Contracts for Difference (CFDs) offer traders the flexibility to profit from both rising and falling markets across a range of assets. However, the leverage and volatility that make CFDs attractive can also magnify risks.

To help you navigate these challenges, here are seven practical tips for a successful CFD trade, suitable for both beginners and experienced traders.

7 Tips for a Successful CFD Trade

1. Start with a Solid Trading plan

A well-defined trading plan is the foundation of success in cfd trading. Your plan should outline your trading objectives, risk tolerance, preferred markets, and entry and exit strategies. By having a clear roadmap, you reduce the risk of making impulsive decisions during market volatility.

Remember, your trading plan should be tailored to your personal goals and risk appetite, not simply copied from others.

2. Manage Your Risk Carefully

Effective risk management is crucial. Most seasoned traders recommend risking only 1–2% of your trading capital on any single trade. Use stop-loss orders to limit potential losses and avoid risking more than you can afford to lose.

Surviving in the market is more important than chasing large wins, especially when trading with leverage.

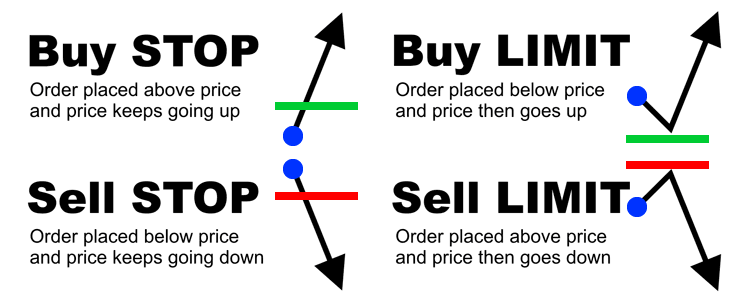

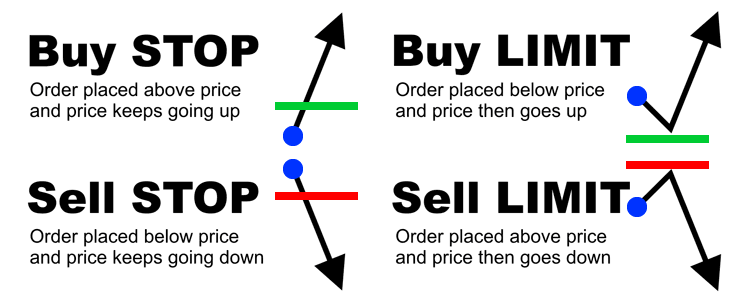

3. Use Stop-Loss and Limit Orders

Stop-loss and limit orders are essential tools for protecting your capital and locking in profits. A stop-loss order automatically closes your position if the market moves against you, while a limit order takes profit at a predetermined level.

These tools help you trade with discipline and remove emotion from decision-making.

4. Analyse the Markets Thoroughly

Successful CFD traders use both technical and fundamental analysis to identify trading opportunities. Technical analysis involves studying price charts and indicators to spot trends and entry points.

Fundamental analysis looks at economic data, company news, and broader market events. Combining both approaches gives you a well-rounded view and helps you time your trades more effectively.

5. Size Your Positions Properly

Position sizing determines your total market exposure on each trade. Always consider your available capital and risk limits before opening a position. Remember, CFDs are leveraged products, so your exposure is much greater than your initial deposit.

Only risk a small percentage of your account on each trade to avoid large losses.

6. Keep a Trading Journal

Maintaining a detailed trading journal helps you learn from both your successes and mistakes. Record every trade, including your reasoning, entry and exit points, and the outcome. Regularly reviewing your journal allows you to identify patterns, refine your strategy, and avoid repeating costly errors.

7. Practise Discipline and Continuous Learning

Discipline is vital for sticking to your trading plan and strategy, even when emotions run high. Avoid overtrading and never add to losing positions out of frustration. Markets change, so commit to ongoing education—use demo accounts to test new strategies and stay updated on market developments.

Conclusion

CFD trading can be rewarding, but it requires careful planning, disciplined risk management, and a commitment to continuous improvement. By following these seven tips, you can approach each CFD trade with greater confidence and increase your chances of long-term success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.