EUR/ZAR began 2026 near R19 per €1, reflecting South Africa’s improved inflation outlook and credibility, balanced against the rand’s ongoing sensitivity to global risk and domestic execution. On February 17, 2026, the ECB reference rate set the euro at R19.032, with a late-January low of R18.758.

The path for the rest of 2026 is less about “a stronger euro” or “a weaker rand” in the abstract, and more about whether South Africa can convert lower inflation and fewer power constraints into durable growth and fiscal traction while global markets stay constructive. The euro side of the cross matters too, but EUR/ZAR will still trade like a high-beta risk barometer when volatility rises.

Euro To Rand Forecast: Key Takeaways For 2026

Base-Case Range:

EUR/ZAR is expected to trade between R18.50 and R20.50 in 2026, with risks tilted toward the upper end if global volatility increases. The current level near R19 represents a reasonable mid-cycle valuation that can shift rapidly with market sentiment.

Carry Still Supports The Rand, But Less Than Before:

With the South African policy rate at 6.75% and the ECB deposit facility at 2.00%, the policy-rate spread is roughly 475 bps, which remains a meaningful cushion for rand longs when markets are calm.

The 3% Inflation Target Is a Structural Positive:

South Africa’s new 3% inflation target, with a 1 percentage point tolerance band, lowers expectations and reduces the long-term risk premium in the currency. This tighter anchor also increases the requirements for administered prices and fiscal discipline.

External Balances Are No Longer the Main Weak Link:

The current account deficit narrowed to 0.7% of GDP in Q3 2025, supported by a significant trade surplus despite outflows in services and income. This creates a more manageable external funding profile than typically assumed during risk-off periods.

Fiscal and Political Factors Determine the Risk Premium:

Treasury forecasts the consolidated deficit to narrow from 5% of GDP in 2024/25 to 3.5% in 2027/28, with gross debt stabilizing at about 76.2% of GDP in 2025/26. The credibility of this trajectory, along with election-related uncertainty in late 2026, will influence the yield investors require for rand assets.

Where EUR/ZAR Stands Entering 2026

The starting point is the ECB’s own reference rate: €1 = R19.032 on February 17, 2026, with the 2026 low at R18.758 (January 29, 2026) on the same series.

Two additional indicators help frame valuation:

The SARB’s Nominal Effective Exchange Rate (2015=100) printed 85.25 in January 2026, which is consistent with a rand that is still weak on a longer historical lens.

Inflation has declined significantly. South Africa’s CPI was 3.6% in December 2025 and 3.5% in January 2026, aligning with the new policy anchor and reducing the inflation risk premium previously embedded in ZAR pricing.

South Africa’s 2026 Rand Drivers

Interest Rates, Inflation Target, And Carry Mechanics

SARB maintained the repo rate at 6.75% at its January 2026 meeting. The key change is not only the rate level but also the shift to a 3% inflation target with a 1 percentage point band, which is a stricter anchor than the previous 3% to 6% range that was viewed as relatively soft.

For EUR/ZAR, this matters in two ways:

Lower expected inflation reduces the long-run depreciation that investors demand as compensation.

This allows for gradual rate cuts without undermining credibility, though the pace is important. If rate cuts occur faster than expected, the carry advantage diminishes and EUR/ZAR may rise quickly.

Fiscal Math, Risk Premium, And The Bond Bid

Rand stress episodes usually originate in the bond market rather than the spot market. South Africa can sustain moderate growth if its fiscal trajectory is credible. Treasury’s 2025 Budget Review projects the deficit narrowing to 3.5% of GDP by 2027/28 and gross debt stabilizing at 76.2% of GDP in 2025/26. Debt-service costs remain high, stabilizing at about 21.7% of revenue.

If these targets are met, the sovereign risk premium should continue to decline, lowering EUR/ZAR through reduced forward-implied depreciation and more stable portfolio flows. If fiscal slippage occurs, local yields typically widen first, followed by currency weakness.

Current Account, Commodity Basket, And Terms Of Trade

South Africa’s external position is often described as a chronic vulnerability, but the latest SARB current account release shows a more nuanced reality. In Q3 2025, the current account deficit narrowed to R57.0 billion, or 0.7% of GDP, while the trade balance remained in surplus.

That profile changes the rand’s sensitivity: when the current account is near balance, the currency is less dependent on fickle short-term flows to fund imports. The flip side is that South Africa remains exposed to commodity cycles and shipping logistics. Weak commodity realizations or higher oil prices can erode the trade surplus quickly.

Electricity Supply And Growth Sensitivity

Power availability continues to limit potential growth. As of February 19, 2026, Eskom’s dashboard reported no load shedding, a notable improvement compared to previous years of frequent outages.

For FX, the link is clear: fewer outages boost production, tax revenue, and investor confidence, reducing the risk premium in ZAR. In 2026, markets will focus on consistent performance during winter demand, maintenance, and grid stability.

Politics And The 2026 Local Election Run-Up

Political risk in 2026 is less about a single event and more about narrative drift. The Independent Electoral Commission sets the municipal election window between November 2, 2026 and January 30, 2027.

Currencies reflect uncertainty in advance. As the election window nears, expect increased sensitivity to headlines, especially if fiscal decisions become more politically constrained. This often results in EUR/ZAR remaining stable for extended periods, then rising sharply during brief risk-off episodes.

Euro Side Of The Cross: What Drives EUR In 2026

ECB Rates And Euro Area Growth

The ECB deposit facility rate sits at 2.00% as of February 2026. With euro area inflation easing to 1.7% in January 2026, the ECB has room to stay patient, and the market’s conviction about the next move matters as much as the move itself.

The ECB projects euro area growth to average about 1.2% in 2026, indicating steady but unspectacular performance. (European Central Bank) A stable euro environment usually limits EUR/ZAR volatility, making the rand the primary driver.

EUR/USD Is The Hidden Multiplier

EUR/ZAR is determined by both EUR/USD and USD/ZAR. Even with stable South African fundamentals, a broad euro rally against the US dollar can mechanically push EUR/ZAR higher. In 2026, global trade policy changes and US rate expectations will be the main drivers of EUR/USD and, consequently, the euro-rand cross.

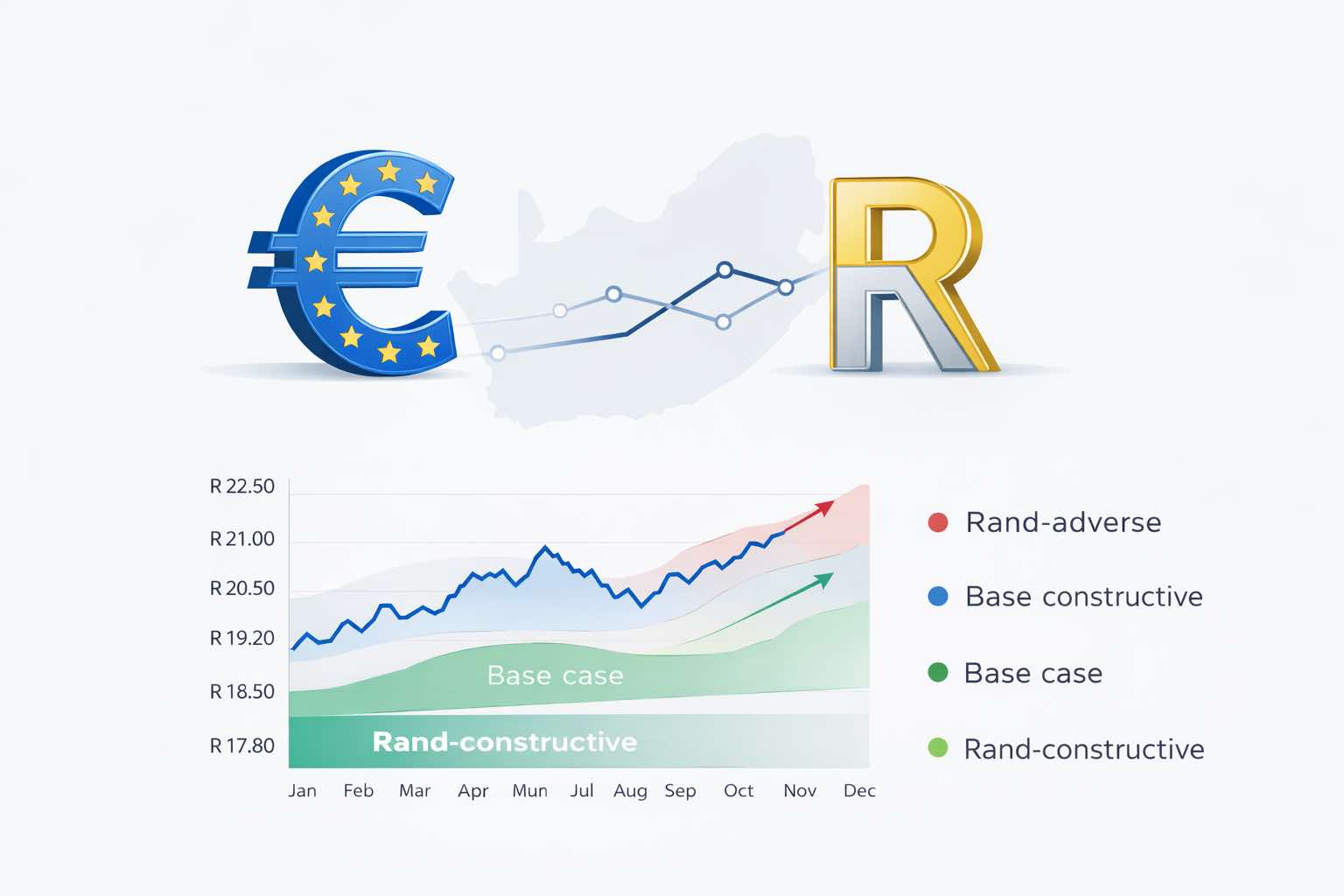

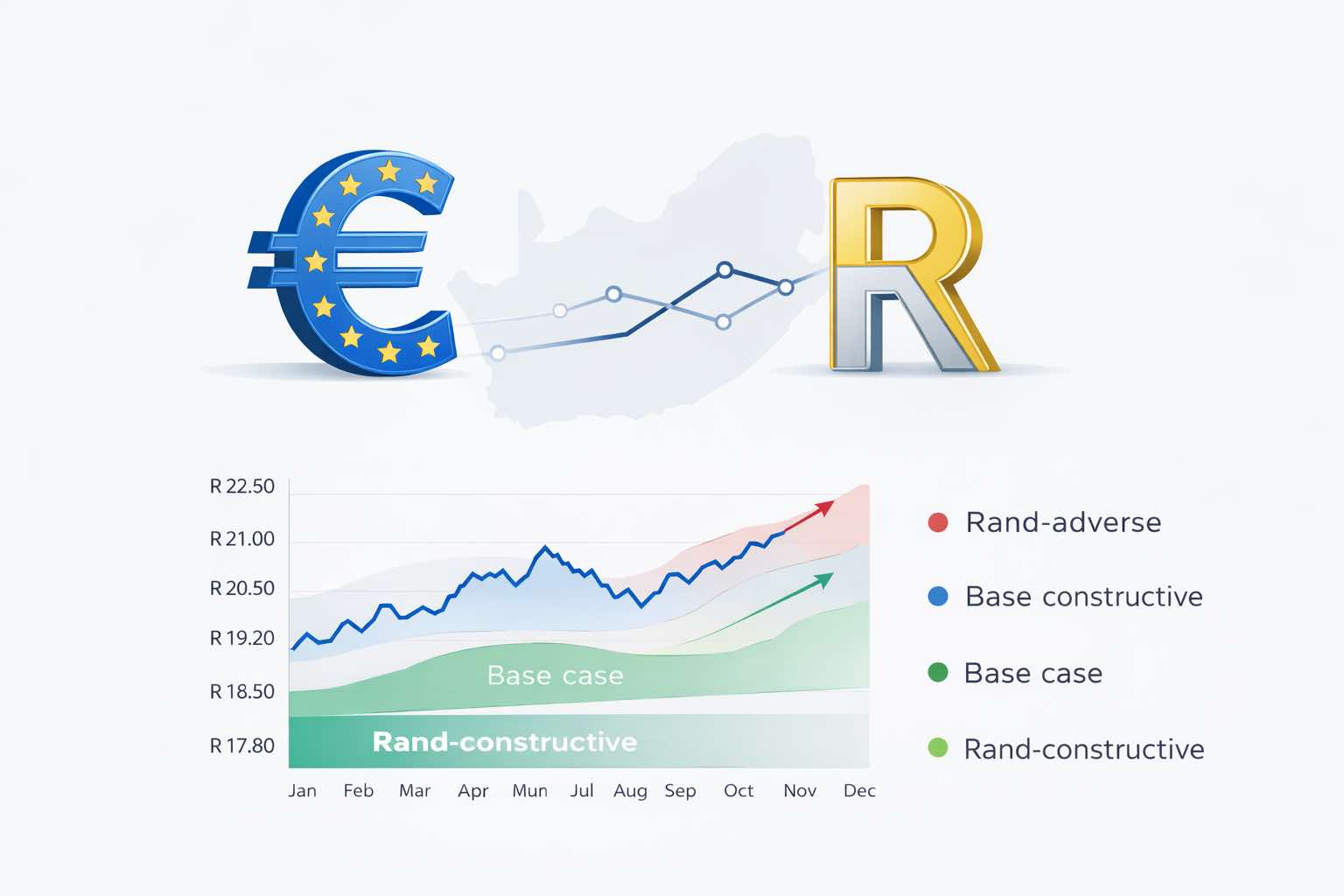

Scenario Table: EUR/ZAR Ranges For 2026

2026 Scenario |

What Has To Happen |

Likely EUR/ZAR Range |

Year-End Bias |

| Rand-Constructive |

Reform traction, steady power, contained inflation, calm global risk |

17.80 to 19.20 |

18.20 to 18.90 |

| Base Case |

Gradual SARB easing, modest growth, manageable fiscal optics, episodic volatility |

18.50 to 20.50 |

19.00 to 19.80 |

| Rand-Adverse |

Fiscal slippage, renewed power strain, commodity drawdown, global risk-off shock |

20.50 to 22.50 |

21.00 to 22.00 |

The base case assumes South Africa’s growth remains modest, broadly in line with the IMF’s 2026 real GDP projection of 1.4%, while inflation stays close to the new target path.

Technical Levels That Matter In 2026

EUR/ZAR trades with a clear “round-number gravity” because liquidity concentrates around big figures. The market has already validated R18.75 to R18.80 as a demand zone in early 2026, as evidenced by the January trough near R18.758. On the topside, R20.00 is the psychological threshold that tends to shift hedging behavior among importers and offshore investors, often accelerating moves once broken.

In practical terms, the base case is for spot to mean-revert around R19, with moves toward R18.7 or R20.5 likely driven by specific events rather than sustained trends.

Euro To Rand Forecast FAQs

What Is The Most Important Driver Of EUR/ZAR In 2026?

Global risk appetite. When volatility rises, the rand typically weakens faster than fundamentals can justify. When risk is calm, South Africa’s yield advantage and improving inflation credibility tend to pull EUR/ZAR back toward equilibrium.

Does South Africa’s New 3% Inflation Target Strengthen the Rand?

Over time, yes. A 3% target with a 1 percentage point band reduces long-run inflation expectations and lowers the risk premium investors demand. It can also support lower nominal rates later without destabilizing the currency if credibility holds.

How Much Does The Interest Rate Gap Matter For EUR/ZAR?

The interest rate gap is significant, but mainly when volatility is low. With SARB at 6.75% and the ECB deposit rate at 2.00%, the policy spread supports carry trades. However, during risk-off periods, capital preservation becomes more important than the spread.

Is South Africa’s Current Account Still A Problem?

It is less of a concern than before. The current account deficit narrowed to 0.7% of GDP in Q3 2025, supported by a trade surplus. The main risk is not the deficit’s size, but how quickly it could widen if commodity prices fall or oil prices rise.

Could The 2026 Local Elections Move The Rand?

Yes, primarily through shifts in sentiment and fiscal expectations. The election window is from November 2, 2026 to January 30, 2027, and markets typically demand a higher risk premium during politically sensitive periods, regardless of the outcome's uncertainty.

Conclusion

The 2026 Euro to Rand forecast is best viewed as a range trade with asymmetric risk. South Africa’s disinflation, adoption of a 3% inflation target, and a manageable current account deficit provide a stronger foundation for the rand compared to previous cycles.

However, EUR/ZAR will continue to act as an emerging-market risk instrument, rising sharply during periods of global volatility or when domestic fiscal credibility is in doubt. If global conditions remain stable, a base-case range of R18.50 to R20.50 is most likely, with sustained rand strength depending on policy discipline and consistent execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(European Central Bank)(Reserve Bank of South Africa)(Reserve Bank of South Africa)(Reserve Bank of South Africa)(European Commission)(IMF)