The crude oil price has eased in recent trading as markets digest a combination of rising output, official selling price moves from major producers and mixed inventory signals from the United States. These forces, together with revisions in agency forecasts, have tilted sentiment toward a softer near term for benchmarks such as Brent and West Texas Intermediate.

Where The Crude Oil Price Stands Now

Brent crude is currently trading at around $62.61 per barrel, while West Texas Intermediate (WTI) is quoted near $58.38 per barrel. Both benchmarks have drifted lower over the past few sessions as traders respond to rising supply expectations and a steady accumulation of global inventories.

The price spread between Brent and WTI remains near $4 per barrel, reflecting regional differences in production and export dynamics. Market participants continue to monitor signals from OPEC Plus and official selling price adjustments from major producers for clues on short-term direction.

Key Price Levels And Near Term Moves

| Benchmark |

Latest Price (USD/barrel) |

Weekly Change |

Market Note |

| Brent Crude |

62.61 |

Slightly lower |

Pressured by rising output and inventory builds |

| WTI Crude |

58.38 |

Modestly lower |

Weighed down by higher US production and stock levels |

Immediate Drivers Of The Current Crude Oil Price Move

1. OPEC+ Output Adjustments And Official Selling Prices

OPEC and its partners have continued to adjust output settings this autumn. Collectively, member states have raised production quotas in recent months, and the increased near term supply expectation has weighed on prices.

At the same time, Saudi Aramco cut its official selling prices for December Asian crude allocations, which is an important regional price signal that tends to pressure benchmark levels when it reduces Asian netbacks.

Markets interpreted the cut as Aramco trying to retain market share amid rising supply.[1]

2. US Inventory Data And Market Reaction

Analysts and traders were watching the American Petroleum Institute estimates and the official EIA weekly inventory report for a clearer stock picture.

Recent industry estimates expected a build in U.S. crude inventories, and those builds, when confirmed or larger than expected, add to near term bearish pressure on the crude oil price. [2]

The EIA will also publish updated weekly numbers that often move sentiment sharply on publication.

3. Demand Signals From Agencies And Economic Data

Major energy agencies have tempered demand expectations in the medium term.

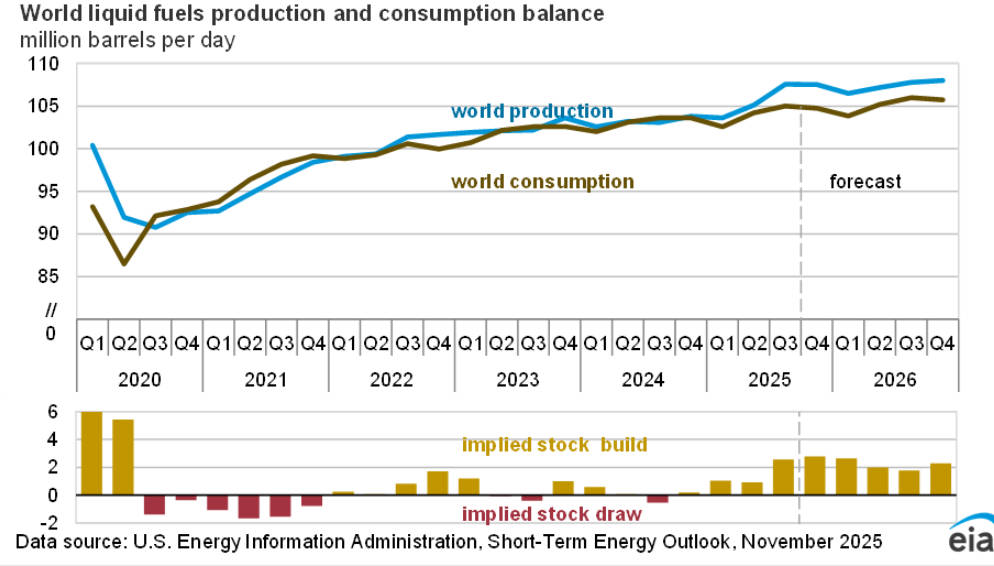

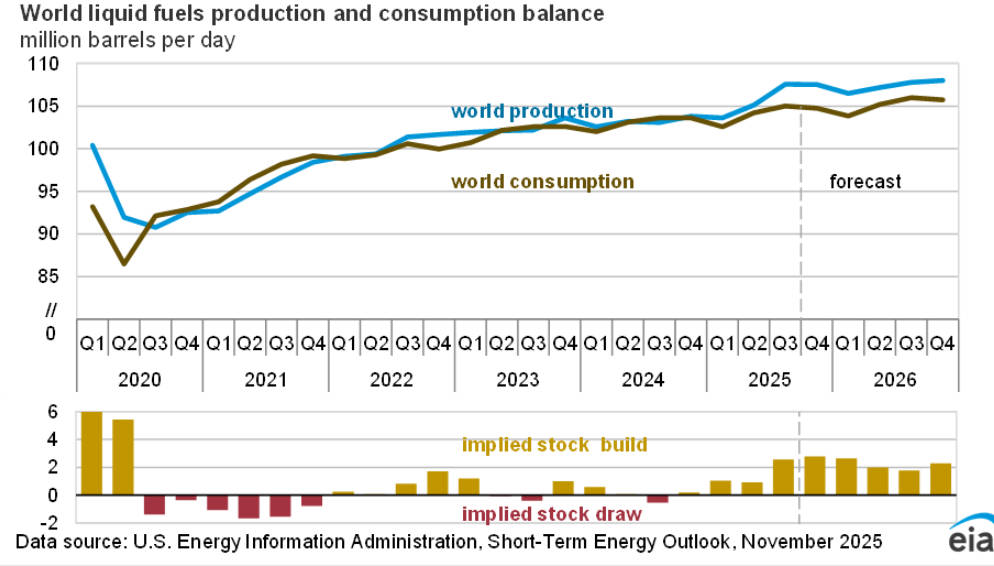

The U.S. Energy Information Administration now expects global oil inventories to rise through 2026 and forecasts lower average Brent prices in early 2026 compared with recent months.

Slower demand upgrades or downgrades across China, Europe and emerging markets influence how persistent any price moves might be.[3]

Technical And Market Structure Considerations For The Crude Oil Price

From a technical perspective, traders are watching the $60 per barrel area for Brent as a psychological support. For WTI, the $58 to $60 band similarly functions as a short term support zone.

The structure of futures curves, liquidity around options expiries and changing positioning in speculative accounts can all amplify small headline moves into larger price swings. These dynamics leave the crude oil price sensitive to both economic data and geopolitical surprises.

Geopolitical And Macro Tail Risks That Could Reverse The Trend

The market remains responsive to supply disruptions and geopolitical events. Sanctions, sudden outages, or logistical shocks can quickly tighten balances and push the crude oil price higher.

Conversely, a sustained strengthening of the US dollar would add downward pressure on the crude oil price, especially if demand weakens more than expected.. The path of Chinese demand remains a critical macro variable because of its outsized influence on global product consumption.

Analysts' Forecasts And Scenario Ranges For The Crude Oil Price

The EIA in its November Short Term Energy Outlook projects that Brent will average around $54 per barrel in the first quarter of 2026 and about $55 for the full year of 2026. Bank and broker forecasts differ in the shorter term, but many have trimmed near term expectations as inventories are set to rise. Below are three scenario ranges that capture the most likely pathways and triggers.

| Scenario |

Brent Range (USD/bbl) |

Primary Triggers |

| Base Case |

$52 to $70 |

Continued modest OPEC+ output increases, steady but not collapsing demand, inventories inching higher. |

| Downside Case |

<$52 |

Larger than forecast inventory builds in the United States and elsewhere, demand softness in China and Europe. |

| Upside Case |

>$75 |

Unexpected supply disruptions, stronger Chinese demand or tighter OPEC+ production than signalled. |

These scenario bands are not predictions but conditional ranges that help readers frame risk. Attribution to the EIA and major news coverage should be kept alongside any published ranges.

Market Implications: Refiners, Consumers And Investors

A softer crude oil price compresses input costs for refiners but can narrow refining margins depending on product cracks. Lower crude prices are generally beneficial for consumers at the pump after transmission through regional distribution and tax structures.

For investors, energy equities and bond spreads react differently when prices fall. High yield energy issuers may see stress if weak prices persist, while large integrated oil companies with low production costs tend to be more resilient. Commodity-linked portfolios should consider the scenario risks outlined above when sizing exposures.

Timeline Of Key Events That Drove Recent Moves In The Crude Oil Price

OPEC+ discussions and gradual output increases announced across recent months that raised collective supply expectations.

Saudi Aramco cut its official selling prices for December Asian allocations, a move that signalled increased competition for regional crude flows.

API and early EIA signals pointed to inventory builds that were at or above market expectations, prompting short term price weakness.

The EIA published its November Short Term Energy Outlook projecting higher inventories through 2026 and lower average Brent in early 2026.

Expert Voices And Market Colour

Commentators emphasise that the crude oil price is acting like a barometer for the balance between near term supply and demand. Analysts note that official selling prices from major producers matter because they change trade flows and regional spreads.

Policymakers and central bankers also set the macro backdrop that influences energy demand through growth and currency channels. Reuters and other wire services have reflected analyst views that the recent Aramco move was aimed at preserving market share.

Frequently Asked Questions

Q1: Why Has The Crude Oil Price Fallen Recently?

The crude oil price has been pressured by a combination of increased supply expectations from OPEC+ and cuts to official selling prices from major producers, together with inventory prints in the United States that suggested stocks may be rising. These factors together reduced near term upward pressure on the market.

Q2: Will Saudi Aramco's Price Cut Push Global Prices Much Lower?

Aramco's cuts are regionally important for Asia and can widen differentials between Middle Eastern and Atlantic Basin crudes. The cuts help Aramco remain competitive and can contribute to downward pressure if they lead to higher flows into Asian refining markets. The global effect depends on how other suppliers and refiners respond.

Q3: Are Inventories Still The Most Important Determinant Of Price Moves?

Inventories are central for near term movements because they reflect the immediate supply and demand balance. However, medium term price direction is shaped by a broader set of variables including OPEC+ policy, macroeconomic growth and structural changes in energy consumption.

Conclusion

Short term price direction will probably hinge on the next series of data points and policy signals. The most important items to watch are weekly US inventory reports, further official selling price announcements from Gulf producers, OPEC+ statements and any unplanned supply outages.

In addition, readers should monitor updates to agency forecasts, such as the EIA Short Term Energy Outlook, for revisions to the medium term inventory and price path. Those items will determine whether the current soft patch turns into a longer term down cycle or remains a pause before renewed strength.

Sources:

[1]https://www.reuters.com/business/energy/saudi-arabia-cuts-december-oil-prices-asia-opec-boosts-output-2025-11-06/

[2]https://www.reuters.com/business/energy/oil-extends-losses-us-inventory-build-opec-forecast-shift-2025-11-13/

[3]https://www.eia.gov/outlooks/steo/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.