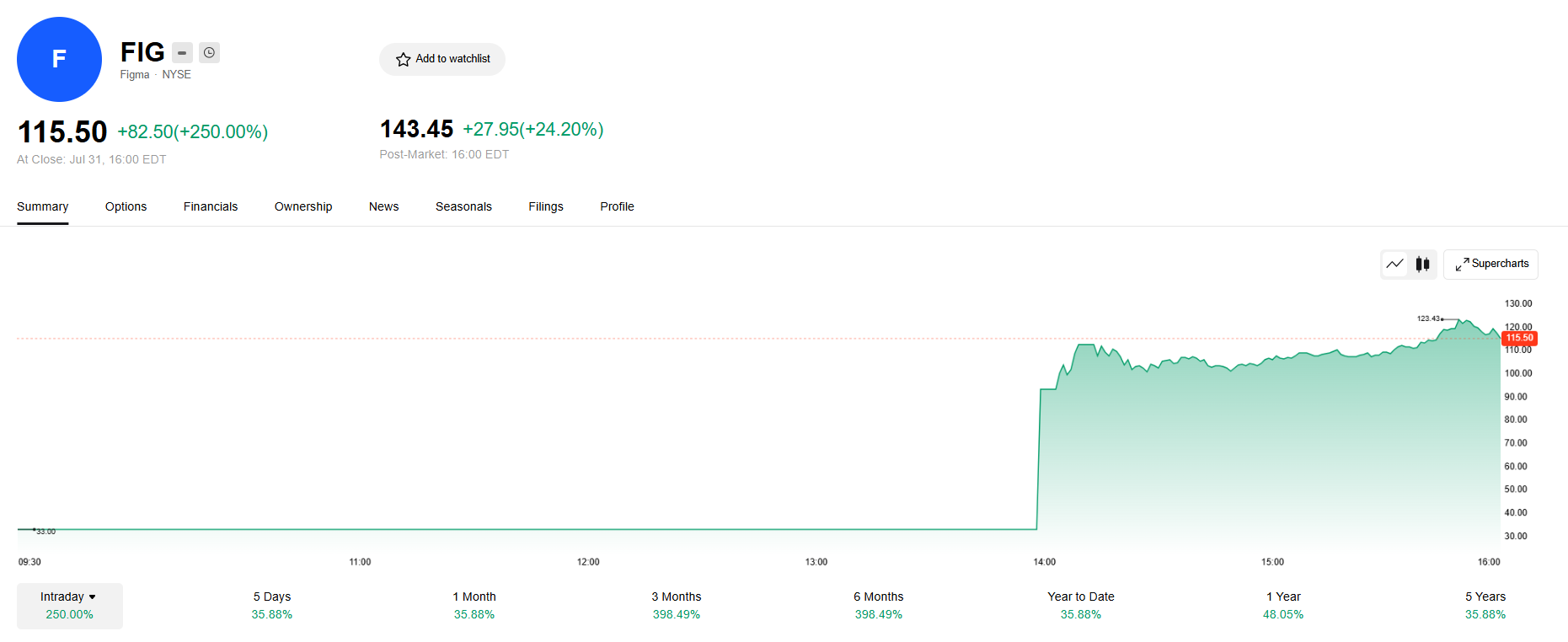

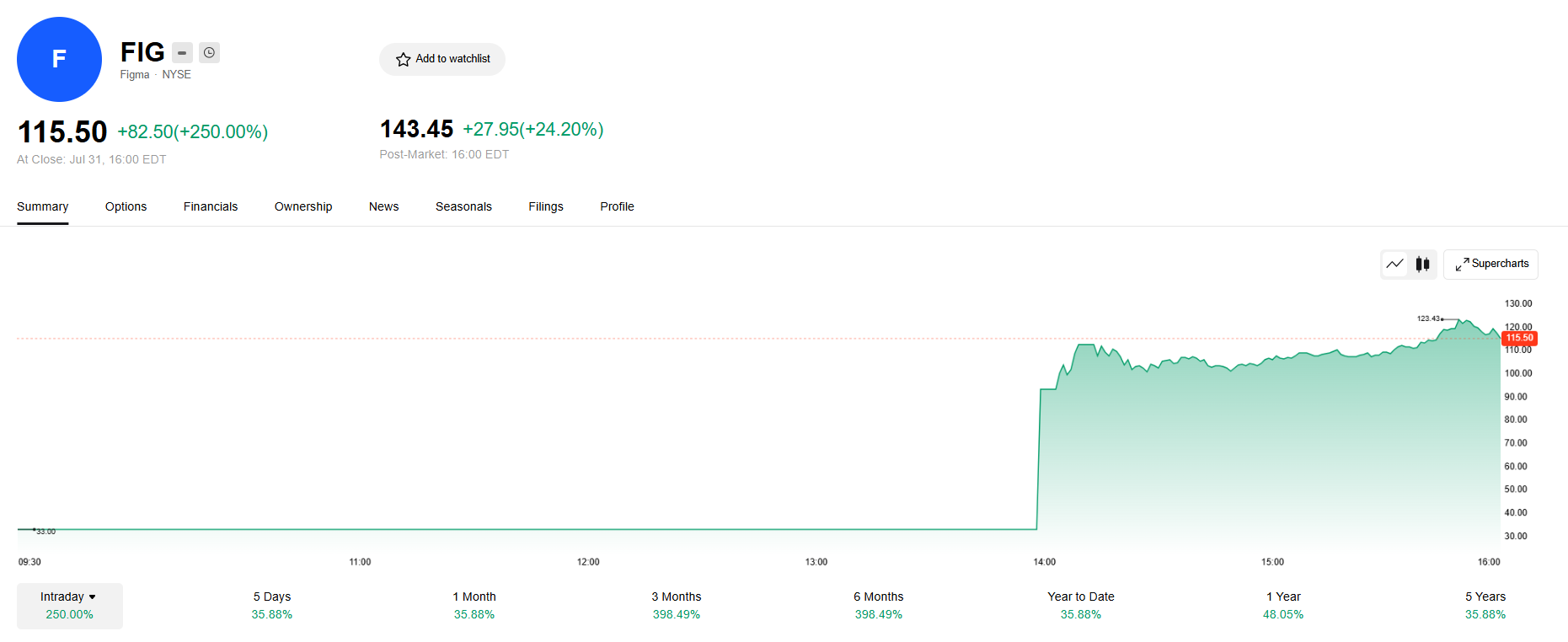

Figma Inc. (NYSE: FIG) made a spectacular entrance onto Wall Street on July 31, 2025, with its share price soaring over 250% from its debut price of $33.

Closing at $115.50, the stock's remarkable performance raised Figma's fully diluted valuation to roughly $67–68 billion, far eclipsing the $20 billion valuation offered in a now-cancelled Adobe acquisition bid.

This article examines Figma's IPO finances, expansion path, valuation issues, investment dangers, and whether investing after the surge remains beneficial.

Figma IPO Debut: Breaking Records & Setting the Tone

Figma priced its IPO at $33/share, significantly above the initial guidance of $30–32 (up from $25–28). The company sold 36.94 million shares, raising $1.22 billion, with approximately $411 million going to Figma and the rest to selling shareholders.

Trading opened at about $85, quickly jumped to over $124.63, and settled at $115.50, delivering a 250% return in a single session. The stock's intraday peak represented gains closer to 277% above the IPO price.

It marked the largest first-day pop for any U.S. IPO, raising over $500 million in over 30 years. With a closing valuation of $67.6 billion, Figma leapfrogged its prior intended buyout value and staked its position as a marquee IPO event for the tech sector.

Rationale Behind the Figma Stock Surge

1. Growth and Product Leadership

PitchBook analyst Derek Hernandez described Figma as a "generational SaaS company" with near-monopolistic influence over product design tools. Its rapid revenue growth and long-term enterprise penetration attracted intense investor interest.

2. Strategic Refocus Post-Adobe Deal

After Adobe abandoned a $20 billion acquisition in 2023 due to antitrust concerns, Figma honoured the breakup fee and pivoted toward growth, accelerating innovation alongside product expansion—strategy now delivering strong results.

3. Revival of the IPO Market

Figma's blowout debut marked a key moment in the tech IPO rebound, following souls like CoreWeave, Circle, Chime, and AIRO earlier in 2025. Its performance reinforced renewed public demand for high-growth tech listings.

Comparison with Post-IPO Software Peers

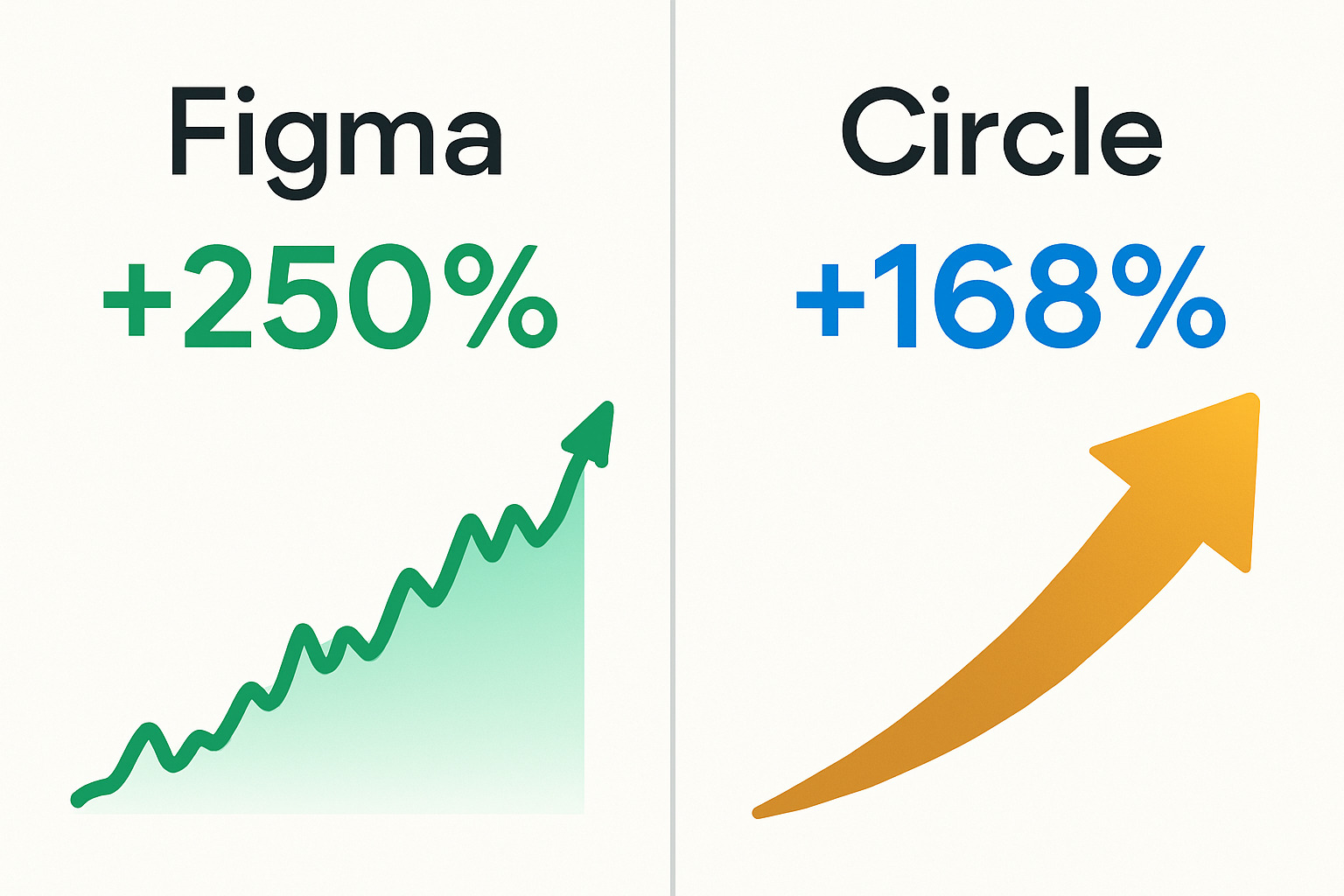

Speaking of IPO peers, while companies like Circle, Chime, and CoreWeave also posted strong openings, Figma's 250% first-day return is unprecedented for a billion-dollar-plus IPO.

Market analysts liken it to Circle's ~168% and Palm's double-digit surge from the 2000s, highlighting the distinctive investor interest in SaaS growth by mid-2025.

Figma's IPO stands out as an inflexion point signalling renewed tech investor confidence; whether its momentum endures will depend on execution and macro factors.

Valuation in Focus: Is FIG Stock Overheated?

With a closing price of $115.50, Figma's market capitalisation was approximately $67.6 billion, suggesting a fully diluted valuation exceeding $65 billion. Figma now holds a valuation three times larger than Adobe's previous $20B offer, reflecting current market sentiment.

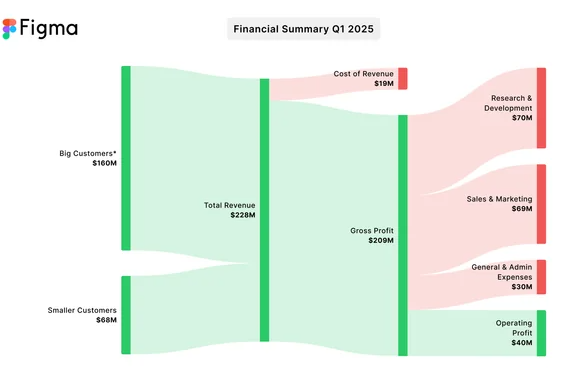

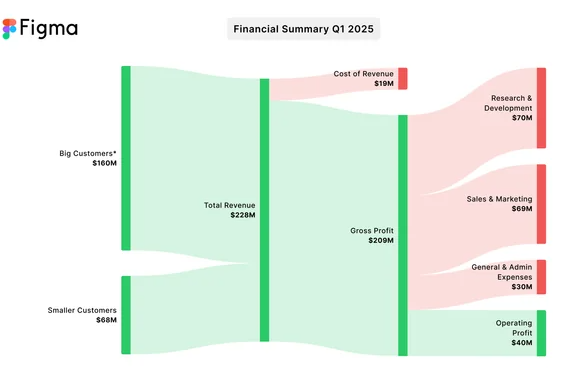

For a company demonstrating around 46% growth and exceeding 92% gross margins, while facing inconsistent profitability (with a net loss in 2023 against a Q1 profit of approximately $44.9M in 2025), the implied valuation suggests significant growth potential.

Analysts note Figma has only recently posted quarterly profit and may require patience to justify its premium multiples.

Figma's Business: Growth, Clients & Products

Established in 2012 by Dylan Field and Evan Wallace, Figma evolved from a Clay startup into a design platform utilised by 95% of Fortune 500 firms. In 2024, Figma posted ~$749 million in revenue, followed by 46% y/y growth in Q1 2025 that translated into ~$228 million revenue, supported by strong gross margins (~92%).

The platform's real-time collaboration tools are integral to cross-functional teams, and its expansion into AI, announced at Config 2025, includes products like Figma Sites, Figma Make, Figma Buzz, and Figma Draw, each leveraging generative AI to enhance design and prototyping workflows.

Figma's massive usage base, 13 million monthly users, two-thirds of whom are non-designers, reflects widespread cross-disciplinary adoption.

Investor Sentiment: Enthusiasm vs Caution

Bullish Case

Optimists highlight Figma's scale, dominance over conventional rivals (Adobe XD, Sketch), remarkable SaaS metrics, and recent AI features as evidence of lasting value.

Investor excitement indicates confidence that Figma's IPO will drive momentum for upcoming SaaS listings, including Canvas, Databricks, Genesys, and more.

Bearish Viewpoints

Some analysts warn of overvaluation risk, comparing Figma's ambition to earlier tech peaks. The company's early revenue base and nascent profitability may not support a $68B valuation if broader tech growth slows or competition intensifies.

The IPO also included large insider share sales: the firm's founders and early investors realised hundreds of millions in gains, raising questions about the alignment of long-term ownership incentives.

Is It Too Late to Invest in Figma Now?

Entry Now: Pros

Captures equity in a high-growth SaaS company with strong network effects

Provides exposure to AI-augmented design infrastructure—future category leader

Early entry before lock-up expiration or SaaS momentum fade

Caution Ahead: Cons

Elevated valuation amplifies downside risk if growth slows

Post-IPO price already embeds massive expectations

Potential pullback after lock-ups and insider share unlocks

Better entry opportunities may exist after short-term profit-taking or correction

Risks Ahead and What to Watch Near Term

Competitive pressure from Big Tech or AI-native tools

Integration risks with emerging AI features

Reliance on high growth to justify valuation

Potential tech sector rotation or macro downturn

Regulatory scrutiny given Figma's dominance in the design infrastructure space

As to what to watch regarding Figma:

Figma's Q2 earnings in late 2025, including revenue growth, margins, and profitability

Subscriber metrics: enterprise logos, monthly active users, retention rates

Sentiment shifts: IPO cohort performance, tech sector rotation, valuations

AI product adoption traction: user feedback on Figma Make, Buzz, Sites

Lock-up expiration events, which could lead to selling pressure if insiders decide to liquidate

Conclusion

In conclusion, Figma's IPO performance delivered fireworks, reaffirming investor appetite for SaaS and AI-led growth companies. Its valuation showcases both its dominance in product design infrastructure and anticipations for AI becoming a commodity.

If you're a long-term, growth-oriented investor confident in Figma's execution and pipeline, a carefully sized, patient entry may still appeal. Yet investing now demands acknowledging elevated risk, as any slowdown in momentum or broader tech correction may result in sharp price declines.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.