Short selling is a powerful trading strategy that allows traders to profit from falling prices in stocks, forex, commodities, and other markets. While it can be lucrative, short selling carries unique risks and requires a solid understanding of market mechanics, margin requirements, and risk management.

This guide explains how short selling works, why traders use it, and what you need to know to use it effectively.

What Is Short Selling?

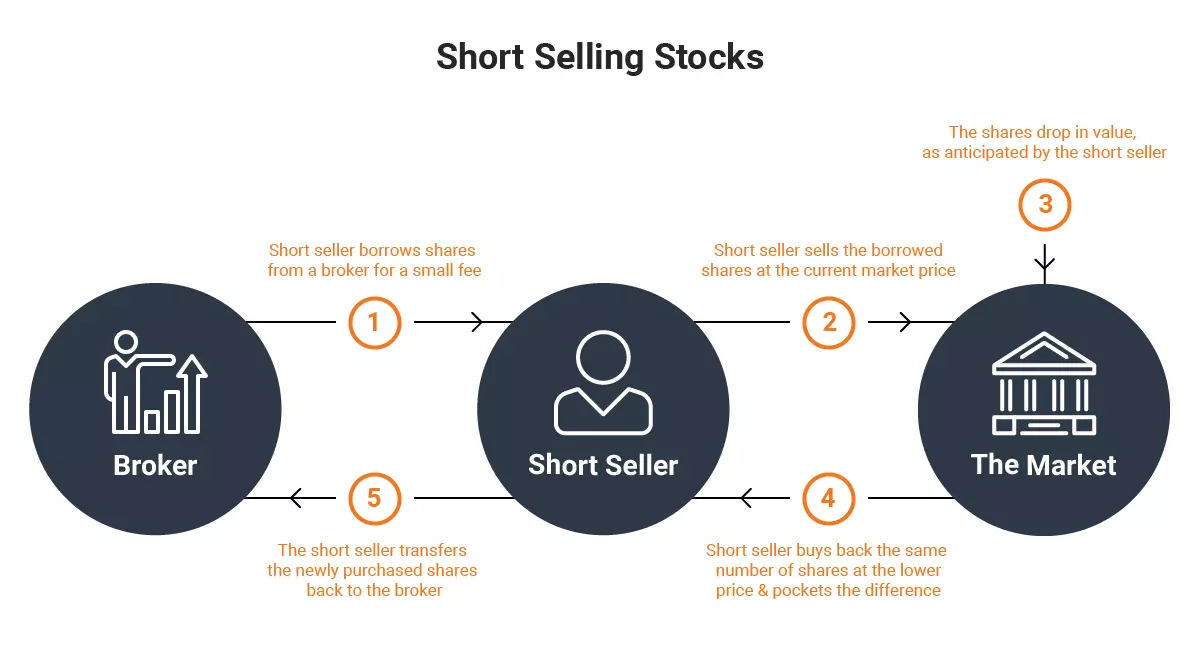

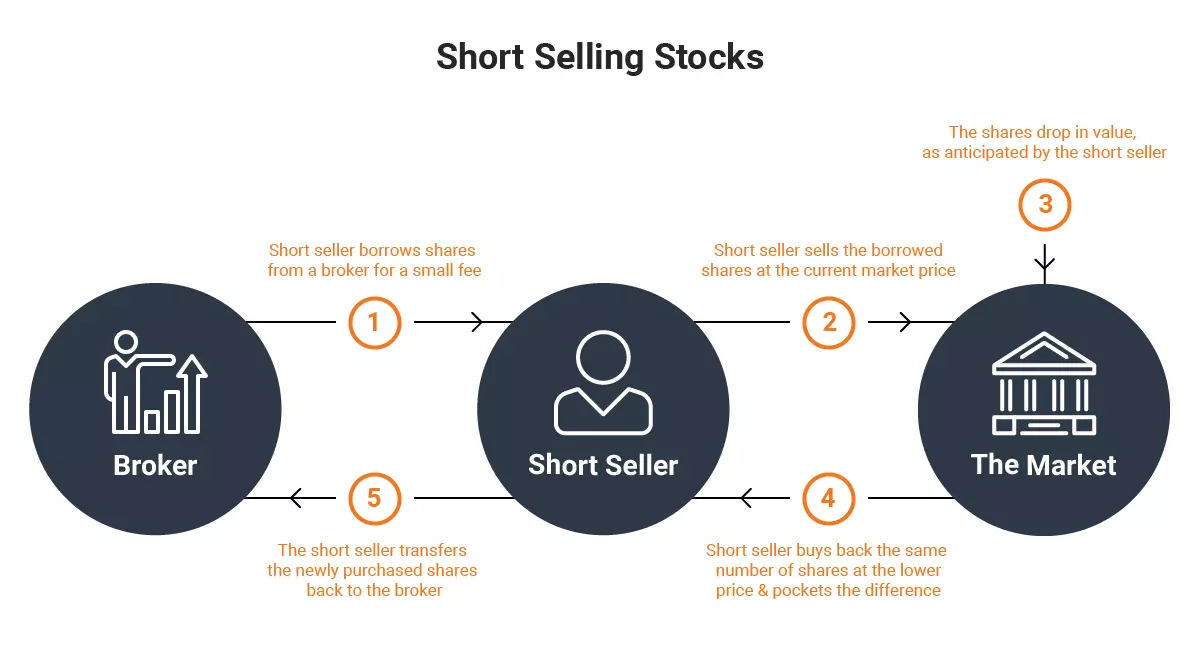

Short selling, also known as "shorting" or "going short," is a strategy where a trader sells an asset they do not own, aiming to buy it back later at a lower price. The trader borrows the asset—usually shares—from a broker, sells it at the current market price, and hopes the price will drop. If it does, the trader can repurchase the asset at a lower price, return it to the lender, and keep the difference as profit.

Short selling is most common in equities but is also widely used in forex, indices, and commodities markets. Instruments like contracts for difference (CFDs) and futures make short selling accessible without the need to physically borrow the underlying asset.

How Does Short Selling Work? Step-by-Step

1. Open a Margin Account:

Traders must have a margin account with a broker, which allows them to borrow assets and trade with leverage. Margin accounts require minimum balances and have maintenance requirements.

2. Identify a Target Asset:

The trader analyses the market to find an asset they believe is overvalued or poised to decline, using technical, fundamental, or sentiment analysis.

3. Borrow and Sell the Asset:

The broker locates and lends the asset, which the trader then sells at the current market price.

4. Monitor the Position:

The trader watches the market, hoping the price falls. If it does, they can buy back the asset at a lower price. If the price rises, losses can mount quickly.

5. Buy Back and Return:

The trader repurchases the asset (known as “covering” the short), returns it to the broker, and realises profit or loss based on the price difference.

Example:

Suppose you short 100 shares of a stock at $100 each. The price falls to $80. You buy back the shares for $8,000, return them, and pocket a $2,000 profit (minus fees). If the price rises to $120, you face a $2,000 loss.

Why Do Traders Short Sell?

The primary motivation is to profit when an asset's price falls.

Short selling can offset potential losses in a long portfolio, serving as a hedge against downturns.

Short sellers help correct overvalued markets, contributing to efficient price discovery and increased market liquidity.

Popular Short Selling Strategies

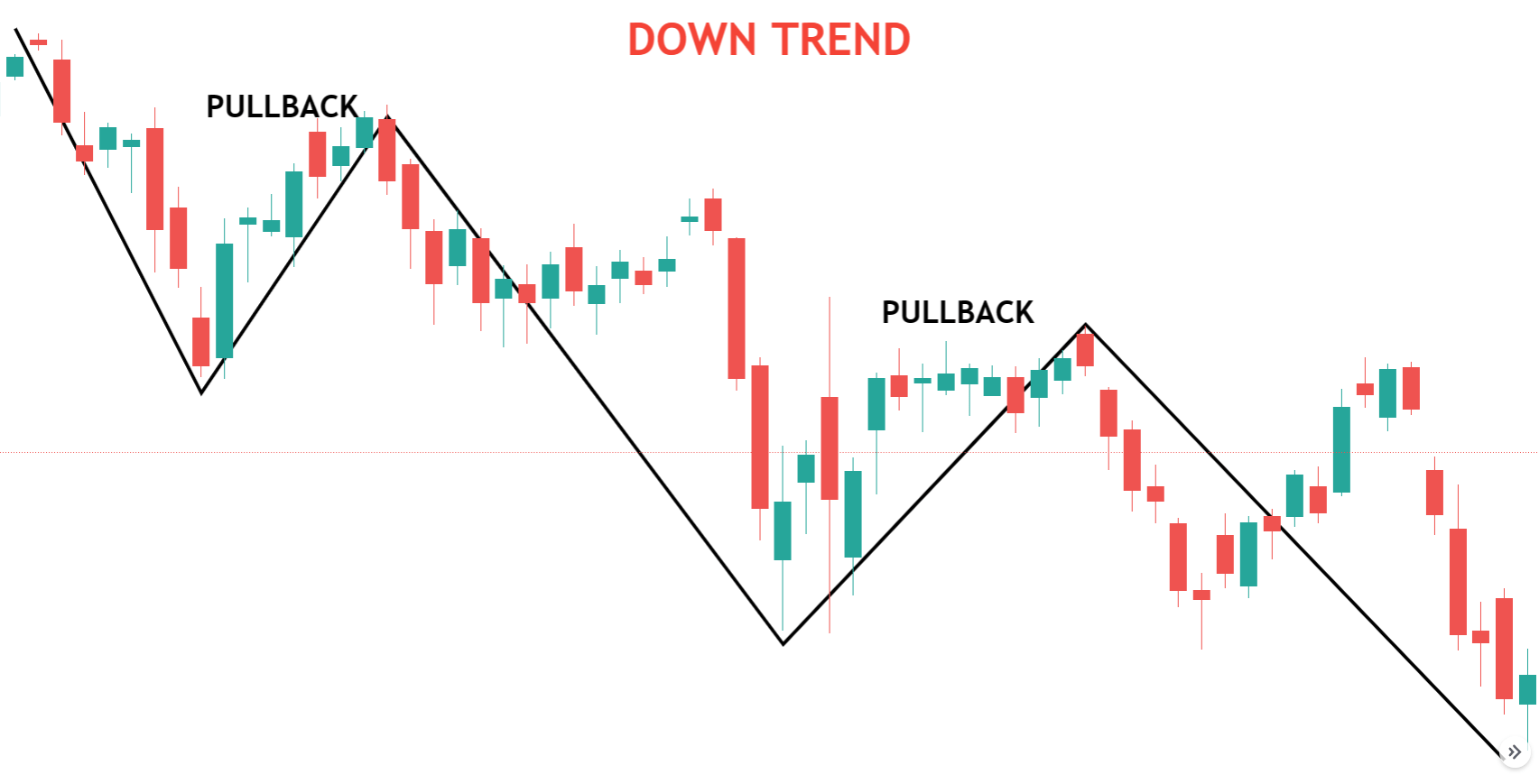

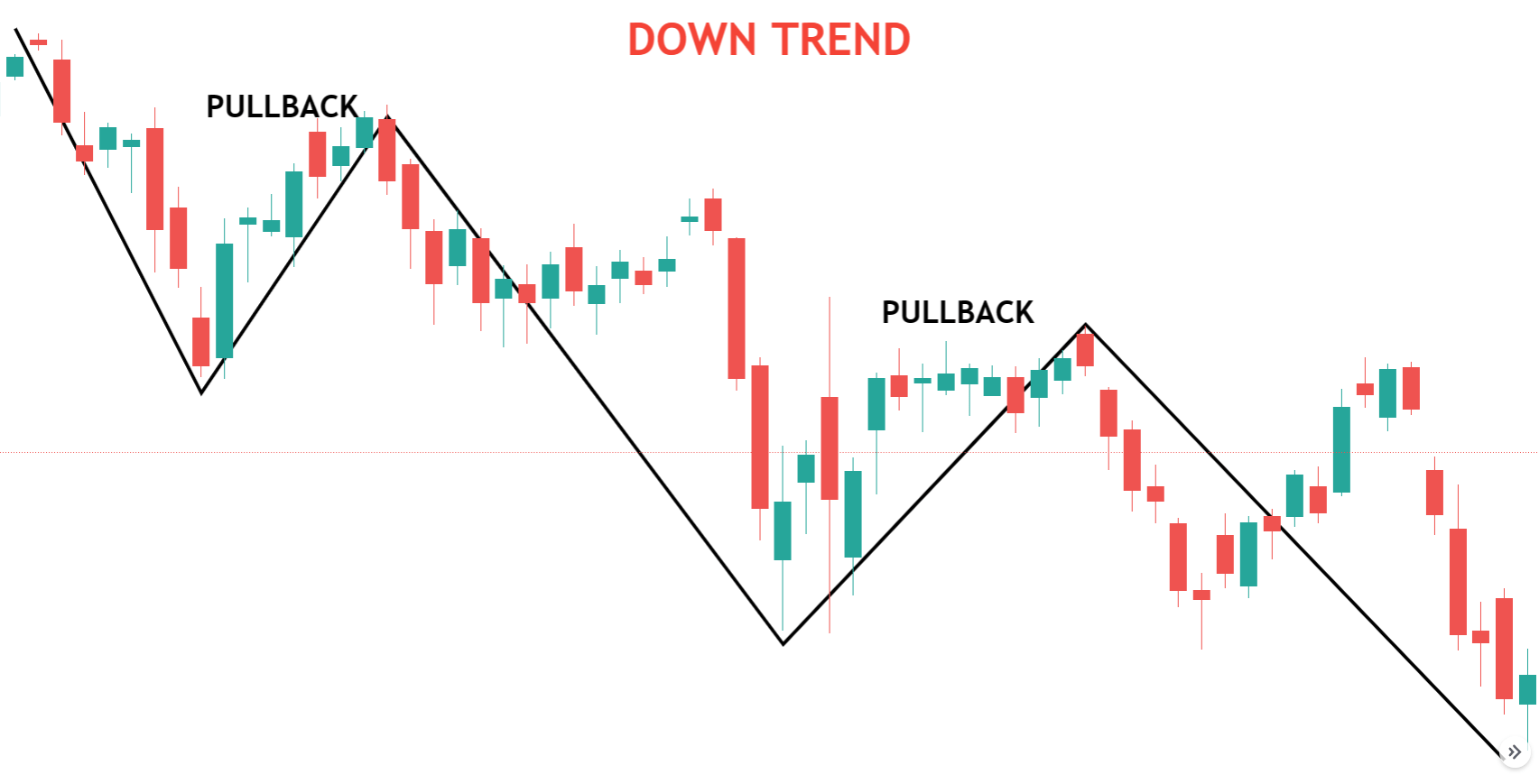

1. Selling a Pullback in a Downtrend:

Short after a brief rally in a falling market, anticipating a continuation of the decline.

2. Breakdown from Support:

Short when the price breaks below a major support level, signalling further weakness.

3. Active Decline Selling:

Enter short positions during strong downward moves, particularly in bear markets.

4. Shorting with Derivatives:

Use CFDs or options to short assets without borrowing the underlying security.

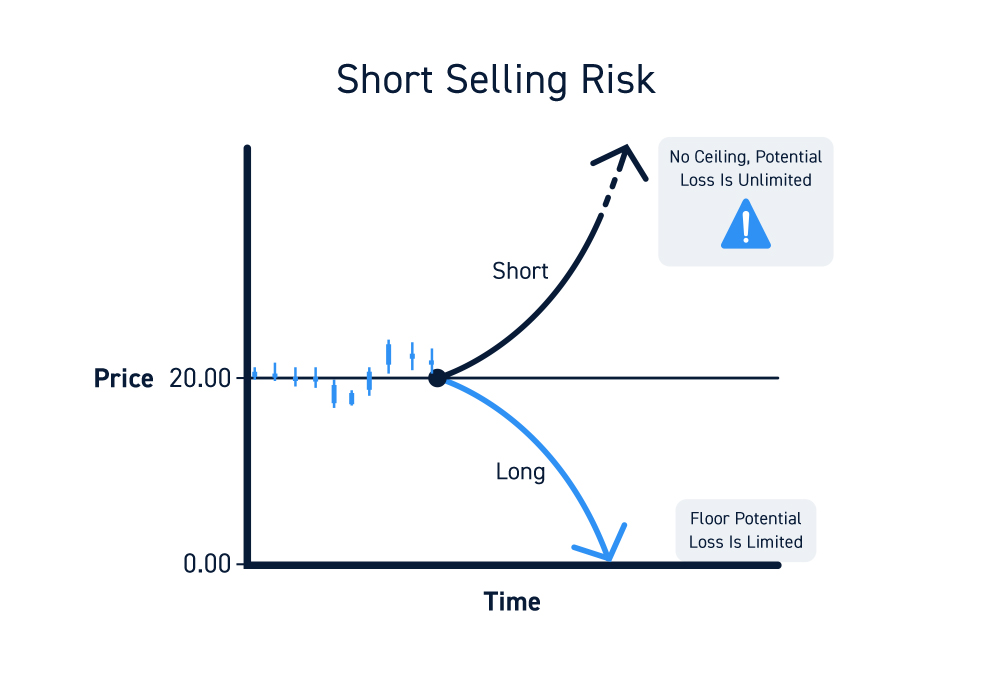

Key Risks of Short Selling

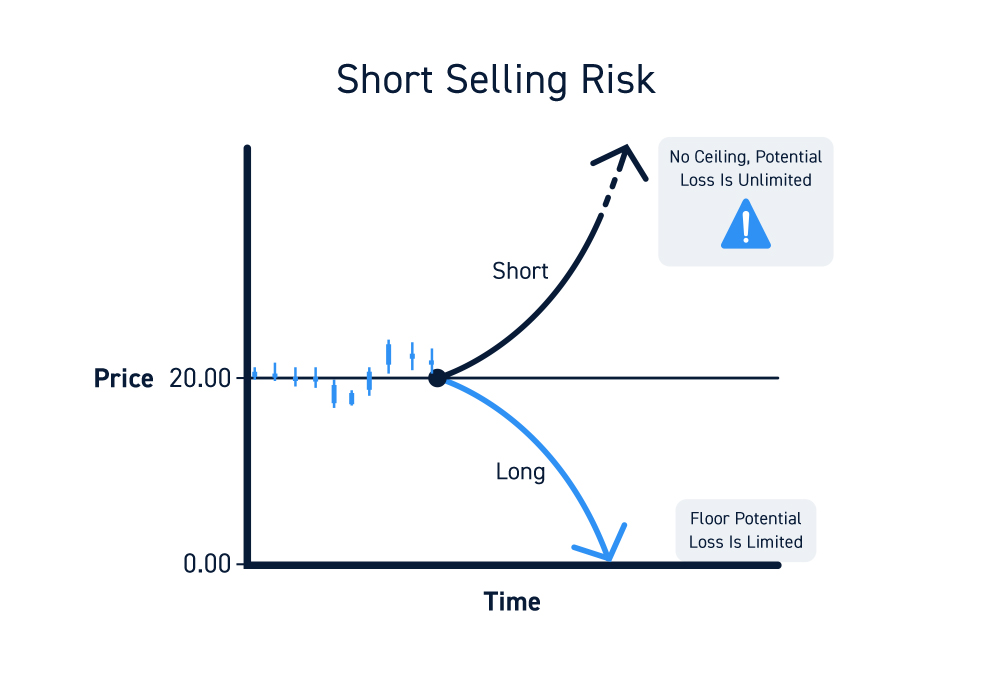

Unlike buying, where losses are capped at your investment, short selling exposes you to unlimited risk if the asset price rises sharply.

If losses mount, brokers may require you to deposit more funds or close your position, potentially at a loss.

You pay interest and fees on borrowed assets, which can erode profits.

If many traders are short and the price rises, a rush to cover positions can drive prices even higher, compounding losses.

Short selling may be restricted or banned during periods of extreme market volatility.

Practical Tips for Short Sellers

Protect yourself from runaway losses by setting stop-losses above your entry price.

Ensure you have sufficient funds to meet margin calls if the trade moves against you.

Watch for news, earnings, and market sentiment shifts that could trigger sharp price moves.

Avoid concentrating short positions in a single asset or sector.

The Role of Short Selling in Markets

Short selling is sometimes criticised for contributing to market declines, but it plays a vital role in ensuring efficient markets. By betting against overvalued assets, short sellers help correct bubbles and expose corporate fraud or weak fundamentals. Their activity increases liquidity and can even act as a check on market euphoria.

Conclusion

Short selling is a sophisticated trading tool that enables traders to profit from falling prices, hedge risk, and contribute to market efficiency. However, it carries significant risks, including unlimited losses and margin calls.

By understanding the mechanics, strategies, and pitfalls, traders can use short selling as part of a balanced and well-informed trading approach.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.