What if the oil powering our lives isn't as simple as we think?

Crude oil fuels the global economy, from transportation to manufacturing. Its value and environmental impact depend on type, density, and sulfur content. Understanding these differences is key to grasping why some crude oils are more sought after than others.

What Is Crude Oil?

Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials.

Extracted from the earth, it is processed in refineries to produce fuels like petrol, diesel, and jet fuel, as well as raw materials for plastics, chemicals, and more.

Major Oil-Producing Countries

The type of crude a country produces affects its global influence and revenue:

Saudi Arabia & UAE: Primarily light/sweet crude; high export value.

USA: WTI is mainly shale-based; dominates domestic and North American supply.

Russia: Produces a mix of heavy and sour crude; sanctions in 2025 affected global supply.

Canada & Venezuela: Heavy crude; more costly to refine, often discounted.

Understanding these profiles helps readers grasp why geopolitical events or sanctions can ripple through global prices.

Types of Crude Oil

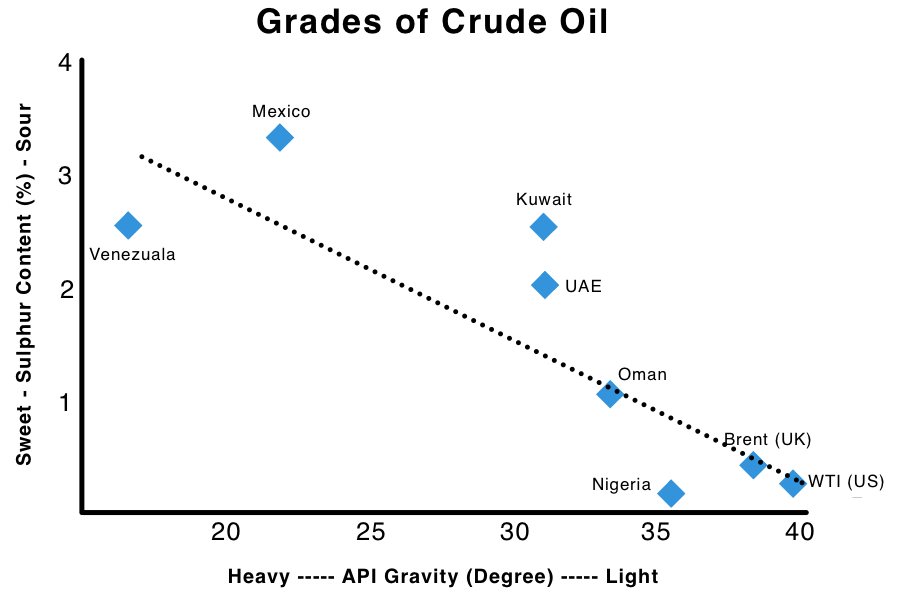

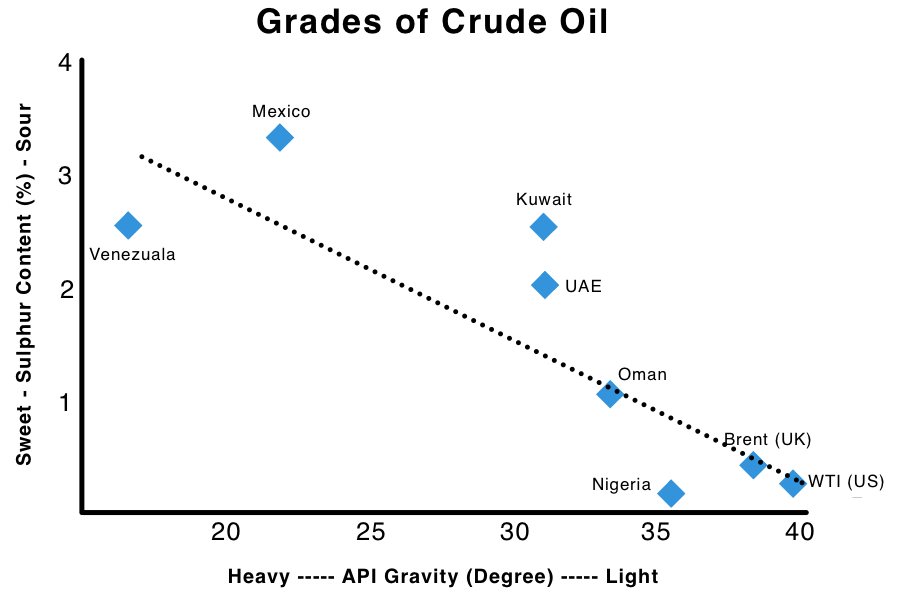

Crude oil is classified based on two main properties: density (how heavy or light the oil is) and sulfur content (how “sweet” or “sour” the oil is). These characteristics determine how easy the oil is to refine and what products can be made from it.

| Type of Crude Oil |

Characteristics |

Examples |

Uses |

Market Value (Approx.) |

| Light Crude Oil |

Low density, high API gravity (31–45°), low viscosity, low sulfur |

Brent Crude (North Sea), WTI (USA) |

Produces high-quality petrol, diesel, and jet fuel |

Commands premium prices; Brent trades around $80–$100 per barrel

|

| Heavy Crude Oil |

High density, low API gravity (<22°), high viscosity, higher sulfur |

Oil Sands (Alberta, Canada), Orinoco Belt (Venezuela) |

Used for fuel oil and asphalt; refining is more expensive |

Trades around $30–$50 per barrel due to higher refining costs |

| Sweet Crude Oil |

Less than 0.5% sulfur content |

Brent Crude, WTI, Bonny Light (Nigeria) |

Easier to refine into clean fuels; meets strict environmental standards |

Priced higher than sour crude due to lower processing costs

|

How Is Crude Oil Named and Classified?

Crude oils are often named after their geographic origin, such as Brent (North Sea), WTI (Texas), or Dubai (Middle East).

These names serve as global benchmarks for oil pricing and trading. Classification also depends on API gravity and sulfur content, influencing refining processes and end products.

Why Do These Differences Matter?

Understanding the type of crude a country produces helps explain its economic influence and refining challenges:

Refining Efficiency: Light, sweet crudes are cheaper and easier to refine.

Market Pricing: Light, sweet crudes fetch higher prices; heavy, sour crudes are often discounted.

Environmental Impact: Sweet crudes burn cleaner, while heavy/sour require more energy and produce more pollutants.

Global Trade: A country’s crude type shapes its position in international energy markets.

Crude Oils Price In The Market

Here is the latest price table for crude oil, natural gas, and related energy products as of October 23, 2025.

| Product |

Last (USD/barrel) |

Change (USD) |

% Change |

Last Updated |

| WTI Crude |

60.60 |

+2.10 |

+3.60% |

October 23, 2025 |

| Brent Crude |

64.76 |

+2.14 |

+3.47% |

October 23, 2025 |

Global Benchmarks Explained

Crude oil prices are often quoted using global benchmarks, which serve as reference points for trade:

Brent Crude (North Sea): Widely used in Europe and Asia; light and sweet, making it easier to refine.

WTI (West Texas Intermediate, USA): U.S. benchmark; slightly lighter than Brent but mainly consumed domestically.

Dubai/Oman Crudes: Serve as benchmarks in the Middle East and Asia; often heavier and sourer than Brent/WTI.

These benchmarks influence regional pricing, import/export decisions, and global market sentiment.

What Affects Crude Oil Prices

Crude oil prices are shaped by a mix of supply, demand, and market factors:

Supply & Production: OPEC+ quotas, U.S. shale output, and inventory levels influence availability.

Geopolitical Events: Sanctions, conflicts, or political instability can tighten supply and push prices up.

Demand & Seasonality: Global economic activity and seasonal fuel needs affect consumption.

Market Speculation: Futures trading and investor sentiment can amplify short-term price swings.

Crude Type & Refining Costs: Light, sweet crudes are more valuable; heavy or sour grades cost more to process.

Recent price movements on October 23, 2025, reflect these combined factors, including sanctions on Russian oil and OPEC+ production decisions.

Tips for Following Oil Markets

Beginners can stay informed with of the oil markets by:

Watch general price trends to see if the market is rising or falling.

Note changes in supply and demand, such as production shifts or storage levels.

Consider geopolitical events and their potential impact on oil availability.

Observe how expectations of these factors influence future prices.

Compare current conditions with recent patterns to gauge risk and opportunity.

Future Outlook for Crude Oil

The energy landscape is evolving:

Renewable energy adoption and electric vehicles may gradually reduce demand for gasoline and diesel.

Heavy and sour crude may face higher refining costs due to stricter environmental standards.

Geopolitical tensions, such as Russian sanctions, and OPEC+ production policies continue to influence global prices.

Investors, policymakers, and consumers need to consider these trends when evaluating oil markets in 2025 and beyond.

Frequently Asked Questions (FAQ)

1. Why are some crude oils more valuable than others?

Light, sweet crudes are easier to refine, produce cleaner fuels, and command higher prices, while heavy, sour crudes cost more to process and are often discounted.

2. How do crude oil types affect global trade?

Countries producing high-quality crude hold stronger market positions, influencing export revenue and energy partnerships, while heavy or sour producers face higher refining costs and lower prices.

3. Can price trends predict future oil movements?

Observing supply-demand shifts, geopolitical events, and historical patterns provides insight, but market speculation and sudden events can still cause short-term volatility.

Conclusion

Understanding the types of crude oil is crucial for anyone interested in the energy sector. Light, heavy, sweet, and sour crudes each have unique characteristics that affect their value, refining process, and impact on the environment.

As the world continues to evolve its energy mix, knowing these differences helps investors, policymakers, and consumers make informed decisions in a complex global market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.