Choosing the right CFD (Contract for Difference) broker is one of the most critical decisions any trader will make. Whether you're a beginner looking for user-friendly tools or a seasoned trader focused on tight spreads and advanced charting features, your broker should align with your unique trading style.

This guide will help you evaluate the most important factors when choosing a CFD broker, with a close look at how top-tier firms like EBC Financial Group cater to different trader needs.

Understanding cfd trading and Why Your Broker Matters

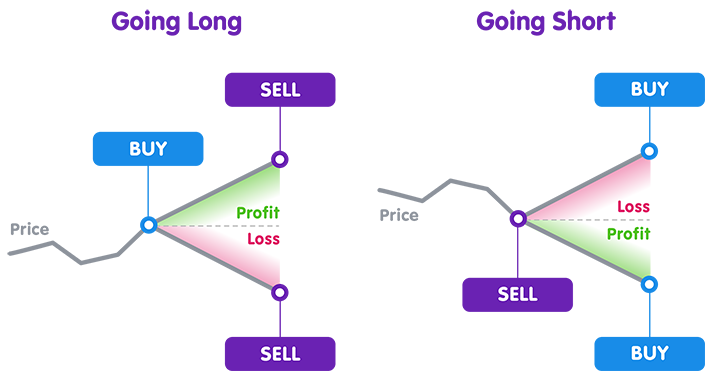

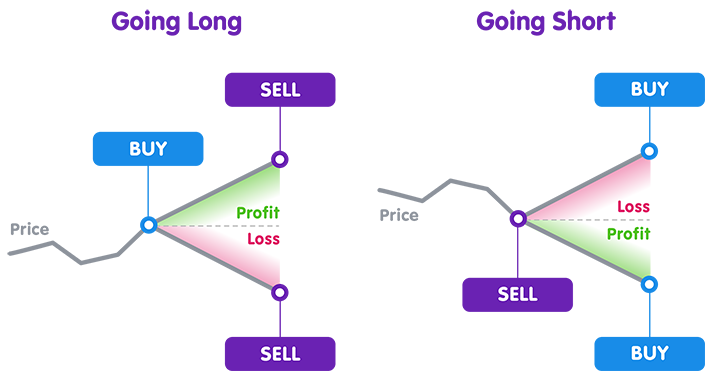

CFD trading allows you to speculate on the price movement of a variety of assets—stocks, forex, indices, commodities, and cryptocurrencies—without owning the underlying asset.

The broker provides the trading platform, access to the market, leverage options, and liquidity. But beyond offering access, your CFD broker plays a massive role in the quality of your trading experience.

For instance, a scalper may need ultra-fast execution, while a swing trader may prioritise tools for long-term trend analysis. The best broker is one that complements—not complicates—your trading strategy.

7 Things to Consider Before Choosing the Best CFD Broker for Yourself

1) Regulatory Compliance and Safety of Funds

Your primary focus should be on regulation before assessing features and tools. A regulated broker is held accountable by financial authorities and must comply with strict standards to protect client funds and ensure transparency.

In 2025, leading brokers will be regulated by bodies such as:

FCA (Financial Conduct Authority – UK)

ASIC (Australian Securities and Investments Commission)

CySEC (Cyprus Securities and Exchange Commission)

EBC Financial Group functions under several regulatory authorities, including the FCA and ASIC, offering confidence to traders worldwide. The broker implements strict security protocols, segregates client funds, and provides transparent details regarding pricing and execution.

2) Trading Platforms and Technology

Your trading platform is where decisions are made and executed. A fast, intuitive, and reliable platform can make all the difference, especially in fast-moving CFD markets. Look for brokers that offer:

Stable desktop and mobile trading platforms

Access to popular platforms like MetaTrader 4/5

Low latency and high-speed execution

Integrated tools for technical and fundamental analysis

EBC Financial Group provides both MetaTrader 4 and advanced trading infrastructure tailored for institutional-grade execution. With global liquidity access and ultra-fast trade execution, it's a strong match for both short-term traders and long-term investors.

3) Spreads, Fees, and Commissions

Spreads and commissions directly impact your profitability. Tight spreads are crucial for high-frequency traders, while low overnight swap fees may benefit position traders. Brokers typically earn through:

EBC Financial Group offers competitive spreads on major instruments, starting as low as 0.0 pips in its institutional accounts. Its transparent pricing model ensures that you know exactly what you're paying, which is especially important for traders operating with tight risk management.

4) Leverage and Margin Requirements

Leverage enables you to manage a bigger position with a reduced capital investment. Nonetheless, the appropriate leverage level relies on your strategy. Day traders may utilise greater leverage for swift gains, whereas cautious traders could adhere to lesser ratios.

Ensure that your broker provides adjustable leverage choices. For example, novices may begin with 1:10 or 1:20, whereas more daring traders might opt for access to 1:100 or more.

EBC Financial Group offers customisable leverage options, allowing traders to adjust their exposure based on account type and risk profile. This flexibility is ideal for tailoring leverage to your unique strategy.

5) Available Instruments

A good CFD broker should offer a wide range of trading instruments. The more diverse your trading options, the easier it is to implement multi-asset strategies, hedge positions, or explore new markets.

Check that your broker offers:

Major and minor forex pairs

Indices like the US30, NASDAQ, and DAX

Commodities such as gold, oil, and agricultural products

Individual stock CFDs from key global markets

EBC Financial Group provides access to all major markets and asset classes. Its global reach and deep liquidity pools ensure smooth execution across even the most volatile assets.

6) Order Execution Speed and Slippage Control

Execution speed can mean the difference between a profit and a loss, especially in volatile markets. Slippage—where your order executes at a different price than expected—can erode your returns over time.

Top brokers should offer:

EBC Financial Group is recognised for its execution that meets institutional standards. Its framework is designed to reduce latency and enhance accuracy, which is particularly vital for strategies dependent on speed, such as scalping and news trading.

7) Customer Support and Educational Resources

Even seasoned traders occasionally need help. Access to educational resources and customer support can greatly enhance your trading experience, particularly when dealing with technical challenges or acquiring knowledge about new tools:

24/5 or 24/7 customer service

-

Multilingual support

Webinars, video tutorials, and trading guides

Personalised account managers for high-tier clients

EBC Financial Group excels in client support, offering multilingual assistance and personalised guidance. Their educational content and webinars are updated for 2025 market conditions, making it easier for traders to stay ahead of the curve.

Platform Experience: EBC Financial Group in Focus

EBC Financial Group has emerged as the best CFD broker in 2025 for several reasons:

Global Regulation: Trusted by regulators in multiple regions

Trading Environment: Tight spreads, fast execution, and zero-requotes

Market Access: Over 1,000 instruments, including forex, indices, stocks, commodities, and ETF CFDs

Support & Education: Personalised service, multilingual support, and professional-grade resources

Security & Transparency: Segregated accounts, audited financials, and full transparency in execution and pricing

For traders looking for a reliable, well-rounded CFD broker, EBC provides all the essentials—backed by a strong infrastructure and a commitment to client success.

Conclusion

In conclusion, finding the best CFD broker isn't about going with the most popular name—it's about matching your trading style, risk appetite, and goals with a broker that offers the right tools, pricing, and support.

EBC Financial Group stands out as a top choice in 2025 for traders of all levels. From institutional execution speeds to flexible leverage and global market access, EBC combines reliability with performance. Their commitment to transparency, education, and client satisfaction makes them a trusted partner in your trading journey.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.