Oil markets in 2026 present a mixed outlook: while average prices are expected to soften, ongoing supply vulnerabilities keep the risk of price spikes elevated. As inventories build and geopolitical risks persist, investors are favoring producers that can self-fund, maintain margins, and continue to grow.

This is why steady accumulation of oil equities is more significant than daily price movements. The focus should be on companies with strong free cash flow and operational flexibility, led by management teams capable of asset acquisitions and share buybacks throughout the cycle. For investors exposed to emerging-market currencies, these equities can also serve as a hedge against oil shocks, as currencies like the South African rand are sensitive to rising import costs.

Key Takeaways On Undervalued Oil Stocks In 2026

Baseline projections call for Brent to average around $58 in 2026 as supply edges ahead of demand, but “average” is not “path.” A single disruption through key maritime routes can still reprice crude quickly.

Roughly 20 million barrels per day moved through the Strait of Hormuz in 2024, about 20% of global petroleum liquids consumption. That is the kind of concentration that keeps volatility bid even in surplus narratives.

ExxonMobil is the “advantaged barrels” anchor: production is already at multi-decade highs, with Permian and Guyana records and a clear runway to scale into 2030.

Cenovus offers leverage within a disciplined capital plan. Its 2026 budget targets capital expenditures of $5.0 billion to $5.3 billion, with modest pro forma growth following the MEG acquisition. Recent performance also indicates positive momentum.

GeoPark stands out for its valuation. As a small-cap oil company, it has a board-approved 2026 plan, significant exposure to heavy oil, robust hedging, and has attracted strategic interest through an 11.8% stake and a $9-per-share cash proposal.

The South African rand offers attractive carry but remains vulnerable to energy shocks. With a policy rate of 6.75% and recent inflation at 3.6%, the USD/ZAR exchange rate near 16 suggests there is still significant risk from oil price volatility.

Stock |

What Hedge-Fund Style Capital Likes |

2026 Operating Catalyst |

Valuation Snapshot |

Balance Sheet Signal |

Shareholder Return Signal |

| ExxonMobil (XOM) |

Scale plus advantaged growth barrels |

Permian and Guyana records, 2030 growth plan |

$630.9B market cap; EV/EBITDA 11.29; forward P/E 21.73 |

Debt/EBITDA 0.80 |

Dividend yield 2.73%; ongoing buyback capacity |

| Cenovus Energy (CVE) |

Torque to heavy-oil and refining spreads |

Post-MEG integration with a defined capex envelope |

$41.41B market cap (Feb 13, 2026); EV/EBITDA 7.05 |

Debt/EBITDA 2.40 |

Dividend framework plus buyback flexibility |

| GeoPark (GPRK) |

Deep value plus event optionality |

2026 plan with hedges and Vaca Muerta ramp |

$442.8M market cap; EV/EBITDA 2.87; forward P/E 8.99 |

Net leverage targeted lower into 2028 |

$0.03 quarterly dividend plan; strategic stake in the register |

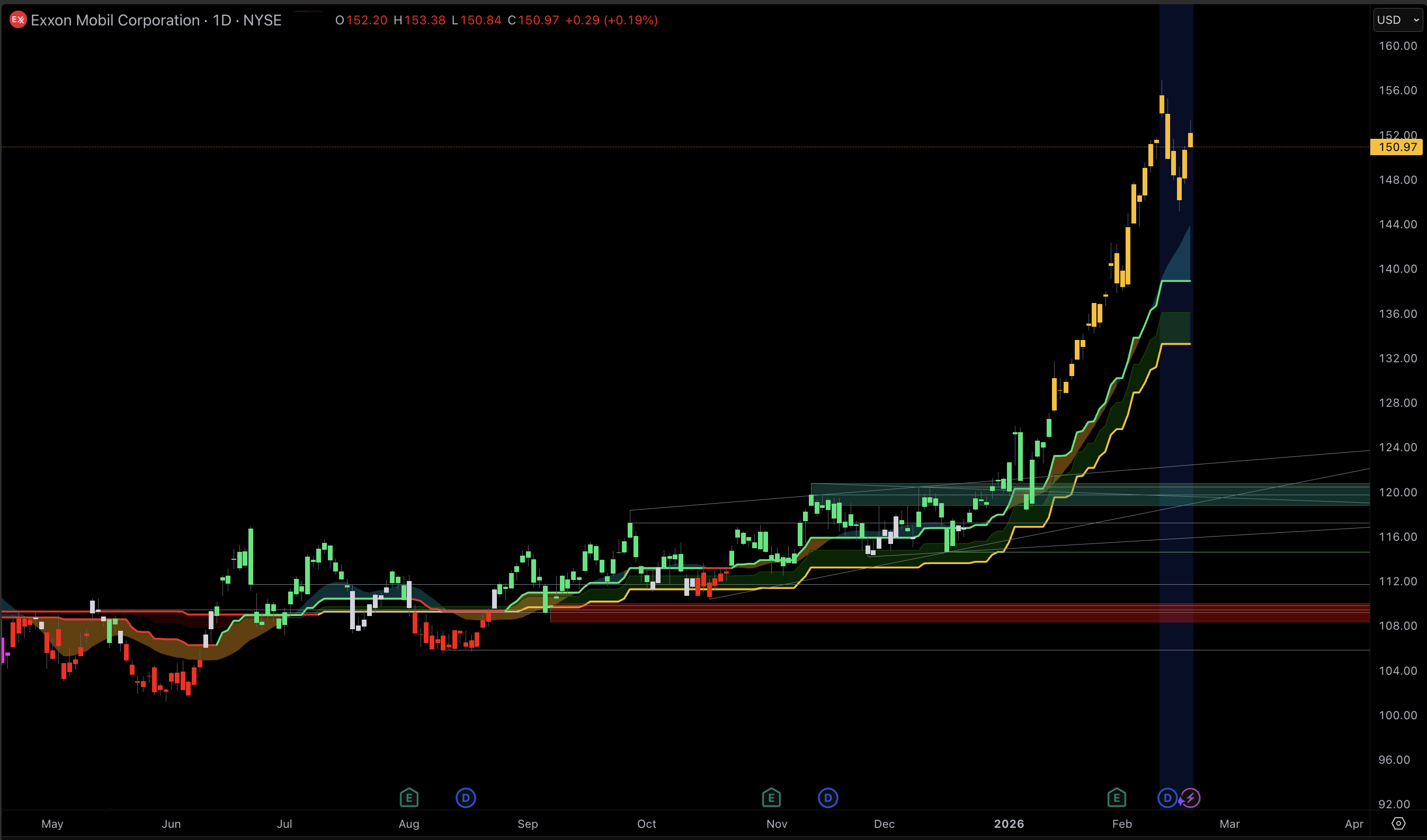

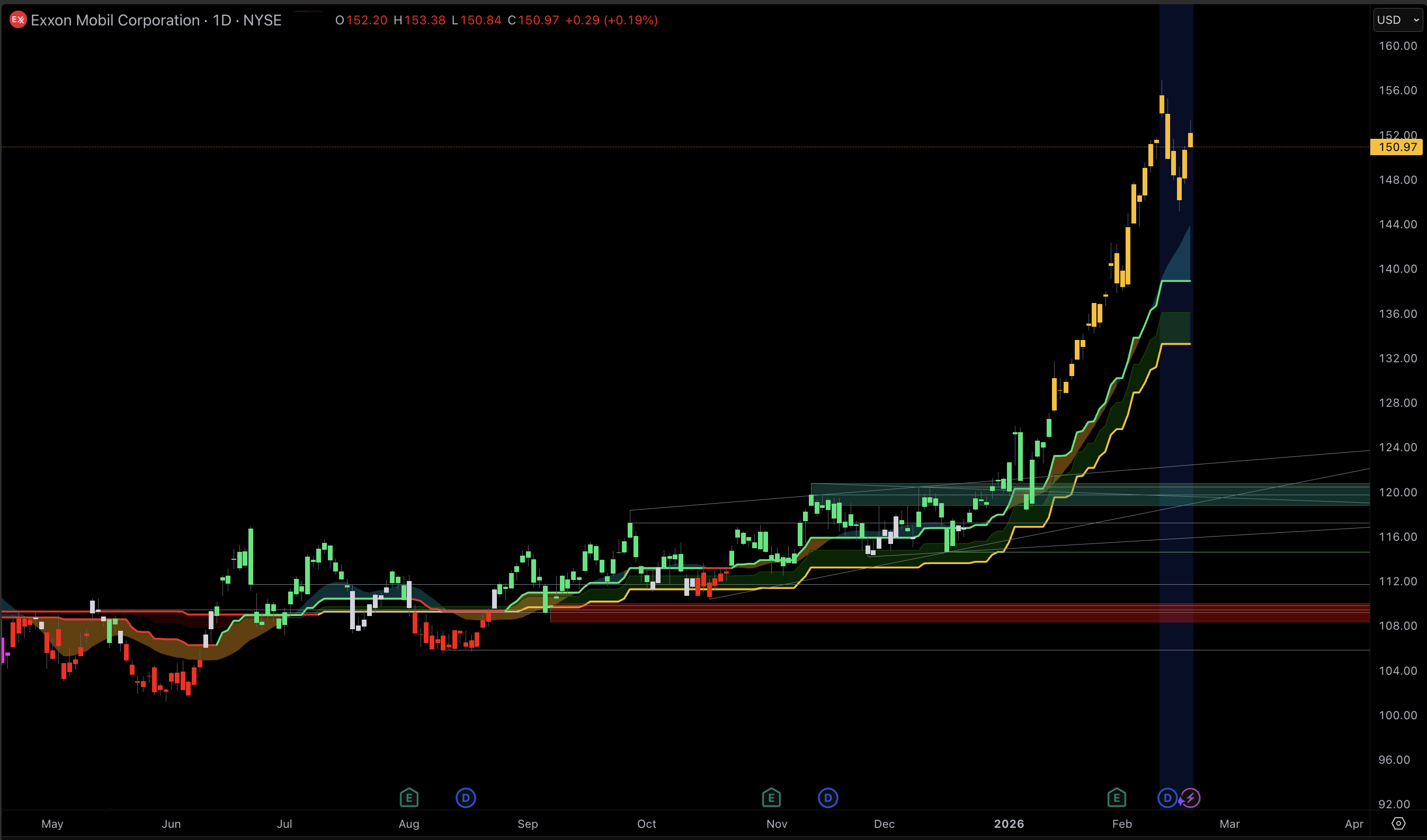

ExxonMobil (XOM)

The Volume Story Is Already Real, Not A Forecast

Exxon is not selling a hypothetical Permian and Guyana narrative. Full-year 2025 net production reached 4.7 million oil-equivalent barrels per day, the highest level in more than 40 years. The Permian set an annual record at 1.6 million oil-equivalent barrels per day, and Guyana exceeded 700,000 gross barrels per day. Fourth-quarter net production hit 5.0 million oil-equivalent barrels per day, with the Permian at 1.8 million and Guyana approaching 875,000 gross barrels per day.

This is important in 2026 because not all supply growth is equally valuable. Barrels with low lifting costs and strong netbacks support dividends and buybacks even when prices decline. Exxon’s asset portfolio is increasingly focused on these assets, allowing the company to pursue growth without relying on optimistic price forecasts.

Cost Structure And Capital Allocation Are The Hidden Edge

The market often treats Exxon as a mature major, but its operating model is still bending lower. Estimated cumulative structural cost savings totaled $15.1 billion versus 2019 levels, including an additional $3.0 billion in 2025.

Exxon’s 2030 plan targets upstream production of 5.4 million oil-equivalent barrels per day, with the potential to generate $20 billion in earnings and $30 billion in cash flow. This strategy supports ongoing shareholder returns while growing the core business.

Valuation And Technicals Show A Strong Bid, Not A Cheap Sticker Price

Based on current metrics, Exxon is not inexpensive compared to distressed exploration and production companies. However, it is attractively valued given the stability of its cash flows and project pipeline. The company’s market capitalization is approximately $630.9 billion, with an EV/EBITDA of 11.29 and a dividend yield of 2.73%.

Technically, the trend is intact: the 50-day moving average sits well above the 200-day (130.82 versus 116.18) with RSI near 66, consistent with an advancing structure rather than a late-cycle blowoff.

Key Risk To Watch: a prolonged margin reset in downstream and chemicals at the same time crude realizations soften. Exxon can absorb it, but multiple expansion becomes harder in that tape.

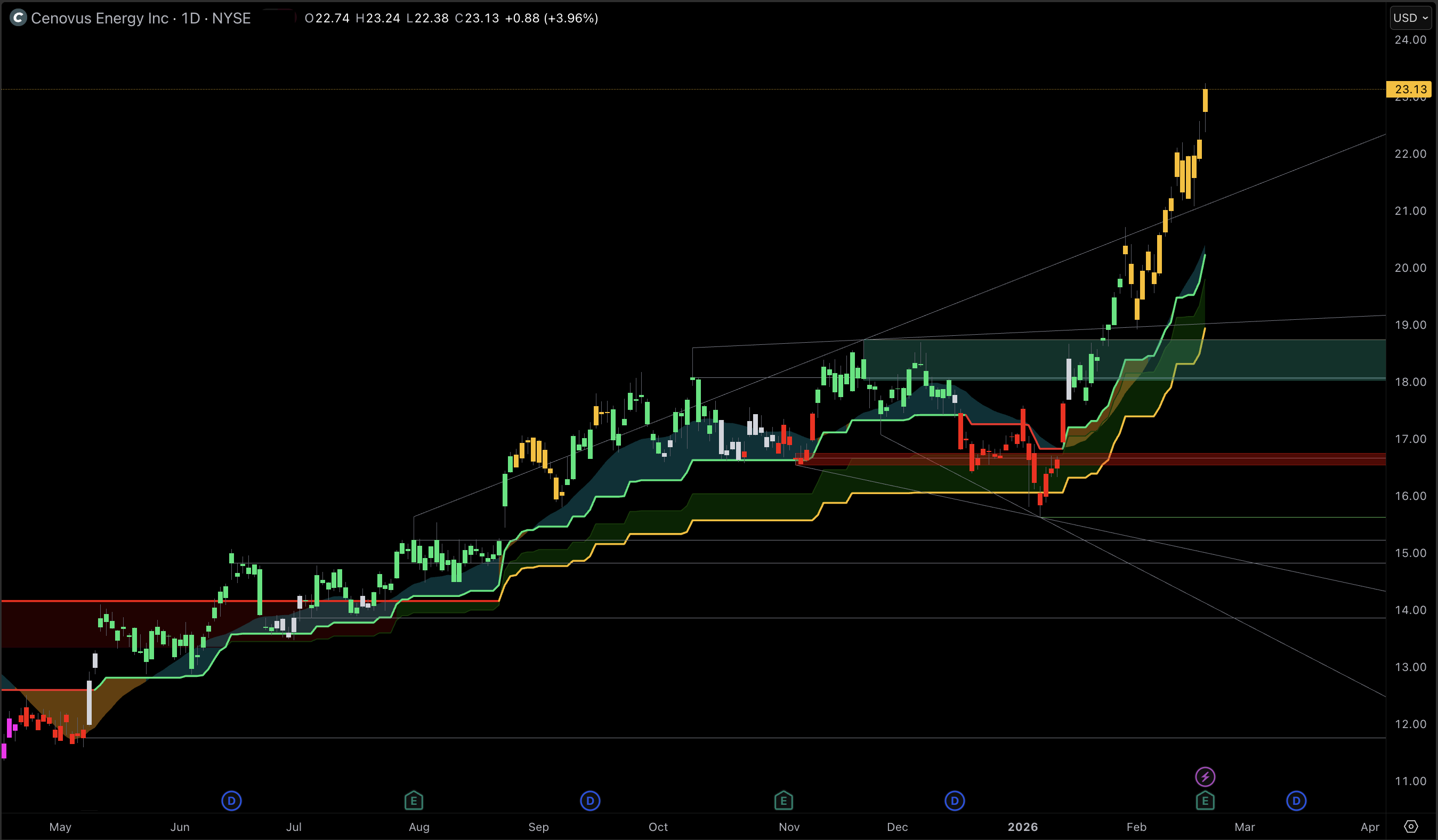

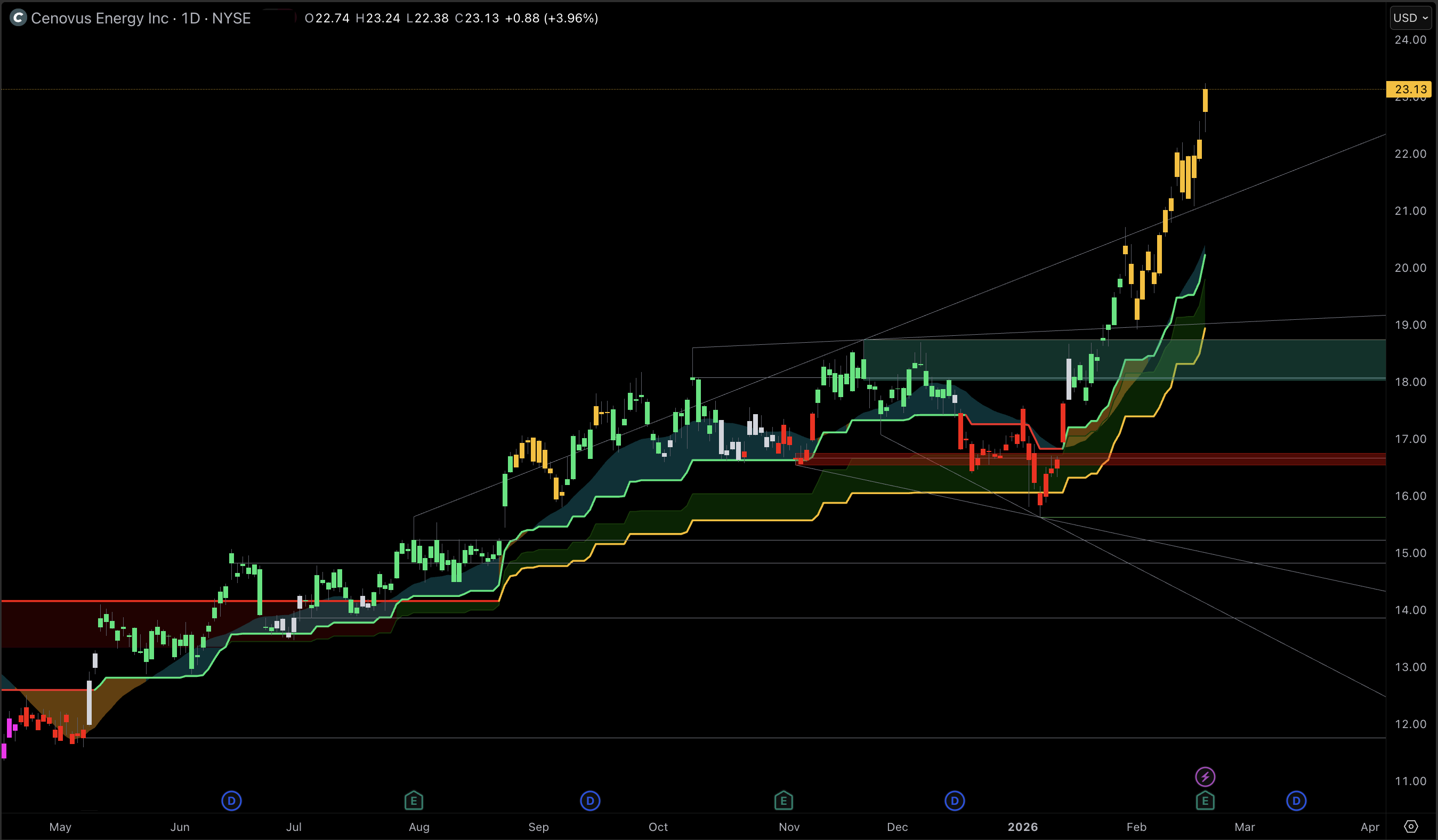

Cenovus Energy (CVE)

MEG Turns Cenovus Into A Different Kind Of Heavy-Oil Machine

Cenovus is primarily a heavy-oil operator that is evolving into an integrated cash-flow platform. The MEG acquisition is central to its 2026 strategy, adding scale in oil sands, extending inventory, and enabling more efficient capital allocation across long-life assets. The acquisition closed on November 13, 2025.

With oil prices expected to be lower on average but more volatile, long-life assets are advantageous if costs are managed and transportation risks are addressed. While heavy-oil producers are vulnerable to widening differentials, integration and disciplined logistics can help mitigate these risks.

2026 Guidance Is Conservative, Which Is Part Of The Bull Case

The loudest claims about Cenovus in early 2026 have focused on explosive production growth. The company’s own framing is more measured: the 2026 plan carries a $5.0 billion to $5.3 billion capital budget, with production expected to increase about 4% year over year when adjusted for the MEG acquisition.

This conservative guidance is valuable because it indicates that management is prioritising free cash flow quality over production volume. Institutional investors often favor this approach late in the cycle.

Momentum Is Strong, but Valuation Remains Attractive if Oil Prices Support

Cenovus is not hiding in a low-volatility corner. The stock is up about 49.6% over the last 52 weeks, and RSI is near 72 points in a momentum regime.

Valuation is a key discussion point. The enterprise value-to-EBITDA is approximately 7.05, while the forward P/E is higher at 25.19 due to volatility in crude and crack spreads. Evaluating CVE should focus on mid-cycle cash generation and balance sheet trends rather than a single-year P/E.

Key Risk To Watch: heavy-oil differentials and refinery margin compression hitting at the same time. That combination tends to pressure both halves of the integrated model.

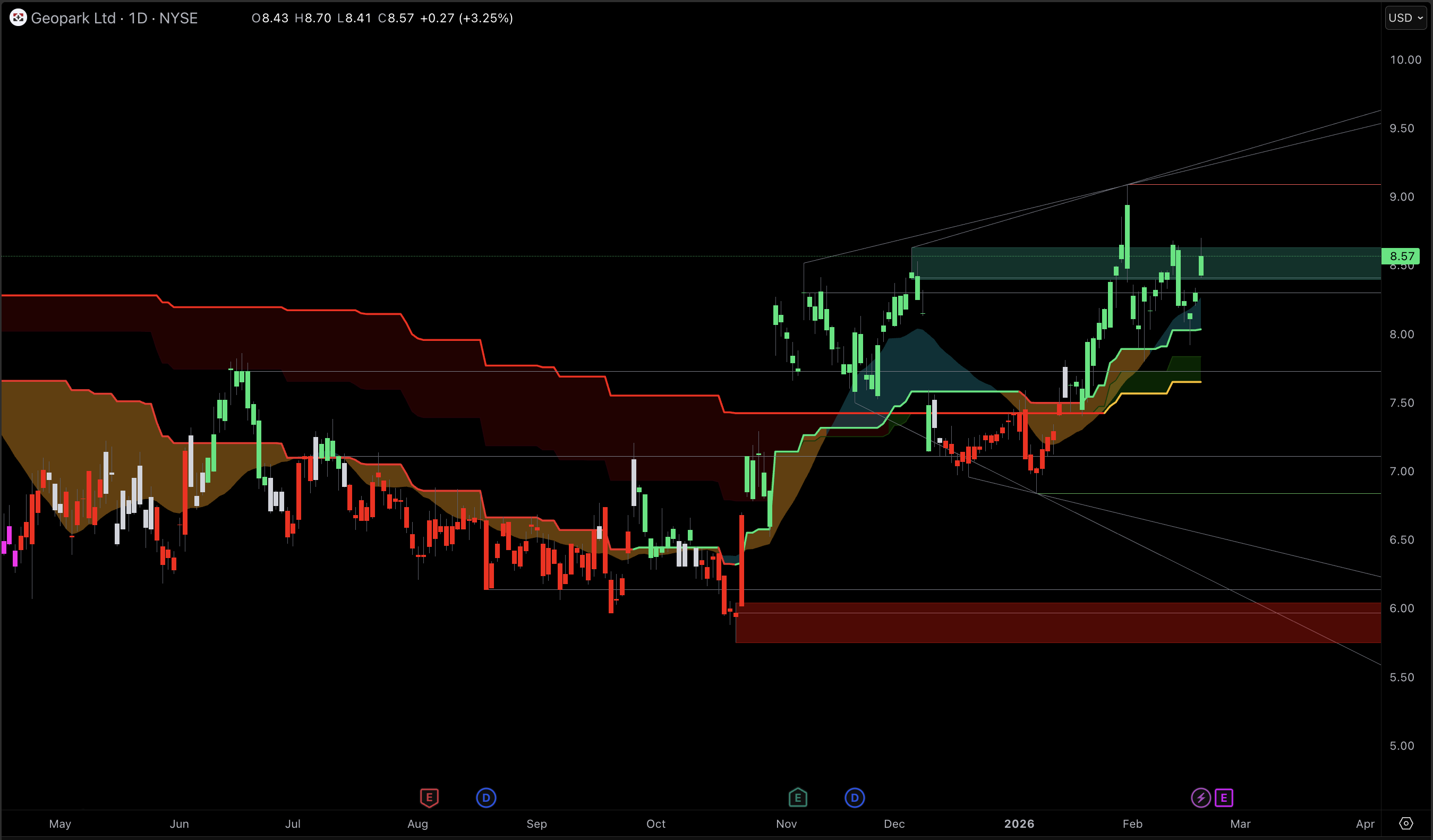

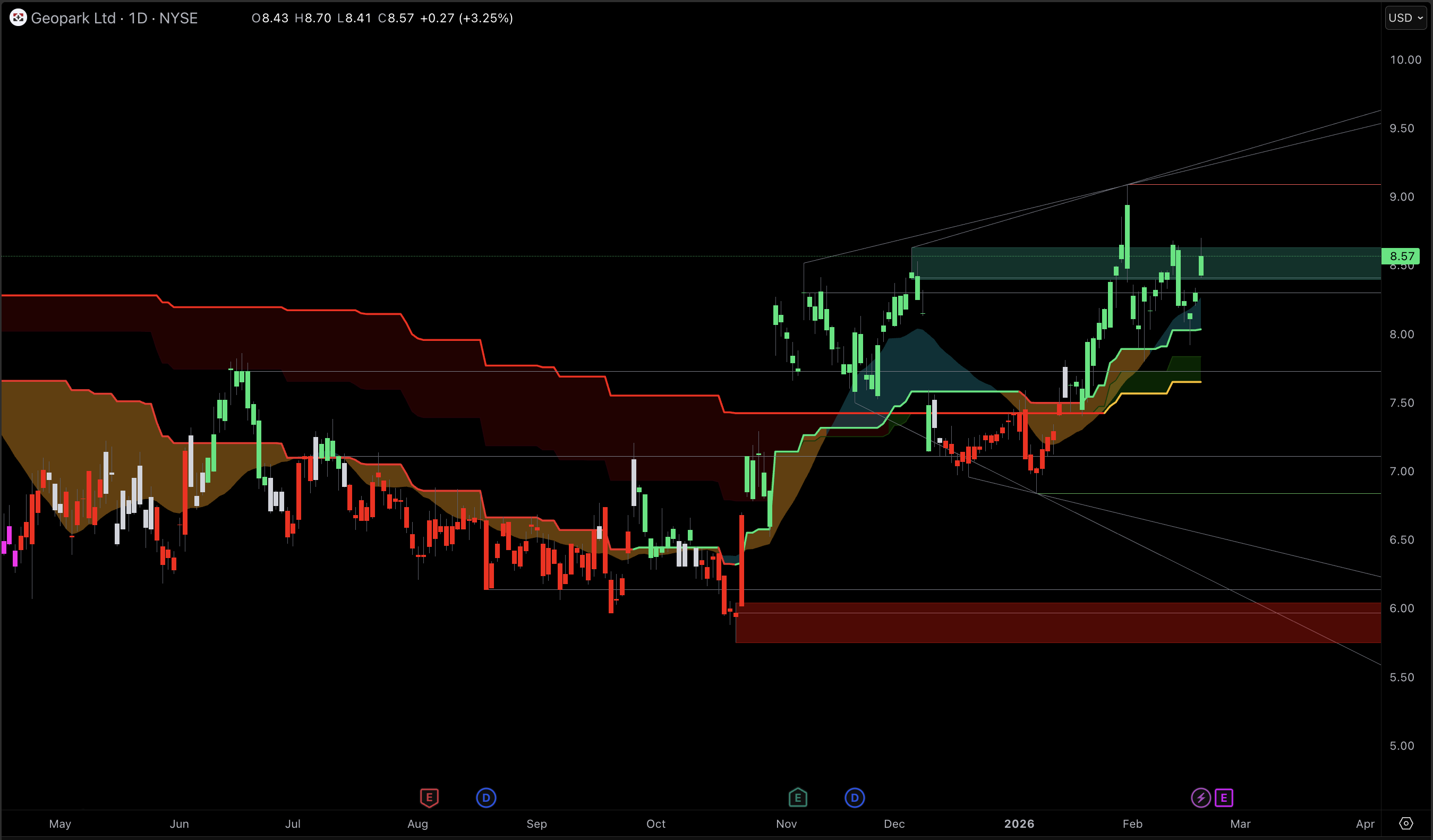

GeoPark Limited (GPRK)

This Is A Classic Small-Cap Oil Discount With A Defined Plan

GeoPark appears undervalued due to its exposure to country and execution risks, as well as lower liquidity compared to North American majors. However, credible plans and visible catalysts can create significant upside potential.

The board-approved 2026 program outlines $190 million to $220 million in capex to support production of 27,000 to 30,000 barrels of oil equivalent per day, with a mix expected to be about 97% oil.

Hedging And A Multi-Year Ramp Create A Floor Under Cash Flow

GeoPark’s long-term strategy highlights the market’s undervaluation. The company plans to significantly increase production and EBITDA by 2028, with an improving leverage profile. As of late November 2025, approximately 56% of the estimated 2026 production was hedged, and the board approved a quarterly dividend of about $0.03 per share for four quarters.

For a small-cap oil company, this combination is important. Hedges lower the risk of forced deleveraging, and the dividend program encourages ongoing capital discipline.

The “Quiet Buying” Angle Is Real Here

GeoPark is not just a valuation screen. It has already attracted strategic attention. On October 29, 2025, a $9.00 per share cash proposal was submitted to GeoPark’s board, and an 11.8% ownership position was built.

While this does not guarantee a transaction, it increases the range of possible outcomes. A stock with strong cash flow and potential for strategic events remains attractive to institutional investors.

On current valuation metrics, GeoPark stands out: market cap of about $442.8 million, EV/EBITDA of 2.87, forward P/E of 8.99. Technically, the 50-day moving average remains above the 200-day (7.44 versus 6.52) with RSI around 60, consistent with a constructive structure that has not yet gone parabolic.

Key Risk To Watch: political and regulatory shocks in core operating regions, plus the always-present risk that a strategic process ends with no transaction and the stock re-rates back toward “pure” operating fundamentals.

Frequently Asked Questions

What Does “Energy Squeeze” Mean In 2026 If Prices Are Forecast To Decline?

The focus for 2026 is on volatility rather than a consistent price trend. Inventories may increase on average, but geopolitical risks and supply disruptions can still cause frequent price spikes. The hedging value of oil equities increases in such an environment, even if average prices are lower.

Are Oil Stocks Still A Good Inflation Hedge?

Oil stocks can serve as an inflation hedge, but only selectively. The most effective hedges are companies with low-cost production, disciplined capital expenditures, and shareholder return policies that are not reliant on high oil prices. These companies can convert commodity price increases into cash flow without significant downside when prices normalize.

Why Bring Up ZAR In An Oil-Stock Article?

Oil price shocks can affect the purchasing power of currencies in net-importing countries. While South Africa’s carry profile is supported by a 6.75% policy rate and recent inflation of 3.6%, a sudden increase in energy-driven inflation can still put pressure on the rand.

Which Stock Has The Best “All-Weather” Profile?

ExxonMobil. The company offers scale, record volumes of “advantaged” barrels, and a long-term growth outlook through 2030 that is not reliant on a single region. While its returns may be less volatile than those of small-cap companies, the risk of permanent capital loss is also significantly lower.

What Is The Cleanest Catalyst Setup?

GeoPark. The company trades at a significant valuation discount, has a clear 2026 plan, and has already attracted strategic interest through an equity stake and a cash proposal. This provides several potential avenues for upside, including successful operational execution.

Conclusion

The most compelling oil stock opportunities in 2026 are not based on forecasting a specific crude price. Instead, they involve owning companies with durable cash flows that can withstand lower average prices while remaining positioned for volatility. ExxonMobil offers the strongest compounding profile, Cenovus offers leverage through a disciplined capital plan following the MEG acquisition, and GeoPark offers the greatest valuation discount with meaningful event-driven potential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(U.S. Energy Information Administration)(U.S. Energy Information Administration)(Exxon Mobil Corporation)(ExxonMobil)(GeoPark)(Cenovus Energy)