The stock market is filled with acronyms, and few are as crucial or as frequently discussed as IPO. Whether you're a seasoned investor or a newcomer to trading, you've likely heard the term when a company "goes public." But what exactly does IPO mean, and why does it matter in the stock market?

In this comprehensive guide, we'll explain the full form of IPO, explore the process behind it, highlight its significance to companies and investors, and provide key strategies to consider before investing in an IPO.

What Is IPO Full Form?

The full form of IPO is Initial Public Offering. It refers to the first instance when a private company offers its shares to the public via a stock exchange listing.

An IPO enables the company to obtain funding from outside investors while providing the public an opportunity to acquire shares in a business that was formerly privately owned.

Once the IPO is complete, the company becomes publicly traded, and its shares can be bought and sold in the open market.

Why Companies Go Public

There are several reasons why a private company might decide to go public through an IPO. The most common motivation is to raise capital to fund business expansion, innovation, or debt reduction.

Going public also increases a company's visibility, credibility, and access to future financing. It allows initial investors and founders to cash in on their shares and offers employees stock-related incentives such as options and restricted stock units (RSUs).

However, it comes with increased scrutiny, regulatory compliance, and shareholder accountability. Once public, the company must disclose financial statements regularly and adhere to corporate governance standards.

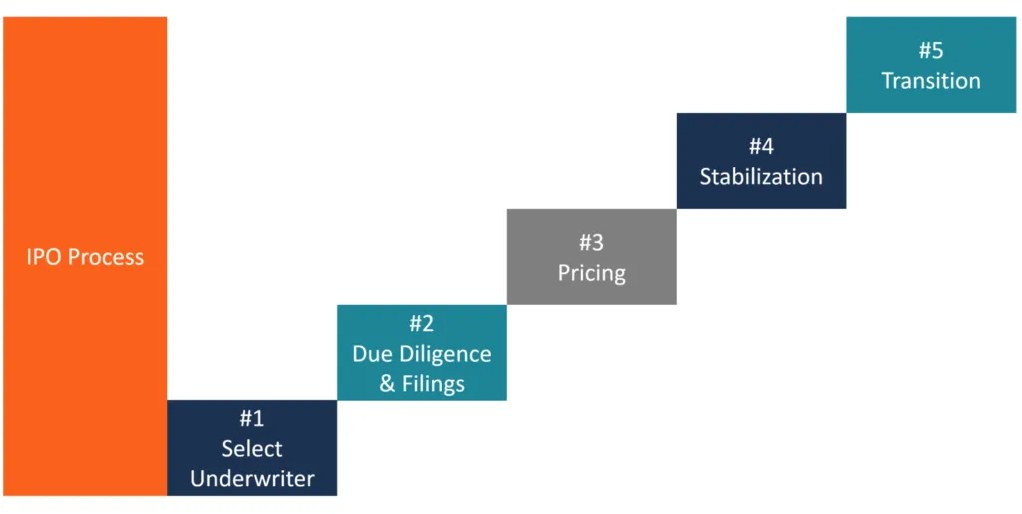

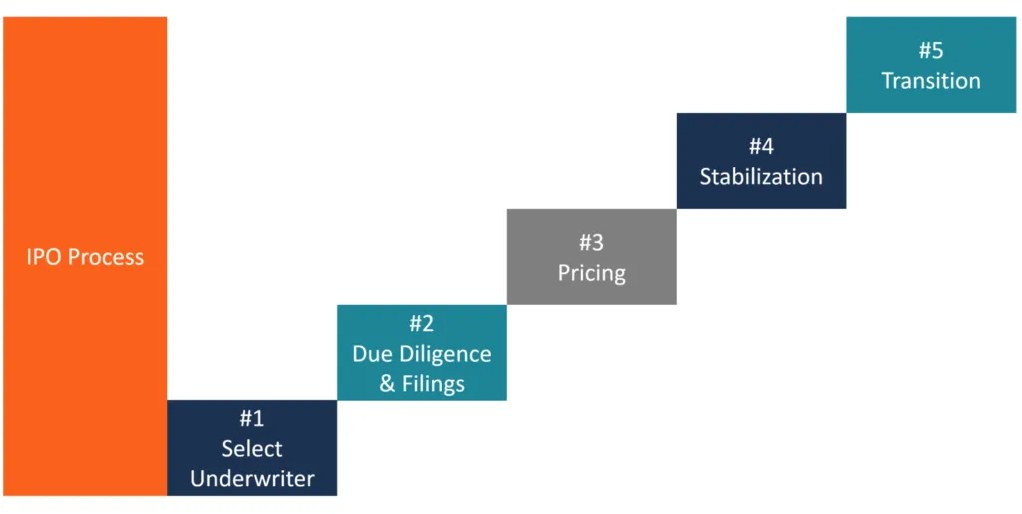

How the IPO Process Works

1. Selecting Investment Banks (Underwriters)

A company hires one or more investment banks to serve as underwriters. These banks help determine the offering price, structure the deal, prepare necessary documentation, and market the IPO to potential investors.

2. Filing the Red Herring Prospectus

The company, along with its underwriters, submits a draft red herring prospectus to the relevant securities regulator. This document outlines the company's business model, financial statements, risk factors, and IPO details. In the U.S., it's filed with the SEC.

3. Roadshows and Investor Outreach

The underwriters organise roadshows, presentations aimed at institutional investors. These events are used to generate interest, explain the company's story, and assess demand.

4. Pricing the IPO

Based on market interest and valuation models, the underwriters and the company decide on the IPO price or a price range. The pricing must strike a balance between attracting investors and maximising capital raised.

5. Share Allotment and Listing

After the offering is closed, shares are allotted to investors. The company is then listed on a stock exchange, and trading of its shares begins on the listing day.

Types of IPOs

There are generally two main types of IPO structures, each offering a different path for investor participation:

Fixed Price Offering

In this format, the price of shares is fixed before the IPO is open to investors. Investors know the price upfront and act accordingly. Once the IPO closes, allotment is made based on demand and availability.

Book Building Offering

Here, a price band is set (e.g., $20–$24 per share), and investors bid within that range. The final price is determined based on the bids received. This method offers better price discovery and is more commonly used in modern IPOs.

Historical IPO Examples

Facebook (Meta) – 2012

One of the largest tech IPOs in history, Facebook went public at $38 per share. The stock fell initially, causing concern, but recovered over time. Today, it's one of the most valuable companies globally.

Alibaba – 2014

The Chinese e-commerce giant launched a record-breaking IPO on the NYSE, raising over $25 billion. It surged post-listing and became a favourite among global investors.

Rivian – 2021

An electric vehicle company backed by Amazon, Rivian's IPO was highly anticipated. It started with a strong valuation but dropped considerably in the subsequent months, illustrating that IPO excitement doesn't guarantee lasting achievement.

Risks and Rewards of Investing in IPOs

Rewards

IPOs provide investors with the opportunity to invest early in companies that have the potential to become the giants of tomorrow. Some IPOs generate significant returns on listing day or over time, especially if the company is in a high-growth sector or enjoys strong market demand.

Being part of an IPO also allows investors to participate in the growth journey of innovative startups or expanding businesses.

Risks

Not all IPOs perform well. Some get overhyped and become overvalued, only to fall below the issue price after listing. Additionally, limited historical data for newly public companies makes it difficult to evaluate their fundamentals.

Moreover, lock-up periods often prevent insiders from selling their shares for a fixed time, leading to possible price drops when the lock-up expires.

How to Evaluate an IPO Before Investing

1) Company Fundamentals

Read the prospectus carefully. Analyse the company's revenue, profit trends, market share, debt levels, and management credentials. Companies with solid business models and strong leadership are more likely to succeed after an IPO.

2) Industry and Growth Potential

Understand the industry in which the company operates. Are there growth opportunities? Is the company an innovator or merely trying to cash in on a hot trend?

3) Use of Proceeds

Examine how the funds raised through the IPO will be used. Are they utilised for growth, research, and innovation, or merely to settle previous obligations?

4) Valuation

Assess the valuation compared to peers. A company may be overvalued relative to its competitors, reducing the upside potential for early investors.

5) Promoter Holding and Lock-In Period

Check the post-IPO promoter holding. A high stake retained by the founders may indicate long-term commitment, while a low stake may raise red flags.

IPO Performance in 2025 (So Far)

As of mid-2025, IPO activity has seen a resurgence after a quieter period in 2023–2024. With market volatility easing and investor appetite returning, several sectors—especially green energy, AI, and fintech—have led the charge.

Many newly listed firms have offered decent listing gains, but a few have also experienced sharp corrections.

For example:

1. GemLife (ASX: GEM) – Australia

Debut Date: Early July 2025

Raised: ~A$780.7 million (≈ US$500 million) in the largest Australian IPO of the year

Performance: Shares opened at A$4.16 and surged 6.3% intraday to A$4.42, boosting the company’s valuation to ~A$1.65 billion

Business: Developer of 50-plus retirement land-lease communities, with the IPO proceeds aimed at debt repayment (A$400 million) and land acquisitions, signalling strong investor appetite in Australia's ageing population segment.

2. Sri Lotus Developers & Realty (BSE/NSE: TBD) – India

Approval Received: Early July 2025

Planned Raise: ₹792 crore (≈ US$95 million)

Highlights: Promoted by massive Bollywood figures—including Amitabh Bachchan, Shah Rukh Khan, and Hrithik Roshan—this real estate player combines celebrity capital with growth ambitions to finance new projects and reduce debt.

3. Accelerant (NYSE: ARX) – United States

Filed: June 30, 2025

Backed By: Todd Boehly; underwritten by Morgan Stanley, Goldman Sachs, BMO, and RBC.

Scale: First-quarter revenue reached $178 million (+39% YoY) and net income was $7.8 million, up from $2.1 million in 2024

Sector Focus: An insurtech platform that connects niche insurers and institutional investors—its filing signals strong investor confidence in fintech innovation and digital risk marketplaces.

Analysts recommend cautious optimism when investing in IPOs in 2025, with an emphasis on fundamentals and valuation.

Conclusion

In conclusion, understanding the full form of IPO—Initial Public Offering—is just the first step. IPOs offer exciting opportunities to invest in new and innovative companies, but they also come with significant risks.

To successfully navigate IPOs, investors need to perform extensive research, evaluate fundamentals, and ensure their investments align with financial objectives. Although IPOs can be profitable, particularly in robust markets, not all offerings result in gains.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.