Copper pricing has evolved beyond a straightforward correlation with global growth. With LME three-month copper near $12,965 per tonne and spot prices around $13,000, the market is assigning a scarcity premium to deliverable units and to the option value of holding metal within the appropriate warehouse network. Currently, inventory allocators responding to basis, spreads, and availability are increasingly setting marginal prices rather than end users purchasing copper for immediate fabrication.

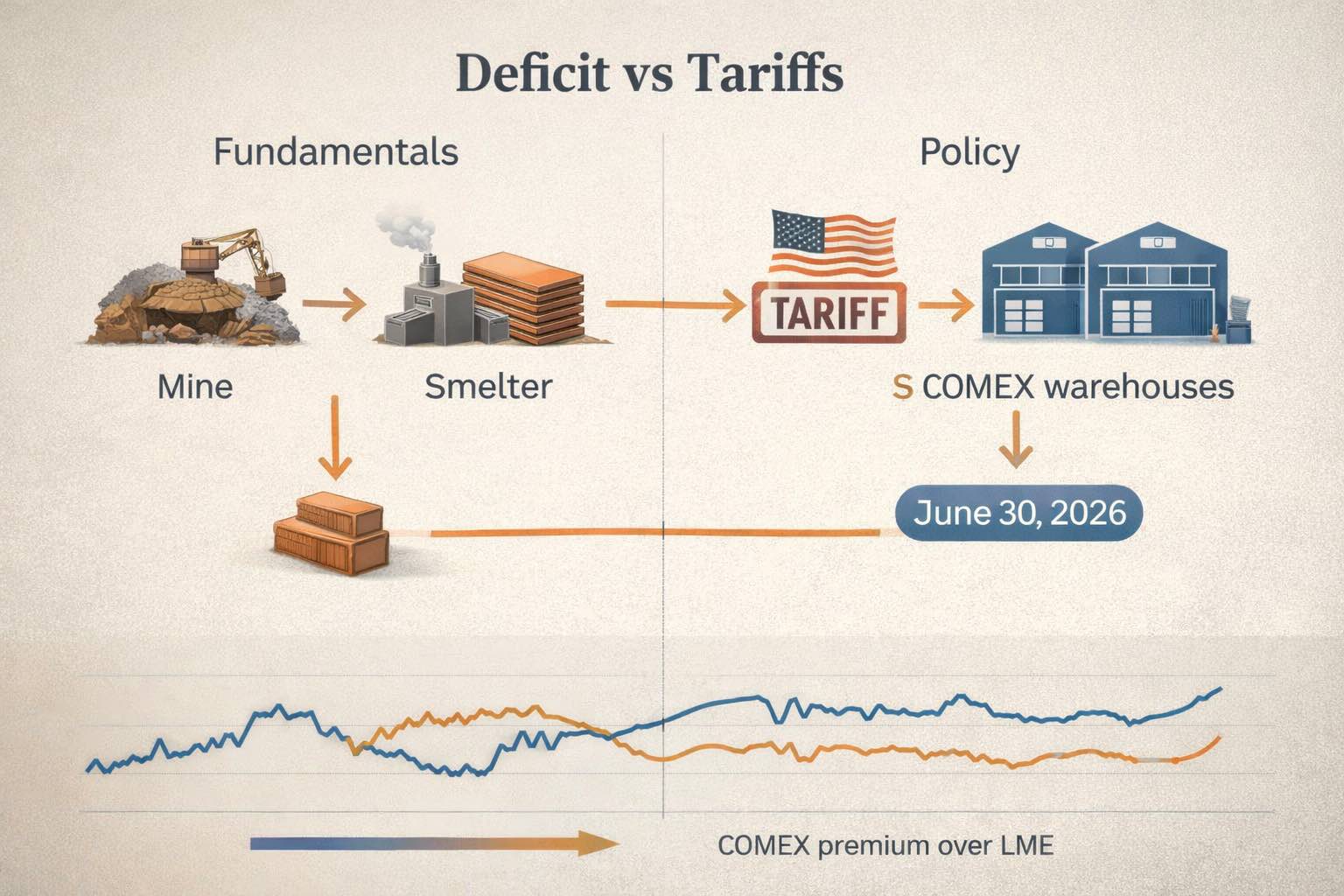

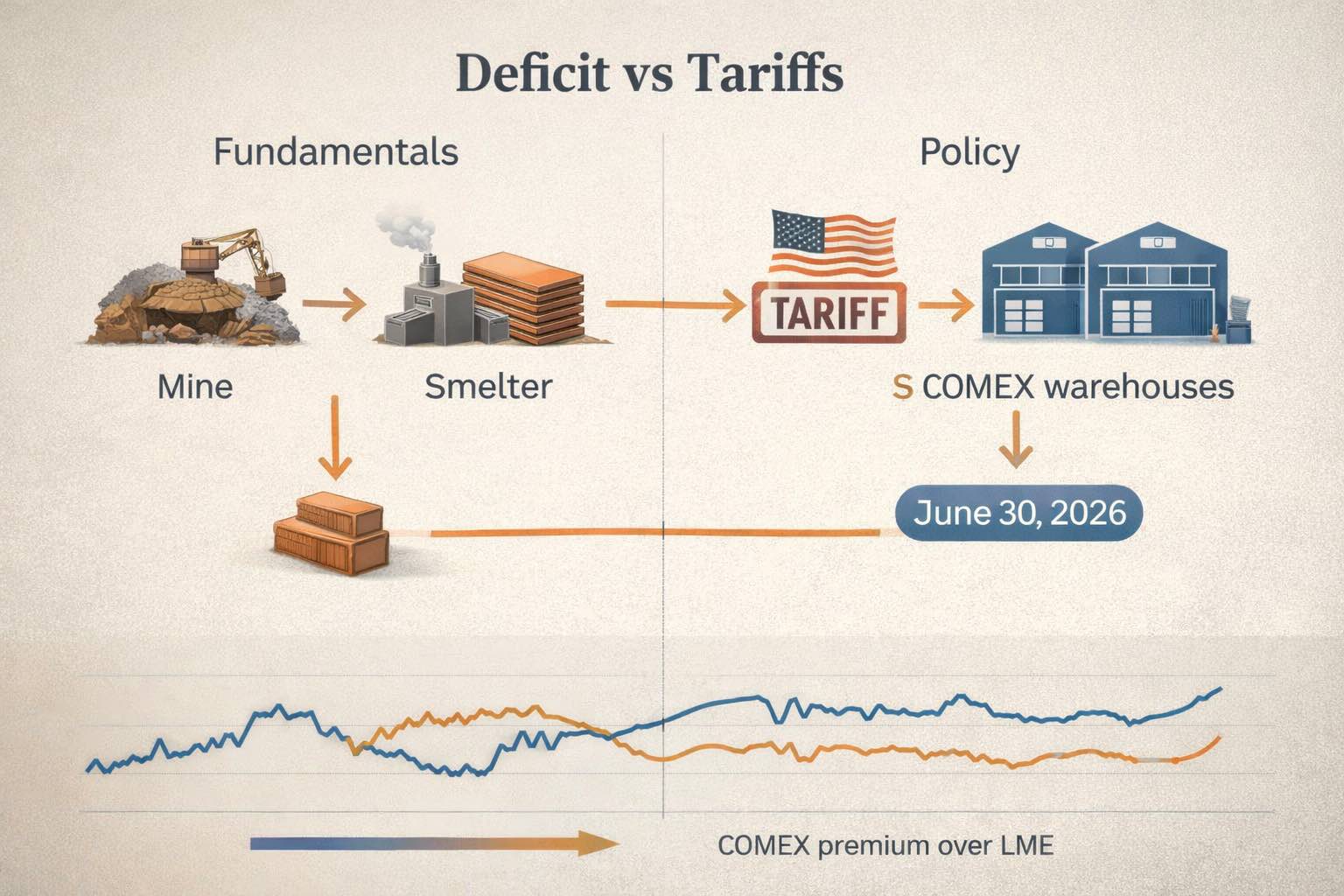

Trade policy transforms manageable global tightness into pronounced regional constraints. The imposition of a 50% tariff on semi-finished copper and copper-intensive derivatives has altered flow incentives, while the June 30, 2026, refined-copper review deadline sustains pre-positioning strategies throughout much of 2026.

Simultaneously, upstream constraints are evident in processing economics: 2026 benchmark treatment and refining charges (TC/RCs) reported at $0 in some agreements indicate that concentrates are sufficiently scarce for smelters to compete for feed, supporting elevated prices even if demand growth moderates.

Copper Price Forecast 2026: Deficit vs Tariffs Key Takeaways

The supply deficit is genuine, though it varies by region and product. Certain 2026 models suggest a modest refined copper deficit, while others indicate a more significant shortfall. Key variables include scrap availability, the elasticity of Chinese demand at elevated prices, and the persistence of mine disruptions throughout the year.

Tariffs are generating a two-tier copper market. Since August 1, 2025, a 50% tariff on semi-finished copper products and copper-intensive derivatives has been in effect. Although refined cathodes are not currently subject to direct tariffs, the incentive to hedge against future policy risk has already drawn metal into the United States, thereby tightening availability in other regions.

June 30, 2026, represents a critical juncture for copper pricing. By this date, an updated assessment of domestic refined copper markets is expected, followed by a decision on whether to implement a phased import duty on refined copper, beginning January 1, 2027, at 15%, increasing to 30% in 2028. This timeline sustains pre-positioning demand throughout much of 2026.

Concentration market tightness serves as the most direct fundamental indicator. Treatment and refining charges have fallen to zero in some annual benchmark agreements, while spot terms are reported in negative territory. This development directly signals that smelting capacity now exceeds the availability of mined concentrate.

Concentration market tightness serves as the most direct fundamental indicator. Treatment and refining charges have fallen to zero in some annual benchmark agreements, while spot terms are reported in negative territory. This development directly signals that smelting capacity now exceeds the availability of mined concentrate.

Technical analysis confirms the recent price breakout, but also highlights the risk of a potential pullback. Copper prices have reached new highs; however, the rapid pace of the rally suggests that price corrections are likely if the US premium diminishes, if Chinese demand slows, or if broader macroeconomic risks prompt a reduction in market positioning.

Where Copper Is Priced Now, And What That Price Is Really Saying

A $13,000 market is pricing scarcity and dislocation

LME copper has been trading around $13,000, with three-month pricing broadly in the $12,900-$13,200 range in recent sessions. On the US benchmark, COMEX copper has been trading near $5.89 per pound.

At current price levels, copper functions less as a standard industrial input and more as an asset sensitive to policy and inventory dynamics. The market increasingly values the location of metal, delivery speed, and the capacity of specific warehouse systems to meet contract specifications amid evolving regulations.

Visible inventories show a split market, not a single shortage

Inventory data underscore the central tension for 2026: global visible stocks are being redistributed rather than uniformly depleted across regions.

LME stocks: about 147,425 tonnes on January 19, 2026, down from roughly 256,225 tonnes on January 31, 2025.

SHFE copper warehouse stock: about 152,655 tonnes as of January 19, 2026.

COMEX stocks: recent figures place US warehouse stocks at around 492,523 metric tonnes, roughly half a million short tons.

The 2026 pricing environment is characterized by regional inventory flows into the United States, which can restrict LME availability and raise non-US prices, even when the global balance is not acutely short.

Fundamental Analysis: Copper Supply And Demand In 2026

Supply: Mines are tight, smelters are tighter

Copper supply stress is most evident in declining reliability, limited concentrate availability, and the growing mismatch between smelting capacity and available feedstock.

1) Mine disruptions and reliability risk

Mine supply projections have undergone frequent revisions due to operational disruptions, permitting constraints, and elevated decline rates at mature assets. In several forecasts, individual disruptions have been significant enough to remove hundreds of thousands of tonnes from supply across 2025 and into 2026.

2) Chile is improving, but not resetting the curve

Chile continues to serve as the cornerstone of global copper market sentiment. Projections for 2026 output are centered around 5.5 to 5.7 million tonnes, slightly exceeding prior-year estimates. However, even if these targets are met, the increase is insufficient to alleviate market tightness, particularly as inventories are redistributed across regions due to policy incentives.

3) Concentration tightness is the loudest signal

The concentrate market is where copper scarcity is clearest, with 2026 benchmark TC/RCs reported at $0 per tonne or below in some agreements, reflecting tight supply.

When smelters accept zero or negative processing margins, they are effectively incurring additional costs to secure feedstock. This dynamic supports the structural bullish outlook for 2026, as it indicates that the mine-to-refined supply chain is constrained even before any acceleration in demand growth.

Demand: Electrification is steady, AI is additive, and price elasticity matters

Copper demand seldom experiences rapid annual increases; instead, it accumulates through multiple channels that are difficult to substitute.

Power grids and electrification: grid upgrades and expansion are copper-intensive and typically policy-backed, which reduces cyclical sensitivity.

AI and data centers: the copper load rises once power delivery, transformers, cabling, and redundancy are included.

Defense and industrial reshoring: higher strategic spending shifts copper demand toward less price-sensitive streams.

Long-term projections indicate that demand growth will remain substantial through 2040. Some analyses suggest a multi-million-tonne supply gap may emerge in the absence of new mining projects and increased recycling rates.

For 2026 copper price forecasts, price elasticity, particularly in China and lower-margin manufacturing sectors, is the critical demand variable. At $13,000 per tonne, substitution into aluminum becomes more economically viable in certain applications, and scrap collection rates improve. Consequently, minor adjustments to scrap assumptions can shift refined-balance forecasts from deficit to near equilibrium.

Tariffs and Trade Flows: The Hidden Engine Behind The 2026 Copper Premium

What the tariff regime actually covers

The current policy framework is specific and time-bound.

A July 30, 2025, proclamation imposed a 50% tariff on imports of semi-finished copper products and intensive copper derivative products, effective August 1, 2025.

The same framework calls for an update by June 30, 2026, to support a decision on whether to impose a phased duty on refined copper starting January 1, 2027 (15%), rising to 30% in 2028.

The copper market anticipates tariff implementation by pricing in the incentive to pre-position metal in advance of its enactment.

How tariffs can inflate prices without a true global shortage

Tariffs and tariff risk can raise prices through a mechanism that many forecasts underweight:

Policy uncertainty widens the US premium between COMEX and LME.

Metal chases the premium as traders monetize arbitrage.

LME deliverable availability tightens as units are pulled from the market.

Nearby prices strengthen even in the absence of a significant decline in global mine and refined output.

That mechanism fits today’s inventory split: LME stocks are much lower than a year ago, while US warehouse stocks have surged.

Technical Analysis: Copper Chart Structure And Key Levels For 2026

LME copper: breakout structure with clear risk markers

With LME three-month copper trading between $12,900 and $13,200, psychological price levels are particularly significant, as positioning and flow dislocations can accelerate market movements.

Key levels for 2026 (LME copper price):

Resistance: $13,300 to $13,400, the recent record zone where rallies can stall if physical buying thins.

First support: $12,800 to $12,900, a zone that has recently held during pullbacks.

Deeper support: $11,700 to $12,000, the area likely to be tested if the US premium compresses or if macro stress forces systematic selling.

Forward curve structure and spreads are as important as spot prices. The cash-to-three-month spread provides a rapid indicator: a cash premium typically signals nearby tightness, while contango indicates market comfort. Recent fluctuations in spread readings reinforce that tightness can be episodic and location-specific rather than universally physical.

COMEX copper: the premium is the trade

On COMEX, copper around $5.8 to $5.9 per pound keeps $6.00 in focus as a psychological ceiling and a trigger for hedging behavior in fabrication demand.

For 2026, the critical technical factor is not solely price but also market participation. Elevated open interest levels are consistent with a market characterized by significant positioning risk.

If the COMEX premium over LME narrows materially, the unwind can come in two steps: first, slower inflows into US warehouses, then softer “scarcity” pricing outside the US as metal becomes more available to the LME system.

Copper Price Forecast 2026: Base Case, Bull Case, Bear Case

The 2026 copper outlook is best described as a range with identifiable triggers, rather than a single forecast. The market is balancing a tightening concentrate supply chain against tariff-induced trade distortions and late-cycle price elasticity.

Scenario table: copper outlook 2026

| Scenario |

What has to happen |

LME copper 2026 range |

COMEX copper 2026 range |

| Bull case |

Concentrate stays extremely tight, US premium persists into midyear, inventories outside the US remain thin |

$12,500 to $14,500 |

$5.70 to $6.60 |

| Base case |

Physical balance mildly tight, scrap rises, China demand moderates at high prices, tariff risk stays priced but fades after June review clarity |

$10,800 to $12,800 |

$4.90 to $5.90 |

| Bear case |

Disruptions ease, scrap and substitution accelerate, macro slowdown hits industrial demand, US premium collapses |

$9,200 to $10,800 |

$4.10 to $4.90 |

The base case for 2026 anticipates copper averaging in the low to mid $11,000s per tonne, with price fluctuations potentially testing both sides of $12,000 depending on the outcome of the tariff review and the persistence of the US premium. This projection lies between conservative near-balance models and more aggressive deficit scenarios, reflecting the potential for policy-driven flows to cause price overshoots in either direction.

Frequently Asked Questions (FAQ)

1. Will copper prices rise in 2026?

Copper prices may remain elevated in 2026 if concentrate supply remains constrained and tariff risk continues to draw inventory into the United States. However, heightened volatility is likely to be the dominant feature, as regional dislocations can trigger sharp price spikes even when the global refined balance shifts only modestly.

2. Do US tariffs apply to refined copper cathodes in 2026?

Not directly. The current regime imposes a 50% tariff on semi-finished copper products and copper-intensive derivatives. A potential phased duty on refined copper is tied to a 2026 review, with proposed start dates in 2027 and 2028.

3. Why are LME stocks falling while US stocks are rising?

A location premium can attract deliverable metal into US warehouses, particularly as traders hedge against future tariff risk. This flow reduces LME availability and can strengthen nearby prices outside the United States, even if total visible inventories remain generally sufficient.

4. What is the best indicator for copper fundamentals in 2026?

Treatment and refining charges for concentrates. When TC/RCs collapse toward zero or negative levels, it signals smelters are competing for scarce concentrate, which often precedes tighter refined availability and higher price volatility.

5. Can high prices reduce copper demand?

Yes, in price-sensitive applications. At elevated price levels, substitution into aluminum and increased recycling can limit demand growth. However, essential uses such as grid infrastructure, defense, and high-reliability electrical systems are not easily substituted in the short term.

Conclusion

Copper’s trajectory in 2026 is defined by the interplay between a tightening physical supply chain and policy-driven inventory redistribution. Concentrate on market stress and persistent supply reliability risks, which underpin the fundamental bullish case, while tariffs and associated risks are generating a two-tier pricing environment that can amplify price movements beyond what global balances alone would suggest.

The most likely scenario is significant two-way volatility around an elevated average price. A base case anchored in the low to mid $11,000s per tonne accommodates potential surges above $13,000 during periods of heightened US premiums, as well as sharp declines when increased policy clarity diminishes stockpiling incentives. In 2026, copper is expected to behave less like a conventional growth metal and more like an asset influenced by policy and inventory dynamics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Concentration market tightness serves as the most direct fundamental indicator. Treatment and refining charges have fallen to zero in some annual benchmark agreements, while spot terms are reported in negative territory. This development directly signals that smelting capacity now exceeds the availability of mined concentrate.

Concentration market tightness serves as the most direct fundamental indicator. Treatment and refining charges have fallen to zero in some annual benchmark agreements, while spot terms are reported in negative territory. This development directly signals that smelting capacity now exceeds the availability of mined concentrate.