Imagine a bustling bazaar where dollars, euros, and rupees are the goods being traded, and prices shift with every headline, political change, or central bank decision.

Forex trading is the same marketplace, only digital and open 24 hours a day, five days a week. For Pakistanis, it offers opportunity, flexibility, and access to global markets right from their own rooms. However, the bazaar has rules, customs, and a few shady alleys.

Before you start trading, it's crucial to understand what's legal, how to open an account securely, and how to manage your risk effectively.. This guide explains forex trading in Pakistan in the 2025 context, platform tips, regulation notes, and safe-start checklists for beginners.

Is Forex Trading Legal in Pakistan?

Yes. Forex trading is legal, but it is tightly regulated. The State Bank of Pakistan (SBP) oversees the nation's foreign exchange policy, whereas the Securities and Exchange Commission of Pakistan (SECP) governs capital markets.

Most retail traders in Pakistan open accounts with internationally regulated forex brokers such as EBC, as the SBP primarily oversees banks and formal foreign exchange channels.

For technology and interbank changes, SBP has been rolling out electronic FX trading infrastructure and relevant circulars in 2024–2025.

Who Can You Legally Trade With From Pakistan?

There are three typical routes for Pakistan residents:

1. Local Bank / Authorised FX Dealers

These are the proper onshore channels for moving money or hedging corporate currency exposure. SBP/IFPD circulars cover these services.

2. International, Regulated Forex Brokers (Retail Trading, Margin FX, CFD Platforms)

Many Pakistanis utilise brokers that are overseen by FCA (UK), ASIC (Australia), CySEC (Cyprus), or comparable authorities.

Sites that aggregate broker options list providers accepted by Pakistani clients. Choose well-regulated brokers with good reviews.

3. Unregulated/Off-Market Dealers (Black Market): Avoid

In 2025, Pakistan intensified its crackdown on informal dollar trading, with authorities and media outlets warning of the legal and fraud risks associated with such channels.

According to Reuters, enforcement measures temporarily reduced the open-market gap but also diverted some activity to private digital platforms, underscoring the importance of avoiding unofficial foreign-exchange dealings.

Rule of thumb: Use licensed, supervised institutions for money movements. If a platform asks you to route funds through cash networks or Telegram channels, walk away.

How Do I Open a Forex Trading Account From Pakistan? Step-By-Step Guide

Think of this as opening a bank and a toolbox for trading abroad.

Decide on your instrument, such as Forex, CFD or Gold

Choose a reputable broker

Sign up & verify ID

Fund your account

Set base currency

Start with a demo

Note: Always verify legal status before utilising broker services.

Which Broker Is Best for Pakistani Traders in 2025?

Independent reviewer listings and user feedback show common names used by Pakistan traders:

Checklist when choosing a broker: regulation, spreads/commissions, withdrawal fees, speed, deposit methods from Pakistan, platform stability, and customer support hours.

What's the PKR Status Right Now

| Period (2025) |

Spot / Open-market (indicative) |

% change vs Jan 1, 2025 (approx.) |

| Jan 2025 |

~282 |

0.0% (base) |

| Mar 2025 |

~283 |

+0.4% |

| Jun 2025 |

~288 |

+2.1% |

| Sep 2025 |

~285 |

+1.1% |

| Oct 2025 (late) |

281–283 (open-market) |

+0.0%–+0.4% |

In late October 2025, the US dollar traded near ~281–283 PKR in open-market data (USD buying/selling around PKR 281–283).

Pakistan experienced sharp currency volatility in 2025 as government and security agencies intervened to curb black-market dollar trading.

Why this matters for you:

If PKR is weakening fast, USD-based margin calls become more expensive.

Exchange controls, remittance limits, and online transfer rules can affect how you deposit/withdraw to offshore brokers.

Local foreign-exchange volatility can make hedging strategies appealing, but they also carry elevated risk.

Tip: Track official interbank rates and open-market quotes separately, as the two can diverge significantly during periods of stress.

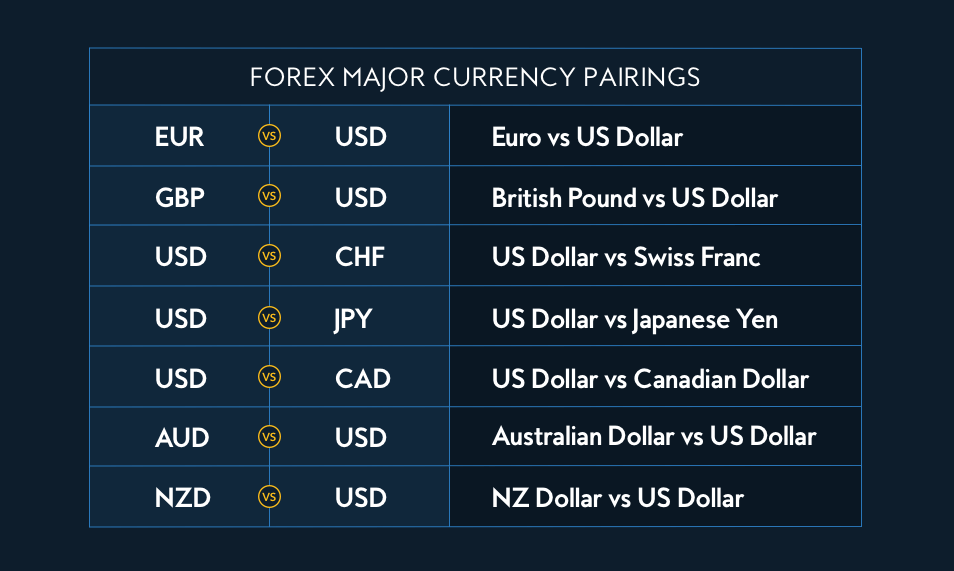

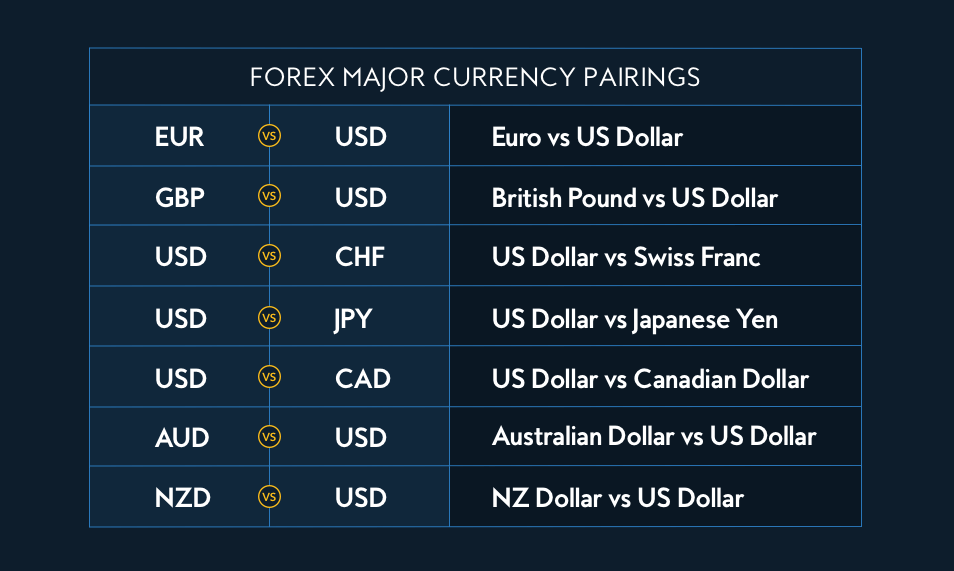

What Markets & Pairs Should Pakistan Beginners Consider?

Start simple:

Major pairs: EUR/USD, USD/JPY, GBP/USD

USD/PKR: If you want PKR exposure, consider local FX products or formal bank hedges.

Crosses & commodities: AUD/USD (sensitive to commodities), USD/CAD, and XAU/USD (gold) are popular hedging/inflation plays.

Start with majors to learn how the market moves before adding exotic or local currency pairs.

Simple Starter Strategy and Risk Management

Demo first

Position sizing: Use fixed fractional risk (1% per trade).

Trade majors and follow the trend

Keep risk-to-reward≥ 1:2: For example, risk 50 pips to make 100 pips.

Limit overnight exposure

Journal trades

Practical Example

Identify trend: EUR/USD up on the daily chart

If hit target: profit ~$20 → consistent small wins compound over time.

Frequently Asked Questions

1. Is Forex Trading Legal in Pakistan?

Yes, forex trading is legal in Pakistan, but it must be done through regulated and licensed brokers.

2. Can I Trade Forex Online From Pakistan?

Yes, Pakistanis can trade forex online through internationally regulated brokers such as those licensed under the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

3. Is Forex Income Taxable in Pakistan?

Yes. Any income earned from forex trading, whether through international or local brokers, is subject to taxation under Pakistani law.

4. Can I Trade USD/PKR in Forex Platforms?

Most global forex brokers do not offer USD/PKR as a tradable pair due to liquidity issues and capital controls set by the SBP.

Conclusion

In conclusion, forex trading in Pakistan in 2025 presents attractive opportunities but also carries significant operational and regulatory challenges.

For beginners: prioritise legal on-ramps, start on demo accounts, limit leverage and risk per trade, and treat formal hedging (via banks or authorised dealers) as a separate tool from speculative retail trading.

With disciplined risk control, education and verified counterparties, retail traders in Pakistan can participate safely in global FX markets while avoiding the worst regulatory & counterparty pitfalls.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.