A trading account is a type of investment account that allows individuals or institutions to buy and sell financial instruments such as shares, commodities, foreign currencies, or derivatives.

For many beginners, the question of what is trading account may seem basic, but it forms the foundation of any active engagement with the financial markets.

Unlike a savings or deposit account, a trading account is not designed for holding cash long-term. It is structured to enable quick and efficient transactions. Every time a trader places an order, whether to buy or sell an asset, it is done through a trading account provided by a licensed broker.

How a Trading Account Works

To understand what is trading account in practice, consider it the gateway to financial market activity. You begin by funding the account, usually via bank transfer or payment gateway. Once the account is funded, you can access a digital trading platform, which provides tools to execute orders, monitor positions, and analyse price trends.

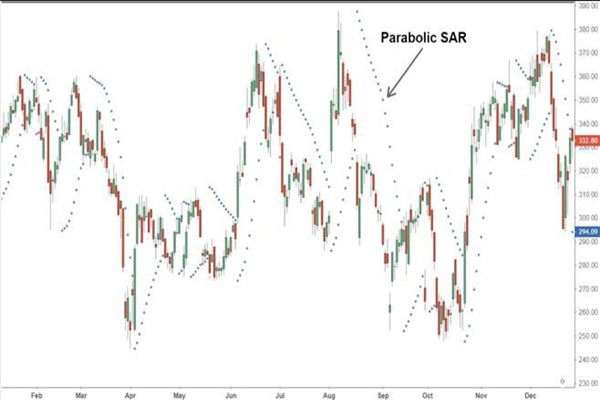

Trades placed through the account are recorded in real time, and any gains or losses are reflected in your account balance. Most modern trading accounts also come with access to advanced charting, live news feeds, and technical indicators. This enables traders to respond swiftly to market events and adjust their strategies accordingly.

Different Types of Trading Accounts

When exploring what is trading account, it helps to recognise that several variations exist, each catering to different trading styles and experience levels.

A basic cash trading account allows users to only trade with the funds they have deposited. This is simple and widely recommended for newcomers due to its lower risk.

A margin account, by contrast, enables traders to borrow money from the broker to take larger positions. While this offers the chance to magnify returns, it also introduces the risk of magnified losses.

For those interested in contracts for difference (CFDs), many brokers such as EBC offer accounts specifically for cfd trading. These accounts are popular in forex, commodities, and indices trading, as they allow speculation on price movements without owning the underlying assets.

There are also accounts designed for more complex financial products, such as futures and options, which are better suited for experienced traders.

What Is Trading Account Used For?

The main function of a trading account is to provide direct access to markets. However, when people ask what is trading account really used for, the answer varies based on personal goals and strategies.

Some use it for short-term speculation, aiming to benefit from rapid price changes. Others employ trading accounts to diversify their portfolio by allocating capital across multiple asset classes. A trading account may also serve as a hedging tool to reduce risk exposure from other investments.

In recent years, trading accounts have evolved to include mobile access, real-time notifications, social trading features, and algorithmic trading support. This makes them highly adaptable for all kinds of traders — from casual retail investors to institutional professionals.

Do You Really Need One?

Once you've answered what is trading account, the next question is whether opening one is right for you.

If your financial approach is passive — such as relying on long-term pension plans or robo-advisers — you may not require a trading account straight away. However, if you want to take greater control over your investments, react to market news, explore global assets, or test your own trading strategies, then a trading account becomes essential.

Many platforms also offer demo accounts, allowing users to experience live trading environments using virtual funds. This offers a risk-free way to understand what is trading account and whether it aligns with your goals.

Fees, Regulations, and Risk

While opening a trading account is often quick and straightforward, it is important to consider the costs. Some platforms offer zero-commission trading, but there may still be spreads, overnight financing charges, platform usage fees, or inactivity penalties.

Equally important is the regulatory standing of your broker. Always ensure the trading account provider is licensed by a recognised authority, such as the Financial Conduct Authority (FCA) in the UK, or the Australian Securities and Investments Commission (ASIC). A regulated broker offers better safeguards, clearer terms, and more transparent practices.

These aspects are central to a broader understanding of what is trading account, especially when your capital is on the line.

Trading Account vs. Investment Account

The two are often confused. To clarify what is trading account in contrast to an investment account, consider this:

A trading account is designed for active, often short-term engagement with the market. You make multiple trades, respond to news, and manage risk in real time. An investment account, however, is more suited for long-term holdings, where assets like stocks or bonds are bought and held with minimal intervention.

Both serve a purpose. Choosing between them depends on how actively you want to participate in the financial world, how much time you're willing to dedicate, and what kind of returns you are targeting.

Conclusion

Understanding what is trading account is more than just defining a term — it's about grasping the role this tool plays in modern finance. Whether you're a beginner exploring investment for the first time or a seasoned market participant looking for more flexibility, the trading account is your operational base.

It gives you real-time access, hands-on control, and the opportunity to grow your portfolio actively. Still, like any financial instrument, it requires knowledge, discipline, and a sound strategy. The more you understand what is trading account, the better positioned you'll be to use it wisely.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.