The pound is walking into a classic "priced-in" central bank event. After UK inflation dropped to 3.2% in November, futures markets became nearly certain that the Bank of England would cut the Bank Rate by 25 basis points to 3.75% at 12:00 noon UK time today, 18 December 2025.

That does not automatically mean GBP must fall. The real driver will be the tone: whether the MPC frames the cut as "risk-managed and gradual" or signals a faster follow-through in 2026.

What to Expect From Today's Bank of England Meeting?

As of now, markets and economists broadly expect the Bank of England to reduce Bank Rate from 4.00% to 3.75%. However, the meeting points to a tight vote, with a 5–4 split viewed as the most likely outcome.

Why This Matters for GBP

When a cut is this heavily priced, sterling often reacts less to the headline and more to the vote split, guidance language, and what the Bank signals about the next two meetings.

Currently, the sterling exchange rate is approximately $1.3373, and the markets are fully anticipating a rate cut following the surprise inflation data.

Why the BoE Is Under Pressure to Cut Rates?

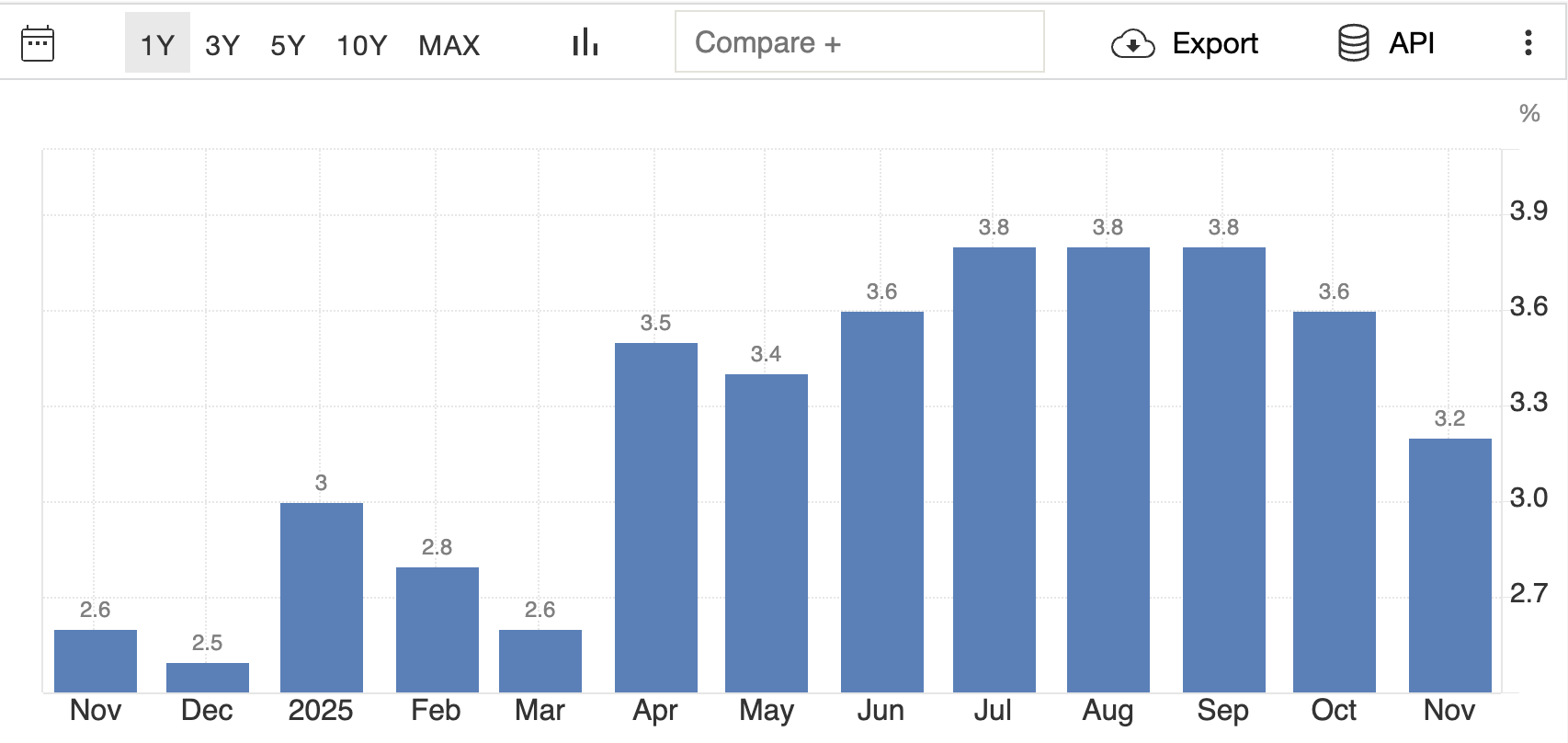

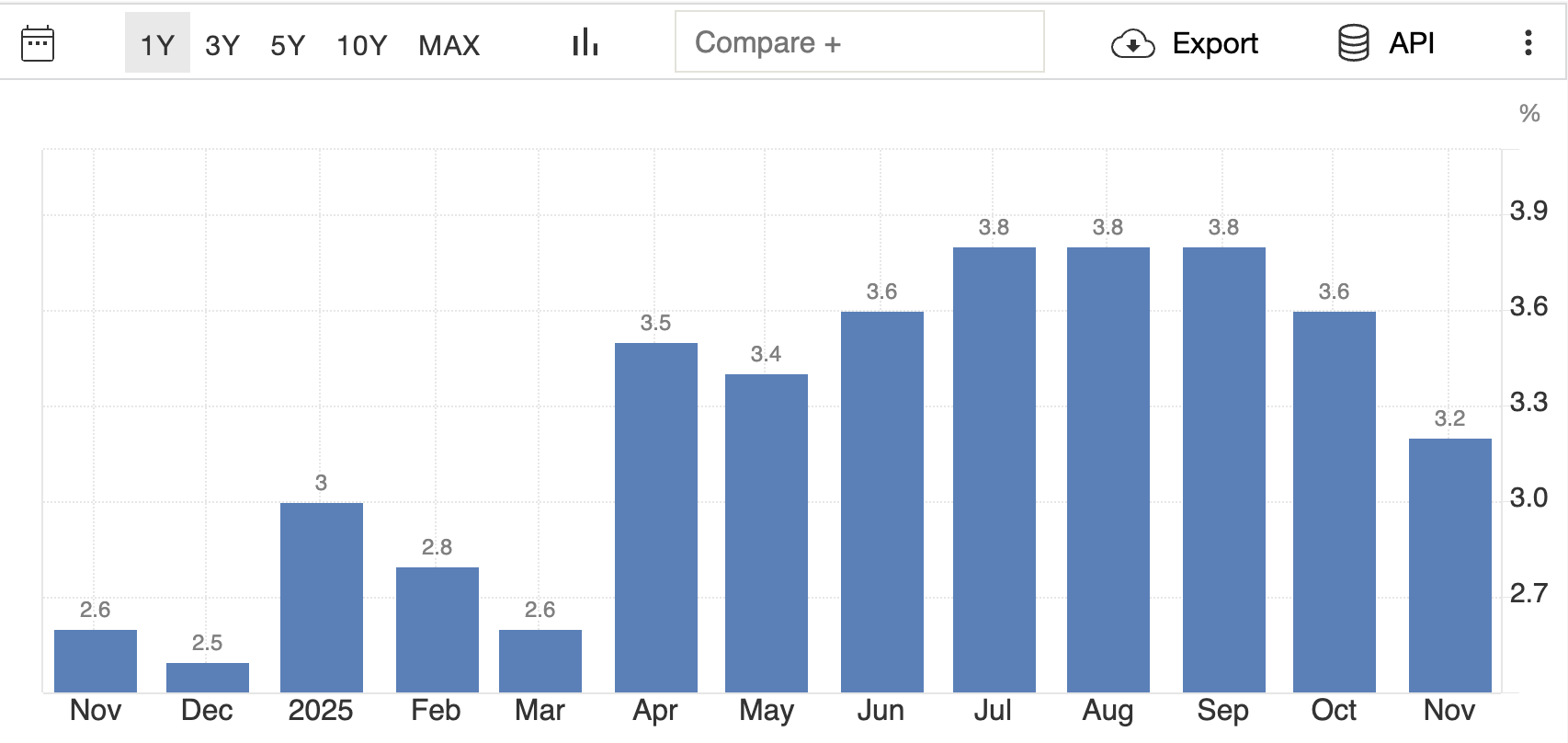

Inflation Has Cooled Faster Than Expected

The UK Consumer Price Index (CPI) fell to 3.2% year-on-year in November, down from 3.6% in October, which was lower than many forecasts predicted. Additionally, the core and services components showed softer results than expected, leading to increased expectations for rate cuts.

Although inflation remains above the Bank of England's (BoE) target of 2%, the trend is significant. The latest data indicate that the Monetary Policy Committee (MPC) is successfully implementing policy restraint.

Growth and Jobs Look Fragile

The economy has been soft, unemployment has been at its highest since 2021, and recent activity data has been mixed.

That is the policy bind for the MPC. Keeping rates too high for too long risks turning a slowdown into something sharper.

The MPC Is Split

In November 2025, the MPC voted 5–4 to hold Bank Rate at 4%, with four members preferring a 25bp cut to 3.75%. That is a narrow committee, which makes today's vote split and guidance almost as important as the rate change itself.

What the Vote Split Could Imply?

A close vote is significant as it shapes expectations for 2026 and highlights the committee's division, indicating a similar split is likely again.

5–4 cut: The "slow and careful" camp still has weight, which can limit GBP damage.

6–3 or 7–2 cut: Markets can interpret this as the MPC becoming more comfortable with easing, which is more GBP-negative.

Any hold: Sterling is likely to appreciate, as it compels a reconsideration of the near-term trajectory.

The GBP Reaction So Far: Sterling Moved Before the Decision

Sterling sold off sharply after the inflation data, marking the largest one-day fall in weeks, and market pricing shifted to near certainty of a cut.

Today, sterling remains weak at $1.3373 as central bank decisions loom.

This is a classic "front-run" pattern. When the market prices the cut in advance, the decision itself matters less than the tone of the statement and the vote split.

GBP/USD Technical Analysis: Where Traders Should Focus Today

| Metric |

Reading |

What it suggests for traders |

| Spot reference |

1.3369–1.3373 |

Market is balanced but sensitive to guidance |

| RSI (14) |

~46.8 (Neutral) |

No strong momentum edge going into the event |

| MACD (12,26) |

Negative / Sell |

Recent drift is softer; rallies can fade |

| Moving averages |

Mixed (more "Sell" than "Buy") |

Trend is not clean; levels matter more than indicators today |

| Key support zone |

1.3350, then 1.3220

|

A dovish cut can press toward lower supports |

| Key resistance zone |

1.3400–1.3450, then 1.3500

|

A hawkish cut or hold can squeeze into these levels |

Sterling remains vulnerable in the lead-up to the decision after the inflation shock, even while the pair remains within a broader range.

Traders are closely monitoring the 1.33 level, with support below 1.3350 and potential further downside if that threshold is breached. Meanwhile, resistance lies in the mid-1.34s.

How Should Traders Proceed (process, not a promise): Traders should wait for the first 15–30 minute candle to close after the announcement, then trade in the direction of the breakout with a defined stop, since the initial spike often reverses.

What to Watch Next: Bank of England Interest Rate Calendar 2026

Today is the final scheduled MPC decision of 2025. The Bank of England's published schedule shows the upcoming meetings and key "report" meetings through 2026.

Key upcoming BoE dates (2026):

5 February 2026

19 March 2026

30 April 2026

18 June 2026

30 July 2026

17 September 2026

5 November 2026

17 December 2026

For sterling, the next major UK catalysts following today are clear: inflation reports, wage growth, and any developments that could impact the market's expectation of how quickly the Bank Rate may decrease from this point onward.

Frequently Asked Questions

1. Is the Bank of England Expected to Cut Rates Today?

Yes. After November CPI fell to 3.2%, markets moved to near-certainty that the BoE will cut 25bp to 3.75% at today's announcement.

2. If the BoE Cuts Rates, Will GBP Definitely Fall?

No. When a cut is fully priced, GBP often reacts more to the tone and vote split than the headline.

3. Why Did Sterling Fall Before the BoE Meeting?

The sterling declined after an unexpected inflation report led markets to anticipate a nearly certain interest rate cut.

4. What Levels Matter Most for GBP/USD Today?

Support around 1.3300, then 1.3270, with resistance in the 1.3420–1.3500 region.

Conclusion

In conclusion, today's BoE decision is about more than a quarter-point move. The cut is widely expected because inflation has cooled to 3.2% and growth momentum looks weak, but the pound's next leg depends on whether the BoE treats this as a cautious tune-up or the beginning of a broader easing push.

For GBP traders, the approach is straightforward: monitor the vote split, pay attention to how strongly the Bank emphasises services inflation and wage risks, and use 1.3300 on GBP/USD as a key level.

This will help you determine whether the market is continuing the sell-off or shifting towards a relief rebound.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.