Rocket Lab stock has entered 2026 with a rare mix of hard catalysts and improving operating fundamentals. The company is scaling launch cadence, expanding its Space Systems footprint, and building deeper relevance in U.S. national security space.

In markets, that combination typically attracts two different buyers: growth investors who want the long runway, and institutions who want contracted visibility. When both show up at the same time, price action can re-rate quickly.

That is exactly what happened in late December. RKLB stock surged to fresh highs and then began consolidating, a pattern often seen in strong momentum names after a major repricing. For a practical RKLB stock forecast, the key question is not whether Rocket Lab has a compelling story. It does. The key question is whether execution, especially in Neutron and government program delivery, can keep pace with expectations now embedded in the stock.

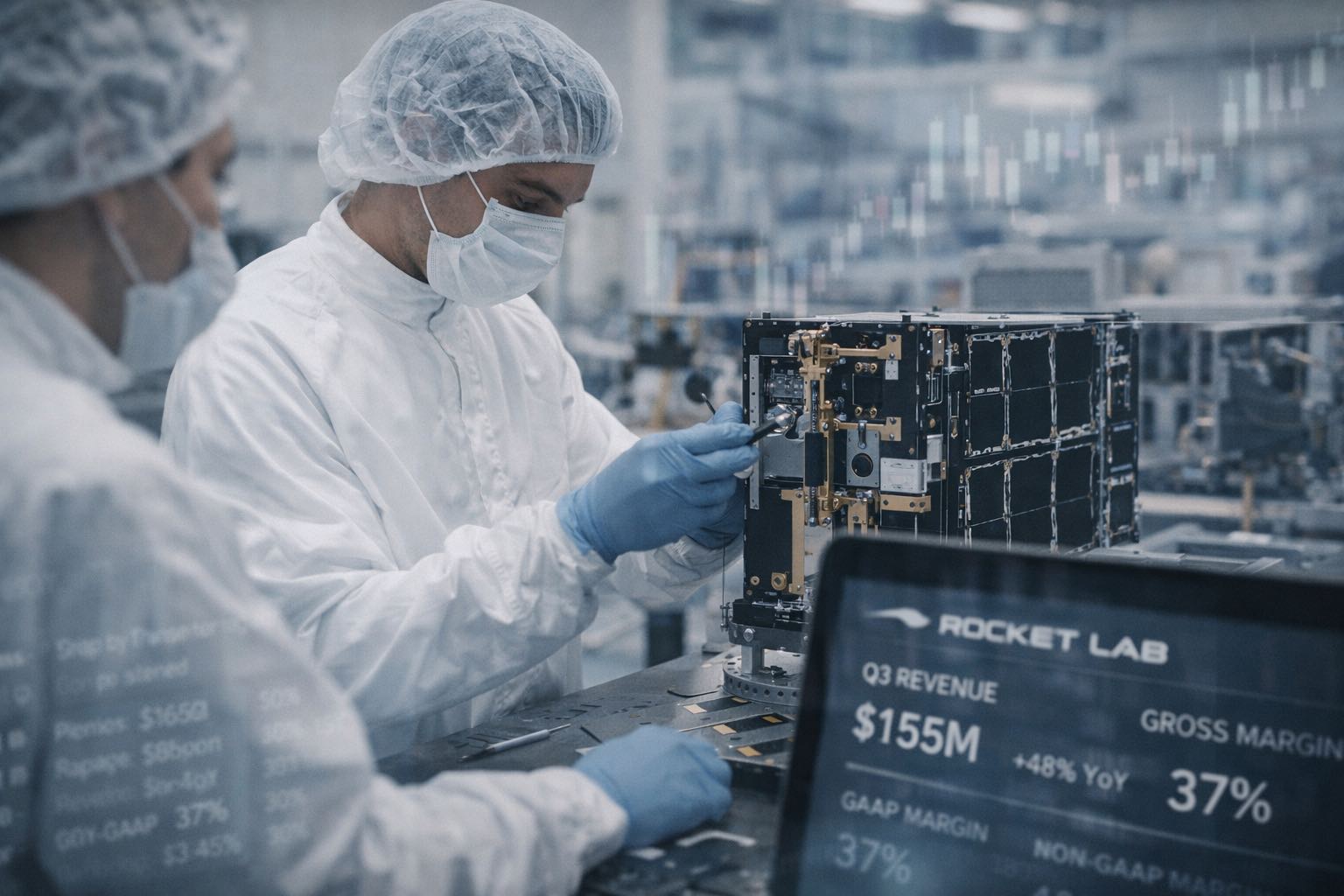

Why Rocket Lab Stock Is Being Treated Like A Defense Space Prime

Rocket Lab’s late-2025 contract momentum materially changed how the market frames the business. The headline was the U.S. Space Development Agency award, in which Rocket Lab was selected as a prime contractor for an $816 million contract to build 18 Tracking Layer Tranche 3 satellites.

That award sits within a larger Tranche 3 procurement reported at roughly $3.5 billion across multiple primes, with deployment targeted for later in the decade.

This matters for valuation because defense-space programs tend to have longer duration, higher switching costs, and more repeatable follow-on opportunities than purely commercial constellation cycles.

It also supports a narrative shift: Rocket Lab is not only a launch company. It is increasingly a spacecraft manufacturer and mission partner with a credible government standing.

Fundamental Analysis: What The Latest Financials Imply

Revenue growth and margin profile

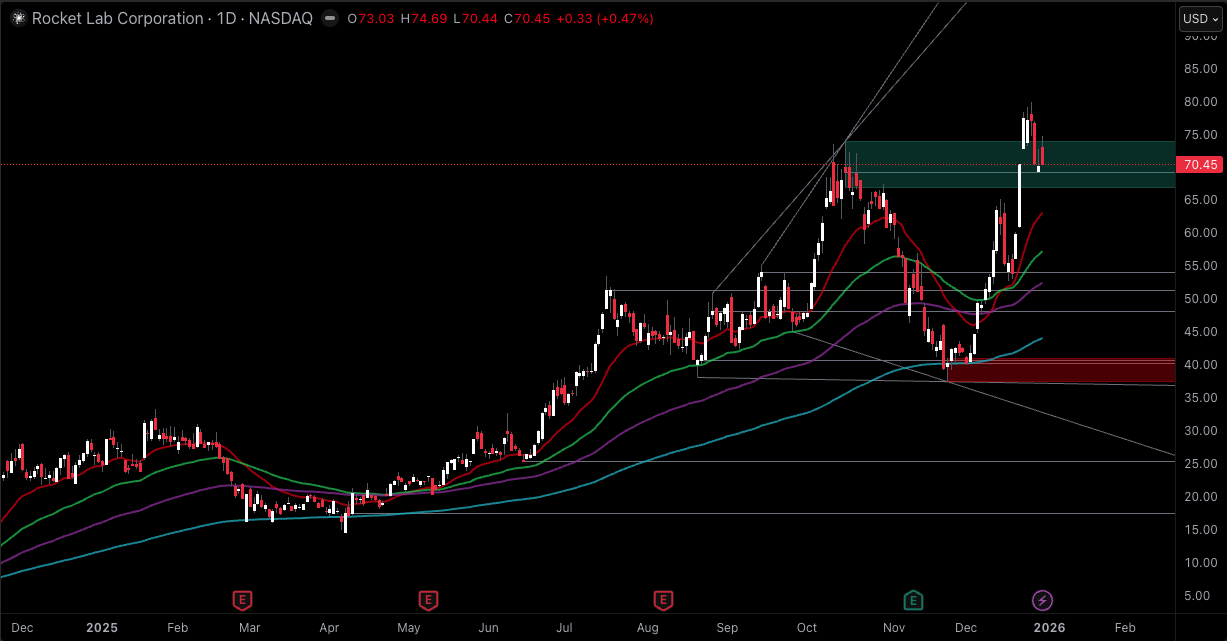

Rocket Lab reported Q3 2025 revenue of $155 million, up strongly year over year, alongside a record GAAP gross margin of 37%. Management guided Q4 2025 revenue to $170 million to $180 million, with GAAP gross margin of 37% to 39% and non-GAAP gross margin of 43% to 45%.

In aerospace and space hardware, margin progression is not a cosmetic metric. Sustained gross margin expansion usually signals improving production efficiency, better program mix, stronger pricing power, or some combination of the three.

For Rocket Lab, the most important driver is the business mix. The more Space Systems becomes the growth engine, the more the company can smooth out the natural lumpiness of launch revenue.

Backlog and conversion visibility

Rocket Lab has cited a total backlog of around $1.1 billion, with a significant portion expected to convert within roughly the next 12 months. Backlog alone is not revenue, but conversion expectations matter because they define near-term visibility. In practical terms, backlog reduces the “narrative risk” discount that many markets apply to emerging industrial technology companies.

Liquidity and funding flexibility

Rocket Lab ended Q3 with over $1 billion in liquidity. That does not eliminate execution risk, but it does reduce financing pressure while Neutron development continues and Space Systems ramps up. Investors should still monitor cash burn, capex intensity, and working-capital swings as large government programs move into production phases.

Neutron: The Single Most Important Variable In Any RKLB Stock Forecast

Neutron is Rocket Lab’s gateway into higher payload classes and a much larger mission set, including heavier national security work and large constellation deployments. Management’s updated timeline placed Neutron at Launch Complex 3 in Q1 2026, with the first launch dependent on qualification and acceptance testing.

For the stock, Neutron is both upside and risk:

If Neutron milestones remain credible and progress stays visible, the market can justify higher long-term revenue assumptions and a stronger strategic position.

If Neutron timelines slip materially or technical issues emerge, the stock can de-rate quickly, as expectations are now high following the late-2025 surge.

This is why Rocket Lab stock can feel “binary” around milestone updates. The company can execute well in Space Systems and Electron, and still see volatility if Neutron confidence changes.

Electron And Operational Credibility: The Foundation Beneath The Story

Rocket Lab ended 2025 with a record 21 launches and reported 100% mission success for the year. Reliability is not a headline that excites social media, but it is a genuine economic asset. In launch, customers pay for schedule confidence and mission assurance.

High reliability also helps Rocket Lab keep and expand relationships with institutional customers, including defense and civil agencies.

Electron also supports specialized missions and test programs that align with defense experimentation cycles. That side of demand tends to be less correlated with commercial satellite funding conditions.

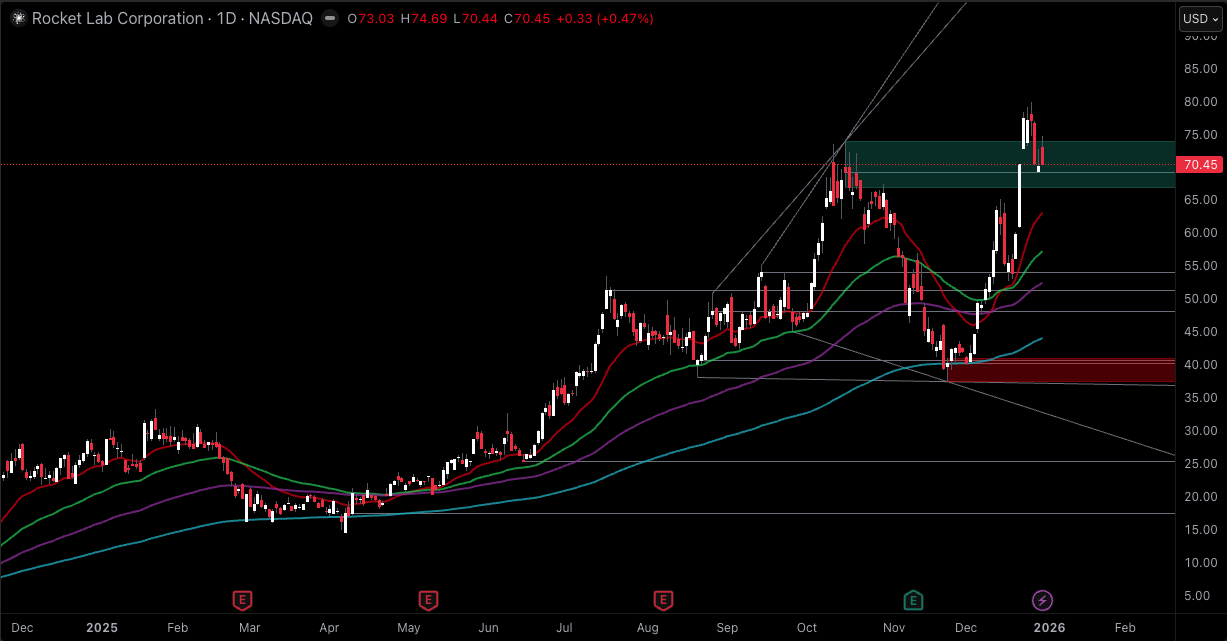

Technical Analysis: The RKLB Stock Setup Into Early 2026

Trend condition

The primary trend is clearly up. The stock printed new highs in late December, then pulled back to the low $70s. That is typical behavior after a strong repricing. The technical question is whether this pullback develops into a stable consolidation or into a deeper mean reversion.

Moving Averages: what they suggest, and what they do not

After sharp runs, the price often stretches well above intermediate moving averages. That does not automatically mean the trend is broken. It means the stock is extended and needs time to rebuild a base. Data vendors differ slightly, but the broader picture was consistent into late December:

The stock was well above its 50-day moving average.

The 200-day moving average remained well below the price, reflecting the strength of the uptrend.

When a stock is extended like this, continuation is still possible, but it often comes in bursts separated by sideways ranges. That is how momentum consolidates without collapsing.

Momentum and Volatility

Late-December momentum indicators such as the 14-day RSI were strong but not at extreme levels commonly associated with short-term blow-off peaks. That supports the idea that the move was powerful but not necessarily “exhausted.” Still, after a sharp climb, volatility tends to remain elevated. Traders should expect wider daily ranges and faster reactions to headlines.

Key price zones that market participants watch

Based on recent price behavior:

Resistance zone: the upper $70s region near recent highs.

Near-term support zone: the low $70s, which has recently served as a consolidation area.

Deeper support reference: prior breakout territory and intermediate trend support, often near the stock’s 50-day area during extended runs.

The most constructive technical outcome would be a multi-week base that holds above the most recent consolidation zone while volume cools. The less constructive outcome would be a break of support accompanied by rising volume, which usually signals that late buyers are being forced out.

RKLB Stock Forecast: 2026 Scenarios That Match How The Business Actually Works

A serious RKLB stock forecast should be scenario-driven because Rocket Lab’s valuation is sensitive to two things: Neutron execution and the pace at which contracted programs convert into revenue with healthy margins.

Base Case: consolidation with an intact long-term trend

Assumptions:

Electron stays reliable with a steady cadence.

Space Systems continues to grow and supports margin stability.

Neutron progress remains on track enough to keep investor confidence, even if timelines remain fluid.

What the stock often does in this case:

Bull Case: execution-driven re-rating continues

Assumptions:

Neutron qualification and integration milestones arrive cleanly and on credible timelines.

Additional national security wins follow, either as new primes, follow-on tranches, or meaningful subcontract work.

Margins remain firm as Space Systems scales.

What the stock often does in this case:

Bear Case: schedule risk or conversion risk forces multiple compressions

Assumptions:

Neutron slips materially again or hits technical hurdles, reducing confidence.

Government program timelines shift, slowing revenue recognition and backlog conversion.

Cash burn rises faster than expected, increasing dilution sensitivity.

What the stock often does in this case:

What To Watch Next: Catalysts That Can Move Rocket Lab Stock

Neutron milestones and schedule clarity, especially qualification progress and integration readiness.

Defense-space follow-on awards, including related spacecraft, payload, and subsystem opportunities.

Backlog conversion pace, reflected in quarterly revenue progression and program mix.

Gross margin durability, which will signal whether Space Systems' scaling is translating into operating leverage.

Electron cadence and mission success, which underpin credibility and customer retention.

Key Risks Investors Should Not Minimize

Neutron execution risk: Timelines and technical readiness can change, and the stock will react quickly.

Program timing risk: Large defense and civil programs can be lumpy in revenue recognition even when work is progressing.

Dilution sensitivity: Growth programs are capital-intensive, and markets price funding risk aggressively after big runs.

Competition: Large incumbents can pressure pricing or schedule, while smaller competitors can compete on niche missions.

Frequently Asked Questions (FAQ)

1. What is a realistic RKLB stock forecast for 2026?

A realistic RKLB stock forecast is best expressed as scenarios. The base case favors consolidation and trend continuation if Space Systems' growth and margins remain healthy and Neutron progress stays credible. The bull case requires clean Neutron milestones and additional defense wins. The bear case centers on schedule slippage, slower backlog conversion, or rising dilution risk.

2. Why did Rocket Lab Stock surge in late 2025?

The move reflected a combination of operational credibility, including a record year of launches with strong mission success, and a major step-up in government relevance with the SDA satellite contract award. Together, those developments improved investor confidence in revenue visibility and long-term positioning.

3. Is Rocket Lab more of a launch company or a space systems company now?

Rocket Lab is increasingly a hybrid. Launch remains strategically important, but Space Systems and government programs are becoming central to the company’s identity, revenue durability, and margin trajectory. This mix shift is one reason the market is more willing to assign a higher-quality multiple than in earlier years.

4. What technical levels matter most for RKLB stock right now?

Markets are watching the recent high zone in the upper $70s as resistance, and the low $70s as near-term support. A deeper pullback would bring intermediate trend support into focus, often near the region where the stock’s 50-day trend has been tracking during extended rallies.

Conclusion

Rocket Lab has matured into a company with both momentum and substance. The late-2025 defense award and the scaling Space Systems business improve revenue visibility and strengthen the strategic narrative. Technically, RKLB stock remains in a powerful uptrend, but it is sufficiently extended that consolidation is a reasonable, and even healthy, expectation.

For investors, the core of any RKLB stock forecast is straightforward: near-term price action will be driven by execution signals. If Neutron progress stays credible and Space Systems continues to convert backlog into high-quality revenue, Rocket Lab stock can support higher levels over time. If those signals weaken, volatility will return quickly because expectations are now high.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Source basis for factual statements: Rocket Lab investor materials and earnings communications, and widely reported coverage of the SDA Tranche 3 Tracking Layer award and related procurement context.