Diversification is the cornerstone of smart investing. Distributing investments among various markets, sectors, and asset types helps traders and investors minimise risk and enhance the likelihood of long-term gains.

Two of the world's most watched equity indices—the KOSPI Index of South Korea and the S&P 500 Index of the United States—represent key benchmarks for regional and global market exposure.

This article provides a thorough comparison between the KOSPI Index and S&P 500, covering what they signify, their performance, notable differences, and ways investors can utilise them for diversification.

What Is the KOSPI Index?

The Korea Composite Stock Price Index (KOSPI) is the main stock market index of South Korea. Managed by the Korea Exchange (KRX), the KOSPI tracks the performance of all common stocks traded on the KRX Stock Market Division. It comprises both large-cap and mid-cap firms, serving as a comprehensive indicator of the South Korean economy.

Some of the largest components of the KOSPI include globally recognised companies like Samsung Electronics, SK Hynix, Hyundai Motor, and LG Chem. These firms are key players in the semiconductor, automotive, and electronics sectors, providing the index with a robust emphasis on technology and manufacturing.

The KOSPI serves as the bellwether for South Korea's economic health and is heavily influenced by global trade trends, especially with China and the U.S.

What Is the S&P 500 Index?

The Standard & Poor's 500 Index (S&P 500) is the benchmark index of the U.S. stock market. It tracks the performance of 500 of the largest publicly traded U.S. companies across 11 sectors. Unlike the broader Russell 3000 or narrower Dow Jones Industrial Average, the S&P 500 offers a balanced representation of the American economy.

Major components include global giants such as Apple, Microsoft, Amazon, Alphabet, and Tesla. The index is heavily weighted toward the tech sector, reflecting the innovation-driven nature of the U.S. market.

The S&P 500 is one of the most widely followed indices worldwide and often acts as a proxy for the entire U.S. economy.

KOSPI vs S&P 500: A Structural Comparison

At first glance, both indices serve similar functions in their respective markets, but they differ significantly in structure.

The KOSPI includes over 900 listed stocks, although the index is heavily influenced by its top 10 constituents, especially Samsung Electronics. It is market capitalisation-weighted, meaning larger companies have a greater influence on index movement.

The S&P 500, on the other hand, comprises exactly 500 companies and is also market-cap weighted. However, the sector distribution and liquidity of the S&P 500 tend to make it more stable and globally diversified than the KOSPI.

Regarding market maturity, the U.S. equity market is more extensive and liquid compared to South Korea's. It affects trading volume, volatility, and foreign investor participation in each market.

Sector Exposure and Risk Profiles

The S&P 500 is dominated by technology, healthcare, consumer discretionary, and financials. Its tech focus makes it highly sensitive to interest rates, innovation cycles, and global demand for software and electronics.

The KOSPI Index, while also tech-heavy due to Samsung and SK Hynix, has a broader exposure to industrials, materials, and export-driven sectors. It means the index is more cyclical and sensitive to external trade dynamics and commodity prices.

Investors seeking stability and growth may lean toward the S&P 500, while those aiming for emerging market exposure and manufacturing upside may favour the KOSPI.

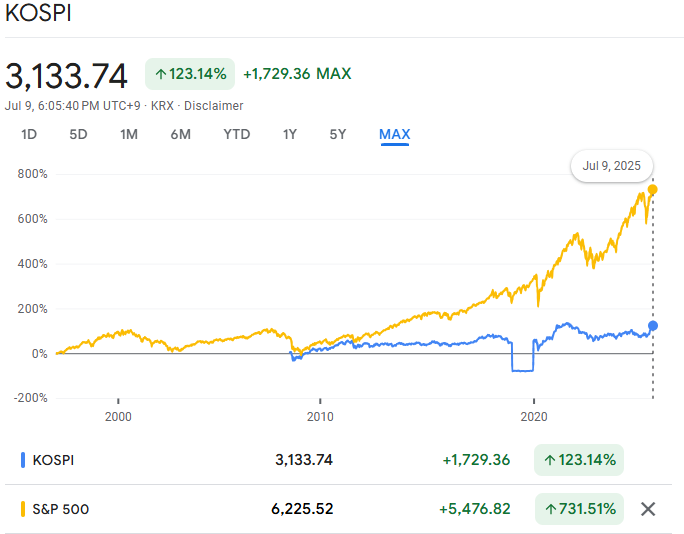

Historical Performance: KOSPI vs S&P 500

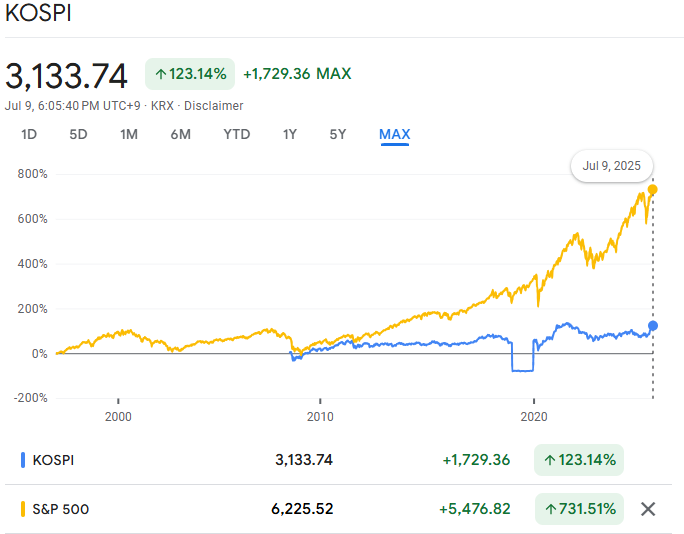

Over the past two decades, the S&P 500 has consistently outperformed the KOSPI in terms of compounded annual growth. From 2010 to 2024, the S&P 500 grew at an average of 10–12%, while the KOSPI hovered around 5–7%.

This gap is partly due to South Korea's cyclical exposure and smaller domestic market. The U.S. market's strength in innovation, global dominance of its tech giants, and robust institutional investment base give it a performance edge.

However, during periods of global recovery or commodity upswings, the KOSPI has shown significant short-term upside. For example, when trade rebounded post-COVID in 2020–2021, the KOSPI experienced double-digit annual gains.

Volatility and Risk Analysis

The KOSPI Index tends to be more volatile due to South Korea's dependency on exports, regional tensions with North Korea, and global risk sentiment. Geopolitical headlines can heavily impact the index in the short term.

The S&P 500, backed by a strong domestic economy and global diversification of its constituents, generally experiences lower volatility. Its stability attracts long-term investors, including pension funds and sovereign wealth funds.

For traders, KOSPI's volatility can offer opportunities for short-term profits. For long-term investors, the S&P 500's consistency and resilience are more appealing.

How Are They Performing So Far in 2025?

As of mid-2025, the S&P 500 has continued its upward trend, fueled by AI innovation, strong tech earnings, and consumer resilience. With interest rates stabilising in the U.S., investors have regained confidence in equity markets.

At the same time, the KOSPI Index has experienced slight gains fueled by semiconductor rebounds, automotive exports, and heightened investor interest in Asia stemming from geopolitical diversification away from China.

Investment Access: How to Trade Both Indices

The S&P 500 is readily available via U.S. ETFs like SPY, VOO, or index futures such as ES and options on U.S. exchanges. Most global brokers offer straightforward access to S&P 500-linked instruments.

While not as well-known, the KOSPI Index can be accessed through Korea-based ETFs, KOSPI 200 futures, and certain international ETFs such as iShares MSCI South Korea ETF (EWY). CFDs (contracts for difference) offered by brokers like EBC Financial Group also provide an easy way to trade KOSPI index movements without owning the underlying shares.

Retail investors prioritising global diversification can incorporate both indices in a multi-asset portfolio by utilising fractional shares, ETFs, or CFDs, based on their risk tolerance and approach.

Why Consider Both as a Diversification Strategy?

Spreading investments across different regions and economies is among the most effective methods for minimising portfolio risk. The KOSPI and S&P 500 complement each other well despite their differences.

Adding KOSPI exposure can:

Increase access to Asia-Pacific growth trends

Balance a portfolio heavy on Western equities

Benefit from emerging-market upside

Holding the S&P 500 maintains:

Exposure to stable, innovative U.S. companies

Reliable dividends and dollar-denominated gains

Defensive characteristics during downturns

Combining both indices helps investors balance risk and reward, particularly in a volatile global economy like that of 2025.

Conclusion

In conclusion, there is no absolute winner in the KOSPI vs S&P 500 debate. Each index plays a unique role in a diversified global portfolio.

The best strategy? Combine both. Use the S&P 500 as your core holding and add KOSPI exposure through ETFs or CFDs to tap into growth and regional balance. Together, they offer the kind of diversification that aligns well with the evolving global market landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.