Nigeria's naira looks "weak" in 2025 for one main reason: the economy still needs more foreign currency than it reliably earns. Thus, the exchange rate continues to serve as a mechanism for allocating scarce resources.

Policy reforms have improved transparency and reduced some distortions, but they have not fully closed the underlying gap between structural demand for $ and structural supply of $.

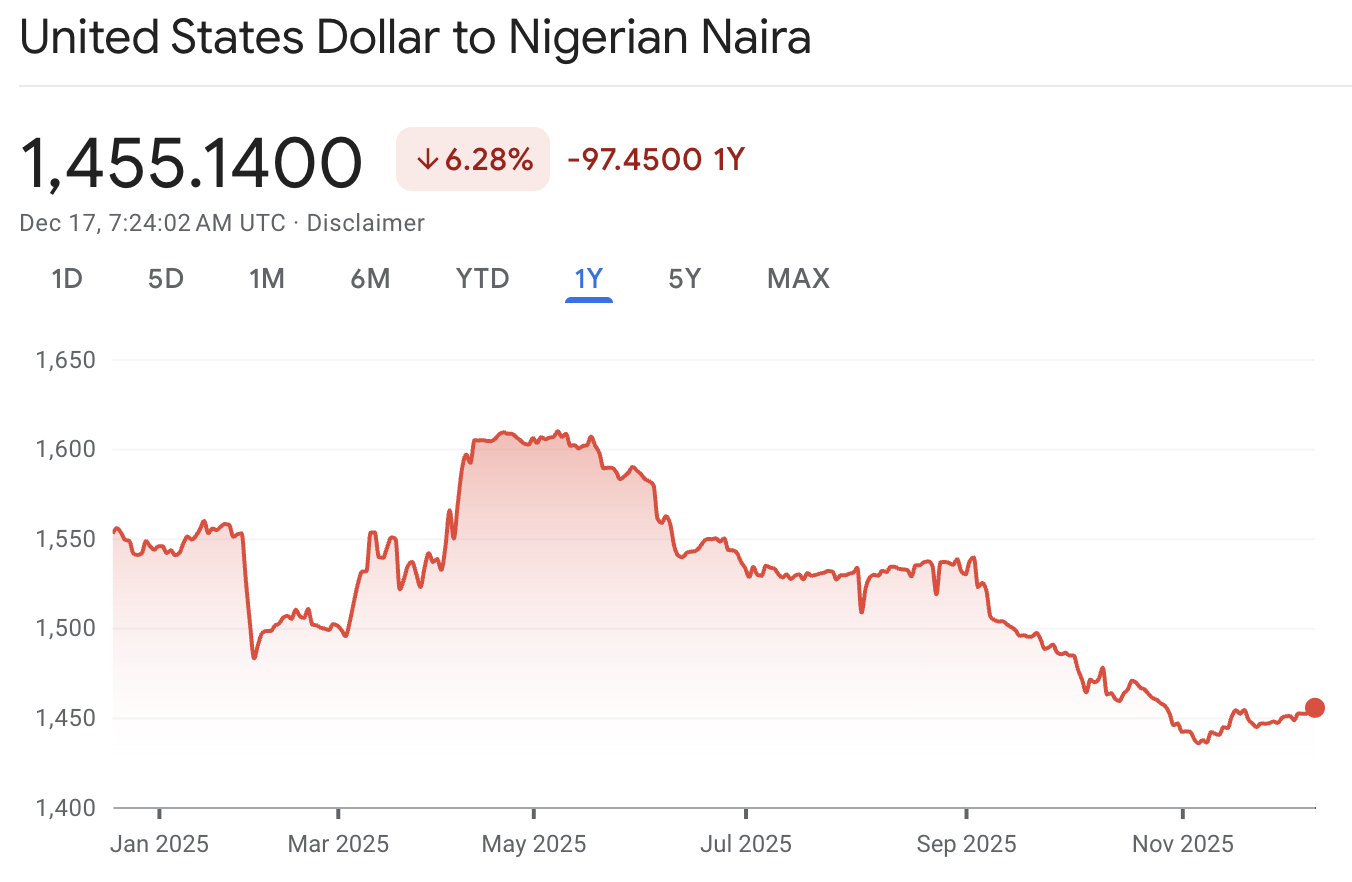

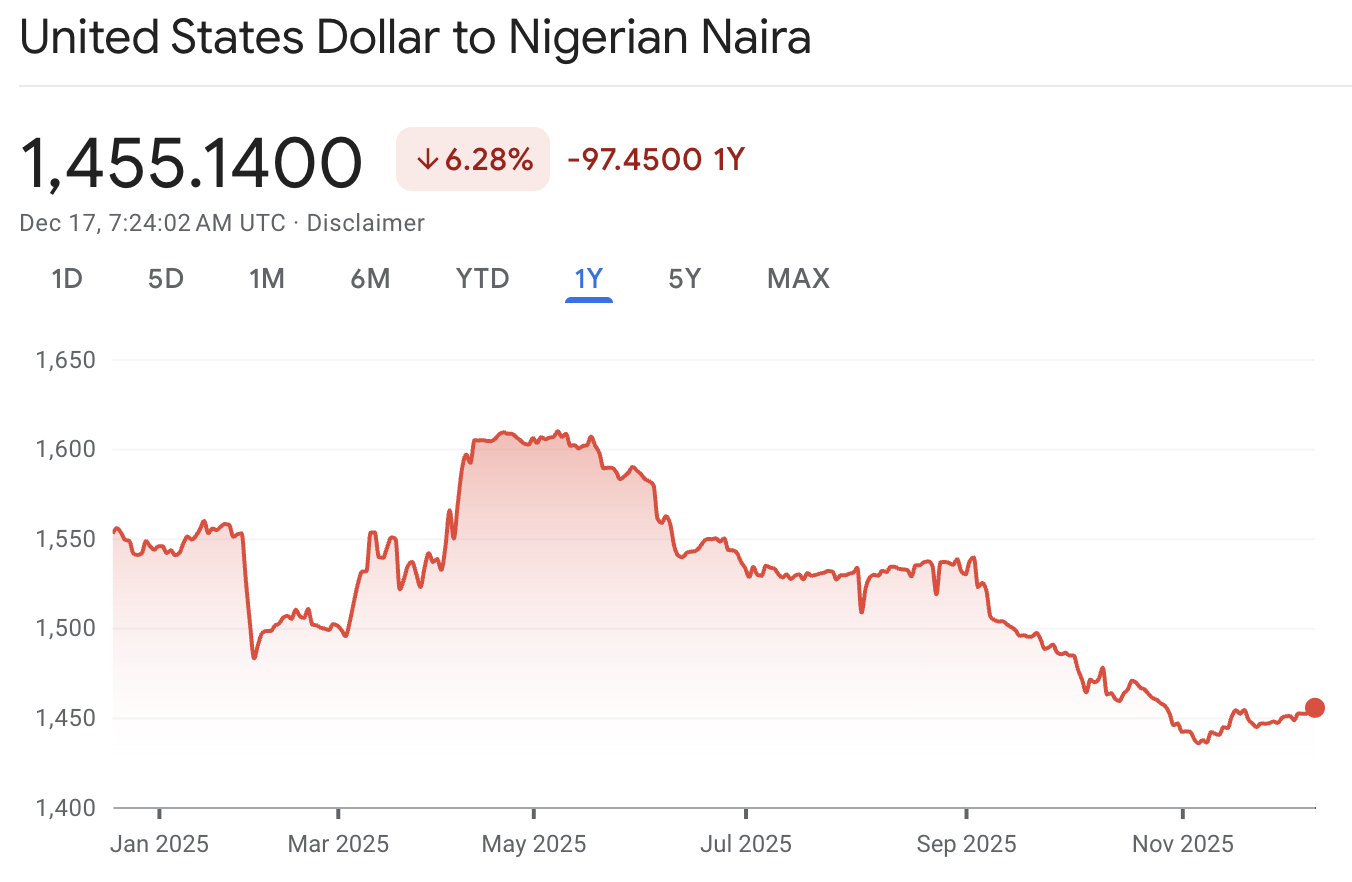

As of mid-December 2025, the naira is trading in the mid-$1,400s per USD in the official market. That level is not just a "number on a screen." It is a live summary of Nigeria's oil-linked inflows, import dependence, inflation psychology, fiscal pressures, and investor confidence together.

USD/NGN Market Snapshot (2025)

| Metric |

Latest reference point |

Why it matters for the naira |

| Official-market trading band (mid-Dec 2025) |

Around ₦1,445 to ₦1,460 per $

|

This signals near-term equilibrium between $ demand and supply. |

| Bank counter rate (Dec 16, 2025) |

₦1,452 bid / ₦1,458 offer (USDNGN) |

This provides a real-world reference for transactional pricing. |

| Headline inflation (Nov 2025) |

14.45% y/y |

Lower inflation helps, but expectations take longer to reset. |

| Policy rate (CBN MPR) |

27.50% (held in 2025) |

High rates can slow demand and support inflows, but they do not create FX supply. |

| Gross external reserves |

$40.11 billion (July 18, 2025) |

Reserves help smooth volatility and signal confidence. |

| Net FX reserves |

$23.11 billion (end-2024) |

Net reserves give a clearer view of usable buffers. |

| Balance of payments (2024) |

$6.83 billion surplus |

A surplus supports stability, but flow quality still matters. |

The 7 Key Drivers Behind Nigerian Currency Weakness in 2025

1) FX Reform Forced Price Discovery, and the Market Repriced Fast

Nigeria's move toward a more market-determined FX framework meant that the official rate could no longer ignore scarcity for long.

The June 2023 shift toward liberalised trading triggered an abrupt adjustment because the market had to absorb a backlog and reprice risk.

Why This Still Matters in 2025:

A reform-driven repricing can create a long aftershock, because businesses reset prices, contracts, and hedges based on the new reality.

It also changes behaviour, because participants start to treat the official price as a tradable signal rather than an administered number.

2) Structural FX Supply Constraint

Nigeria's FX supply is still concentrated in hydrocarbon-linked inflows, while non-oil export capacity is improving, but not large enough to dominate the flow story.

There are signs of progress as Nigeria's daily crude output rises into a 1.7 to 1.83 million barrels per day range during 2025 as reforms supported activity.

Even so, OPEC-era headlines still feature production slippage and outages, and Nigeria is often cited in output surveys as a contributor to month-to-month declines.

Why This Weakens the Naira:

When oil-linked receipts wobble, the market does not wait for quarterly data. It prices the shortage immediately.

3) Import Dependence Keeps $ Demand Sticky

Nigeria imports significant volumes of refined products, machinery, pharmaceuticals, food inputs, and services. That demand does not fall quickly when the exchange rate moves, especially when firms need to keep production lines running or meet basic consumption needs.

The elimination of the fuel subsidy in May 2023 represented a crucial fiscal reform, but it also heightened immediate price pass-through and altered import trends.

What to Watch:

If non-oil import restrictions arise mainly from hardship rather than productivity gains, it reduces foreign exchange demand. However, it does not instil the type of confidence that attracts long-term capital.

4) Inflation Psychology and Confidence Still Drive Private-Sector Behaviour

Inflation is easing on current prints. Nigeria's headline inflation decreased to 14.45% YoY in November 2025, aided by CPI rebasing and lower food inflation.

However, confidence is path-dependent. After a period during which inflation peaked at nearly 30%, households and corporations learned to protect their purchasing power by shifting to dollars and increasing inventory.

Why This Matters for USD/NGN:

Currencies do not trade only on current inflation. They trade on whether people believe next month will be better than last month.

5) Tight Monetary Policy Cannot Substitute for FX Inflows

The CBN has kept its policy restrictive. The Monetary Policy Committee retained the MPR at 27.50% in 2025, signalling that disinflation and credibility remain priorities.

Tight policy can support the naira through three channels:

It can reduce credit-driven import demand.

It can raise local yields and attract carry-style portfolio inflows.

It can reinforce the perception that inflation will continue to cool.

The Limitation:

Even very high interest rates cannot create export receipts. They can only influence how scarce FX is allocated and how confident investors feel about holding naira risk.

6) Fiscal Pressure and Debt Service

Nigeria's fiscal arithmetic remains tight. Nigeria's cabinet has approved a medium-term plan that projects a sizable 2026 deficit and heavy debt-service costs, based on an exchange-rate assumption of ₦1,512 per dollar.

Why This Matters for FX Markets:

When debt service absorbs a big share of revenues, investors worry about liquidity stress, arrears, or renewed pressure on monetary financing. Those worries can increase demand for $ as a hedge, even before any crisis appears.

7) Market Segmentation Keeps the Parallel Price Influential

| Date |

Policy or event |

FX relevance |

| May 29, 2023 |

Fuel subsidy removal signal at the start of the new administration |

This shifted fiscal expectations and price pass-through dynamics. |

| Jun 14, 2023 |

FX liberalisation and exchange-rate unification steps |

This triggered rapid price discovery and official repricing. |

| Nov 25, 2024 |

EFEMS guidelines issued |

This aimed to improve transparency in interbank FX execution. |

| Jan 10, 2025 |

Non-resident account framework introduced |

This aimed to channel diaspora funds through formal rails. |

| Jan 28, 2025 |

Nigerian FX Code launched |

This aimed to strengthen governance and conduct standards. |

| Jul 18, 2025 |

Reserves referenced at $40.11 billion |

This signalled stronger buffers and improved stability. |

Despite reforms, Nigeria's FX market remains partly segmented, reflecting the scale of the informal economy and its reliance on cash-based pricing and restoring trust takes time.

The CBN has introduced market plumbing reforms and conduct standards, including:

EFEMS guidelines were issued in November 2024 to enhance transparency and price discovery in interbank trading.

The Nigerian FX Code was launched in January 2025, establishing principles for ethical and compliant market conduct.

New non-resident accounts aimed at supporting remittance and investment flows through formal channels.

Why the Naira Can Still Feel Weak:

When liquidity is low, rumours and parallel pricing can influence behaviour more rapidly than policy statements can.

What Could Keep the Naira Steadier Into 2026

These factors are not guarantees, but they are the clearest pathways to reducing structural FX stress.

More stable oil output would strengthen confidence and make FX supply more dependable.

Non-oil export growth would diversify inflows and reduce oil sensitivity

Stronger remittances and portfolio inflows can smooth liquidity, and 2024 data showed higher remittances and stronger portfolio inflows alongside a balance of payments surplus.

Continued market transparency via EFEMS and FX Code implementation would reduce fear-based hoarding and encourage formal interbank liquidity.

Frequently Asked Questions

1) Why Does the Naira Weaken Even When Inflation Is Falling?

The exchange rate responds to flows first, then to macro prints.

2) What Is the Difference Between the Official Market and the Parallel Market?

The official market is the regulated venue where authorised institutions execute trades and publish recognised rates. The parallel market reflects informal cash pricing when access to official liquidity is limited. The gap often widens when confidence is low or when supply is rationed.

3) Are Nigeria's Reserves Strong Enough to Defend the Naira?

Reserves help the central bank smooth disorderly moves and signal credibility. Reserves give the central bank room to smooth disorderly moves and reinforce credibility, but they are no substitute for durable, steady inflows.

Conclusion

In conclusion, the naira's weakness in 2025 is not the result of a single policy misstep; it reflects a multi-year transition in which reforms improved transparency and reduced distortions, even as a fundamental constraint remains: dependable FX supply has yet to catch up with demand.

The key question for 2026 is whether Nigeria can translate a better market structure into deeper, more resilient liquidity. That requires stable oil-linked inflows, faster non-oil export growth, credible disinflation, and a fiscal path that reduces fear-driven demand for $.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.