Money is the foundation of global trade, investment, and financial markets. For traders, understanding the different types of money and how they have evolved is essential for making informed decisions in today’s fast-changing market environment.

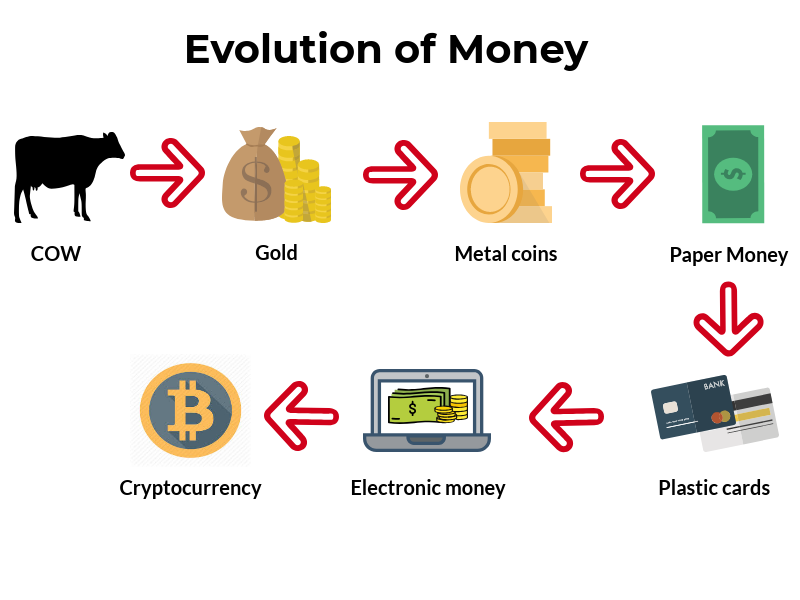

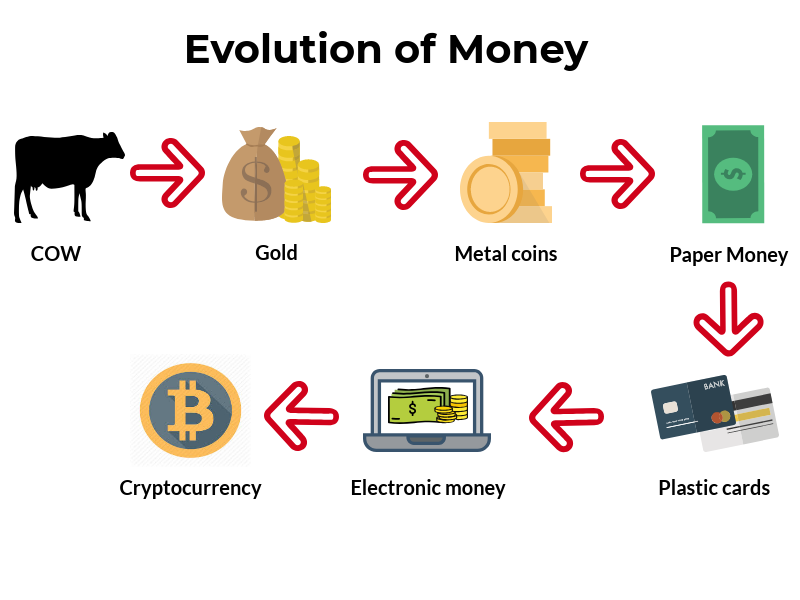

From early barter systems to modern digital currencies, money has undergone a significant transformation over time. This article guides you on the types of money every trader should know, helping you better navigate financial markets with more clarity.

A Brief History Of Money And What Is Money

Money is anything that functions as a medium of exchange, a unit of account, and a store of value. Throughout history, the form of money has evolved alongside trade, technology, and financial systems.

Early economies relied on barter, where goods and services were exchanged directly. As trade expanded, barter became inefficient, leading to the use of commodity money such as cattle, grains, and precious metals like gold and silver.

Later, representative money emerged, where paper notes or tokens could be exchanged for commodities. China introduced paper money as early as the 11th century, while Europe developed banknotes and bills of exchange to simplify long-distance and large-scale trade.

By the 19th century, many countries adopted the gold standard, linking their currencies to a fixed amount of gold. Over time, most economies transitioned to fiat money, which derives its value from government decree and public trust rather than physical backing.

Today, the majority of money exists in digital form, but its role is rooted in this long monetary history.

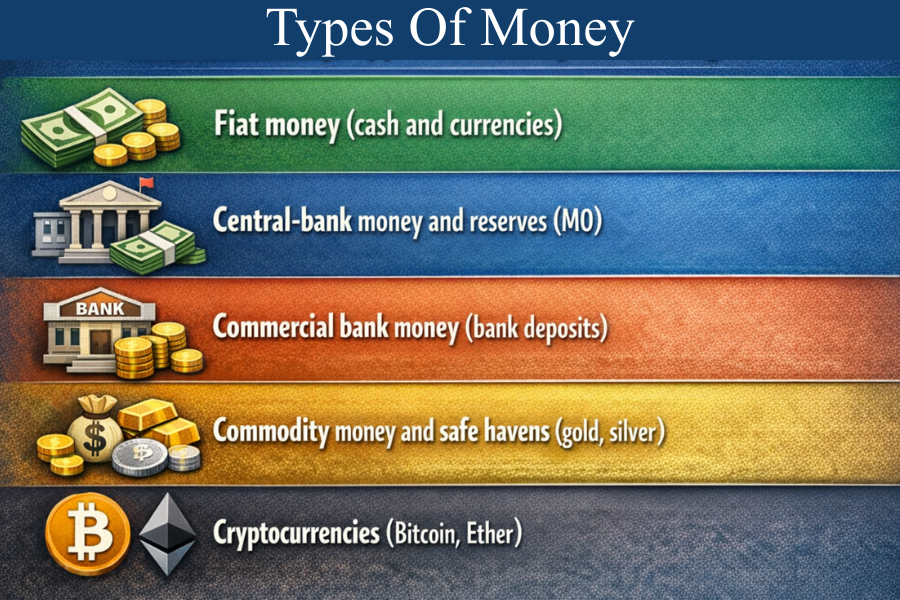

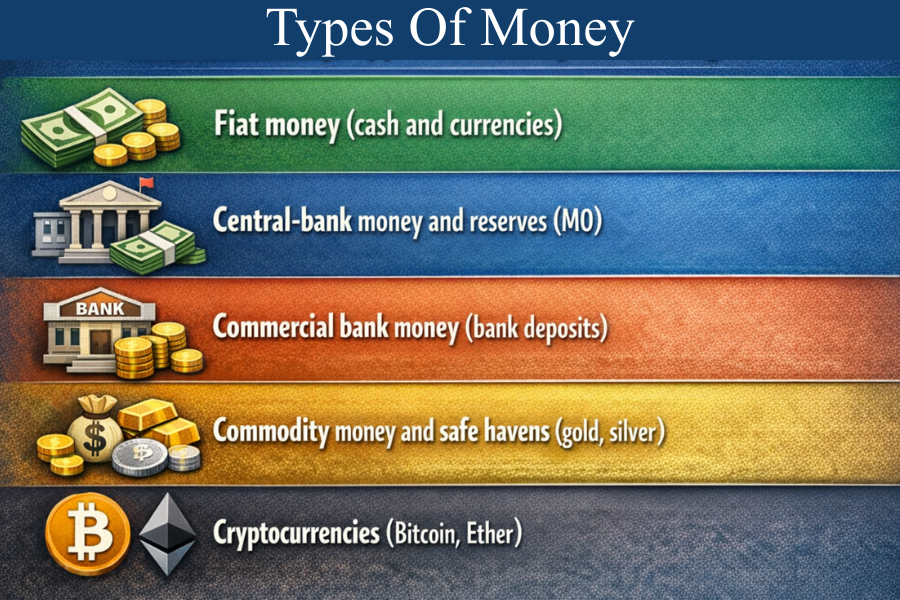

Quick Summary: Types Of Money In Trading

Fiat money (cash and currencies)

Central-bank money and reserves (M0)

Commercial bank money (bank deposits)

Commodity money and safe havens (gold, silver)

Cryptocurrencies (Bitcoin, Ether)

Types of Money Every Trader Should Know

1) Cash / Currency (Fiat Money)

Fiat money is government-issued legal tender such as USD, EUR, or JPY, backed by trust in the issuing authority rather than a physical asset. For traders, fiat currency forms the basis of pricing, settlement, margin, and profit calculation across financial markets.

Exchange-rate movements, interest-rate differentials, inflation, and central-bank policy directly influence fiat value, making it essential for forex trading, funding strategies, and cross-asset risk management.

2) Central-Bank Money / Reserves (M0)

Central-bank money consists of physical currency in circulation and reserves held by commercial banks at the central bank. Although traders rarely interact with it directly, it determines system-wide liquidity and short-term interest rates.

Changes in M0 through tools such as rate decisions, quantitative easing, or liquidity facilities influence funding costs, bond yields, currency flows, and overall risk appetite, making it critical for macro, fixed-income, and FX traders.

3) Bank Deposits / Commercial Bank Money (Inside Money)

Commercial bank money refers to deposits created through lending and credit expansion, which make up the majority of money used in the real economy.

For traders, this is the money held in bank and brokerage accounts, used as trading capital and margin. Understanding inside money is important because it carries counterparty and banking-system risk, and its expansion or contraction affects credit conditions, market liquidity, and asset-price cycles.

4) Commodity Money & Safe-Havens (Gold, Silver)

Commodity money refers to assets with intrinsic value that historically functioned as money, with gold and silver now primarily serving as stores of value and safe-haven assets. Traders monitor these markets closely because they often respond to real interest rates, inflation expectations, currency debasement, and geopolitical risk.

Gold, in particular, is widely used as a hedge against fiat currency weakness and financial instability.

5) Cryptocurrencies (Native Digital Money - e.g., Bitcoin, Ether)

Cryptocurrencies are decentralized digital assets that operate independently of central banks and governments, secured by blockchain technology. For traders, they represent a new form of money characterized by high volatility, 24/7 trading, and unique risks related to custody, regulation, and network integrity.

Understanding cryptocurrencies is important not only for direct trading opportunities but also for interpreting market sentiment, speculative cycles, and alternative monetary systems outside traditional finance.

Which Type of Money Matters Most for Different Trading Style

Different trading styles interact with money in different ways. While all traders rely on fiat currency and banking systems, the type of money that matters most depends on time horizon, leverage, and risk exposure.

Day traders are most sensitive to liquidity and settlement. Tight spreads, deep order books, and fast execution matter more than long-term monetary trends. For short holding periods, the ability to enter and exit efficiently, without slippage or settlement delays, is critical. Market liquidity, trading hours, and transaction costs are therefore the primary money-related factors.

Swing traders are more affected by monetary policy and funding costs. Holding positions for days or weeks exposes them to interest-rate expectations, central-bank decisions, and rollover or financing charges. Changes in liquidity conditions, rate differentials, and risk sentiment can significantly influence price direction over these timeframes.

Long-term investors focus most on store of value and credit cycles. Inflation, currency debasement, and long-term monetary expansion shape real returns over months or years. This is why assets such as gold, strong fiat currencies, and, increasingly, alternative monetary systems are monitored closely.

By matching your trading style with the type of money that drives your risk and returns, you can filter out noise, interpret market movements more accurately, and make better-informed trading decisions.

Trader Tips: What to Watch

Liquidity & Trading Hours: Fiat markets operate within sessions, while crypto trades 24/7.

Counterparty Risk: Bank deposits, money-market funds, and stablecoins depend on issuer stability.

Settlement Risk: Cross-border FX settlements differ from on-chain crypto transfers.

Monetary Policy & Money Supply: Central-bank decisions influence rates, currencies, and risk assets.

Funding Costs: Repo rates, overnight indices, and borrowing spreads affect leveraged trades.

Safe-Haven Flows: Monitor real rates and geopolitical risk for USD, JPY, CHF, and gold moves.

The Future of Money and What It Means for Traders

The form of money continues to evolve as technology, regulation, and market infrastructure advance. While the core functions of money remain unchanged, how money is issued, transferred, and regulated is shifting, with direct implications for traders across asset classes.

Central Bank Digital Currencies (CBDCs) represent a digital form of sovereign money issued by central banks. For traders, CBDCs could improve settlement efficiency, reduce counterparty risk, and enhance transparency in payment systems.

At the same time, wider adoption may give central banks greater visibility and control over money flows, influencing liquidity conditions, capital movement, and monetary transmission mechanisms.

Regulation of digital money will play a decisive role in shaping future market structure. As governments clarify rules around cryptocurrencies, stablecoins, and digital payment systems, traders should expect changes in market access, leverage availability, reporting requirements, and counterparty standards.

For traders, the future of money is less about speculation on new forms and more about understanding how infrastructure, regulation, and liquidity dynamics are evolving.

Frequently Asked Questions (FAQ)

1. What is the difference between money and currency?

Money is a broad concept that includes any medium used to store value, measure prices, and facilitate exchange. Currency is a specific form of money, usually issued by a government, that is used as legal tender in everyday transactions.

2. Why do traders need to understand different types of money?

Different types of money behave differently under economic stress, policy changes, and shifts in market confidence. Understanding these differences helps traders interpret price movements, liquidity conditions, and risk more accurately.

3. How does monetary policy affect financial markets?

Monetary policy influences interest rates, liquidity, and credit conditions in the economy. Changes in policy can directly affect currency values, asset prices, and market volatility across forex, equities, and commodities.

4. Why is fiat money sensitive to confidence and trust?

Fiat money is not backed by a physical commodity, so its value depends on trust in the issuing authority and economic stability. Loss of confidence can lead to inflation, currency depreciation, or capital outflows.

5. Why is gold often considered a hedge in financial markets?

Gold has intrinsic value and limited supply, which helps preserve purchasing power over long periods. It is often used by traders and investors to manage risk during inflationary periods or market uncertainty.

6. How does commercial bank money impact market liquidity?

Commercial bank money is created through lending and credit expansion, which increases the amount of money circulating in the economy. When credit expands, liquidity rises, while tighter lending conditions can reduce market activity.

7. Is digital money changing how markets function?

Digital money has increased the speed, efficiency, and scale of financial transactions. While the form has evolved, the underlying principles of trust, liquidity, and value transfer remain central to how markets operate.

Final Thoughts

Understanding the evolution and types of money helps traders grasp how value is transferred, why currencies fluctuate, and how central banks influence financial markets.

Fiat currencies are driven by policy and confidence, while commodity money such as gold often acts as a hedge during economic uncertainty. Commercial bank money underpins most modern transactions, and cryptocurrencies represent an emerging alternative monetary system.

For traders, this knowledge is not just theoretical. It supports better market interpretation, stronger risk management, and more informed decisions across different trading environments and asset classes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.