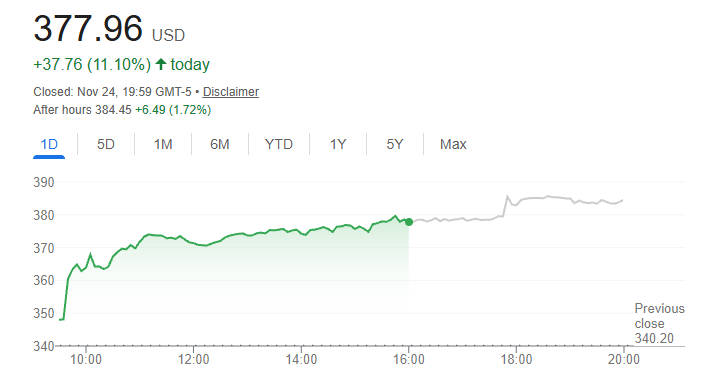

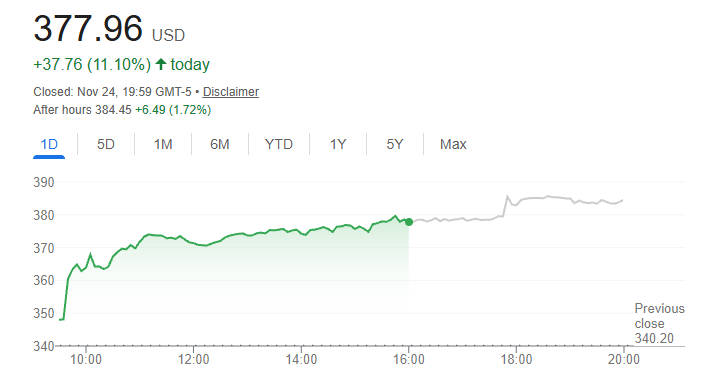

Broadcom (AVGO) spiked roughly 11% in the latest session as investors cheered renewed AI spending and favourable guidance. The move reflects both concrete business wins in AI infrastructure and broader risk-on sentiment, but it also raises valuation and execution questions.

The rally can continue if AVGO's AI revenue and margins hold up, yet macro, legal and technical risks could still prompt a pull-back.

The Key Catalysts Behind Broadcom's Strong Momentum

1. AI demand and hyperscaler wins

Analysts and market reports point to stronger-than-expected AI infrastructure spending, where Broadcom supplies key network-switching silicon and custom AI infrastructure components. Reuters and other outlets have highlighted Broadcom's rising AI revenue and large scale orders from hyperscalers that materially improve near-term growth visibility.

2. Upbeat outlook and earnings calendar

Broadcom announced its fiscal Q4 / FY2025 results timing and the investor community is expecting robust guidance for fiscal 2026. which has previously fed bullish re-ratings in AVGO. The company has formally scheduled its next quarterly results and conference call for 11 December 2025. a near-term event that could validate the recent optimism if guidance is strong.[1]

3. Momentum and technical squeeze

After a period of consolidation, once positive news or footprint wins surface, the stock can attract short-covering and momentum flows that amplify moves. Several market commentaries noted that the jump reflected both fundamental news and technical buying from funds rotating back into semiconductors.

4. Assessment of durability

AI contracts and hyperscaler capex are durable sources of revenue, but they must convert into repeatable quarterly figures and expanding margins. A one-time trade win is helpful, yet the market will require sustained evidence in quarterly statements for a long-term re-rating.

AI Infrastructure Demand: The Core Engine of Broadcom's Growth

| Metric |

Latest / recent figure |

Why it matters |

| Recent AI revenue trajectory |

AI revenue has been reported to rise strongly in 2025, with double-digit growth across quarters. |

Confirms Broadcom's exposure to the fastest growing segment in semiconductors. |

| Market cap (approx.) |

~US$1.6 trillion (varies with price). |

Size means AVGO moves the market and expectations are significant. |

| Next earnings date |

11 December 2025 (Q4 FY2025 results). |

Near-term catalyst; guidance can validate or undo the rally. |

| Recent P/E (TTM) |

~96.6 (market snapshot). |

High multiple indicates stretched expectations; leaves less room for error. |

Broadcom's exposure to AI and hyperscaler capex is a clear structural tailwind. Reuters and analyst pieces point to large AI orders and a sizeable increase in AI revenue in 2025. which supports the bullish case.

However, valuation metrics show the market has priced in a large portion of future growth already. That matters: a single quarter of weaker guidance, or a small execution hiccup, is sufficient to trigger a correction because multiples are elevated.

For investors, the key question is not whether Broadcom participates in AI growth, but whether revenue growth and margins accelerate enough to justify the current price.

How Custom Accelerators Strengthen Broadcom's Competitive Position

Broadcom isn't just a chip vendor. It also helps hyperscalers design custom XPU (AI-accelerator) architectures, which gives it a unique value proposition.

These custom chips can deliver highly optimised performance for training and inference, often outperforming generic GPUs in targeted workloads.

In addition, Broadcom's networking products, including high speed Tomahawk Ultra and Jericho switches, are tailored for high throughput AI infused data centre fabrics.

Together, these capabilities allow Broadcom to compete with giants like Nvidia, particularly in niche but high-value AI infrastructure segments.

VMware Integration: A New Chapter for Software Revenue

Broadcom's acquisition of VMware is now paying dividends: its software business is expanding, contributing recurring revenue and improving margin mix.

Infrastructure-software revenue has grown strongly and adds a layer of stability to Broadcom's otherwise cyclical hardware business.

However, Broadcom faces legal risk: Fidelity recently sued the company, alleging it is threatening to cut off access to legacy VMware software, potentially disrupting critical systems.

Beyond the lawsuit, regulatory challenges are also mounting: European cloud providers have appealed Broadcom’s VMware buyout, citing unfair licensing practices.

Nonetheless, successful integration of VMware could transform Broadcom into a more balanced, hybrid hardware-software company.

Financial Performance: Revenue, Margins and Cash Flow Trends

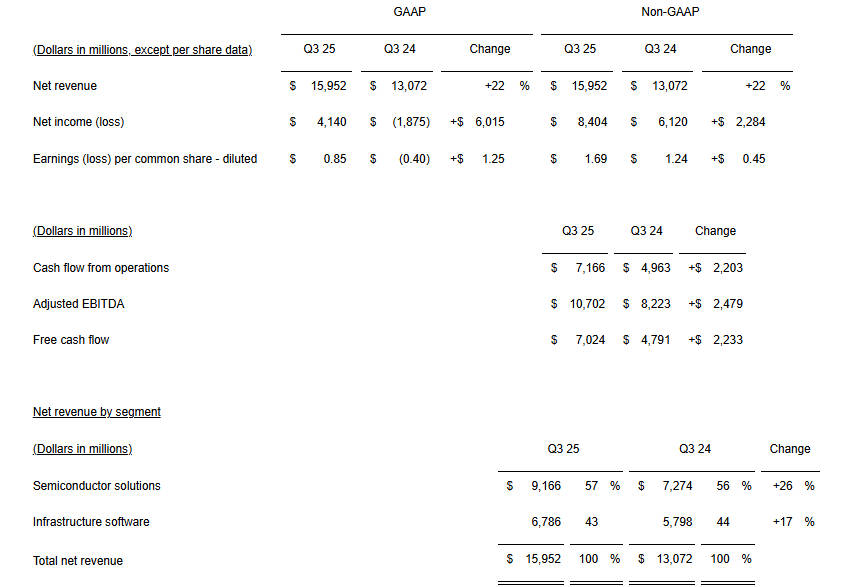

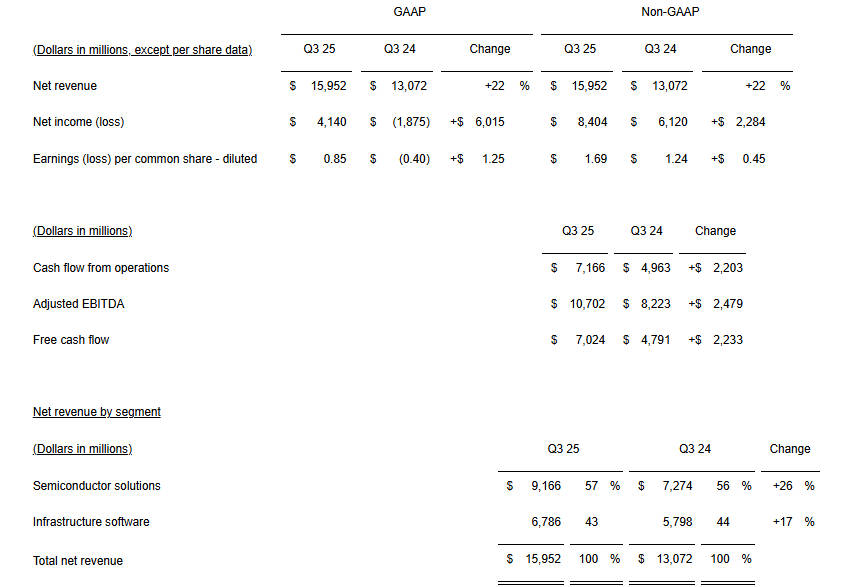

Broadcom's Q3 FY2025 results showcased its strength:

Revenue: US$ 15.95 billion, up 22% YoY.

AI Revenue: US$ 5.2 billion (63% YoY growth).

Free Cash Flow: US$ 7.0 billion in the quarter, up ~47% YoY.

Shareholder return: Broadcom returned US$ 2.8 billion via dividend (~US$0.59/share).

Additionally, the company's newly announced US$10 billion share repurchase authorisation underscores its confidence in cash generation.

Overall, Broadcom's financials reflect a powerful dual-engine model: hardware growth fuelled by AI, complemented by recurring software cash flows.

Broadcom's Valuation After the Rally: Still Room to Rise?

After the surge, Broadcom's valuation metrics are elevated. Some analysts now target US$420–US$480 for AVGO, assuming continued AI backlog growth.

TradingNews projects fiscal 2026 AI revenues could hit US$30–32 billion, a steep ramp from current levels.

That said, its current P/E multiples appear rich compared to traditional chip names.

For the rally to sustain, Broadcom needs to execute on its AI roadmap, deliver on hyperscaler orders, and justify the elevated valuation through both top-line growth and margin expansion.

Technical Outlook: Key Levels to Watch in AVGO Stock

From a technical standpoint, AVGO's breakout signals a shift in sentiment: the 11% surge likely cleared major resistance and put key eyes on new levels.

Key technical support is in the low 330s, with more aggressive support around US$320–330.

Resistance lies in the US$355–360 area, and a decisive break there could trigger higher targets.

Momentum indicators (RSI ~44–46. MACD-) suggest the stock is not yet overheated, offering room for more move — but trend strength (ADX) is modest, so continuation depends on fresh catalysts.

Volatility remains elevated (ATR ~13.6), so risk-aware traders should shape entries and exits with discipline.

Traders might wait for a pullback to support for a better entry; longer-term investors should watch for consolidation and confirmation of Broadcom's AI narrative.

Risks That Could Slow Broadcom's Uptrend

Even with a strong bull case, there are several immediate and medium-term risks:

1. Execution and cadence risk

AI deals with hyperscalers frequently involve long lead times and custom engineering. If revenue recognition or delivery slips, sequential quarters can surprise to the downside.

2. Legal and commercial overhang

Recent reports indicate litigation and large customer disputes involving Broadcom (for example the Fidelity-VMware litigation and other contractual disputes). Such issues can create uncertainty or distract management and have operational impact if access to software or services is constrained.

3. Macro and rates

A quick shift in the macro environment — higher-than-expected inflation or renewed Fed hawkishness — can reduce risk appetite for high-multiple technology names and prompt rotations away from AVGO.

4. Semiconductor cyclicality and inventory risk

The industry is cyclical; if hyperscalers pause or slow CapEx plans, inventory builds across the supply chain can compress near-term orders.

5. Valuation risk

Elevated multiples imply that positive news is already priced in; a modest miss in guidance or strength from competitors could trigger swift profit-taking.

The upside is real but so are the downside catalysts. Investors should weigh conviction in Broadcom's multi-quarter AI revenue delivery against these identifiable risks.

Long-Term Investment View: Can Broadcom Sustain Its Leadership?

Broadcom is not just riding a temporary AI wave. It seems to be building a multi-dimensional business:

Its custom AI-accelerator business gives it a structural edge with hyperscalers.

Its networking portfolio (Tomahawk, Jericho) aligns with long-term data centre traffic growth.

VMware integration provides recurring software revenue and reduces reliance on cyclical chip sales.

The buyback programme and strong cash flow support shareholder returns.

If Broadcom can execute on all these fronts, it could sustain its leadership in the AI infrastructure build-out. That said, investors should maintain a balanced stance: reward on strength but remain attentive to execution, legal overhang, and macro variability.

Frequently Asked Questions

1. Is Broadcom a good long-term investment?

Broadcom is often viewed as a strong long-term investment due to its diversified revenue, strategic acquisitions, and expanding AI, networking, and software segments. Its consistent cash flow and dividend growth appeal to investors seeking stability and long-duration exposure.

2. What are the biggest growth drivers for AVGO?

Broadcom's growth is driven by rising demand for custom AI accelerators, high-end networking chips, enterprise software expansion, and strong relationships with major hyperscalers. Continued integration of VMware strengthens recurring revenue and enhances the company's long-term competitive advantage.

3. What risks should investors consider with AVGO?

Key risks include customer concentration, integration challenges related to large acquisitions, regulatory scrutiny, and cyclicality in semiconductor demand. Any slowdown in hyperscaler spending or delays in AI infrastructure growth could temporarily affect revenue visibility and valuation.

4. Why is Broadcom important in the AI hardware cycle?

Broadcom designs custom accelerators and advanced networking solutions essential for large AI training clusters. Its close partnerships with hyperscalers allow it to capture high-margin, high-volume orders, positioning the company as a vital supplier in the global AI supply chain.

5. How has Broadcom's VMware acquisition changed the business?

The VMware acquisition significantly increased Broadcom's software revenue, improved margins, and created recurring cash flow streams. It strengthens Broadcom's enterprise ecosystem, although integration changes and subscription transitions have generated short-term customer concerns and mixed market reactions.

Sources:

[1] https://investors.broadcom.com/news-releases/news-release-details/broadcom-inc-announces-third-quarter-fiscal-year-2025-financial

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.