold for the long run, backed by Vanguard's strong reputation for low-cost ETFs.

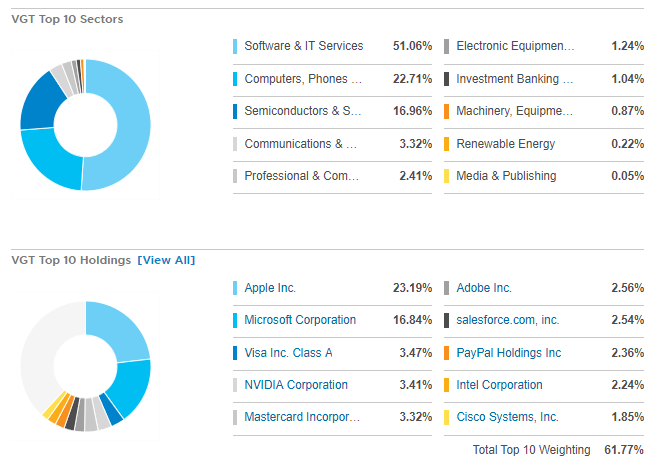

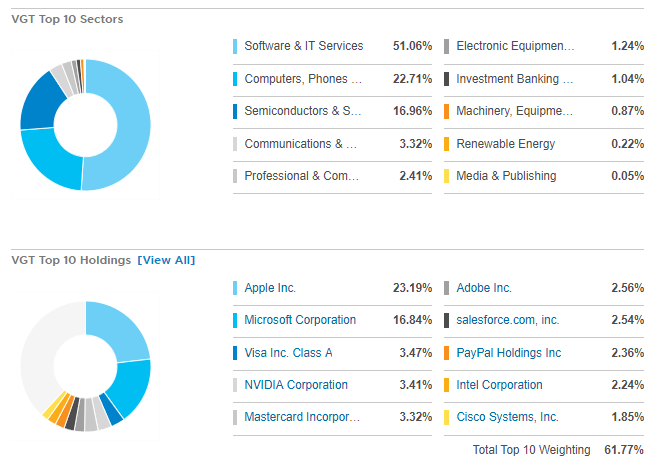

Breakdown of VGT Holdings

VGT is concentrated yet diversified. The fund is heavily weighted toward the largest U.S. tech companies but still includes exposure to emerging players and promising sectors.

Top 10 Holdings (as of 2025 Q1):

Apple Inc. (AAPL) – Market leader in consumer electronics

Microsoft Corp. (MSFT) – Cloud, enterprise software, AI

NVIDIA Corp. (NVDA) – AI chips and data centre hardware

Visa Inc. (V) – Digital payments infrastructure

Broadcom Inc. (AVGO) – Semiconductors and networking chips

Adobe Inc. (ADBE) – Creative and document software

Accenture PLC (ACN) – IT consulting and services

Salesforce Inc. (CRM) – Cloud CRM and enterprise software

Mastercard Inc. (MA) – Global payment networks

Cisco Systems (CSCO) – Networking hardware

These 10 holdings account for around 55–60% of the fund, while the rest is spread across smaller and mid-cap technology companies.

Sector Weights and Diversification:

Software & Services: ~40%

Semiconductors & Semiconductor Equipment: ~25%

Hardware & Equipment: ~20%

Payment Processors & IT Services: ~10%

Other IT: ~5%

This structure balances growth-oriented companies (like Apple and NVIDIA) with stable, cash-generating names (like Visa and Accenture).

VGT ETF Performance and Risk Profile

Long-Term Performance

Since its inception, VGT has delivered strong returns, far outpacing the broader S&P 500:

5-year annualised return (to early 2025): ~18%

10-year annualised return: ~15%

All-time return since 2004: +1,400%

Such performance reflects tech's dominance, especially during the COVID-19 era and the AI boom.

Volatility and Drawdown

With strong returns come higher volatility:

Standard deviation (5‑year): ~20%

Max drawdown: Declines of 30–40% during market corrections (e.g., 2020 tech sell‑off, late‑2022 downturn)

Investors must have risk tolerance and an extended time frame to absorb these swings.

Why VGT ETF Might Be the Ideal Tech Investment

Pure Tech Exposure

Unlike broader ETFs (e.g., VTI, XLK), VGT delivers concentrated exposure to only the tech industry, allowing investors to capitalise fully on sector tailwinds.

Leading Innovators

By holding industry titans like Nvidia, Microsoft, and Apple, VGT taps into powerful growth engines—including AI, cloud, and hardware innovation. It blends high-growth (Nvidia, MSFT) with more dividend-oriented names (Apple, Broadcom).

Cost Efficiency

VGT's near-zero fees mean more money stays compounding, especially valuable over long horizons.

Liquidity & Scale

VGT, with approximately $95B in AUM and daily trading volumes surpassing 500,000 shares, offers outstanding tradeability with tight spreads, ideal for long-term investors and active traders alike.

VGT ETF vs Other ETFS

| Feature / ETF |

VGT (Vanguard Information Technology ETF) |

XLK (Technology Select Sector SPDR Fund) |

QQQ (Invesco QQQ Trust) |

FTEC (Fidelity MSCI Information Technology ETF) |

| Issuer |

Vanguard |

State Street |

Invesco |

Fidelity |

| Expense Ratio |

0.10% |

0.10% |

0.20% |

0.08% |

| Index Tracked |

MSCI US IMI Info Tech 25/50 Index |

S&P Technology Select Sector Index |

Nasdaq-100 |

MSCI USA IMI Info Tech Index |

| Number of Holdings |

~320 |

~75 |

100 |

~340 |

| Top Holdings |

AAPL, MSFT, NVDA, V, ADBE |

AAPL, MSFT, NVDA |

AAPL, MSFT, NVDA, AMZN, META |

AAPL, MSFT, NVDA, V, ADBE |

| Tech Sector Exposure |

100% Tech |

100% Tech |

~50% Tech (some consumer) |

100% Tech |

| Dividend Yield (est.) |

~0.60% |

~0.60% |

~0.50% |

~0.65% |

| Liquidity / Volume |

High |

Very High |

Very High |

Medium |

| Average Market Cap |

Large-cap bias, but includes mid/small |

Large-cap heavy |

Large-cap only |

Broad (large to small-cap) |

| Geographic Exposure |

Primarily U.S. |

U.S. only |

U.S. focused |

Primarily U.S. |

| Ideal For |

Diversified tech growth at low cost |

Concentrated large-cap tech exposure |

Broad Nasdaq growth |

Ultra-low fee diversified tech exposure |

| Best Use Case |

Long-term core tech holding |

Tactical trades in mega-cap tech |

General growth sector tilt |

Cost-sensitive, diversified tech investing |

XLK (Technology Select Sector SPDR Fund)

QQQ (Invesco QQQ Trust)

FTEC (Fidelity MSCI Information Technology ETF)

Expense: 0.08% (slightly cheaper)

Nearly identical holdings and weights to VGT

In practice, differences are minimal. VGT's competitive edge lies in its balance of cost, liquidity, and Vanguard's trusted structure.

How to Incorporate VGT Into a Portfolio

As a Core Growth Holding

VGT can form the backbone of a growth-oriented portfolio, offering exposure to tech without single-stock risk.

Paired with Value or Fixed-Income Funds

Pairing VGT with a low-cost bond fund or a value-focused index can smooth volatility and provide diversification.

Dollar-Cost Averaging (DCA)

Investing fixed amounts regularly helps mitigate timing risks and builds a position over volatile periods.

Rebalancing Strategy

Maintaining a specific allocation, such as 30% VGT, 50% S&P 500, and 20% bonds, helps manage risk and secure profits by adjusting VGT holdings according to market fluctuations.

Where to Invest in VGT ETF?

If you're interested in trading the Vanguard Information Technology ETF (VGT) without owning the actual asset, EBC Financial Group offers a compelling solution through cfd trading.

It allows you to speculate on VGT's price movements—both up and down—without needing to purchase the ETF outright.

Whether you're a beginner seeking tech exposure or a seasoned trader looking for new opportunities, EBC Financial Group offers a secure and flexible way to trade VGT in 2025.

Conclusion

In conclusion, the Vanguard Information Technology ETF (VGT) symbolises the essence of modern tech investing: diversified, low-cost, and aligned with long-term innovation.

If you're seeking a core tech holding for a growth-oriented portfolio in 2025, VGT ticks many boxes: performance, cost, and simplicity. Just be sure you're comfortable with sector concentration and volatile swings.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.