If you've ever seen a price tag with a pound sign or dabbled in foreign exchange trading, you've already encountered GBP. But what is GBP currency, exactly? GBP stands for “Great British Pound,” formally known as the pound sterling. It is the official currency of the United Kingdom and several of its surrounding territories.

Recognised as one of the most widely traded and respected currencies in the world, GBP holds substantial influence in global finance. Whether you're travelling, investing, or trading, understanding what is GBP currency will help you navigate the financial landscape with confidence.

The Long History of GBP

To truly understand what is GBP currency today, it's worth looking back at its origins. The pound sterling dates back over 1,200 years, making it one of the oldest currencies still in active use. Originally, the term "pound" referred to a weight of silver, and "sterling" likely came from the Norman word “esterlin.”

Over time, the currency evolved from being backed by precious metals such as silver and gold to becoming fiat money. During the British Empire's global expansion, GBP became a dominant force in international trade and finance. Even as the empire waned, the pound retained its reputation as a stable and reliable currency.

Where GBP Is Used

When people ask what is GBP currency, they often associate it with the UK alone. However, its reach extends beyond just England, Scotland, Wales, and Northern Ireland. GBP is also used in crown dependencies like the Isle of Man and the Channel Islands. Additionally, British Overseas Territories such as Gibraltar and the Falkland Islands use local versions pegged to GBP.

Importantly, the United Kingdom opted not to join the eurozone. Even during its time as a European Union member, the UK maintained its own currency. This decision allowed the pound to remain a symbol of monetary sovereignty and national identity.

GBP in Global Trading

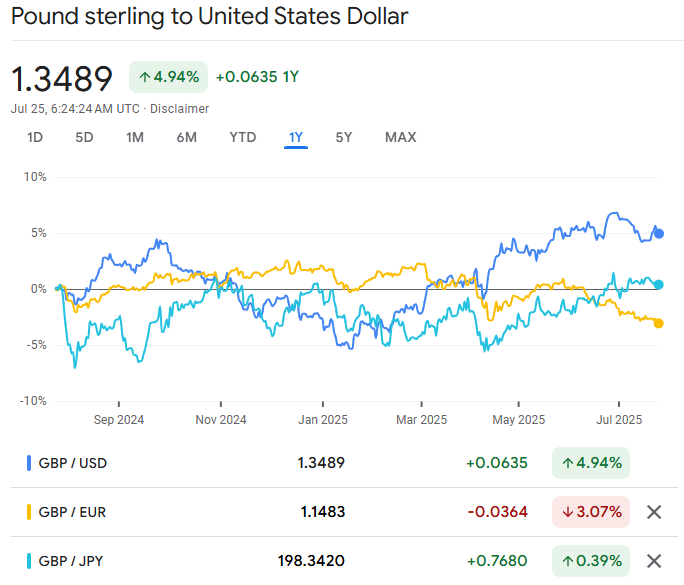

One of the most common contexts for the question “what is GBP currency” arises in the world of forex trading. GBP is the fourth most traded currency globally, following the US dollar, the euro, and the Japanese yen. In foreign exchange markets, the most popular pairing is GBP/USD, often referred to as “Cable,” a name rooted in the transatlantic telegraph line that once carried exchange rates.

GBP is known for its liquidity and volatility. Traders pay close attention to British political events, economic data, and decisions from the Bank of England, as these often cause noticeable shifts in the pound's value. Because of its strong market presence, GBP is considered a benchmark currency and is included in the International Monetary Fund's Special Drawing Rights basket.

Who Manages GBP?

Understanding what is GBP currency also involves knowing who controls it. The Bank of England, the UK's central bank, is responsible for issuing and managing the pound. It sets interest rates, designs monetary policy, and ensures financial stability within the economy. Through these functions, the Bank of England plays a vital role in maintaining the strength and credibility of GBP.

The central bank also issues physical banknotes in denominations such as £5, £10, £20, and £50. Each note includes security features and imagery that reflect Britain's cultural and historical heritage. The introduction of polymer notes in recent years has further improved durability and counterfeiting resistance.

The Impact of Inflation

Like all fiat currencies, GBP is subject to inflation, which gradually reduces its purchasing power over time. The Bank of England targets a 2% annual inflation rate to maintain price stability. However, events such as Brexit, energy crises, or global pandemics can create significant economic shifts that influence the pound's strength.

When evaluating what is GBP currency in terms of long-term value, it's important to consider inflation trends and central bank policies. These factors shape the pound's stability and affect everything from consumer prices to investment performance.

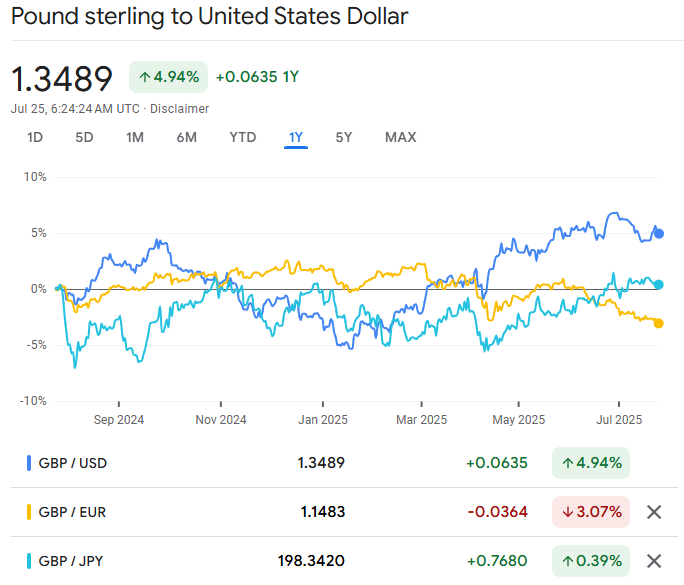

How GBP Compares to Other Major Currencies

Although GBP does not hold the top spot as a global reserve currency, it remains among the most trusted and traded in the world. Compared to currencies like the euro or US dollar, GBP benefits from independent monetary policy and a long-standing reputation for fiscal responsibility.

Its movements are often independent of those in the eurozone or United States, making GBP a valuable asset for diversifying currency exposure. Investors and governments alike continue to hold GBP in significant quantities due to its perceived reliability and liquidity.

Everyday Relevance of GBP

Beyond trading and policy, the question of what is GBP currency also applies in everyday life. If you are visiting the UK, you will use GBP to pay for transport, accommodation, and other expenses. If you are a businessperson dealing with UK-based suppliers or clients, transactions may be settled in pounds.

In the property sector, international buyers often invest in UK real estate using GBP. Students from overseas who enrol in British universities also make tuition and living payments in pounds. As one of the world's key financial hubs, London's prominence ensures GBP continues to play a central role in international commerce.

Final Thoughts

After learning what is GBP currency from historical, economic, and practical perspectives, it's clear that the British pound is more than just a national currency. It is a major player in the global financial ecosystem, backed by a long legacy and robust institutional support.

Whether you're holding GBP for travel, investment, or international business, understanding how it functions — and what influences its value — is essential. The pound sterling continues to be a symbol of trust, independence, and relevance in a world of ever-shifting currencies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.