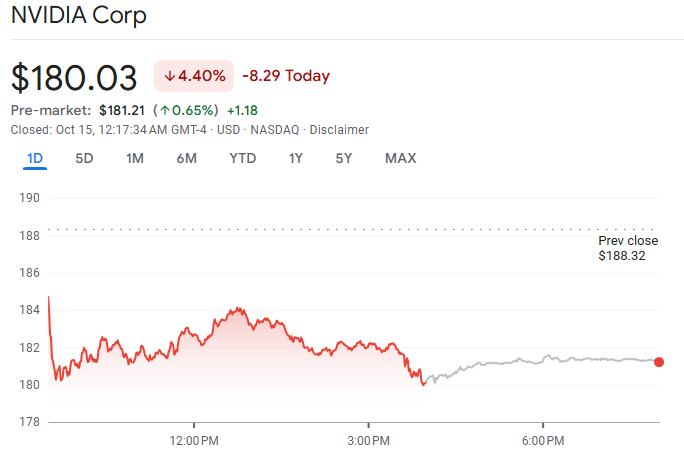

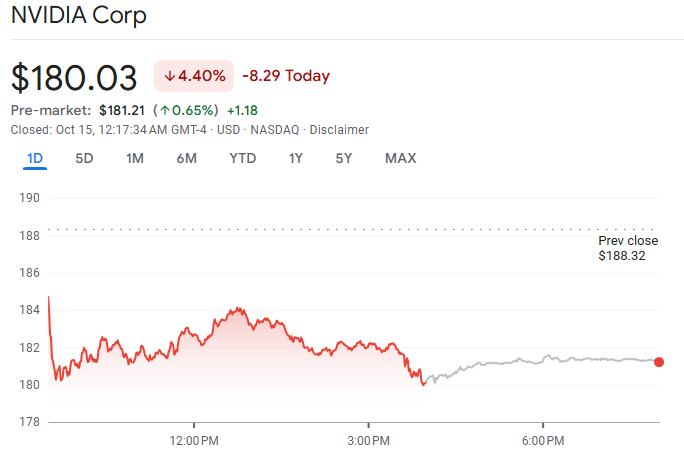

Nvidia's stock is one of the most closely watched on the Planet. When it dips, traders ask, "Why?" in real time. On Oct 14–15, 2025, NVDA plunged more than 4% intraday and has been notably volatile, but the answer isn't a single headline.

Nvidia (NVDA) Key Stats

Price: ~$180.03

Market Cap: ~$4.58 trillion

52-week range: ~$86.62 – ~$195.62

YTD change (total return): +117.3 %

For reference, NVDA now trades between $180 and $188, having fallen roughly 4–6% from its last close on Oct 14 after a significant intraday drop; the 52-week range is about $86 to $196.

Below is a simple yet complete breakdown of why Nvidia Stock dropped today, so you understand what happened, why it matters, and what to watch next.

Why Did Nvidia's Stock Drop Today? 6 Key Drivers

| Factor |

Description |

Impact on NVDA |

| China Customs |

Stricter chip inspections |

Revenue risk in the short term |

| Trade Tensions |

Tariff and policy-related fears |

Triggers risk-off rotation among investors |

| Valuation |

Elevated price multiples leading to profit-taking |

Causes technical correction pressure |

| Options Activity |

Gamma rebalancing by large traders |

Amplifies volatility during selloffs |

| Competition |

Rising pressure from Broadcom and other chip rivals |

Leads to relative repricing across the sector |

| Guidance |

Management issued conservative outlook |

Weighs on sentiment and near-term momentum |

1) China Customs Crackdown

In early October 2025, Reuters indicated that Chinese customs were intensifying inspections at key ports, scrutinising shipments of advanced U.S. chips, such as Nvidia processors, amid Beijing's efforts to prioritise local chip production and implement new regulations. [1]

This directly increases friction for Nvidia selling into China and raises short-term delivery uncertainty for customers. Market participants viewed the action as both a demand impact and a resurgence of geopolitical risk.

Why it matters: China is a key market for AI infrastructure and OEMs. Tighter customs checks slow shipments, create fill-rate uncertainty and force customers to delay purchases or re-route supply, any of which can dent near-term revenue visibility for NVDA and its partners.

Practical nuance: This is not necessarily a long-term ban, and it's an enforcement surge. But in a market pricing perfection, even "temporary" frictions can trigger outsized share moves.

2) Geopolitical Headlines & Trade Tensions Lift the Risk Premium

In October 2025, several headlines emerged connecting trade policies, tariffs, and industrial strategies to chip movements. Reuters and market analyses highlighted revived investor worries that tariffs and political resistance might hinder international trade, leading to a widespread decline in the tech sector.

When geopolitical risk ticks up, capital often moves from high-beta tech names into "safer" corners of the market. NVDA, trading at a very high multiple and very high beta, is a natural casualty.

In the broader context, Nvidia's growth story is dependent on cloud customers, hyperscalers, and enterprise capital expenditures. Anything that clouds the picture (literally or figuratively) makes investors nervous.

3) Valuation & Profit-Taking After a Blistering Run

Nvidia's surge during 2024–2025 has been remarkable. With share prices making large gains, many traders who have owned NVDA through the run are booking profits. Even when fundamentals remain strong, stretched valuations make a stock more vulnerable to corrections.

Analyst context: Consensus 12-month price targets indicate potential gains (~$214), yet there is significant variation in targets ranging from about $120 to over $300, highlighting contrasting opinions on sustainability and raising headline risk when downgrades or target cuts happen.

Why this causes big moves: Large institutional and quant funds manage risk dynamically. When valuations diverge from modelled fair value or volatility spikes, they reduce position sizes, which can accentuate declines in a thin market.

4) Options, Gamma and Technicals

When a high-float, highly traded stock like Nvidia moves, options activity often amplifies the impact. Market-making desks delta-hedge and rebalance their exposures, which can result in additional buying or selling pressure, sometimes in both directions during the same session. [2]

Recent large option flows and high implied volatility (options' "fear gauge" rising) suggest derivative activity has been an amplifier of price moves. Reuters noted a significant increase in volatility in October markets as AI excitement collided with trade risk.

Technical picture: NVDA has flattened from recent peaks; a break of short-term support levels triggers stop orders and margin calls in leveraged accounts, producing a cascade effect. It is mechanical, not always fundamental.

5) Competitive and Industry News

Competitors and ecosystem partners matter. News of competitors such as Broadcom enhancing partnerships or smaller chipmakers achieving successes may lead investors to reassess their exposure within the sector.

Recent reports emphasised Broadcom's growth after its AI partnerships and product introductions, reevaluating NVDA's worth.

Remember: NVDA is not just a GPU company now; it's a platform company tied to data centres, software stacks, and cloud economics. Small changes in perceived share or margin can therefore have outsized price effects.

6) Earnings, Guidance, and Revenue Season Context

Nvidia announced robust results for 2025 (FY quarterly revenues and prior data centre strength), yet markets closely monitor guidance and order visibility.

Recent company announcements suggest peak revenue levels in 2024–early 2025, but any remarks that constrain expectations (e.g., clients postponing deliveries, extended lead times for parts, or weaker margin insights) will impact the market.

Concrete numbers: NVDA's 2025 revenue quarters were enormous (e.g., FY-Q4 revenue cited in company releases earlier), and the company's forward cadence depends on hyperscaler demand for AI infrastructure.

Is the Nvidia Stock Drop a Crash or an Adjustment?

Context is everything. NVDA's drop of ~4–6% over a session or two (as seen Oct 14–15) is painful for holders but not a structural collapse.

As mentioned above, NVDA was trading near $180, experiencing intraday fluctuations between the high-$170s and mid-$180s on October 14–15. The 52-week range still contains the move (low ~86, high ~195).

A single-day move of this size is consistent with volatility compression after a big run rather than evidence that the long-term thesis is broken.

Nvidia Stock Forecast: Expect Insights

Analysts remain broadly positive but divided. MarketBeat's compilation indicates an average 12-month target of approximately $214, featuring a broad range of optimistic and reserved predictions, suggesting that sentiment is mixed and adjustments can significantly influence the stock in both directions. [3]

Many bullish analysts have increased forecasts for 2025, while more cautious firms have heightened concern over valuation and geopolitical issues.

What Traders and Longer-Term Investors Should Watch Next

If you own NVDA or are thinking about buying, here are the precise items that will decide the next few weeks:

1. China customs enforcement updates

2. Earnings/guide updates and customer commentary

3. Macro risk indicators

4. Options market signals

Frequently Asked Questions

Q1: Is Nvidia's Fundamental Growth Story Broken?

No. Demand for AI compute remains historically strong, and Nvidia's data-centre franchise is still a market leader.

Q2: Should I Sell NVDA Now?

That depends on your horizon and risk tolerance. Traders may exit or hedge; long-term believers may buy on weakness. Use defined risk sizes, not gut feelings.

Q3: How Likely Is the Customs Crackdown to Become a Full Export Ban?

Current reporting describes stepped-up inspections and enforcement, not a blanket ban.

Conclusion

In conclusion, Nvidia's stock drop today is not the start of something worse unless the customs enforcement evolves into a long-term ban or there is a major unexpected slowdown in global AI capex.

What you're seeing today is the interplay of very high expectations, geopolitical noise, valuation pressures, and mechanical market flows. These ingredients cause quick, sometimes dramatic moves, but they do not automatically invalidate Nvidia's multi-year growth story.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/china/china-steps-up-customs-crackdown-nvidia-ai-chips-ft-reports-2025-10-10/

[2] https://www.reuters.com/business/finance/global-markets-view-usa-2025-10-14/

[3] https://www.marketbeat.com/stocks/NASDAQ/NVDA/forecast/