Contract for Difference (CFD) trading has become increasingly popular among modern retail investors due to its flexibility and potential for high returns. While it offers opportunities to profit from price movements without owning the underlying asset, it also involves significant risks.

Not to fear; this comprehensive beginner's guide will walk you through everything you need to know to get started with cfd trading in 2025.

CFD Trading for Beginners: A Comprehensive Guide

1) What Is CFD Trading?

CFD trading allows traders to speculate on stocks, indices, commodities and forex price movements without actually owning the asset

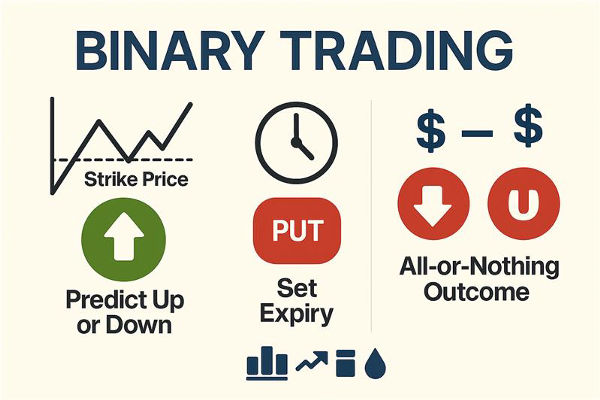

For context, when you trade CFDs, you enter into a contract with a broker to exchange the difference in an asset's price from the opening to the closing of the trade.

For example, if you speculate that a stock's price will rise, you can enter a "buy" CFD. If the price increases, you profit from the difference. If it falls, you incur a loss. The same concept applies if you believe an asset will drop in value; you can enter a "sell" CFD.

2) How Does CFD Trading Work?

CFD trading involves several key components: the underlying asset, the position (buy or sell), leverage, margin, and spreads. When placing a CFD Trade, you choose whether you think the price will rise (go long) or fall (go short). You don't need to own the actual asset to trade it, which makes CFDs highly flexible.

Leverage allows you to control a large position with a relatively small amount of capital, known as the margin. While this increases your potential profits, it also magnifies your losses. The difference between the buy and sell price is called the spread, and this is how brokers make money.

3) Advantages of CFD Trading

One of the biggest advantages of CFD trading is access to global markets. You can trade a wide range of instruments, from U.S. stocks to European indices and Asian commodities, all from a single trading platform. CFDs also allow for short selling, which means you can profit from falling prices—a feature not always available in traditional investing.

Another advantage is leverage. With leverage, you can amplify your potential returns without needing a massive upfront investment. Most brokers offer varying degrees of leverage, allowing you to tailor your exposure to your risk tolerance.

CFDs are also highly liquid and typically come with lower transaction costs than traditional forms of trading. Most brokers offer commission-free CFD trades and make money through the spread.

4) How to Set Up a First CFD Trading Account

To begin CFD trading, the first step is to open an account with a reputable broker. Look for a broker that is regulated by financial authorities, such as the FCA. Regulation ensures that the broker adheres to industry standards and offers a level of protection for your funds.

Once you've selected a broker, complete the account registration process by providing your personal information, financial background, and trading experience. You'll also need to verify your identity.

After setting up your account, fund it using your preferred payment method. Most brokers support bank transfers, credit/debit cards, and e-wallets. Once funded, you can access the trading platform and start placing CFD trades.

5) Choosing What to Trade

Beginners should start by trading assets most familiar to them. Popular CFD instruments include:

Stocks: Shares of companies like Apple, Nvidia, or Tesla

Indices: Basket of stocks representing market performance, such as the S&P 500 or FTSE 100

Commodities: Gold, silver, oil, and agricultural products

Forex: Currency pairs like EUR/USD or GBP/JPY

Each market behaves differently, so it's essential to understand the factors that influence price movements in your chosen asset class.

6) Fundamental vs Technical Analysis

To make informed trading decisions, you'll need to analyse market trends using fundamental or technical analysis or a combination of both.

Fundamental analysis focuses on economic indicators, company earnings, geopolitical events, and other macro factors that can affect asset prices. For example, if a company releases better-than-expected earnings, its stock price may rise.

Technical analysis, on the other hand, involves reading charts and using indicators to predict future price movements. Tools such as moving averages, Relative Strength Index, and Bollinger Bands can help you identify entry and exit points.

As a beginner, it's wise to start with one method and gradually incorporate the other as you gain experience.

7) Understanding the Risks Involved in CFD Trading

Despite the benefits, CFD trading is not without risks. The use of leverage means you can lose more than your initial deposit. Rapid market movements can result in significant losses, especially if you're not using stop-loss orders or other risk management tools.

Market volatility can also trigger margin calls. For context, your broker asks for additional funds to maintain your position. If you cannot meet the margin call, your position may be closed at a loss.

Additionally, CFDs are subject to overnight financing charges if you keep positions open beyond the trading day. These fees can accumulate and eat into your profits over time.

8) Managing Risks

Risk management is crucial in CFD trading. Always use stop-loss orders to limit your potential losses. A stop-loss automatically closes your trade at a predetermined price, preventing further losses if the market moves against you.

Position sizing is another key aspect. Don't risk more than a small percentage of your trading capital on a single trade, typically 1-2%. This helps you survive losing streaks and stay in the game longer.

Leverage should also be used cautiously. While it can magnify gains, it can equally amplify losses. Use lower leverage ratios until you become more experienced.

9) Maintaining Discipline

Lastly, emotions can often cloud judgment, leading to impulsive decisions. Successful CFD traders maintain discipline and stick to their trading plans. Avoid chasing losses or overtrading after a win.

Set realistic goals and track your progress through a trading journal. Recording your trades, strategies, and outcomes helps you learn from mistakes and improve over time.

Patience and consistency are key. Don't expect to become profitable overnight. Focus on building a solid foundation and gradually improving your skills.

Conclusion

In conclusion, CFD trading offers a flexible and potentially rewarding way to engage with global financial markets. If you're a beginner, start by educating yourself, practising with demo accounts, and trading with small amounts. As you gain experience, you can scale up and explore more advanced strategies.

Remember, success in CFD trading doesn't come from luck—it comes from preparation, consistency, and continuous learning. Whether you aim to trade part-time or pursue it professionally, the correct foundation will set you up for long-term success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.