Nancy Pelosi, the former Speaker of the House, has long been a focal point in discussions about congressional stock trading.

As of October 2025, Nancy Pelosi’s estimated net worth stands at around $255 million, according to the latest public disclosure data and portfolio estimates from watchdog trackers such as Quiver Quantitative and Capitol Trades.

Roughly $120 million of that total is reported to be in publicly traded equities and options positions, concentrated in large-cap technology and AI-related firms.

In late 2025, market watchers still debate: Should you follow Nancy Pelosi's stock picks? This article delves into her recent trades, their performance, and implications for investors.

Understanding Nancy Pelosi's Recent Investment Activities

| Company / Ticker |

Type of Trade |

Strike Price (USD) |

Current Price (Oct 31, 2025) |

Approx. Intrinsic Value (USD) |

Notes |

| Tempus AI (NASDAQ: TEM) |

50 Call Options Purchased |

$20 |

$43.23 |

≈ $116,150 |

Stock surged post-disclosure |

| Vistra Corp (NYSE: VST) |

50 Call Options Purchased |

$50 |

$112.63 |

≈ $313,150 |

Exceptional performance |

| Amazon (NASDAQ: AMZN) |

50 Call Options Purchased |

$150 |

$173.18 |

≈ $115,900 |

Strong gains |

| Alphabet Inc. (NASDAQ: GOOGL) |

50 Call Options Purchased |

$150 |

≈ $150 |

≈ $0 |

Around strike price |

| NVIDIA (NASDAQ: NVDA) |

50 Call Options Purchased |

$80 |

$98.89 |

≈ $94,450 |

Profitable |

| Broadcom Inc. (NASDAQ: AVGO) |

200 Call Options Exercised (≈ 20k shares) |

$80 |

— |

$1M–$5M (disclosed) |

Major mid-year trade |

Throughout the year 2025, Paul Pelosi had made several notable trades. Due to her influential position in Congress, Nancy Pelosi's investment activities are closely monitored.

While she has stated that she does not personally engage in stock trading, her husband, Paul Pelosi, has made numerous publicly disclosed trades, as required by the STOCK Act.

These disclosures have led to platforms like Quiver Quantitative and Capitol Trades, which track and analyse congressional trading activities.

The Impact of Pelosi's Trades on Stock Performance

Paul Pelosi's disclosed trades often increased interest and trading volumes in the associated stocks. For instance, after the Tempus AI trade became public, the stock experienced a significant surge, part of the "Pelosi effect." This phenomenon underscores the influence that prominent figures can have on market dynamics.

However, it's essential to note that while some trades have yielded substantial returns, others have underperformed or remained flat. For example, the Alphabet options have not seen significant gains, highlighting the inherent risks of following such trades unknowingly.

Ethical Considerations and Legislative Responses

The trading activities of members of Congress and their families have sparked debates about potential conflicts of interest and the need for stricter regulations.

Critics argue that access to non-public information could provide unfair advantages in the stock market. In response, bipartisan efforts have emerged to address these concerns.

One notable initiative is the reintroduction of the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act by Senator Josh Hawley in early 2025. This legislation aims to prohibit members of Congress and their immediate families from owning or trading individual stocks.

While Nancy Pelosi has faced scrutiny over her husband's trades, she has maintained that she does not engage in stock trading and supports transparency measures.

Should You Follow Nancy Pelosi Stocks?

Pelosi's investment approach has shown a strong focus on the technology sector, particularly companies involved in artificial intelligence and semiconductors. Her timely trades in companies like Nvidia, Amazon, and Alphabet have capitalised on market trends and technological advancements.

Historical Performance Overview

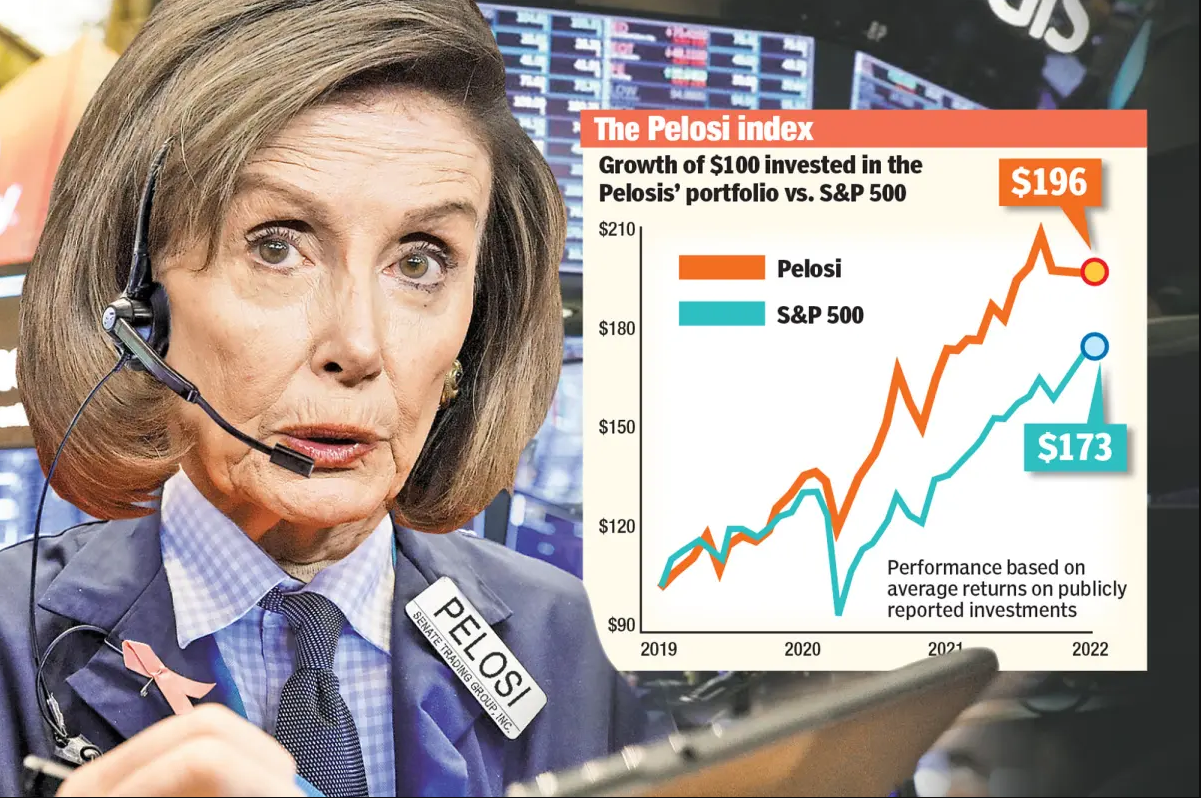

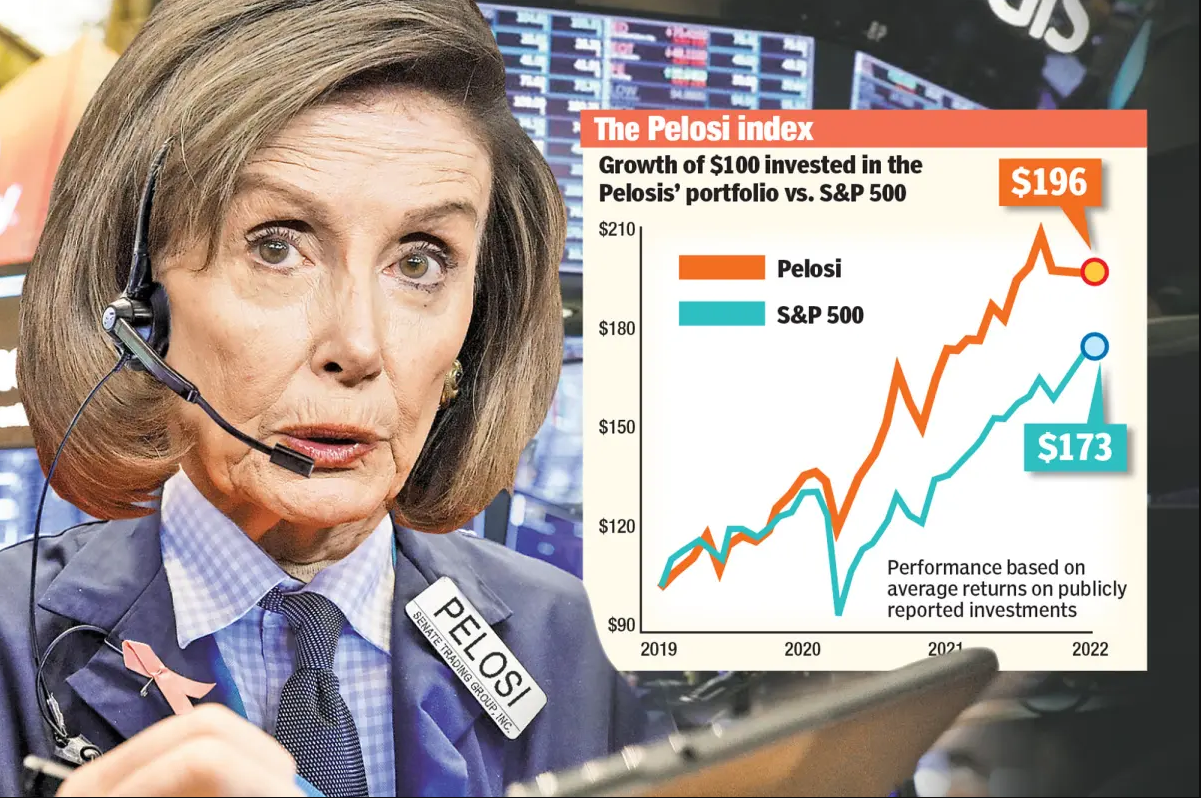

2014–2025: According to Quiver Quantitative, a strategy emulating Pelosi's trades since May 2014 has yielded returns exceeding 700%, significantly outpacing the S&P 500's approximate 230% gain during the same period.

2024: Pelosi's portfolio achieved remarkable returns, with reports indicating gains of 54% and even up to 92.53% by mid-October. These returns were driven by strategic investments in technology stocks, notably Nvidia (NVDA), which saw substantial appreciation.

2025: An early-year position in Tempus AI (NASDAQ: TEM) has been one of the most notable trades. Since disclosure, the stock has surged substantially, marking a gain of roughly 20% on a comparable $1,000 position within the first few weeks and retaining positive momentum through October 2025.

Considerations and Risks

While Pelosi's trading history has been notably successful, it's essential to recognise the inherent risks in following any individual's investment strategy.

Factors to consider include:

Transparency and Timeliness: While congressional trades are disclosed, there is often a delay between the transaction and public reporting, which can affect the potential for replicating gains.

Market Influence: The "Pelosi effect" can lead to short-term stock surges following disclosures, but these may not be sustainable in the long term.

Risk Tolerance: Investing in options, as seen in many of Paul Pelosi's trades, carries higher risk and may not align with all investors' strategies.

Ethical Implications: Some investors may have reservations about profiting from trades under scrutiny.

All in all, while analysing the trades of influential figures can provide insights, it's crucial to conduct independent research and consider personal investment goals and risk tolerance.

FAQ: Nancy Pelosi Stocks (as of October 2025)

1. Who trades the stocks?

Paul Pelosi, Nancy Pelosi’s husband, handles all trades under the STOCK Act.

2. What’s her net worth now?

Around $255 million, with about $120 million in publicly traded tech and AI stocks.

3. Why are her trades followed?

Because of her political influence and consistent market success in tech-heavy investments.

Conclusion

In conclusion, Nancy Pelosi’s stock-market activities, largely executed by her husband, Paul Pelosi remain a focal point of public and media scrutiny in 2025.

Some of their disclosed trades, particularly in technology and AI sectors, have delivered strong gains, while others have produced more modest results in line with broader market fluctuations.

For individual investors, the enduring lesson is clear: thorough research, risk awareness, and alignment with one’s own financial goals should guide investment choices, not the trading activity of public figures, regardless of visibility or past performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.