Apple reports fiscal Q1 2026 results after the U.S. market close today, with the company's conference call scheduled for 2:00 p.m. PT / 5:00 p.m. ET.

This quarter focuses on the holiday season, typically Apple's largest quarter of the year. If Apple earnings beat expectations but guidance sounds cautious, the stock can still fall.

If Apple misses by a small amount but the outlook is strong, AAPL stock can rise. This is why earnings day is less about one number and more about the complete story Apple tells in the results and on the call.

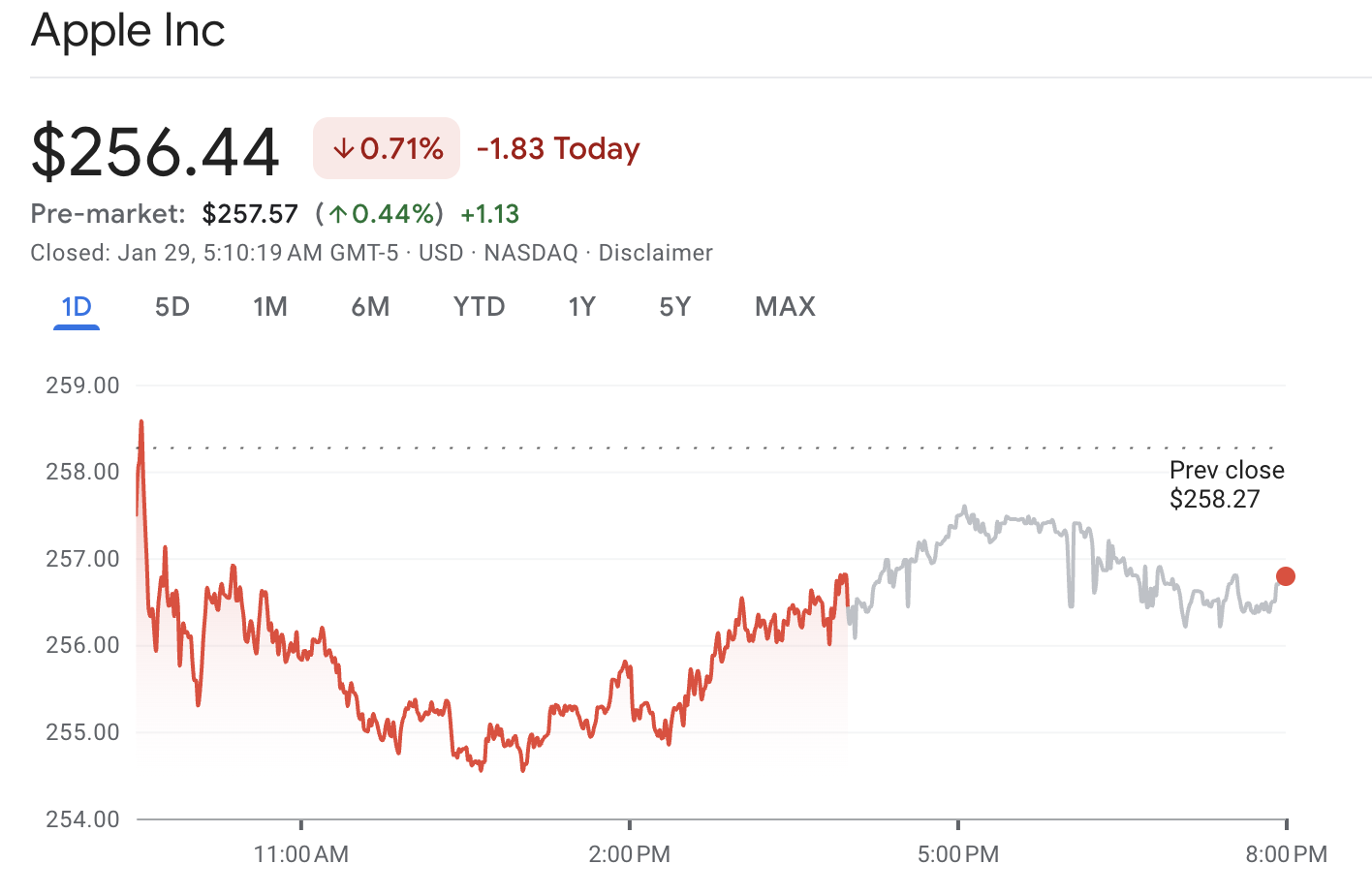

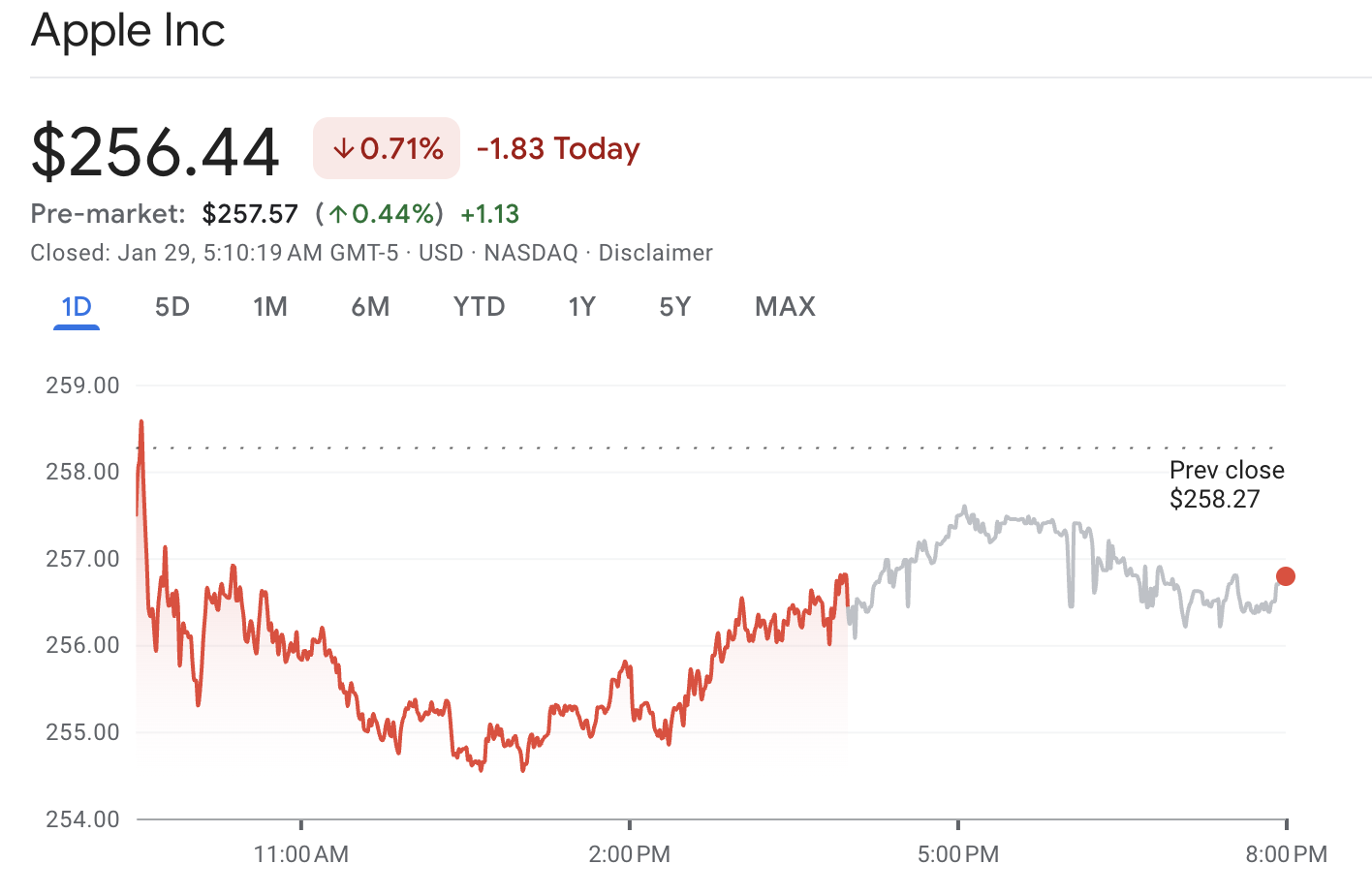

As of the latest trading update available, Apple shares were around $256. Options markets are pricing roughly a ±4% post-earnings move, which makes guidance language almost as important as the headline beat or miss.

Why This Apple Earnings Print Feels Bigger Than Usual?

AAPL is not entering this quarter as an under-owned turnaround story. It is entering as a megacap that is still priced for consistency, while investors debate whether the next leg higher needs a fresh catalyst.

For context, Apple just finished fiscal 2025 with record scale. In fiscal Q4 2025, Apple announced total net sales of $102.466 billion, which comprised $28.750 billion from Services and $49.025 billion from iPhone.

Those numbers set a high bar for the holiday quarter that follows.

This is also a period when investor narratives can shift. Right now, three themes dominate:

1. The Holiday Quarter Is the Scoreboard Quarter

This is typically the largest revenue quarter, so any iPhone surprise tends to dominate the first reaction.

2. Margins Are Being Treated Like a Stress Test

Memory component inflation poses a risk to gross margins, even if unit demand remains strong.

3. AI Narrative Risk Is Real

Investors are watching for credible progress on "Apple Intelligence" and for practical steps to improve Siri, including partnership speculation that has shown up in recent reporting.

The Market's Baseline Expectations for Apple Earnings FY Q1 2026

| Metric (Fiscal Q1 2026) |

Market expectation |

Year-ago comparison (fiscal Q1) |

What traders usually want to see |

| Revenue |

~$138.4B |

~$124.3B |

Clear beat, or strong forward tone |

| EPS (adjusted) |

~$2.67 |

~$2.40 |

Beat plus stable margins |

| Options-implied move |

~4% up or down |

N/A |

Move smaller than priced can fade fast |

Above is a clean snapshot of what many investors are anchored to going into the release.

Key Takeaway:

Analysts predict unprecedented revenue and double-digit growth in the first fiscal quarter relative to the previous year.

When expectations already imply a record quarter, the bar is not "good." The bar is "good, and better than what was already priced in."

The 6 Results Most Likely to Move AAPL Stock Next

1) iPhone Revenue Strength, Especially Outside the U.S.

Apple's biggest product line remains the iPhone. In fiscal Q4 2025, iPhone net sales amounted to $49.025 billion.

The holiday quarter typically benefits from new-model availability and seasonal promotions, so investors will judge whether demand held up through late November and December.

What Tends to Move AAPL Stock:

A clear sign of stronger-than-expected iPhone revenue or better geographic mix.

Comments on upgrade rates and supply conditions.

Any signal that demand was pulled forward or weakened late in the quarter.

What Traders Listen for on the Call:

Management's regional read-through, especially on China, and the pace of promotions.

2) Services: The Profit Engine Investors Trust Most

Services revenue in fiscal Q4 2025 was $28.750B, and full-year fiscal 2025 Services net sales were $109.158B. Services are closely monitored because they tend to be more stable than hardware cycles, as they enhance profit margins.

Additionally, services have become a much larger share of Apple's overall revenue and profit, while legal and regulatory pressures have increased. That backdrop matters because earnings calls often reveal how confident Apple is in defending its business model.

What Investors Look For:

Service growth is consistent and widespread.

Evidence that Services is not slowing, just as the market is paying a premium for stability.

3) Apple's Greater China Sales

Apple's Greater China net sales in fiscal Q4 2025 were $14.493B, down from $15.033B in the same quarter a year earlier. The direction of China's demand can drive sentiment far beyond its share of revenue because it affects expectations for future growth.

What Matters Tonight:

4) Margins: The Quiet Killer

Even if Apple meets its revenue targets, the stock price can still decline if the margins fall short of expectations. Traders are closely monitoring cost pressures, particularly concerns raised in pre-earnings reports about component costs and potential impacts on margins.

In Apple's fiscal Q4 2025, total net revenues hit $102.466 billion, whereas gross margin revenue totaled $48.341 billion. This indicates a gross margin of approximately 47% when these figures are compared.

The market will focus on whether the holiday quarter maintained a healthy margin profile amid rising volumes.

5) Guidance and Tone

Apple's management has previously signalled confidence in holiday-quarter growth. For example, the prior-quarter report mentioned strong revenue growth expectations for the December quarter.

For this release, traders typically care about:

How Apple frames demand into the March quarter.

Whether Apple signals steady pricing, increased promotion intensity, or changes in the mix.

The confidence level in the language used on the call.

6) AI Strategy: Investors Want Clarity, Not Slogans

A growing number of investors are focusing on Apple's AI roadmap and its potential impact on device sales and the ecosystem in the coming year.

If Apple offers more detail on AI features, rollout timing, and how it fits into products and Services, that can shift valuation views quickly.

How Much Could AAPL Stock Move After Earnings?

Options pricing ahead of the report implies a move of roughly ±4%.

From around $256, that implies a rough "earnings range" of approximately:

Upside: near $266.

Downside: near $247.

That does not predict direction, but it sets expectations for volatility and helps explain why post-earnings reactions can look dramatic.

AAPL Stock Technical Analysis: The Levels Traders Are Watching

| Indicator |

Latest reading |

What it suggests into earnings |

| RSI (14) |

45.479 |

Momentum is neutral-to-soft, which can leave the stock reactive to guidance tone. |

| MACD (12,26) |

-0.810 |

Trend momentum is slightly negative, so a bullish surprise may need follow-through to flip it. |

| MA (5) |

256.27 |

Price is near the 5-day area, so the stock is not stretched into the print. |

| MA (20) |

261.47 |

This zone can act as a nearby “decision area” if the reaction is positive. |

| MA (50) |

264.54 |

This is a common re-rating level if guidance convinces longer-horizon buyers. |

| MA (200) |

240.49 |

This is a longer-term support reference if the earnings reaction turns risk-off. |

AAPL is sitting in a zone where short-term trend signals look mixed, which tends to amplify the importance of earnings direction.

Key Takeaway

If results are strong and AAPL reclaims levels above major moving averages, trend traders often become more active.

If results disappoint and price breaks below well-watched support areas, the sell-off can feed on itself for a few sessions.

How Apple Earnings Can Spill Into Broader Markets

AAPL is large enough that its earnings can influence broader U.S. equity sentiment, especially in tech-heavy indices.

When sentiment shifts, it can also be reflected in currency markets through changes in risk appetite. In practical terms:

A strong report can lift risk sentiment, which sometimes supports higher-beta currencies.

A weak report can push investors toward safety, which can support the U.S. dollar and defensive FX pairs.

Frequently Asked Questions

1. Is the Apple Earnings Report Today?

Yes. Apple is scheduled to report fiscal Q1 2026 results after the market close today, with the earnings call at 2:00 p.m. PT / 5:00 p.m. ET.

2. What Are Analysts Expecting From Apple Earnings?

Estimates typically indicate around $138 billion in revenue and approximately $2.67 in earnings per share for fiscal Q1 2026.

3. How Much Could AAPL Stock Move After Earnings?

Options pricing implies roughly a ±4% move. From around $256, that points to a rough range near $266 on the upside and $247 on the downside,

Conclusion

In conclusion, Apple's earnings today are not just a check on holiday sales. They are a test of whether iPhone demand, Services momentum, and margins can stay firm at a time when investors also want a more precise AI roadmap.

If management delivers strong performance in the holiday quarter while providing steady guidance for the March quarter and demonstrating clearer advancements in AI, the stock can quickly regain control of the narrative.

If guidance is cautious or margin commentary feels open-ended, the market can reprice the next quarter's slope and compress the multiple, even if the headline numbers look fine.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.