Gold prices rarely change by themselves. They respond to a combination of economic forces that shape money flows, currency strength, and investor behaviour across global markets. Understanding the main gold price drivers allows investors to look beyond short-term headlines and focus on the forces that consistently influence gold prices over time.

Gold functions both as a monetary asset and a defensive hedge. Its performance is less tied to economic growth and more closely linked to real yields, inflation expectations, movements in the USD index, and shifts in central bank buying. Changes in purchasing power, confidence in paper currencies, and underlying gold demand from investors and institutions remain central to how gold is priced in global markets.

Key Takeaway: Gold Price Drivers Shaping the Market

Several factors play a major role in shaping gold prices. They do not work in isolation. Depending on the economic environment, these forces can either reinforce each other or pull in opposite directions.

Real yields influence how attractive gold is as compared with interest-bearing assets.

Inflation expectations affect gold’s appeal as a way to preserve purchasing power.

Moves in the USD index change how expensive gold looks to buyers outside the US.

Central bank buying adds steady demand and helps limit downside pressure.

The overall gold demands from investors and consumers support long-term price trends.

These elements explain most medium- and long-term movements in gold prices, even when short-term fluctuations seem to be driven by news or headlines.

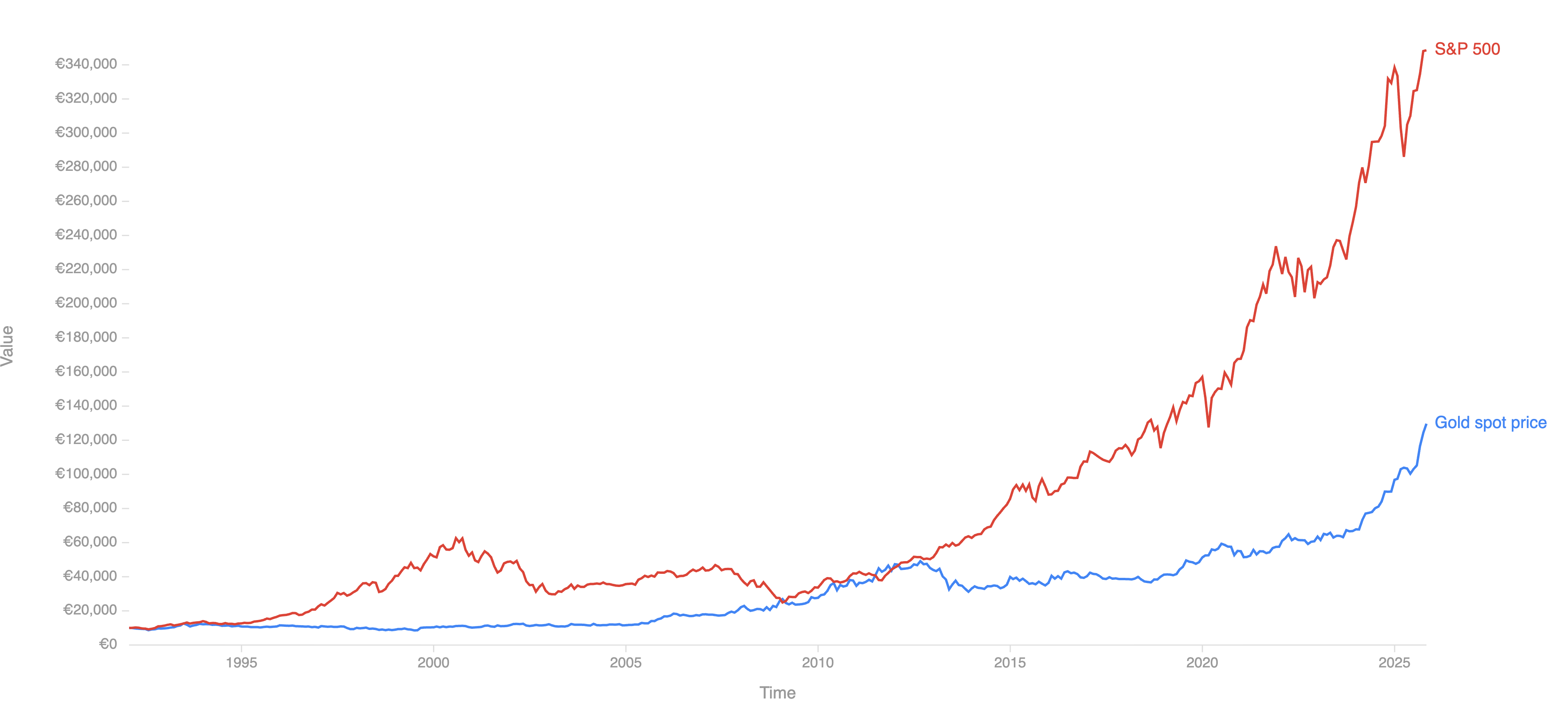

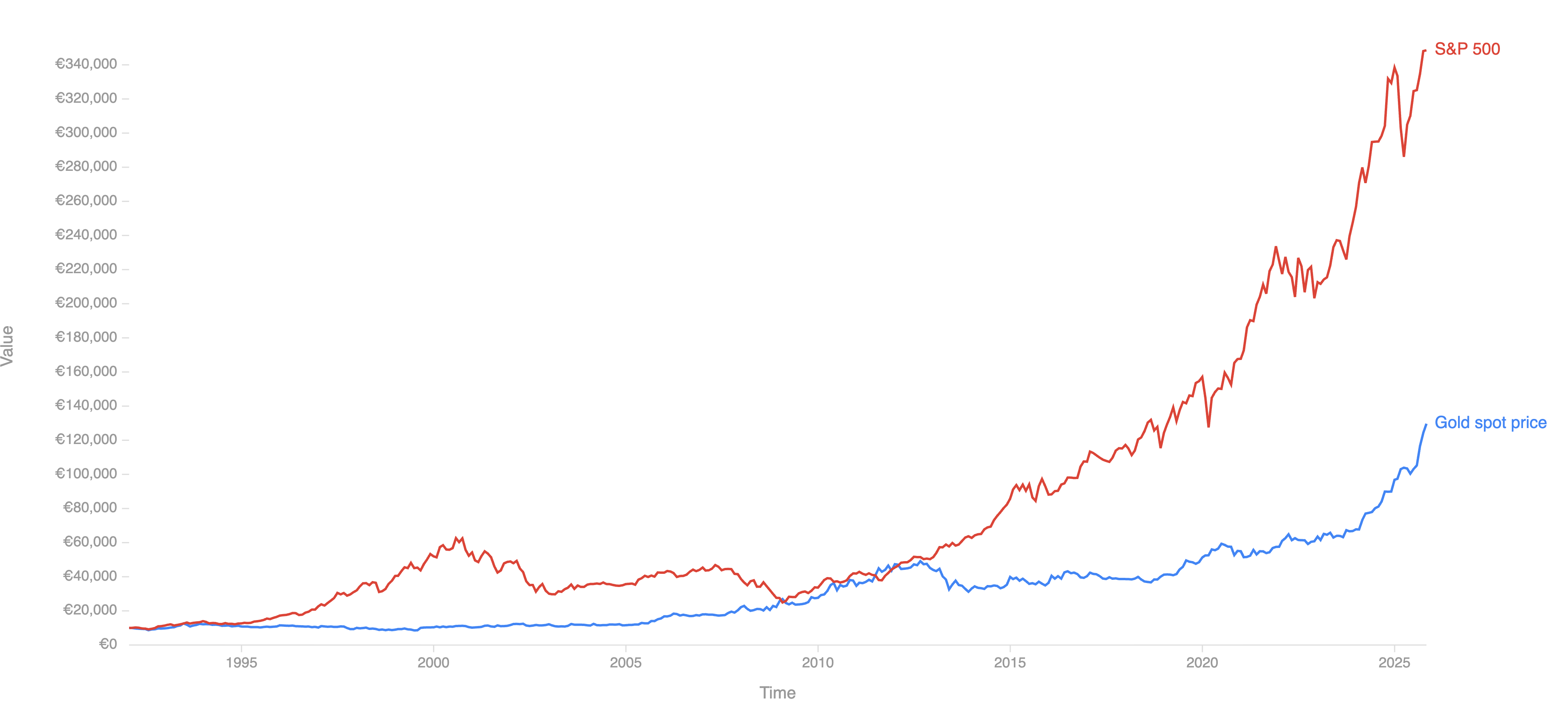

The Average Annual Returns of Gold vs. the S&P 500 Index

This longer-term view highlights gold’s two-sided role. It can act as an effective shield during periods of elevated inflation or heightened market stress, but it often lags behind growth-oriented assets when economic conditions are stable and risk appetite is strong.

What Drives The Gold Prices?

Interest Rates and Real Yields: The Primary Transmission Channel

Nominal interest rates alone do not dictate gold’s direction. What matters is the level of real yields, or interest rates adjusted for inflation expectations.

When real yields rise, holding cash or bonds becomes more attractive relative to gold. When real yields fall or turn negative, gold’s appeal increases because the opportunity cost of holding it declines.

For example, a 10-year Treasury yield at 4% with inflation expectations at 2% implies a positive real yield of 2%. In such an environment, gold typically faces headwinds. Conversely, if inflation expectations rise to 3.5% while yields remain unchanged, real yields compress sharply, often triggering renewed inflows into gold.

Policy decisions by the Federal Reserve are therefore critical. Even when rate hikes dominate headlines, gold can rally if inflation expectations rise faster than nominal yields, pulling real yields lower.

Inflation Expectations and Gold’s Store-of-Value Role

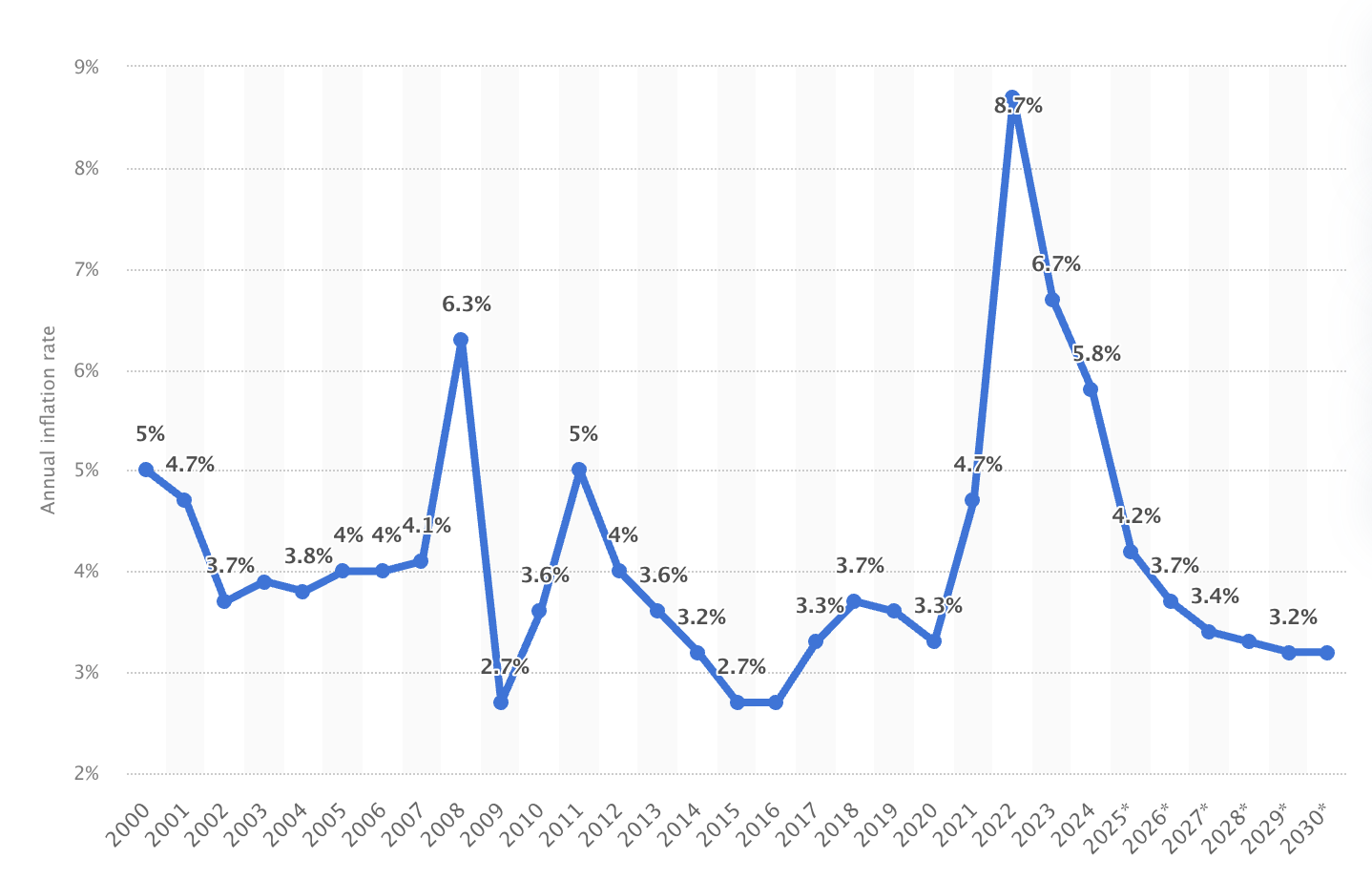

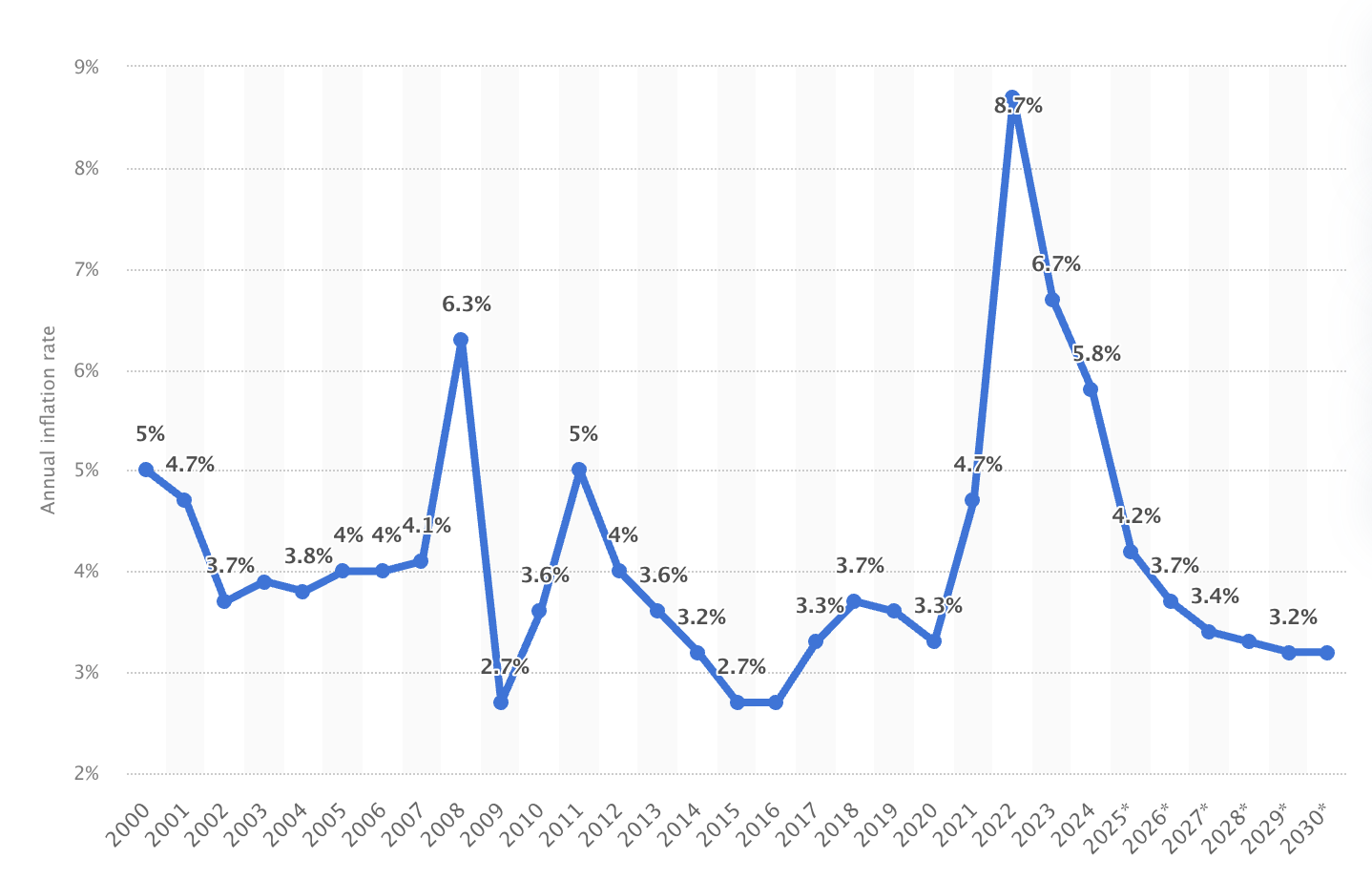

Gold does not react to inflation headlines alone. What matters more is whether people believe inflation will stay high long enough to reduce their purchasing power. When prices rise briefly and then stabilise, gold often does little. When inflation looks persistent, interest in gold usually grows.

In calm periods, with inflation running near 2% and central banks seen as credible, gold demand tends to remain steady. Demand increases when inflation becomes harder to control or lasts longer than expected. Investors then turn to gold not to profit from inflation, but to protect savings from losing value.

A practical example can be seen during supply-driven inflation shocks. When energy or food prices surge and central banks hesitate to tighten aggressively, inflation expectations often rise faster than yields. Gold tends to benefit in such phases, even before actual inflation data peaks.

The USD Index: Currency Strength and Gold Pricing

Gold is priced globally in US Dollars, making the USD index one of the most immediate gold price drivers.

A stronger Dollar increases the local-currency cost of gold for non-US buyers, suppressing international demand. A weaker Dollar has the opposite effect, boosting affordability and broadening global participation.

The relationship is not perfectly inverse, but it is directionally consistent over time. When US growth outperforms, and capital flows into Dollar assets, gold often struggles. When Dollar strength fades due to easing policy or widening fiscal deficits, gold typically finds support.

Importantly, the dollar’s weakness, combined with falling real yields, is one of the most constructive environments for gold prices.

Central Bank Reserves: Structural Demand Beneath the Market

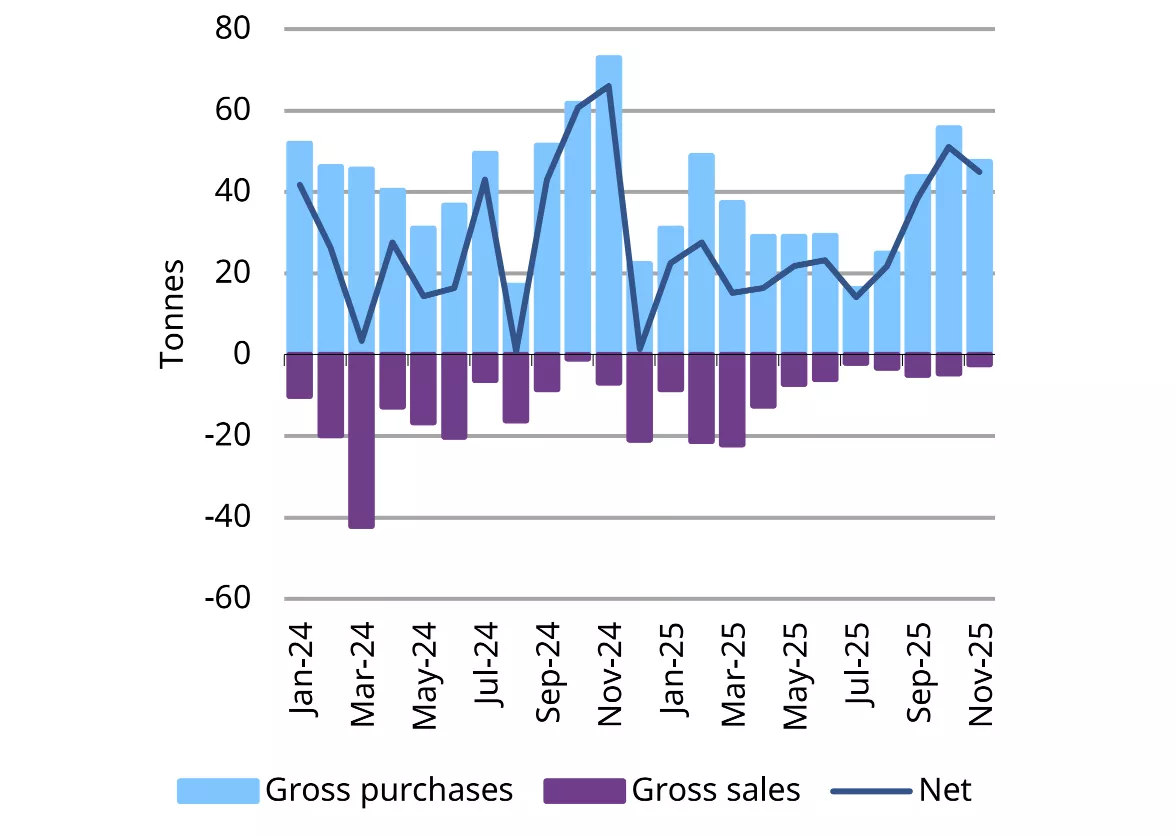

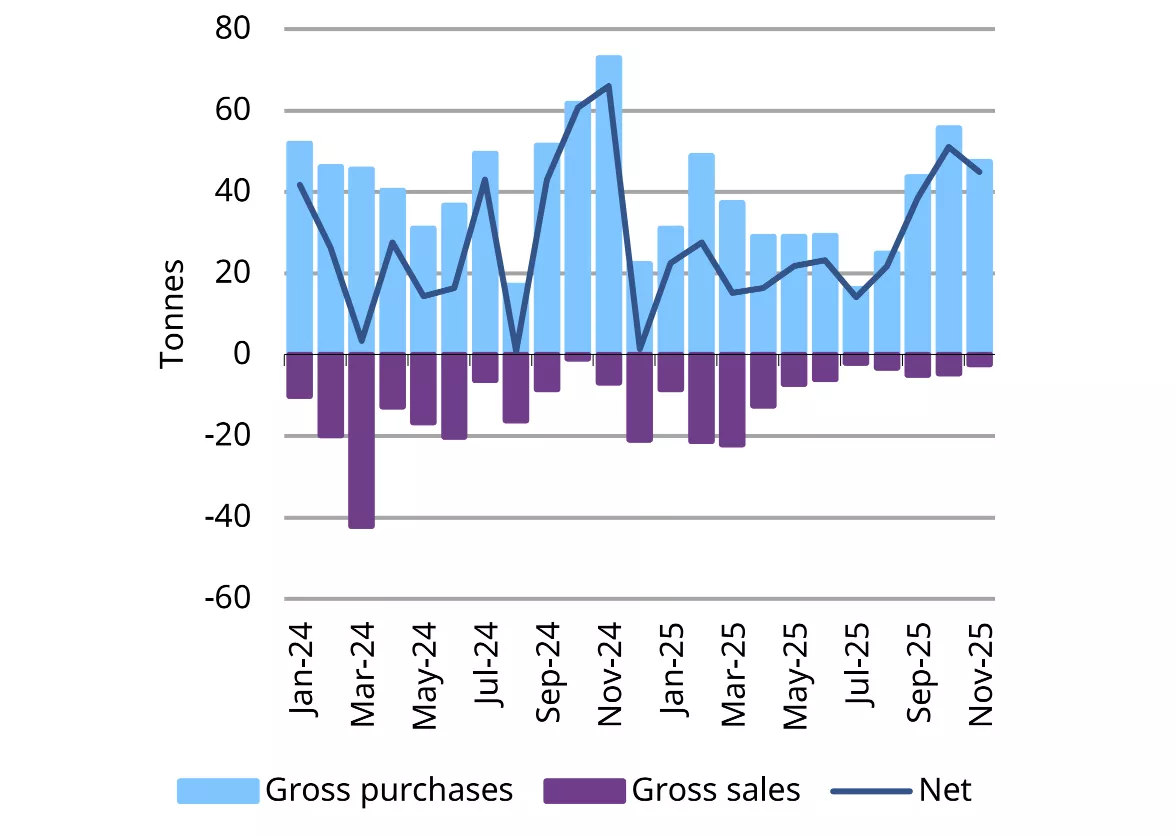

Central banks have become a steady force in the gold market, often buying when investors are distracted by short-term price moves. Unlike traders, central banks typically add gold to their reserves gradually and hold it for many years, which gives their demand a stabilising effect.

A clear example comes from emerging economies that want to reduce reliance on the US Dollar. Over recent years, central banks have collectively added hundreds of tonnes of gold annually to their reserves, a pace well above long-term averages.

World Gold Council data shows central banks have purchased over 1,000 tonnes of gold annually in recent years, well above the ~400 – 500 tonnes average in the past decade.

Quarterly figures show ongoing strong demand, such as 297 tonnes year-to-date into late 2025.

These purchases are not based on short-term price moves. Central banks buy gold to protect value over time, not to time the market.

This matters because once central banks buy gold, it stays off the market for years. Even when investor interest weakens, central banks often keep buying quietly, which helps slow price declines and provides a basic level of support.

Instead of trying to predict market swings, central banks are changing how they store national wealth, strengthening gold’s role as a long-term and dependable asset in the global financial system.

Investment and Consumer Gold Demand

Beyond macro drivers, gold demand from investors and consumers shapes the market’s depth and resilience.

Investment demand includes ETFs, bars, and coins, typically responding to macro uncertainty, real yields, and currency trends.

Consumer demand, particularly from Asia and the Middle East, is more price-sensitive and culturally driven.

During price pullbacks, physical buying often increases, helping stabilise the market. During rapid rallies, consumer demand may soften, but investment inflows usually compensate.

This balance between financial and physical demand helps explain why gold often consolidates rather than collapses after sharp moves.

How These Drivers Interact in Real Market Cycles

Gold rarely responds to a single factor. Instead, price trends emerge when multiple drivers align.

Consider three simplified scenarios:

Bullish setup: Falling real yields, weakening USD index, rising inflation expectations, and sustained central bank buying.

Neutral setup: Stable real yields, range-bound Dollar, moderate inflation expectations, steady physical demand.

Bearish setup: Rising real yields, strong Dollar, falling inflation expectations, reduced investment demand.

Understanding these combinations allows investors to assess whether gold price moves are cyclical reactions or part of a broader structural trend.

Other Factors That Influence Gold Prices

Beyond interest rates, currencies, and central bank activity, several additional forces can influence gold prices, particularly over shorter time frames.

Supply and Demand

Basic economics still applies to gold. Rising demand from jewellery, technology, and investment products supports prices, especially when mine supply grows slowly. Higher mining costs, stricter regulations, and limited new discoveries can also restrict supply, adding upward pressure over time.

Market Sentiment and Speculation

Investor behaviour can amplify gold price moves. During periods of heightened market stress, gold often attracts short-term inflows as a defensive asset. Spikes in market volatility, often reflected in measures like the VIX index, tend to coincide with increased interest in gold.

Geopolitical Uncertainty

Wars, trade tensions, and political instability frequently trigger a flight to safety. In such environments, gold benefits from its reputation as a stable store of value, particularly when confidence in financial markets or governments weakens.

Common Misconceptions About Gold Price Drivers

Several myths persist around gold pricing.

One is that gold will always rise during inflation. In reality, gold responds to expectations and policy credibility, not headline inflation alone.

Another is that interest rate hikes are automatically bearish. If rate hikes lag inflation or fail to lift real yields, gold can still perform well.

Dispelling these misconceptions helps investors interpret price action with greater clarity.

Frequently Asked Questions (FAQ)

1. What are the main factors that move gold prices?

Gold prices are primarily influenced by real yields, inflation expectations, movements in the US Dollar, central bank buying, and investor demand. When several of these forces align, they often drive sustained price trends rather than short-term fluctuations.

2. Why do real yields matter so much for gold?

Real yields measure returns after inflation. When they fall or turn negative, the cost of holding gold declines, making it more appealing compared with bonds or cash that offer limited real returns.

3. How does a strong US Dollar affect gold prices?

Because gold is priced in US Dollars, a stronger Dollar makes gold more expensive for overseas buyers. This typically reduces demand and puts downward pressure on prices.

4. What role does the central bank's buying play in the gold market?

Central banks purchase gold as a long-term reserve asset, not for trading. Their steady buying reduces available supply and often helps support prices during periods when investor demand weakens.

5. Is gold a reliable hedge against inflation?

Gold does not track inflation directly. It performs best when inflation expectations rise, and confidence in central bank policy weakens, rather than during periods of stable, well-controlled inflation.

Conclusion

Gold prices follow a consistent set of macroeconomic forces rather than short-term market noise. Real yields, inflation expectations, movements in the USD index, and central bank buying form the core drivers, while investment and consumer demand shape the strength and durability of price trends.

For investors, the focus should be on how these forces interact, not on daily headlines. When real yields fall, currencies lose strength, and official-sector demand stays firm, gold’s role as a strategic asset becomes more pronounced. In such environments, gold stands out not as a speculative trade but as a tool for stability and long-term portfolio balance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.