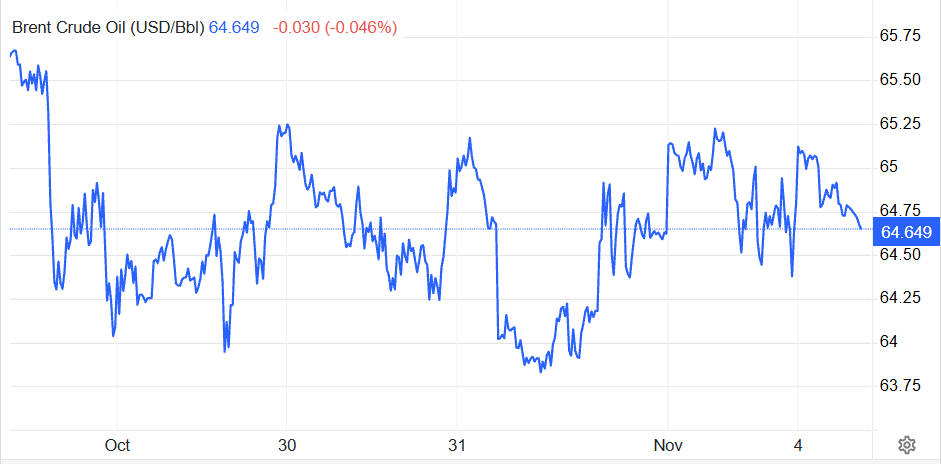

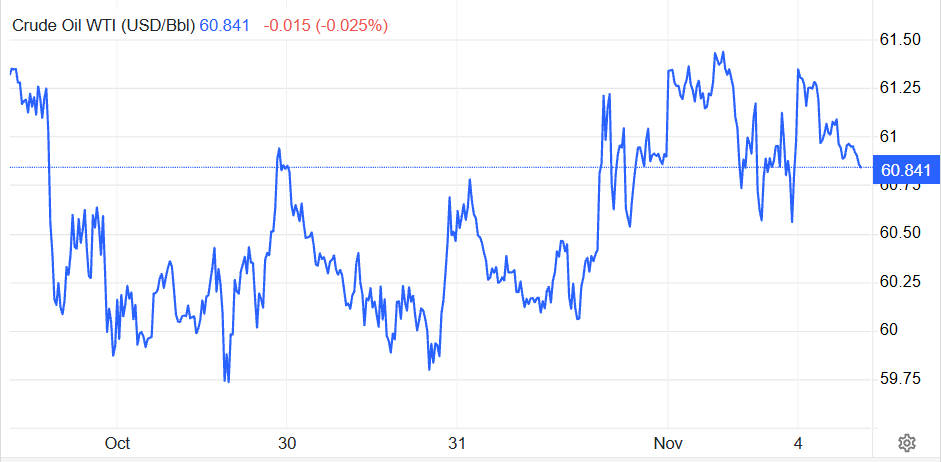

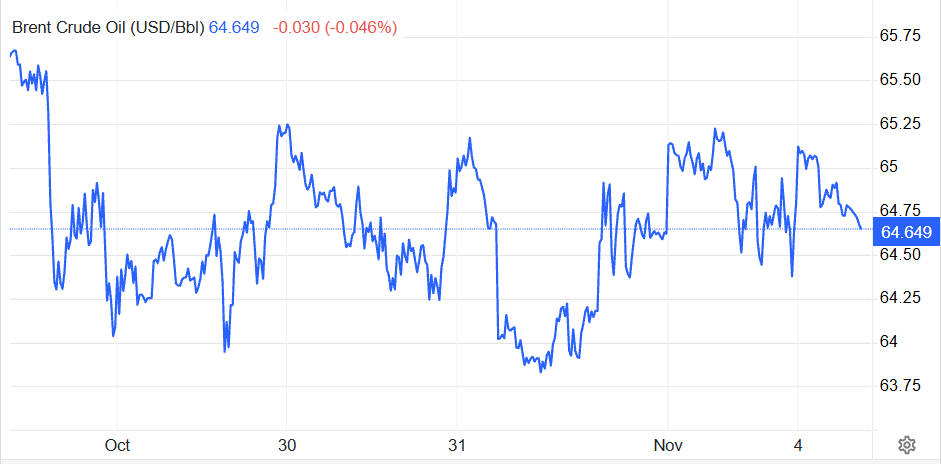

Brent and WTI prices have stabilised in early November 2025 after OPEC+ signalled a modest December output rise followed by a pause in early 2026. while official forecasters warn of rising global inventories next year.

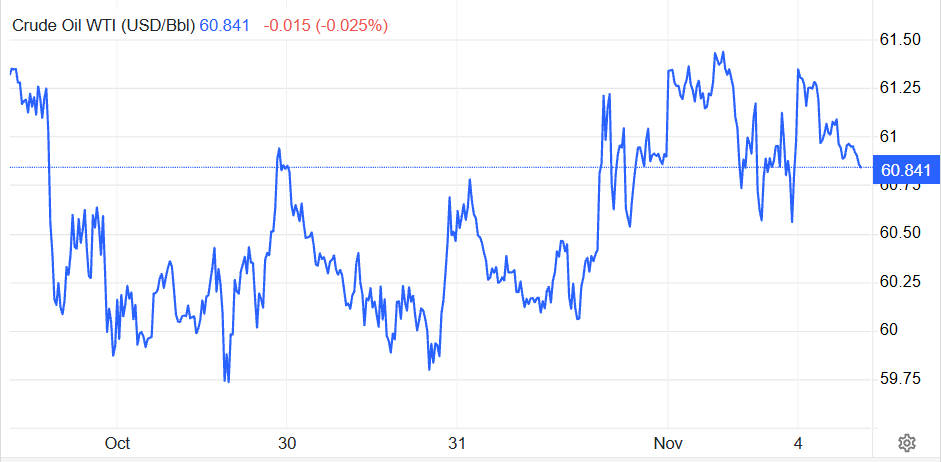

The crude oil price remains steady, with Brent at $64.65 per barrel and WTI at $60.84. as traders balance cautious OPEC+ supply signals against a softer global demand outlook.

Current Crude Oil Price Readings and Recent Moves

| Benchmark |

Most Recent Level (approx) |

Recent Move (1 month) |

| Brent Crude (ICE) |

$64.6 per barrel |

Down slightly month on month |

| WTI (Cushing) |

$60.8 per barrel |

Small decline over the month |

| Front-month Futures Structure |

Mild contango at the front end in recent sessions |

Indicates modest storage incentives |

Why the Crude Oil Price Moved Today: Immediate Drivers

1. OPEC+ Supply Decision and Market Reaction

OPEC+ agreed to a small increase for December and then elected to pause further output rises in January through March 2026.

The decision was framed as a cautious step to avoid exacerbating a supply overhang as seasonal demand weakens and refinery maintenance diminishes product draws.

Markets interpreted the pause as supportive but not sufficiently restrictive to spark a strong rally.

2. Geopolitical and Sanctions-Related Supply Risks

Recent sanctions imposed by the United States and the EU on certain Russian oil interests have elevated speculative attention on potential medium-term supply constraints.

Banks and strategists have begun to price in some risk premium, although analysts stress that the immediate physical disruption is likely to be limited by established Russian export workarounds. [1]

3. Macro Data, Refining Cycles and Seasonal Demand

Demand signals from major consuming regions remain mixed. Asian manufacturing indicators and seasonal adjustments to refinery maintenance influence crude draws and refined product cracks.

Softer macro readings and extended refinery maintenance windows in some regions have weighed on prices, which helps to explain why any OPEC+ support has produced only modest gains. [2]

Medium-Term Fundamentals and the Inventory Outlook

1. EIA Forecasts: Inventory Accumulation and Price Pressure

The US Energy Information Administration forecasts global oil inventories will rise through 2026. placing downward pressure on benchmarks.

The EIA expects Brent to average materially lower in 2026 than in 2025 and projects inventory builds that could keep prices subdued through the year. [3]

Those forecasts are a central element of market scepticism about durable price increases.

2. IEA Assessment: A Potential 2026 Surplus

The International Energy Agency highlights a decelerating pace of demand growth and rising non-OPEC supply, resulting in a sizeable market surplus in 2026 in its October assessment.

The IEA points to subdued consumption growth, continued gains in non-OPEC output and the impact of refinery dynamics when explaining why stock builds are plausible.

3. Non-OPEC Supply Dynamics

US shale and other non-OPEC producers have demonstrated resilience, and recent data show that growth outside OPEC continues to act as a counterweight to OPEC+ production restraint.

Analysts note that although OPEC+ has raised its stated production targets this year, actual output growth has been more measured. This divergence underlines uncertainty in supply accounting and reinforces the risk of an oversupplied market.

Market Structure and Positioning

1. Futures Curve and Storage Signals

The front of the crude futures curve has exhibited a mild contango.

This configuration indicates a small but persistent incentive for storage and cash-and-carry activity, though it is not at the extreme levels seen during previous large gluts.

Traders watch the slope of the curve for signs of increasing spare capacity or a tightening market.

2. Speculator and Hedge Fund Positioning

Speculative positioning has remained cautious. Funds that earlier in the year had built long exposures have taken profits and reduced net length amid increasing downside forecasts from agencies and the prospect of inventory builds.

Changes in speculative flows have amplified moves on headline news such as the OPEC+ pause.

Regional Demand Drivers and Impacts on the Oil Price

1. China and India: The Asian Demand Lens

China and India remain critical to the demand outlook:

China's continued purchases for strategic and commercial inventory, plus the pace of its economic recovery, are pivotal variables for the global crude oil price.

India's sustained growth in oil consumption also provides a supportive demand backdrop, but both countries are subject to cyclical manufacturing trends that can change quickly.

2. Europe: Winter Fuel Needs and Price Transmission

European demand for diesel and heating fuels tends to rise in winter.

The transmission of crude price moves into refined product markets is important for regional energy economics.

If winters are colder than expected or refinery outages persist, regional product tightness could provide a near-term boost to crude. Conversely, weak industrial demand would blunt such pressure.

3. United States: Domestic Inventory and Refinery Throughput

US crude inventories, refinery runs and gasoline demand provide a domestic lens on price direction.

Elevated US production and inventories have been a constraining influence, while seasonal refinery work and gasoline consumption patterns will determine the near-term directional bias for the WTI benchmark.

Forecast Summary For Brent Crude Price

| Institution |

Key Forecast / Comment |

| EIA |

Projects Brent averages lower in 2026 with inventory builds pressuring prices; example projection is $52 per barrel for 2026 in recent STEO scenarios. |

| IEA |

Highlights risk of a market surplus in 2026 due to slower demand growth and rising non-OPEC output. |

| Major Bank (Morgan Stanley) |

Adjusted H1 2026 Brent forecast to around $60 per barrel after OPEC+ pause and sanction considerations, while noting a significant 2026 surplus risk. |

Key Indicators Traders Should Watch In The Short Term

| Indicator |

Why It Matters |

Typical Release Cadence |

| Weekly US API/EIA Inventory Data |

Short term gauge of supply/demand balance in the world’s largest oil consumer |

Weekly |

| OPEC+ Meetings and Technical Committee Notes |

Signal of future group policy on production targets |

As scheduled; ministerial announcements variable |

| IEA Monthly Oil Market Report |

Independent analysis of global stocks, demand and supply |

Monthly |

| Chinese Import Volumes and Refinery Runs |

Direct effect on Asian demand and physical flows |

Monthly |

| Futures Curve Slope and CoT Data |

Shows storage incentives and speculative positioning |

Daily to weekly |

Scenarios That Could Move the Oil Price Materially

1. Upside Scenarios

A meaningful supply disruption in a major producer or export choke point.

Faster than expected recovery in Chinese oil consumption combined with reduced non-OPEC output growth.

Additional geoeconomic measures that restrict supplies more than markets currently anticipate.

2. Downside Scenarios

Continued rapid non-OPEC production growth, particularly in the United States.

Weaker global demand driven by a more pronounced macro slowdown than forecast.

A sustained build in commercial inventories due to soft refining margins.

Each scenario should be accompanied in the article by probability assessments from a range of forecasters to avoid reliance on a single viewpoint.

Practical Takeaways For Traders and Policy Makers

The OPEC+ pause has provided a degree of near-term support, but it is not a cure for a potentially oversupplied 2026 market.

Agency forecasts pointing to inventory builds in 2026 make a strong case for cautious positioning or hedging rather than aggressive long exposure.

Close monitoring of China import flows and weekly US inventory releases remains essential for short-term trade signals.

Conclusion

The crude oil price has stabilised owing to OPEC+ caution and headline geopolitical developments, yet official forecasters and market analysts continue to emphasise the risk of inventory accumulation through 2026.

This mix of supportive supply policy and bearish fundamental projections creates an environment where volatility is likely to remain elevated and where careful scenario planning and repeated monitoring of key indicators are necessary for both market participants and policy makers.

Frequently Asked Questions

1. What drives the crude oil price now?

OPEC+ production policy, global demand trends, US supply growth, and economic data remain the main price drivers.

2. Why has the crude oil price stabilised recently?

OPEC+ paused output hikes, balancing modest demand and growing supply. Limited geopolitical disruptions also kept prices steady.

3. What is the difference between Brent and WTI?

Brent reflects global supply, while WTI tracks US crude. Brent usually trades at a slight premium due to wider export access.

4. How do geopolitical events influence prices?

Conflicts, sanctions, or shipping disruptions can lift prices temporarily, though recent events have had limited long-term impact.

5. Why are US inventories important?

They indicate the supply-demand balance. Rising stocks signal oversupply and weaken prices, while sharp draws support them.

Sources:

[1]https://www.reuters.com/business/energy/morgan-stanley-lifts-h1-2026-brent-forecast-60-opec-pause-russia-sanctions-2025-11-03/

[2]https://www.iea.org/reports/oil-market-report-october-2025

[3]https://www.eia.gov/outlooks/steo/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.