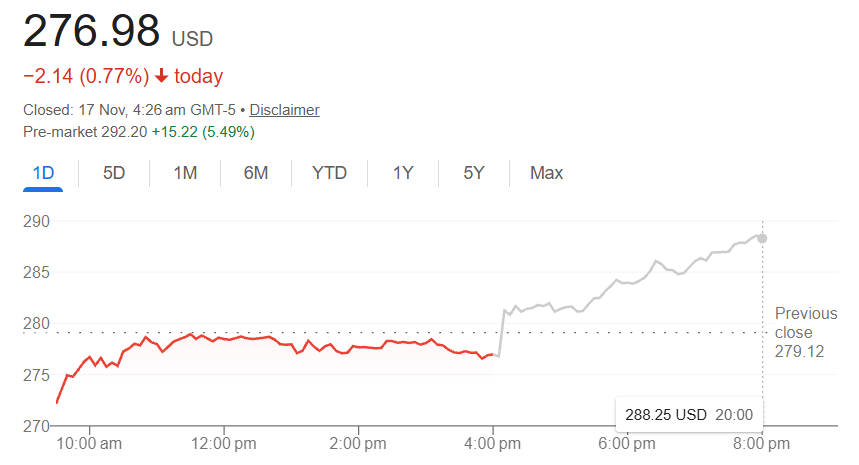

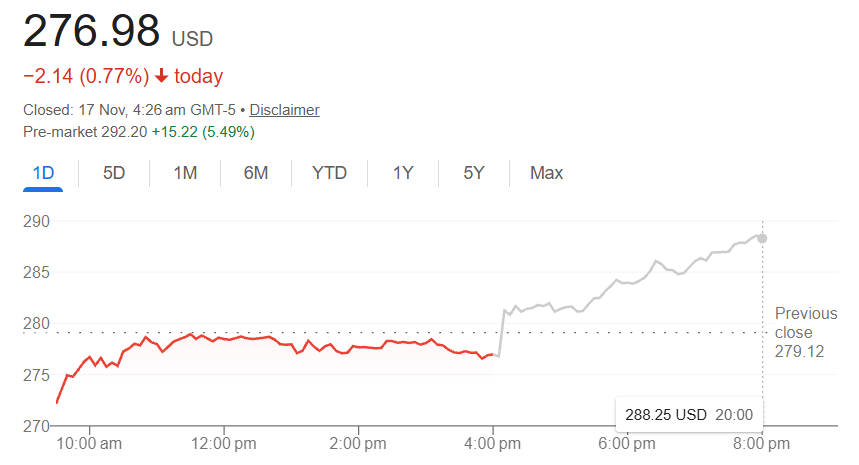

Alphabet shares jumped 5.49 per cent to US$292.20 in early trading following the revelation that Berkshire Hathaway disclosed a US$4.3 billion stake in Alphabet, the parent company of Google. [1]

The sharp move highlights renewed investor confidence in the long-term potential of Google and its associated businesses, particularly in cloud computing and artificial intelligence.

What Triggered Alphabet Shares' Sharp Rally

The rally in Alphabet shares is directly linked to Berkshire Hathaway's regulatory filing, which revealed ownership of 17.85 million Alphabet shares as of 30 September. This is a significant commitment, and Berkshire's US$4.3 billion investment represents a strategic bet in a company it has historically avoided. [2]

Market participants interpreted the move as a strong endorsement. Many investors view Alphabet not only as a mature advertising company through Google but also as a major player in cloud computing, artificial intelligence, and other high-growth areas. [3]

The rally indicates that both retail and institutional investors are reassessing Alphabet's future.

Investor Sentiment: Validation from a Value Legend

When a highly respected value-investing firm such as Berkshire Hathaway steps in, it often signals long-term trust. Key takeaways from the market's reaction include:

Endorsement effect:

Berkshire's investment is perceived as a stamp of approval, lending weight to Alphabet's growth narrative.

Long-term conviction:

The size and nature of the stake suggest this is a structural investment rather than a short-term trade.

Reassessing risk:

Investors may now consider Alphabet's valuation more favourably because of backing by a highly respected investor.

Why Alphabet's Fundamentals Look Even More Compelling

Berkshire Hathaway's disclosure amplifies several already-strong business pillars at Alphabet:

Cloud growth:

Google Cloud continues to expand, with increasing enterprise adoption and a long-term growth trajectory.

AI potential:

Google's infrastructure, data assets, and research position it well to monetise artificial intelligence over the next decade.

Advertising strength:

The core advertising business remains robust, providing cash flows to fund cloud and other strategic projects.

Financial strength:

Alphabet has a strong balance sheet and scale, providing a competitive edge in capital-intensive markets.

These fundamentals, combined with Berkshire's entry, strengthen the investment thesis for Alphabet shares as a growth-oriented, long-term play.

Risks That Could Temper Further Upside

Despite positive momentum, potential headwinds remain for Alphabet shares:

Valuation risk:

At US$292.20. Alphabet may already reflect expectations of continued rapid growth, which could lead to a correction if growth slows.

Regulatory scrutiny:

Alphabet continues to face antitrust and data privacy challenges in multiple jurisdictions.

Execution risk:

Scaling cloud and AI profitably is capital- and execution-intensive, and missteps could hurt margins.

Competition:

Other technology giants are also investing heavily in AI and cloud, and Alphabet must maintain its innovation edge.

Investors should consider these risks while evaluating the recent surge.

What to Watch Next: Key Catalysts for Alphabet Shares

To determine whether this rally marks a new phase for Alphabet shares, investors should monitor the following:

Earnings updates:

Growth in Google Cloud, data-centre spending, and other strategic initiatives.

Capital expenditure guidance:

Alphabet's spending on infrastructure, particularly for AI workloads.

Further institutional activity:

Whether other major investors follow Berkshire Hathaway's lead.

Leadership and strategy:

Any statements or actions by Google or Alphabet management that clarify long-term strategy.

Tracking these themes will help investors assess whether the 5.49 per cent jump is part of a sustained trend or a short-term reaction.

Frequently Asked Questions

Q1: Why did Alphabet shares spike 5.49%?

Alphabet shares rose 5.49 per cent after Berkshire Hathaway disclosed a US$4.3 billion stake in the company. The move is seen as a vote of confidence in Google's and Alphabet's long-term growth potential across cloud and AI.

Q2: How large is Berkshire Hathaway's position in Alphabet?

Berkshire Hathaway owns 17.85 million Alphabet shares as of 30 September, valued at approximately US$4.3 billion. This represents a significant investment from one of the most respected value-focused investors, signalling long-term confidence in Alphabet's prospects.

Q3: Is this a long-term bet on Alphabet?

Yes, many analysts view Berkshire Hathaway's investment as a long-term commitment rather than a short-term trade. It demonstrates confidence in Alphabet's growth areas, particularly Google Cloud, AI development, and other strategic initiatives across the company.

Q4: What are the major risks for Alphabet shares now?

Key risks include potential valuation pressure, regulatory scrutiny across multiple jurisdictions, execution challenges in AI and cloud initiatives, and rising competition from other major technology companies, all of which could impact Alphabet's future share price performance.

Q5: Should investors buy Alphabet shares after this rally?

Investment decisions depend on individual strategy and risk tolerance. Long-term investors may view the surge as a strong endorsement of Alphabet's growth, while short-term traders should consider potential volatility and assess market timing carefully.

Conclusion

The 5.49 per cent jump in Alphabet shares is more than a short-term reaction. It reflects a high-profile institutional endorsement from Berkshire Hathaway, which disclosed a US$4.3 billion stake in Alphabet.

This event may reshape how investors view Google, its subsidiary, as a driver of growth in AI, cloud, and advertising. While risks remain, the rally highlights strong conviction around Alphabet's long-term growth trajectory.

Sources:

[1]https://www.investing.com/news/stock-market-news/berkshire-buys-shares-of-google-parent-alphabet-sells-more-apple-4360598

[2]https://www.reuters.com/business/google-parent-alphabets-shares-rally-after-berkshire-reveals-49-billion-stake-2025-11-17/

[3]https://ts2.tech/en/alphabet-stock-today-nov-17-2025-buffetts-big-bet-meets-antitrust-heat-and-a-40b-ai-gamble/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.