Imagine a tech company quietly becoming a pillar of artificial-intelligence infrastructure, valued at more than many well-known public firms, yet still privately held. That's Databricks.

As of late 2025, the company is valued at more than $100 billion and has surpassed a $4 billion annualised revenue run-rate. Yet for public investors, one mystery remains: when will it finally go public, and what could that mean for them?

In this article, we unpack Databricks' business model, financial health, IPO prospects, key risks, and what to watch next.

Databricks Snapshot: From Spark Roots to AI Platform

Founded in 2013 by the creators of Apache Spark, Databricks developed a "lakehouse" platform that integrates structured and unstructured data within a single system, facilitating analytics, machine learning, and AI applications across various industries.

Today, the platform serves thousands of enterprises (including major names like Shell and Rivian) and works on top of cloud providers such as AWS, Google Cloud and Microsoft Azure.

What's new in 2025:

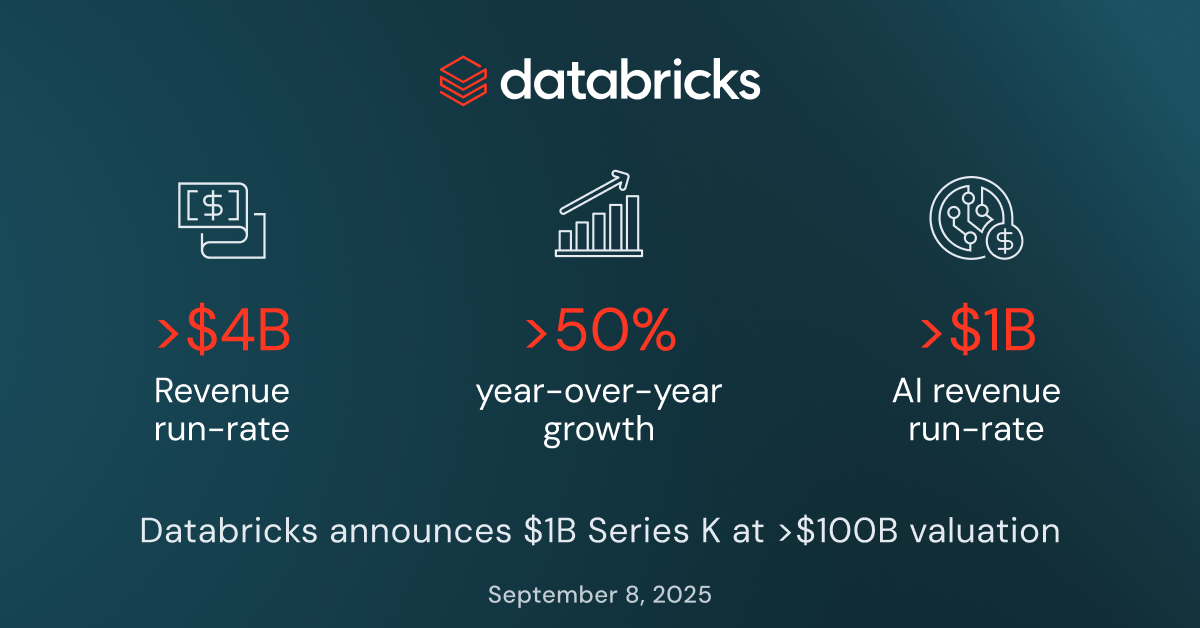

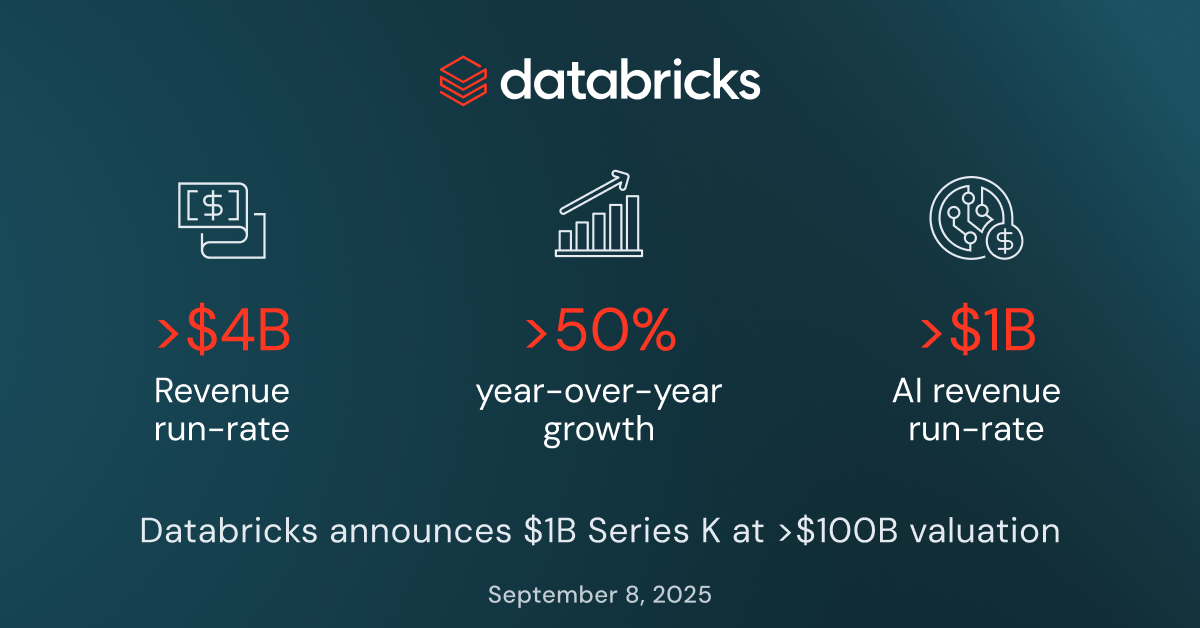

Annualised Revenue Run Rate: Over $4 billion as of Q3 2025, with >50% year-over-year growth [1]

AI Revenues: Exceeded $1 billion run-rate by mid-2025

Valuation: Over $100 billion following its $1B Series K funding in September 2025

Profitability: Achieved sustained cash-flow positivity over the past 12 months

These milestones place Databricks among the most valuable private software companies globally, and make its IPO one of the most anticipated tech listings remaining.

Is the Databricks IPO Coming Soon in 2025?

For many investors, the question is simple: When will Databricks file for an IPO and start trading? Here's what we know:

1. No S-1 Filing Yet:

As of late October 2025, Databricks has not publicly filed a registration (S-1) statement with the SEC. However, discussions within the industry and official company remarks indicate that preparations are still underway.

2. IPO Window:

CEO Ali Ghodsi and insiders reiterate the plan is to go public "when the timing is right", likely targeting late 2025 or early 2026 if public market conditions remain robust for AI and enterprise software.

3. Series K Funding

In September 2025, Databricks finalised a $1B Series K, increasing its valuation to beyond $100 billion, making it one of the few private tech companies to achieve that landmark. The capital will fuel further AI investment, product expansion, and global hiring. [2]

4. IPO Readiness:

Executives, including CEO Ghodsi, state that the board structure, auditing, and business operations are now ready for an IPO, with market sources expecting a Nasdaq launch.

In short, an IPO seems inevitable, but timing will hinge on broader market conditions.

Databricks IPO Forecast: What Are Analysts Predicting?

IPO Date Estimate

Most predictions suggest that Databricks is expected to go public in late 2025 or early 2026, contingent on market conditions, but not before Q4 2025.

Valuation Forecast at IPO:

Consensus estimates suggest an IPO valuation in the $100–$140 billion range.

IPO Price Range:

No official guidance; speculated price per share is likely to fall in the $125–$180/share range, depending on float size and market appetite.

Is Databricks the Next $100 Billion Tech Giant? Strategic Advantage

What gives Databricks its edge? A few factors stand out:

1. Platform Breadth:

Unlike some competitors that focus on specific areas (e.g., data warehousing or business intelligence), Databricks' lakehouse integrates data lakes, warehouses, and AI workflows in a unified environment, providing a comprehensive solution.

2. Enterprise Adoption:

More than 15,000 organisations utilise the platform and possess major enterprise-level clients.

3. AI Product Momentum:

With the launch of Agent Bricks and the new Lakebase, which is an operational database optimised for AI, the company is entering the booming segment of AI workflow infrastructure.

4. Strong Cloud Partnerships:

Integrations with Microsoft Azure, Google Cloud and major enterprises help bolster distribution and ecosystem support.

5. Competition & Threats:

| Company |

Revenue (2025 run-rate) |

Valuation / Market Cap (latest) |

Key Focus |

IPO / Status |

| Databricks |

~$3.7 B |

$100 B+ |

Data lakehouse & AI/ML platform |

Pre-IPO |

| Snowflake |

~$3.6 B |

~$87.4 B (Oct 2025) |

Cloud data warehouse & AI platform |

Public since 2020 |

| Palantir |

$4.14 B–$4.15 B guidance |

~$379 B–$400 B+ |

Data analytics, AI software for govt & enterprise |

Public since 2020 |

Despite being crowded with key competitors such as Snowflake, Palantir Technologies, and native cloud provider services (AWS/GCP), along with newer AI infrastructure specialists, there remains significant competitive pressure.

Risks & Variables That Could Delay or Dampen the Databricks IPO

Even with strong fundamentals, several risk factors loom:

1) Market Sentiment and Timing Risk:

Going public when valuations are high and market appetite is strong is ideal. If sentiment sours, the company may delay, and valuation upside could shrink.

2) Execution Risk:

Rapid growth is great, but maintaining 50 %+ growth as scale increases is harder. Large customers and revenue models based on consumption carry risks regarding scaling up.

3) Cloud Dependency:

Heavy reliance on major cloud providers may limit margin upside or expose Databricks to pricing/strategy shifts across these partners.

4) Profitability and Margin Profile:

Being cash-flow positive is a positive sign. But can margins widen sufficiently in an expensive, competitive infrastructure market?

5) Valuation Expectations:

With a revenue multiple of approximately 25 times on a private basis, the public market may demand even greater growth or apply a discount if these multiples contract.

6) Regulatory or Macro Headwinds:

Data governance, AI regulation, trade tensions, and a tech IPO winter could all impact timing and valuation.

What Investors Should Watch Next?

Listed are the indicators that will matter most in determining Databricks' public debut and valuation:

| Metric |

Why It Matters |

| S-1 filing |

Signals IPO seriousness. |

| Revenue guidance |

Confirms whether high growth is sustainable. |

| AI product revenue share |

Demonstrates moat in AI infrastructure. |

| Cloud partner disclosures |

May affect distribution and margin pathways. |

| IPO valuation & pricing |

Determines the public market’s appetite for the name. |

| Market conditions |

Timing with tech/AI sentiment and IPO environment. |

Frequently Asked Questions

Q1: Has Databricks Officially Filed for IPO as of October 2025?

No official S-1 has been filed with the SEC. However, substantial groundwork is in place, and late 2025–early 2026 is considered the likely window.

Q2: Will Databricks IPO on Nasdaq or NYSE?

Market consensus suggests a Nasdaq listing, but no confirmation yet.

Q3: What Could Delay the Databricks IPO?

Market volatility, a tech selloff, regulatory hiccups, or a "surprise" AI competitor.

Conclusion

In conclusion, the Databricks IPO is poised to be a defining event for 2025 or early 2026, reflecting both the strength and the risks of the AI platform boom.

Databricks is experiencing significant revenue growth, boasts a valuation of over $100 billion, and has formed influential partnerships, positioning it to influence the upcoming tech investment cycle.

However, with these heightened expectations come considerable risks. Investors should closely monitor the IPO window but refrain from pursuing inflated valuations until official filings substantiate the company's fundamentals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.databricks.com/company/newsroom/press-releases/databricks-surpasses-4b-revenue-run-rate-exceeding-1b-ai-revenue

[2] https://www.reuters.com/business/databricks-eyes-over-100-billion-valuation-investors-back-ai-growth-plans-2025-08-19/