After a long stretch of record highs, Microsoft stock is feeling real selling pressure. From a recent peak around $555, MSFT has slipped to about $477, a slide of roughly 14% that includes a fresh daily loss of around 2.4%.

For traders and investors watching this latest drop in Microsoft stock, the focus is not on headlines but on what the numbers are saying. Is this pullback just a healthy pause after an aggressive rally, or the start of a deeper reset in MSFT’s trend?

The sections that follow look at the drivers behind the move, the key technical levels, and what the current price action might mean for different trading styles.

Microsoft stock: how big is the drop?

At the latest close, Microsoft stock is around $477.73, down $11.89 on the day, which is about a 2.4% fall from the prior close near $489.62.

Key context around the move:

52-week range: $344.79 to $555.45, so price now sits roughly 14% below the high and still well above the low.

Market cap: about $3.85 trillion, keeping Microsoft among the most valuable companies in the world even after the pullback.

Valuation: trailing price-to-earnings ratio sits in the mid-30s, which is rich compared with the wider market and leaves less room for disappointment.

Volume: roughly 34.6 million shares traded vs an average near 25.7 million, so today’s drop came with about 35% higher than normal activity.

This is a meaningful but not yet extreme correction from very strong levels after a long AI-driven rally.

Reasons for Microsoft Stock Drop

1. AI sales news triggered fresh profit-taking

The most direct trigger for the latest leg lower was a report claiming Microsoft had lowered sales growth targets or quotas for some AI software products after sales teams missed goals.

The chain of events:

The story raised doubts about how fast AI tools like copilots and “agents” will ramp in real revenue.

Microsoft responded and said the report mixed up growth targets and quotas, and stated that AI sales quotas were not lowered, but the damage to short-term sentiment was already done.

For traders, that’s classic “headline risk”: one story was enough to flip algorithms and short-term traders from buying strength to selling the news on Microsoft stock.

2. Longer AI spending concerns have been building

The current slide does not come out of nowhere. In early November, Microsoft went through its longest losing streak in more than a decade, dropping about 8.6% in eight sessions and wiping out roughly $350 billion in market value.

The driver then was also AI:

Investors focused on huge AI infrastructure spending, with reported capital expenditure near $35 billion in a single quarter.

At the same time, there were early signs that many corporate AI projects are slow to move beyond pilots, feeding the idea that the pay-off may take longer than the hype suggested.

When a stock is priced for perfection, any hint that growth might take longer to materialise can trigger a sharp reset. That is what we are seeing in Microsoft stock dropping now.

3. Valuation reset after a huge run

Even after this pullback, Microsoft is still:

That combination of high expectations plus slower-than-hoped AI adoption is the core reason behind Microsoft stock falling. The market is not suddenly bearish on the business. It is simply willing to pay a bit less for the same growth story.

Is Anything “Wrong” With Microsoft?

The short answer from the numbers is no.

From Microsoft’s latest full fiscal year (ended June 30, 2025):

Revenue: $281.7 billion, up 15% year-on-year

Operating Income: $128.5 billion, up 17%

Net Income: $101.8 billion, up 16%

Diluted EPS: $13.64, up 16%

Segment growth was also strong:

Intelligent Cloud revenue up 26%, with Azure and other cloud services up around 39%.

Productivity and Business Processes up 16%.

Consumer-facing areas like gaming and devices still grew, just at lower single-digit or low-double-digit rates.

So while Microsoft stock dropping grabs the headlines, the business is still growing fast and remains very profitable.

The issue is not earnings quality. It is how much investors are willing to pay for those earnings, given the heavy AI capex and the time it may take for those projects to fully pay off.

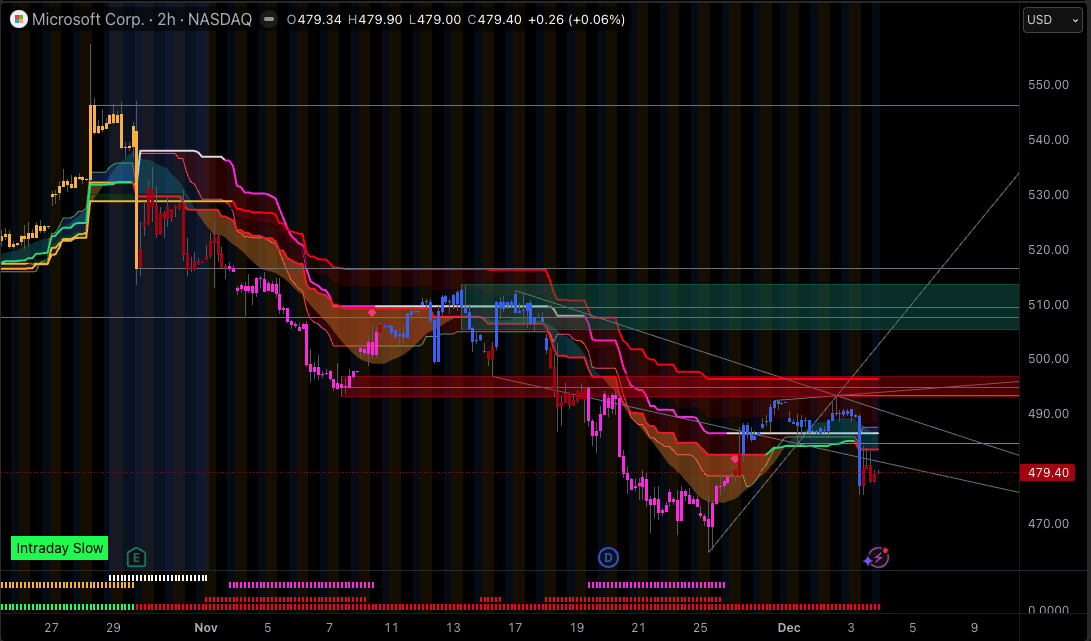

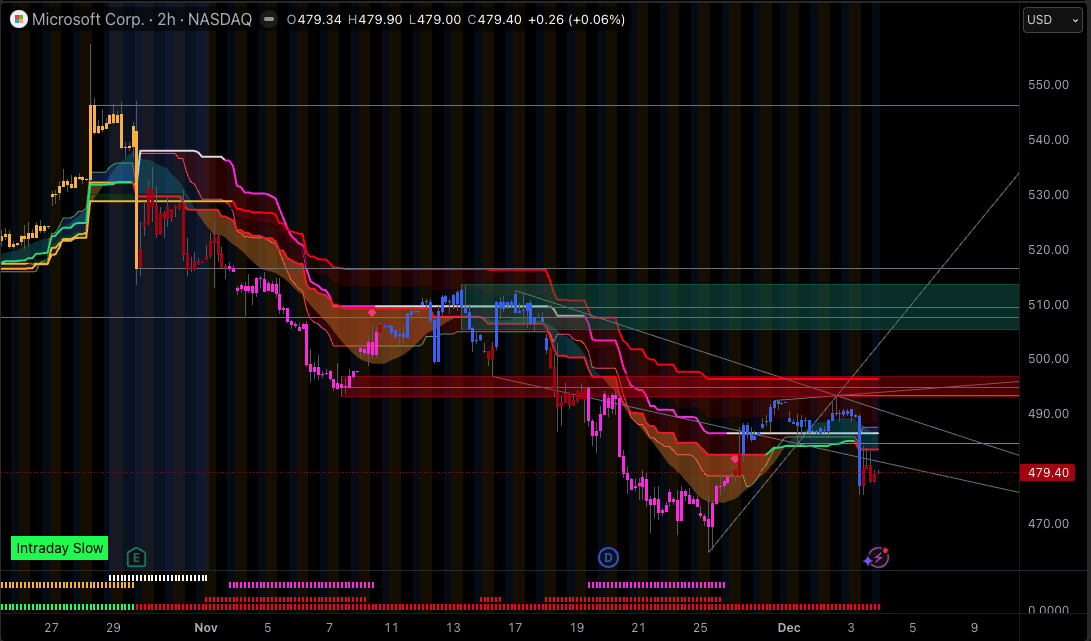

Microsoft Technical Analysis: Key Levels and Indicators

Core indicators for MSFT stock

All technical data below is as of the daily close on 3 December 2025.

| Indicator |

Latest Value (Approx) |

What It Tells Us |

| Last price |

$477.73 |

Current trading level after the latest drop |

| Change today |

–$11.89 (~–2.4%) |

Sharp single-day loss with elevated volume |

| 52-week range |

$344.79 – $555.45 |

Price is ~14% below the high, still well above the low |

| 5-day simple MA |

$481.04 |

Price just below very short-term trend |

| 10-day simple MA |

$483.38 |

Short-term momentum still negative |

| 20-day simple MA |

$486.22 |

Stock is trading under the recent consolidation zone |

| 50-day simple MA |

$483.05 |

Price ~1.1% below this line, confirming a near-term downtrend |

| 100-day simple MA |

$489.59 |

Medium-term trend now above price, showing pressure since October |

| 200-day simple MA |

$503.34 |

Price ~5% below the 200-day, signaling a deeper correction rather than a small dip |

| RSI (14-day) |

39.0 |

Momentum is weak but not yet in oversold (<30) territory |

| MACD (12,26) |

–0.89 |

Bearish crossover supports a short-term “sell” bias |

| ATR (14) |

~$4.11 |

Volatility is elevated compared to recent months |

| Daily technical summary |

“Strong Sell” |

Most daily indicators and moving averages show sell signals |

Support And Resistance Zone

Based on recent swing highs/lows, moving averages, and pivot levels:

Immediate support:

Around $470 (near the lower end of the latest day’s range and a recent intraday floor).

A wider support band stretches into the $460s, where the stock paused during earlier pullbacks.

First resistance:

Major resistance:

MSFT is in a short-term downtrend below all its main moving averages, with declining momentum but not yet at extreme oversold readings on the daily chart.

What Microsoft’s Pullback Means For Different Types Of Traders

1. Short-term traders (intra-day and 1–3 days)

The strong sell signals across daily indicators favour selling intraday spikes into resistance rather than chasing breakouts.

Volatility is higher, so risk per trade needs to be sized carefully. ATR near $4 means normal daily swings of that order.

The most important levels are $470 on the downside and $490 on the upside for short-term bias.

2. Swing traders (days to weeks)

Microsoft stock dropping below the 50- and 200-day averages suggests a correction phase, not a trend break in the big picture yet.

Many swing traders will watch for:

Either a flush lower into the mid-$460s with an RSI dip towards 30, which can set up a bounce.

Or a close back above $500 with improving RSI and MACD as a sign the pullback is losing strength.

3. Longer-term investors

Fundamentals (revenue growth, margins, balance sheet) remain strong, and Microsoft continues to grow cloud and AI income at double-digit rates.

The recent sell-off is mainly a valuation and expectations reset linked to AI spending and slower-than-hoped adoption, not a collapse in earnings.

Many long-term investors focus more on whether the business can keep compounding earnings than on the next $10 in price.

Whatever your style, risk control is key in a name that is still heavily owned and widely traded. Moves can be sharp in both directions.

Frequently Asked Questions (FAQ)

1. Why is Microsoft stock dropping after recent highs?

Microsoft is slipping because reports suggested its AI sales growth may be slowing, with some teams missing targets and adjusting quotas. Even though the company pushed back, the news triggered profit-taking after a strong AI-driven run. Ongoing concerns about high valuations and heavy AI spending are adding extra pressure.

2. How far has Microsoft fallen from its peak?

From a 52-week high near $555.45, the stock is now around $477.73, which is roughly 14% below the high. That sits in the typical correction range (10–20%) after a strong run, rather than a full-scale bear move.

3. Is Microsoft still growing its earnings?

Yes. For the fiscal year ended June 30, 2025, revenue grew 15%, net income grew 16%, and diluted EPS rose 16% to $13.64. Cloud and AI-linked segments, including Azure, saw growth rates in the high-20s to high-30s percent range.

4. What do the technical indicators say about MSFT now?

Microsoft is trading below the 50-, 100-, and 200-day moving averages, showing clear short-term weakness. The RSI near 39 and a bearish MACD crossover support this negative momentum. Most indicators now screen as a “Strong Sell,” pointing to a short-term downtrend even though the long-term uptrend remains intact.

5. Where are the important support and resistance levels for Microsoft stock?

Key support sits around $470, with a wider support zone in the mid-$460s if selling continues. Resistance is now at $485–$490, followed by a stronger barrier at $500–$505 near the 200-day moving average. These levels can change quickly, so traders should always confirm them on a live chart.

Conclusion

Microsoft stock dropping after recent highs is less about a broken story and more about a market that is re-pricing big expectations. The company is still growing earnings, cloud income and AI-related revenue at a healthy pace, but the share price had already moved a long way ahead of that growth.

When questions appeared around AI sales momentum and heavy spending, it was enough to trigger a correction in MSFT rather than a collapse.

On the charts, Microsoft is in a short-term downtrend, trading below key moving averages with weak momentum, while the longer-term trend and fundamentals remain intact.

That mix often creates a split view: short-term traders focus on support, resistance and volatility, while longer-term investors care more about whether earnings and cash flow can keep rising over time.

For anyone following Microsoft stock today, the key is to link decisions to time frame and risk tolerance, not headlines alone. Watching how price behaves around the main support and resistance levels, how quickly AI and cloud revenue convert into profit, and whether spending plans stay under control will all matter more than a single news story.

Microsoft’s path from here will be driven by execution and data, but the recent pullback has already reminded the market that even strong names can correct when expectations run ahead of reality.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.