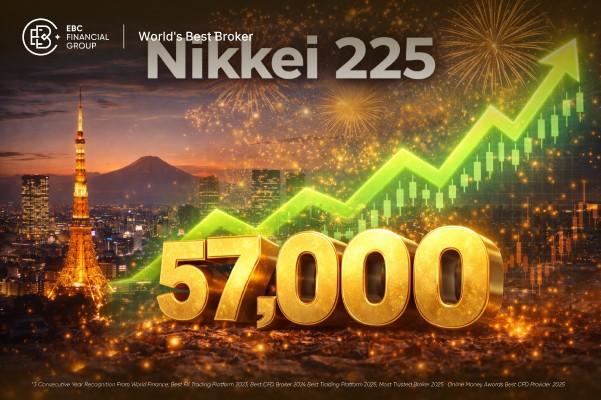

The semiconductor trade has started 2026 with real force. On Tuesday, January 6, 2026, the PHLX Semiconductor Sector Index (SOX) hit a fresh all-time high, rising 2.75% on the day and pushing its gain in the first three trading sessions of the year to about 8%. Official index data shows SOX at $7,650.93 with an intraday high of $7,665.77.

This rally resembles a simple "AI is back" headline, but the tape is telling a more useful story. The bid is spreading beyond a single winner, and it is showing up in parts of the chip stack that usually move only when the market believes the cycle is improving.

At the same time, the risks are not subtle. Valuations are stretched into earnings, export headlines can hit without warning, and a single confident remark from a major CEO can still reprice entire sub-industries overnight.

What Is the SOX Index, and Why Do Traders Track It?

The SOX is designed to measure the performance of 30 large US-listed semiconductor companies across chip design, manufacturing, equipment, and related areas.

Two features make it useful for traders:

It is broad enough to show the health of the chip cycle, not just one name.

It is rules-based and capped, so mega winners do not fully dominate performance. Under the methodology, the largest constituents are capped (for example, the top three are subject to set limits), and most other names can't exceed a lower single-stock cap.

That second point is crucial for this week's story. NVIDIA remains the bellwether, but a catch-up move in other parts of the chip market is also helping the index's strength.

SOX Index Record Print: Market Snapshot

| Metric |

Latest read |

Why traders care |

| SOX Close |

$7,650.93 |

Fresh breakout level and new reference point for pullbacks |

| Day range |

$7,521.95 to $7,665.77 |

Shows strong demand even with wide intraday swings |

| One-day move |

+2.75% |

Confirms risk-on appetite in a crowded theme |

| 2026 start |

~+8% (1st three sessions) |

Signals aggressive positioning early in the year |

This is a real breakout because the index was aiming to clear the prior peak set in December, around the mid-7,400s.

With the SOX now printing highs in the 7,660s, the breakout has moved from "nearly there" to done.

What Drove the SOX Index to Reach All-Time High?

To best grasp this surge, it is three forces stacking on top of each other: AI demand, earnings revision momentum, and technical positioning.

1) Nvidia Reignited the AI Hardware Story

NVIDIA remains the centre of gravity for the sector because investors treat it as the cleanest proxy for AI infrastructure spend. At CES 2026, Nvidia's CEO announced that the next-generation Vera Rubin platform is in complete production, detailing significant performance improvements and expansion strategies for data-centre systems.

Even when Nvidia is not the biggest gainer on a given day, upbeat product-cycle headlines tend to lift the whole group, because they reset expectations for demand down the value chain.

Trader's Angle: When Nvidia headlines hit, watch not only chip designers, but also memory, equipment, and networking-exposed names. The market often reprices the whole "AI build-out" group all at once.

2) The Rally Broadened Beyond "AI-Only" Chips

A standout feature of this push is that analogue and industrial-facing chip stocks joined the party. For example, sharp rallies in names like Microchip, Texas Instruments, and NXP reflect a brighter outlook and growing confidence that the worst of the inventory correction may be behind the group.

This matters because analogue strength often signals something bigger than a single AI cycle. It can hint at improving demand across autos, industrials, and general electronics.

Simple test: If "boring chips" are rallying with AI chips, the market is leaning towards a broader cycle recovery.

3) Memory Became a Tailwind Again

Memory serves as a significant swing element in the SOX as it often fluctuates in distinct cycles. Late 2025 delivered a strong memory narrative, with a worldwide supply crunch and robust AI data-centre demand supporting a major forecast beat from a key memory producer.

If memory pricing is rising while AI demand remains hot, the market tends to pay up for the whole group.

4) The Start-Of-Year Positioning Effect

Semiconductors opened the year strongly, with a sharp jump in the SOX in the first session of 2026, as risk appetite improved.

When a sector begins January with strong momentum, trend-following investments frequently provide additional support.

The Unique Angle: The Market Is Paying for "Spillover," Not Just Chips

An additional effective approach to interpret this move is to cease regarding "semis" as a single trade.

The market is currently pricing three spillover bets:

Compute spillover: More GPUs and accelerators.

Memory and storage spillover: Increased bandwidth and consistency near the model.

Infrastructure spillover: Power, cooling, networking, and physical buildouts.

That third bucket is where risk can hit quickly. In fact, that same CES cycle demonstrated how quickly sentiment can change within the ecosystem. For context, cooling-related stocks sold off sharply after comments that suggested future platforms may reduce traditional cooling needs.

The lesson for traders is simple: The SOX upward trend can remain stable even as specific sub-themes fluctuate dramatically.

Key Risks: What Can Stop the SOX Rally Fast

| Risk |

Probability |

Market impact |

Early warning sign |

| Earnings guidance miss |

Medium |

High |

SOX fails to hold above $7,636 after results |

| Policy / export headline |

Medium |

High |

Sudden gap moves in leaders and suppliers |

| Capex fatigue narrative |

Medium |

Medium |

AI names rise less on good news, fall more on small misses |

| Rotation out of semis |

Medium |

Medium |

Breadth narrows and only a few names hold up |

The cleanest way to frame the risk is to separate "slow risks" from "headline risks."

Slow Risks (They Build Over Weeks)

Valuation compression: Expensive markets can stay expensive, but the moment earnings guidance disappoints, the multiple drops quickly.

Capex payoff doubts: Investors are monitoring if substantial AI expenditures generate actual profits throughout the ecosystem, rather than just revenue increases.

Inventory relapse: The analogue-led bounce is encouraging, but a demand wobble can restart inventory issues.

Headline Risks (They Hit in Minutes)

China licensing and export controls: Nvidia has applied for licenses to ship certain chips into China and is awaiting approvals, which keeps policy risk alive.

Competition pressure: Nvidia faces intensifying competition from rivals and even from large customers building their own chips.

Infrastructure shock: Cooling and power constraints can shift winners and losers quickly, as shown by the sharp reaction in cooling-related names after CES comments.

Frequently Asked Questions

1) What Is the SOX Index?

The SOX is the PHLX Semiconductor Sector Index, designed to track 30 large US-listed semiconductor-related companies.

2) Did the SOX Really Hit an All-Time High This Week?

Yes. The PHLX Semiconductor Sector Index hit a new all-time high on January 6, 2026, with an intraday high of 7,665.77 and a close of 7,650.93. For context, the prior record area was set on December 10, 2025 (about 7,467.5 on the close and about 7,490.3 at the day's high).

3) Why Is Nvidia Still the Key Driver Even When the Whole Sector Is Rising?

NVIDIA often anchors AI spending expectations. When its product roadmap signals higher performance and sustained production, investors become more confident that demand will spread into memory, storage, and networking.

Conclusion

In conclusion, the SOX Index did not reach a new all-time high by accident. The market is reacting to a renewed AI confidence signal, clear spillover into memory and storage, and improving breadth that suggests the cycle narrative is expanding beyond a single winner.

The technical picture remains bullish, but it's also stretched, with strong momentum and an elevated RSI.

In this setup, the key tells are straightforward: whether the SOX can defend the $7,636 area on pullbacks, and whether leadership stays broad as earnings season kicks off.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.