As the world accelerates its energy transition, the International Energy Agency (IEA) has quietly sent a reminder: oil's story isn't over yet.

In its latest World Energy Outlook 2025, the agency revised its long-term projections, suggesting that under current policies, global oil demand may continue to grow well into the 2030s. By 2035, crude prices could hover around USD 90 per barrel, a level once thought to belong to the past.

For policymakers, it's a signal of the transition's complexity. For investors, it's a test of how much the world still depends on oil to power its ambitions.

Oil's Demand Path: Still Rising in One Scenario

The IEA lays out multiple possible futures.

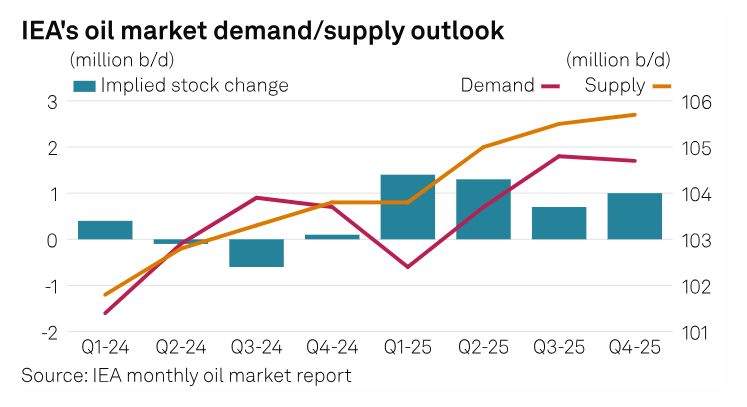

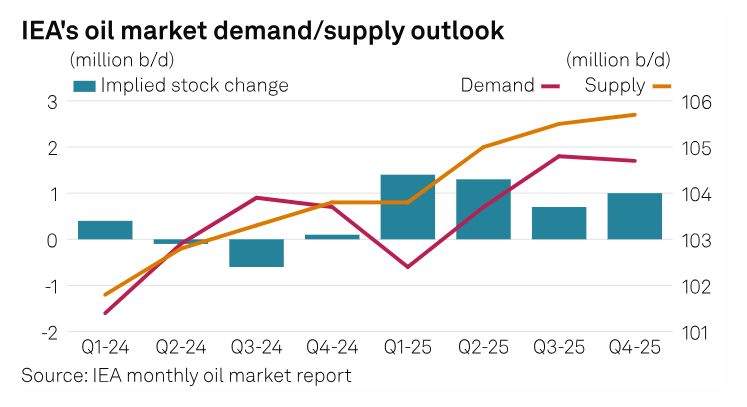

In its Current Policies Scenario (CPS), which assumes that existing regulations remain unchanged and a few new climate measures are adopted, oil demand could rise to 105 million barrels per day (mb/d) by 2035, and even 113 mb/d by 2050.

That's about 13% more than in 2024, indicating consistent population growth and the increasing energy demands of developing economies.

In the more optimistic Stated Policies Scenario (STEPS), which accounts for existing government climate commitments, global oil demand is expected to peak around 2029–2030 and then gradually decline to about 100 million barrels per day (mb/d) by 2035.

Even so, both paths tell the same story: global dependence on oil remains deeply rooted.

The $90 Question: Why Oil Prices Could Stay High

So how does the world arrive at $90 oil by 2035?

So how does the world arrive at $90 oil by 2035?

The IEA outlines several intersecting forces that could keep prices elevated:

1. Investment Gaps and Capacity Strain

If demand continues to rise while upstream investment lags, supply could tighten, creating market pressures.

Many oil producers are cutting long-term exploration budgets amid ESG pressures and regulatory uncertainty.

The IEA estimates that up to 25 million barrels per day of new capacity will be required by 2035 to maintain market equilibrium. [1]

2. Geopolitical and Regional Risks

Oil remains a strategic commodity. Disruptions in the Middle East, North Africa, or Russia, whether due to sanctions, production cuts, or conflicts, could easily shift the supply-demand equilibrium. A fragile geopolitical landscape means price volatility may persist well into the next decade.

3. Transition Costs and Substitution Limits

Even as renewables and electric vehicles expand, the global oil system is not easily replaced.

If the adoption of clean technologies lags or extraction costs rise due to ageing fields and stricter regulations, the marginal cost of production could push the oil price floor to between USD 80 and 90 per barrel.

In other words, the road to net zero might paradoxically make oil dearer before it fades.

What This Means for Investors

The IEA stresses that these are scenarios, not predictions. Yet for investors, the implications are tangible.

If oil prices remain elevated for an extended period, energy stocks and commodities may regain importance in diversified portfolios, albeit with heightened volatility.

Conversely, a faster-than-expected transition to clean energy could cap fossil fuel prices and increase the risk profile of related assets.

Investors must navigate a delicate balance between seizing short-term opportunities and managing long-term transition risks.

A Word of Caution

Several caveats remain critical:

Scenario, not certainty: The IEA is mapping possibilities, not guaranteeing outcomes.

Demand elasticity: Faster adoption of renewables or efficiency improvements could flatten consumption sooner than expected.

Supply surprises: Advancements in technology or new findings could boost production and alleviate price pressures.

Macroeconomic volatility: Inflation, policy shifts, and global slowdowns could all reverse upward trends.

In essence, $90 oil by 2035 is plausible, but far from inevitable.

Conclusion

The IEA's latest findings are less a forecast and more a mirror of global tension between ambition and dependence, transition and inertia.

An oil price of $90 per barrel should not be viewed as a doomsday prediction but rather as a reminder that the transition to cleaner energy will be complex and nonlinear. Even as wind farms rise and EVs multiply, millions of barrels will still move daily to power industries, heat homes, and sustain economies.

The real takeaway?

The energy transition isn't just about replacing oil; it's about managing its long goodbye.

Frequently Asked Questions

1. What Did the IEA Say About Oil Demand in 2035?

Under its "Current Policies Scenario," global oil demand could reach around 105 million barrels per day by 2035 before stabilising.

2. Will Oil Prices Definitely Hit $90 by 2035?

No. The figure represents a potential situation where high demand coincides with inadequate supply growth, rather than a definitive prediction.

3. What Factors Could Prevent Oil Prices From Rising?

Quick renewable adoption, improved efficiency standards, or unforeseen supply increases could all maintain lower prices.

4. How Reliable Are IEA Projections?

IEA scenarios are analytical tools that explore potential futures; they are not meant as precise forecasts.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.iea.org/commentaries/scenarios-in-the-world-energy-outlook-2025