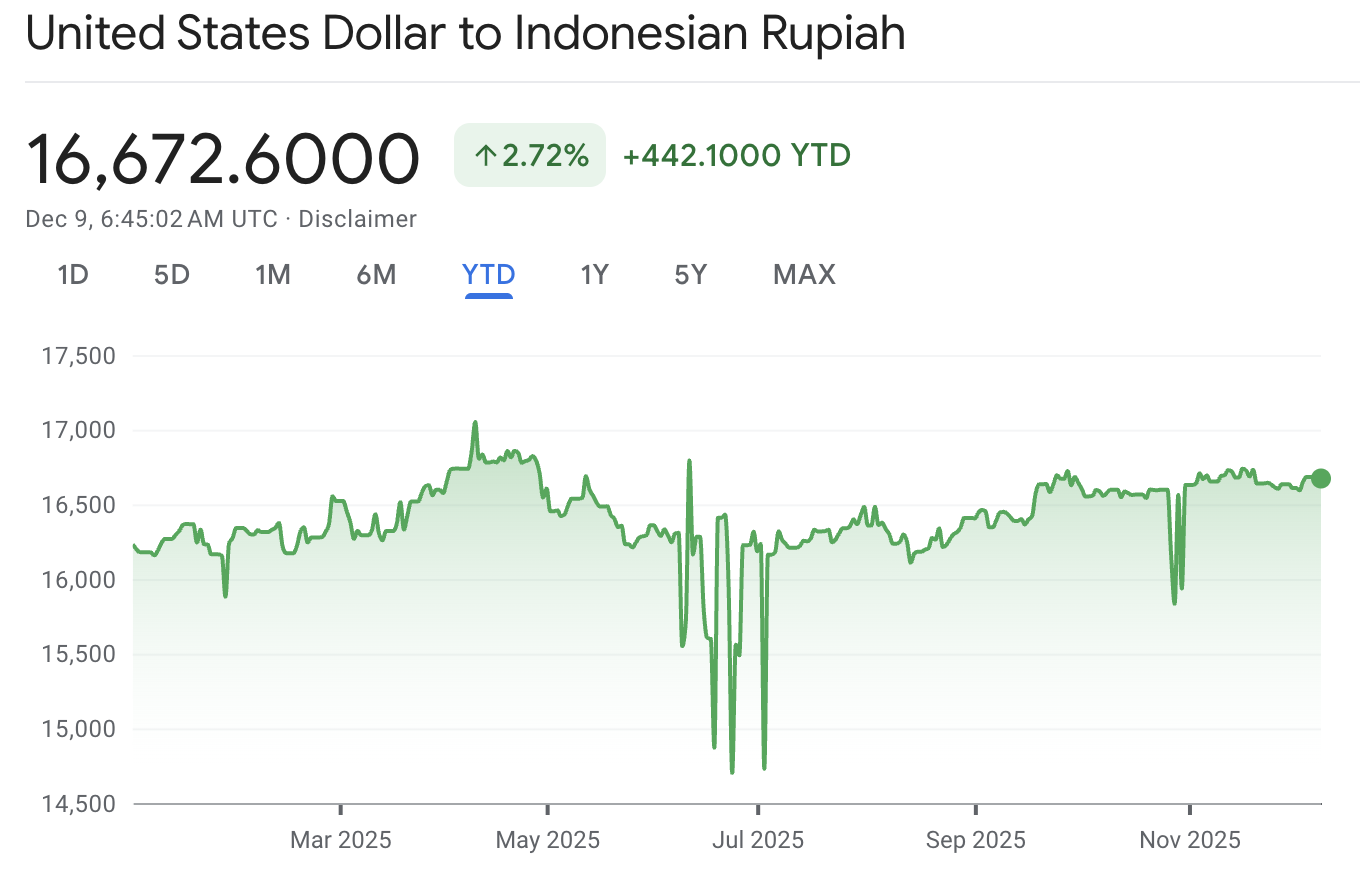

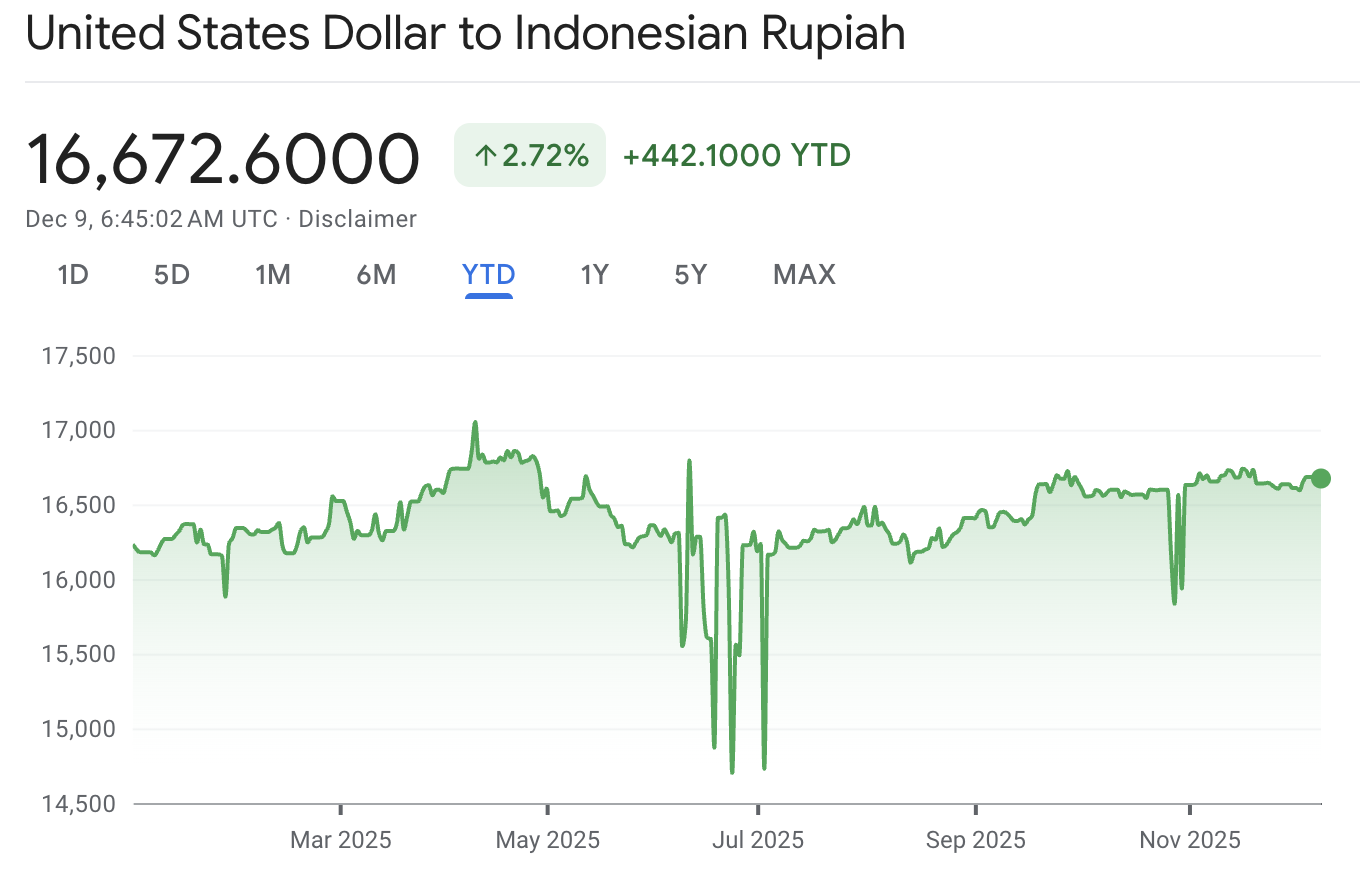

Indonesia's currency is back in the headlines for the wrong reasons. The Rupiah is trading around 16,600–16,700 per US dollar, near its weakest levels since the Asian Financial Crisis in the late 1990s. It makes it Asia's worst-performing major currency in 2025, with a roughly 3–4% drop against the dollar YTD.

From a trader's screen, that looks like a chronically weak currency. But under the surface, it's a mix of long-term scars from 1997–98, structural reliance on foreign capital and imports, and a 2025 policy mix that has emphasised growth and politics ahead of FX strength.

The fundamentals are not 1998-bad, but the market is demanding a chunky risk premium all the same.

How Weak Is the Indonesian Rupiah Right Now?

| Metric |

Latest reading / range |

Why it matters |

| Spot USD/IDR |

~16,680–16,700 |

Close to the weakest levels since the late-1990s crisis. |

| YTD move (2025) |

From ~16,089 to ~16,680 (IDR down ~3–4%) |

Underperforms many Asian peers despite decent macro data. |

| 6-month range |

Roughly 16,110 (Aug low) to 16,750 (Sep high) |

Market has been stuck in a weak but relatively tight band. |

| Historical extremes |

Crisis peaks near 16,800 (1998 and March 2025) |

Current levels are uncomfortably close to those crisis highs. |

| BI “comfort” zone |

BI says it wants rupiah nearer 16,300 per dollar |

Market is trading above where the central bank would like it. |

Spot USD/IDR is around 16,680–16,700 (8–9 December 2025).

At the start of 2025, it was roughly 16,089.

Year-to-date, that's about a 3–4% depreciation against the dollar, making it one of Asia's worst-performing currencies in 2025.

On a longer lens:

In March 2025, USD/IDR traded around 16,640–16,840, its weakest level since the 1998 crisis.

During the Asian Financial Crisis, the Rupiah briefly blew out to ~16,000–16,800 per dollar.

In the COVID-19 shock of March 2020, it weakened to about 16,600–16,625 intraday.

So today's level is not some random move; it is back near crisis-type highs for USD/IDR.

Why Is Indonesia Currency So Weak? Key Factors Explained

1. The Asian Financial Crisis Never Really Left

The Rupiah's modern story starts with the 1997–98 crisis:

Research from central banks and academics shows IDR lost more than 80% of its value in a few months, falling from around 2,400 to 15,000–16,800 per dollar at the peak of the turmoil.

That collapse destroyed bank capital, blew up corporate balance sheets loaded with dollar debt, and toppled the Suharto regime.

Crucially, the Rupiah never went back to its pre-crisis levels. Since then, the currency has lived in a much weaker range and has become one of the lowest-valued units in Asia in nominal terms.

That low starting point makes every new bout of depreciation look dramatic, even when the macro backdrop is very different.

2. Structural Reliance on Imports and Foreign Capital

Several structural features keep a constant downward bias on the Rupiah:

Indonesia relies heavily on imported goods and services, especially fuel and capital goods, which tends to push the current account towards deficit and increases demand for foreign currency.

World Bank shows Indonesia's current account has averaged about -1.3% of GDP over the last decade, with a 0.6% deficit in 2024 and an expected wider gap in 2025 as exports soften and imports rise with domestic stimulus.

A small, persistent current account deficit is not catastrophic, but it means Indonesia needs foreign funding most years. When global investors are happy to provide that funding, the currency behaves. When they get nervous, the Rupiah is one of the first to be punished.

3. External Debt in Foreign Currency

When a country borrows heavily in dollars, every rupiah drop inflates the local-currency value of that debt. That increases concerns about debt servicing and can trigger further capital flight, especially from bond markets.

Recent studies (2025) indicate that prolonged external debt can affect FX reserves more significantly than anticipated, highlighting Indonesia's continued vulnerability to currency fluctuations.

Put simply, the Rupiah carries an "EM crisis" memory. Investors know that if the currency slides too far, it can strain the sovereign and corporate balance sheet. They demand a risk premium, which feeds back into the exchange rate.

4. Politics and Fiscal Worries

In 2025, the Rupiah is under extra pressure. For context:

In March, the Rupiah fell to around 16,640 per dollar, as investors worried about President Prabowo Subianto's fiscal plans and a spike in the early-year budget deficit.

Flagship programmes like the free meals scheme, variously estimated at $28–44 billion per year, and the creation of a huge new sovereign wealth fund have raised questions about fiscal discipline, governance and political interference.

Reports and data describe:

A sharp sell-off in Indonesian stocks (Jakarta Composite down about 14% in dollar terms at one point in Q1),

Large foreign outflows from Indonesian assets as global investors rotated to China and other markets

That kind of narrative of fiscal expansion plus governance worries is toxic for a currency that already depends on foreign inflows to fund a structural current account gap.

5. The Global Backdrop: Tariffs, Fed policy, and Flow Rotation

External factors have piled on:

US tariff threats and trade tensions have hit export-dependent Asia, flagging that proposed reciprocal tariffs and weaker global demand have made investors far more cautious on ASEAN.

At the same time, global equity flows have rotated into China, Japan and Korea, where AI-related stocks and corporate-governance reforms have revived interest. Indonesian assets have lagged that narrative badly.

Result:

Indonesia has seen heavy foreign selling in both equities and bonds this year, with the MSCI Indonesia index down double digits in dollar terms earlier in 2025.

That directly reduces demand for the Rupiah and reinforces the weakness that domestic politics has already triggered.

6. Bank Indonesia's Rate Cuts and Growth over FX Bias

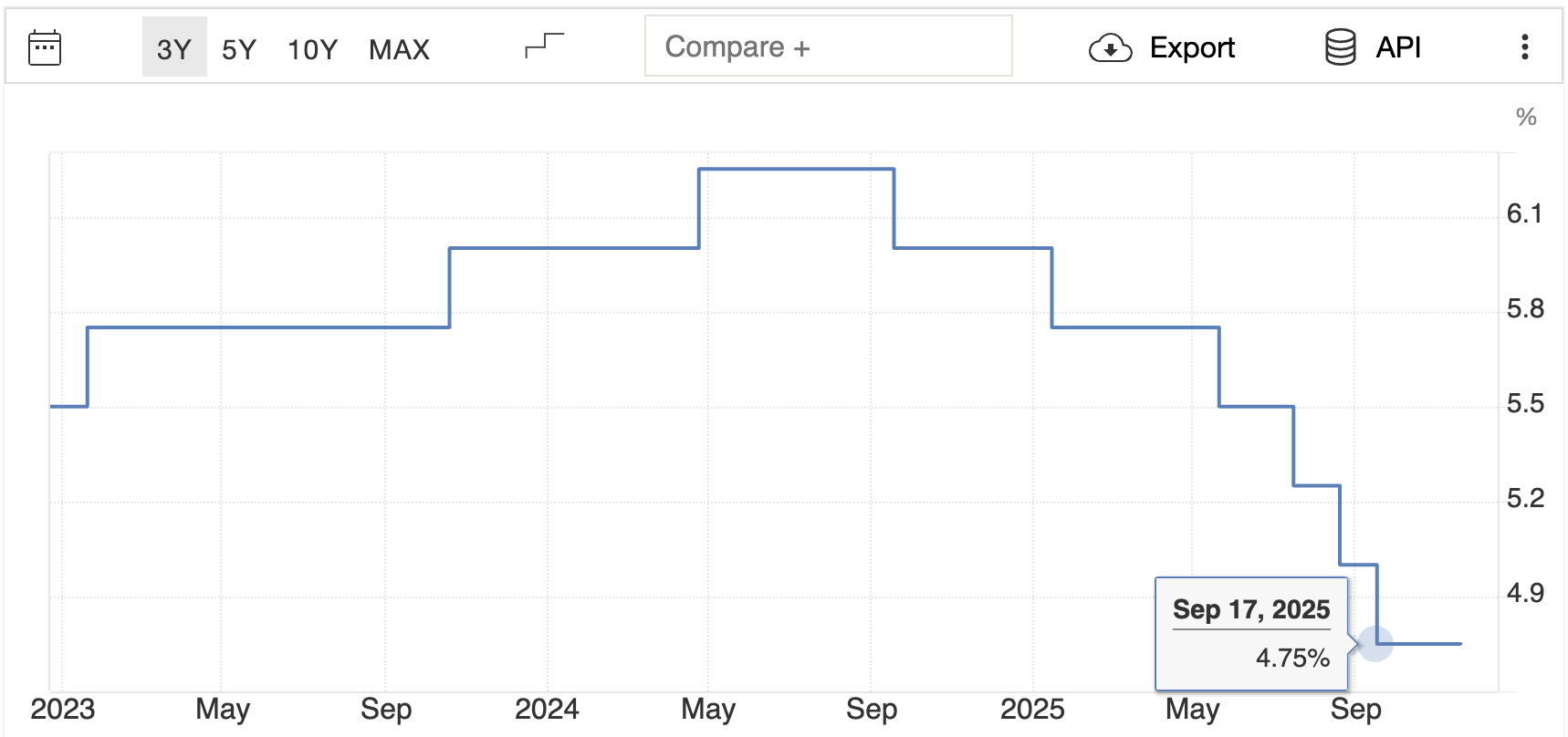

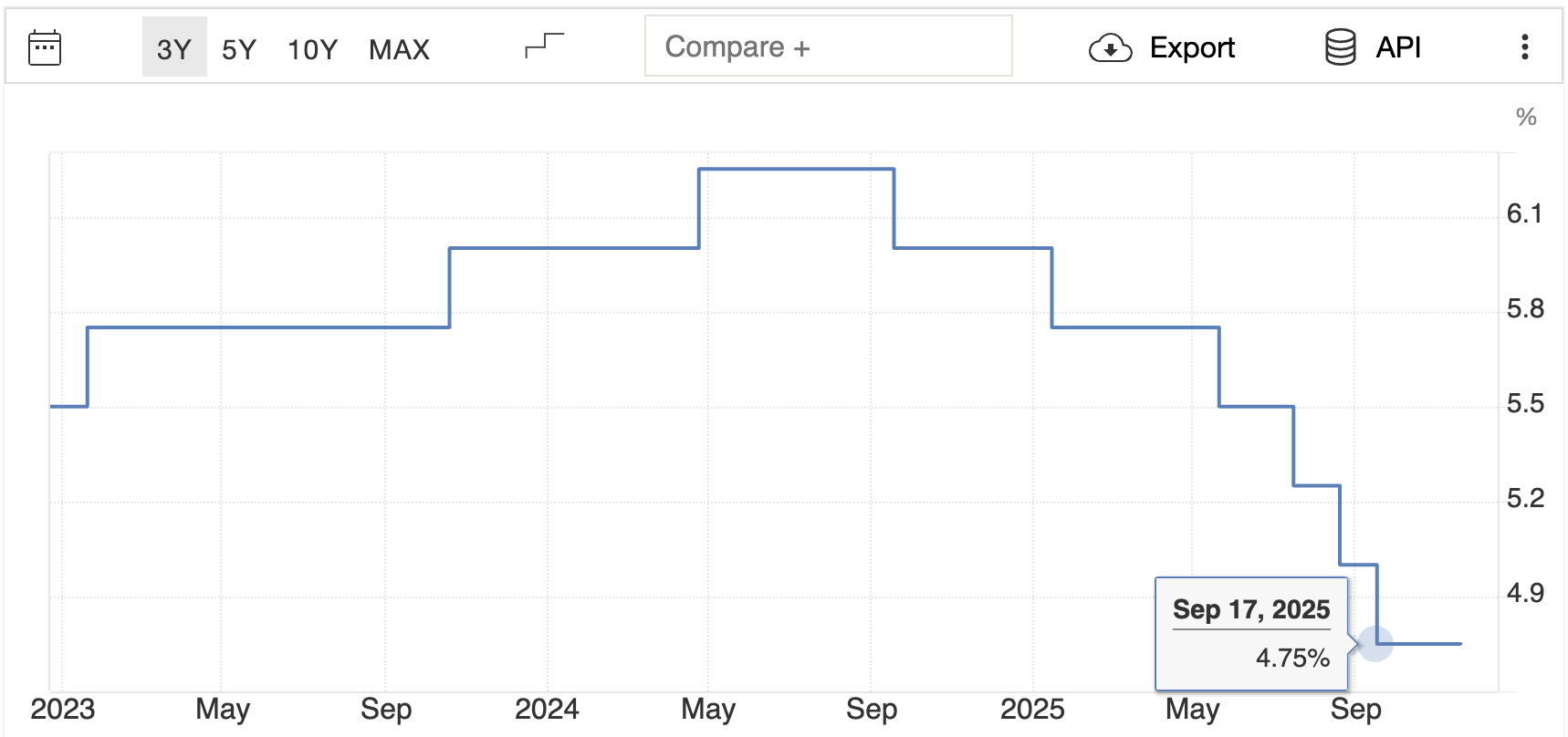

Monetary policy has added another layer. In 2023–24, Bank Indonesia (BI) hiked its policy rate to 6% to help defend the Rupiah. But in 2025, the central bank reversed course:

BI started cutting in September, surprising markets with a 25 bp cut to 4.75%, against expectations for a hold.

It was a "growth gambit" that put the Rupiah in the crosshairs, noting the currency was already down about 3% for the year at that point.

In November, BI left rates at 4.75%,

However, Governor Perry Warjiyo stressed that the short-term focus is now on rupiah stability and attracting foreign portfolio flows, acknowledging that the earlier easing had dented the currency's appeal.

7. Capital Outflows and Redenomination Chatter

Lastly, Indonesia has persistent capital outflows, with BI openly targeting FX stability via intervention and special instruments. The central bank admits it has spent reserves this year to smooth its volatility.

The government has also revived a redenomination plan, essentially, dropping zeros from rupiah banknotes to simplify transactions and boost "credibility", with a legislative push aiming for completion by 2029.

However, just weeks after the announcement, Coordinating Minister for Economic Affairs Airlangga Hartarto stated that the plan had not been addressed and will not be in the near future.

Technical View: USD/IDR Levels that Matter

Below is a technical map of USD/IDR showing recent price action near 16,680, with a 6-month high around 16,750 and a recent trading range of 16,100–16,800.

| Timeframe |

Trend bias |

Key support (approx.) |

Key resistance (approx.) |

| Weekly |

Bullish (IDR weak) |

16,300–16,350 |

16,750–16,800 (2025 and 1998 crisis highs) |

| Daily |

Sideways-to-up within a weak band |

16,450–16,500 (recent pullback lows and area BI has defended); then 16,300 |

16,700–16,750 |

| 4-hour |

Range-bound |

16,600 then 16,520–16,550 |

16,700–16,720 intraday |

Two key observations:

The currency is weak, but local equities in IDR are near highs, suggesting domestic investors still trust the growth story.

For foreign investors, the combination of a weak currency and equity outflows has meant much lower dollar returns than the headline JCI chart suggests.

Frequently Asked Questions

1. Is the Indonesian Currency at a Record Low Against the US Dollar?

It's very close. In nominal terms, the all-time peaks were around 16,800 per dollar during the 1998 crisis and again in March 2025. Current levels around 16,700 are just a step below that band.

2. Is Bank Indonesia Letting the Rupiah Fall on Purpose?

Officials have said they want the Rupiah closer to 16,300, and they've been intervening in spot and DNDF markets, as well as using bond purchases and liquidity tools, to smooth volatility. However, they also don't want to crush the economy with very high rates, so they're accepting a gradual depreciation.

3. Could Indonesia Face Another 1998-Style Currency Crisis?

The risk is much lower than in 1998. The more realistic risk is prolonged rupiah weakness, not outright collapse.

Conclusion

In conclusion, the Rupiah's weakness against the US dollar in 2025 isn't a mystery once you put the pieces together. Your currency bears the marks of crisis, has a history of ongoing depreciation, and exhibits a high-beta tendency to fluctuations in the global dollar.

Additionally, you've imposed a fresh political and financial framework, disruptive trade conflicts, and a wary central bank that won't jeopardise growth merely to create an attractive exchange rate.

That doesn't mean Indonesia is broken. It does mean that the currency is doing the adjusting while politics and policy find their footing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.