Imagine trying to sell your house; it could take weeks to find a buyer. But if you own shares of Apple or trade EUR/USD, you can sell instantly with a single click.

Liquidity is the ease and speed at which you can buy or sell an asset without causing significant price fluctuations.

For traders, understanding liquidity is essential because it affects execution speed, transaction costs, and risk management. Without liquidity, even the best trading strategy can fail, since you may not be able to buy or sell at your desired price.

What Is Liquidity in Trading in Simple Terms?

Liquidity fundamentally refers to the simplicity of turning an asset into cash. Since cash is the most liquid asset, the more an asset resembles cash in terms of tradability, the more people deem it liquid.

In trading, liquidity measures:

Volume of buyers and sellers: Greater participation in a market leads to increased liquidity.

Bid-ask spread: A tight spread (small difference between the buy and sell prices) usually signals strong liquidity.

Execution speed: In liquid markets, trades are filled quickly at near-expected prices.

For example, EUR/USD in forex is highly liquid because millions of traders, banks, and institutions trade it daily.

In contrast, a small-firm stock traded by only a few investors might exhibit low liquidity, complicating the process of buying or selling without affecting the price.

Types of Liquidity in Trading

1. Market Liquidity

It shows how easily investors can exchange assets in a specific market. For example:

High-Liquidity Markets: Forex majors (EUR/USD, USD/JPY, GBP/USD), U.S. Treasuries, and mega-cap stocks such as Apple (AAPL) and NVIDIA (NVDA).

Low Liquidity Markets: Penny stocks, thinly traded commodities, low-cap cryptocurrencies.

2. Accounting Liquidity

It measures how easily a company can use its assets to meet short-term obligations. Ratios such as the current ratio and the quick ratio are used to assess this.

3. Funding Liquidity

It relates to how easily traders or institutions can obtain cash or financing. For instance, during a financial crisis, funding liquidity may dry up even if market liquidity remains.

4. Asset Liquidity

Individual assets vary in liquidity. Gold, for instance, is more liquid than real estate, as it can be sold rapidly in international markets with minimal price impact.

Why Is Liquidity Important in Trading?

1. Faster Execution

High liquidity ensures that trades are executed almost instantly. For day traders and scalpers, even a few seconds of delay can affect profitability.

2. Tighter Spreads and Lower Costs

In liquid markets, competition among buyers and sellers narrows the bid-ask spread, reducing transaction costs. This is why forex majors are often cheaper to trade than exotic currency pairs.

3. Price Stability

Illiquid assets may experience significant price fluctuations from minor trades. Liquidity acts as a buffer against fluctuations, providing more stable price changes.

4. Easier Risk Management

Stop-loss and take-profit orders are more reliable in liquid markets since they are likely to be executed close to the specified price.

Examples of Liquidity in Different Markets

Forex Market

Highly Liquid: EUR/USD, USD/JPY, GBP/USD. Traded 24/5 by banks, institutions, and retail traders.

Less Liquid: Exotic pairs such as USD/ZAR or USD/TRY. Wider spreads, harder exits.

Stock Market

Highly Liquid: Apple (AAPL), Tesla (TSLA), NVIDIA (NVDA). Traded in massive daily volumes.

Illiquid: Penny stocks or over-the-counter (OTC) stocks. Few buyers, high slippage.

Commodity Market

Highly Liquid: Gold (XAU/USD), Crude Oil (WTI/Brent). Global demand, institutional activity.

Illiquid: Rare metals like Rhodium or niche agricultural products.

Cryptocurrency Market

Highly Liquid: Bitcoin (BTC), Ethereum (ETH), stablecoins like USDT/USDC.

Illiquid: Low-cap altcoins or meme tokens, where a $10,000 order can move the price 20%+.

How to Measure Liquidity in Trading

1. Trading Volume

High trading volume usually means high liquidity. For example, Apple stock may trade millions of shares daily, signalling deep liquidity.

2. Bid-Ask Spread

Narrow spreads suggest liquid markets. If the spread for EUR/USD is 0.1 pips, it is more flowing than a low-volume exotic currency pair, which has a spread of 5 pips.

3. Market Depth

Order books indicate the quantity of buy and sell orders available at different price points. A deep order book indicates higher liquidity.

4. Slippage

If trades consistently execute near the expected price, liquidity is strong. High slippage signals weaker liquidity.

Liquidity and Trading Strategies

1. Scalping

Scalpers depend heavily on liquidity because they enter and exit trades quickly, aiming for small profits. A liquid market ensures minimal slippage.

2. Swing Trading

Swing traders prefer liquid assets to avoid getting stuck in trades. High liquidity ensures they can exit when their technical signals reverse.

3. Long-Term Investing

While long-term investors may hold positions for years, liquidity still matters. Selling a highly liquid stock is far easier than unloading a rare asset in a downturn.

The Role of Brokers and Exchanges in Liquidity

Brokers and exchanges play a direct role in ensuring traders have access to liquid markets.

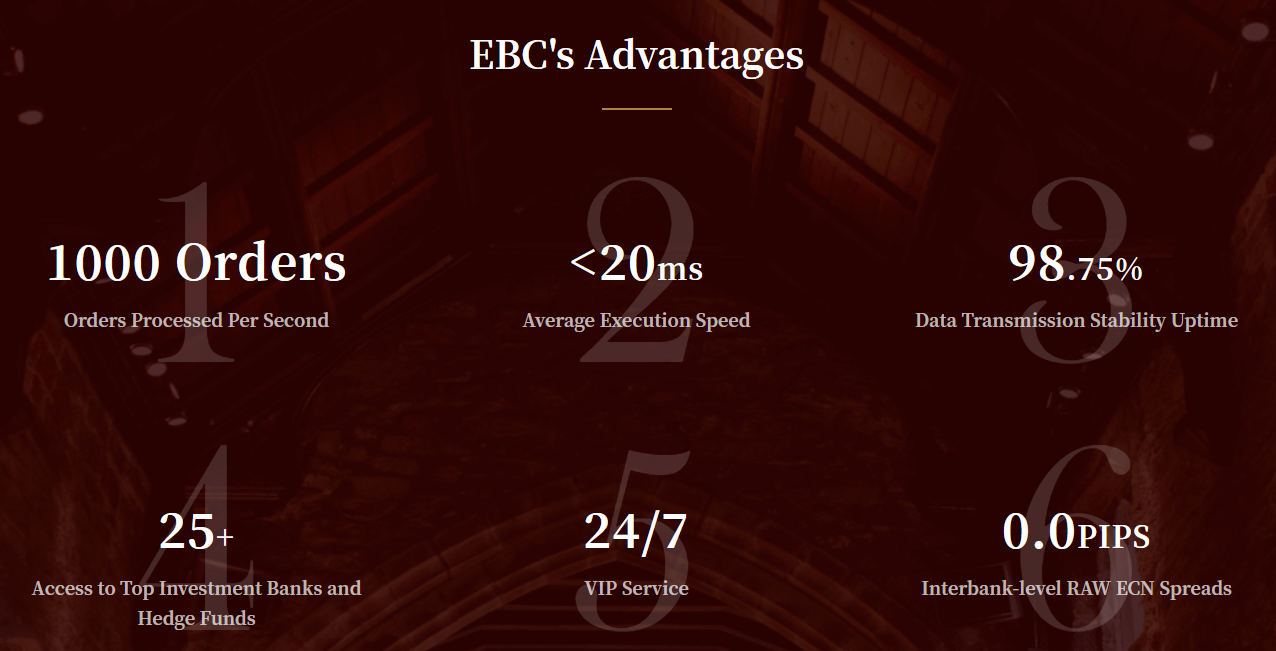

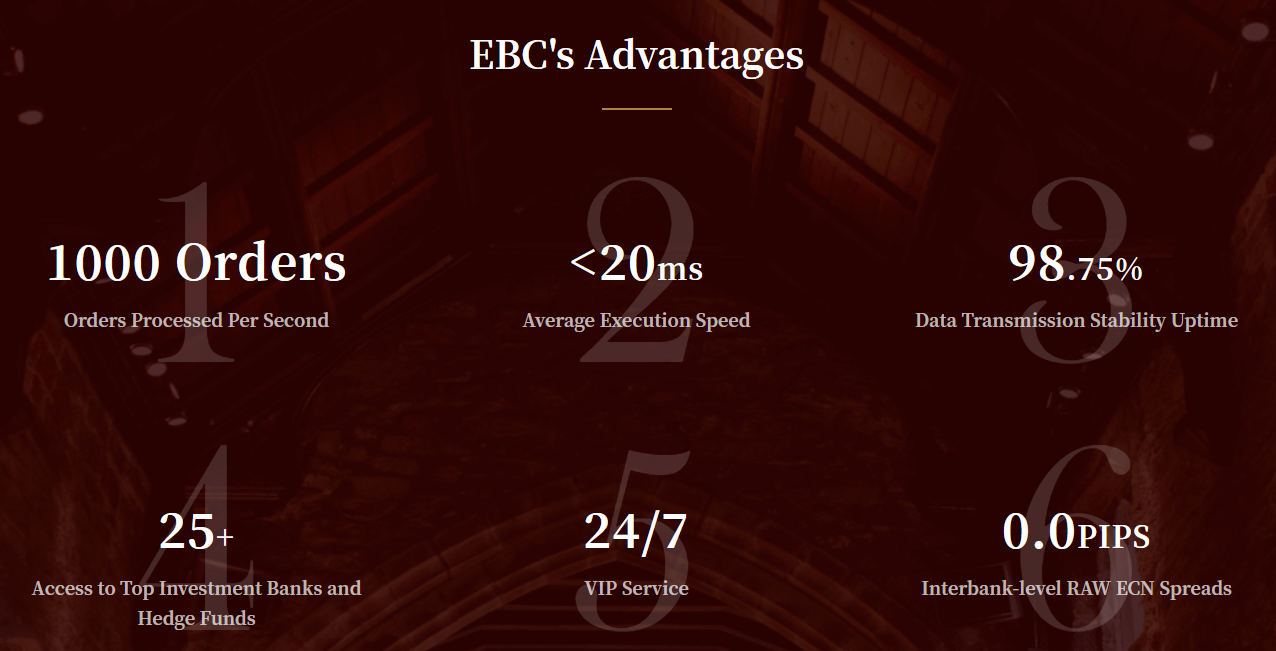

Forex brokers such as EBC Financial Group aggregate prices from multiple liquidity providers (banks, institutions) to offer better spreads.

Stock exchanges like the NYSE and NASDAQ ensure smoother executions due to their massive trading volumes.

Crypto exchanges with robust order books provide more secure trading for major coins.

Selecting the appropriate broker or exchange can greatly influence access to liquidity.

Frequently Asked Questions

1. What Does Liquidity Mean in Trading?

In trading, liquidity refers to the ease with which buyers and sellers can buy or sell an asset without triggering major price fluctuations.

2. Is High Liquidity Always Better Than Low Liquidity?

Generally, high liquidity is better for most traders because it lowers costs and improves execution.

3. How Does Liquidity Affect Day Trading and Scalping?

Liquidity is essential for day traders and scalpers, as they rely on quick entries and exits. In liquid markets, trades are filled instantly at desired prices, whereas in illiquid markets, spreads and slippage may reduce profits.

Conclusion

In conclusion, liquidity is the lifeblood of financial markets. It determines how smoothly you can trade, how much you pay in costs, and how stable prices remain.

For beginners, stick to highly liquid assets such as major forex pairs, gold, large-cap stocks, and top cryptocurrencies. For advanced traders, monitoring liquidity helps refine strategies, manage risk, and optimise timing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.