Key Takeaways

Falling rates in 2025 are boosting bond prices and investor demand.

Short- to mid-term government bonds offer the best balance of yield and safety.

ETF inflows show renewed confidence in fixed income as rate cuts deepen.

Diversifying maturities helps manage risks as yields keep sliding.

As central banks globally, including the Federal Reserve and Bank of England, signal and implement interest rate cuts across 2025, many investors ask: Are bonds still a good investment in this environment?

The quick answer is yes. Bonds can still be a good investment as rates fall, as falling yields lift bond prices (a near-term capital gain for existing holders) and make income-focused allocations more attractive. However, they also raise duration risk and compress future yield potential.

With bond ETFs seeing renewed inflows and central banks pivoting to easing, 2025 marks a turning point for fixed-income investors after years of volatility. This article explores the key trends, data, and strategies for navigating the bond market in 2025.

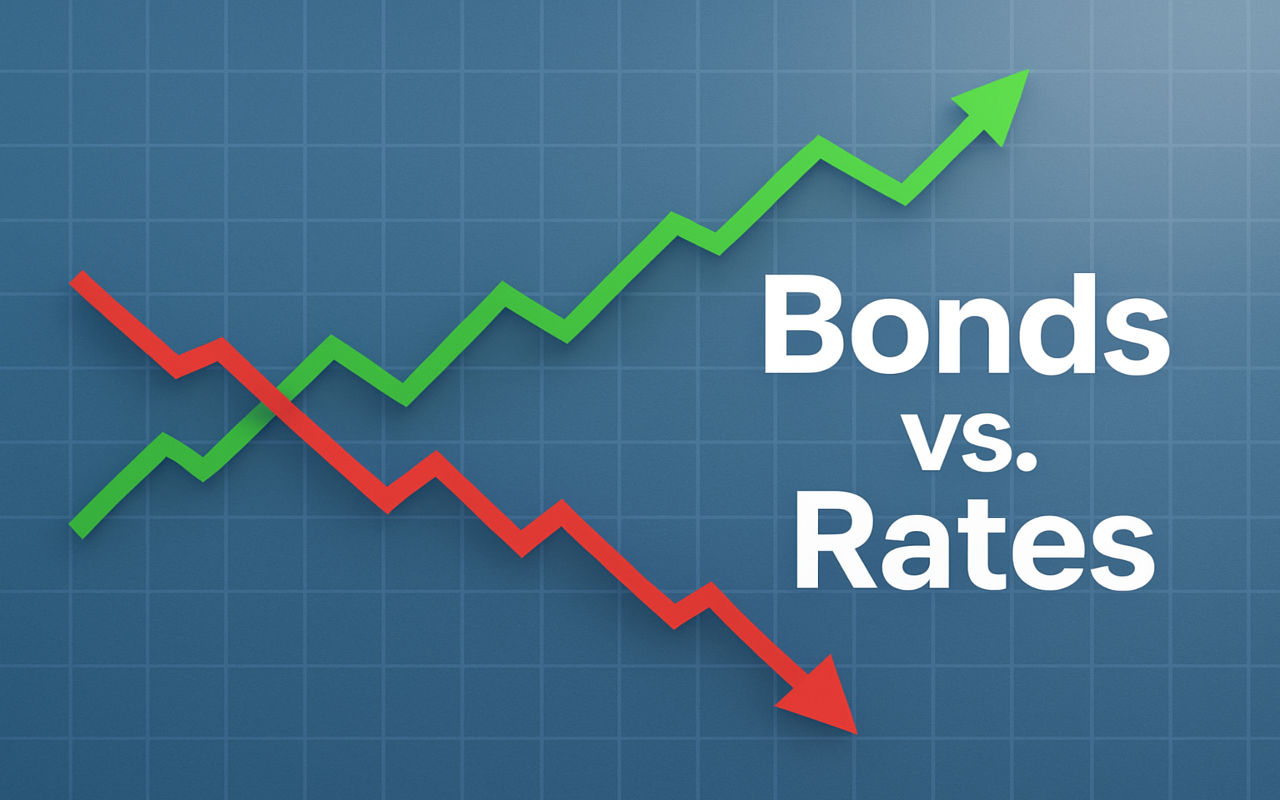

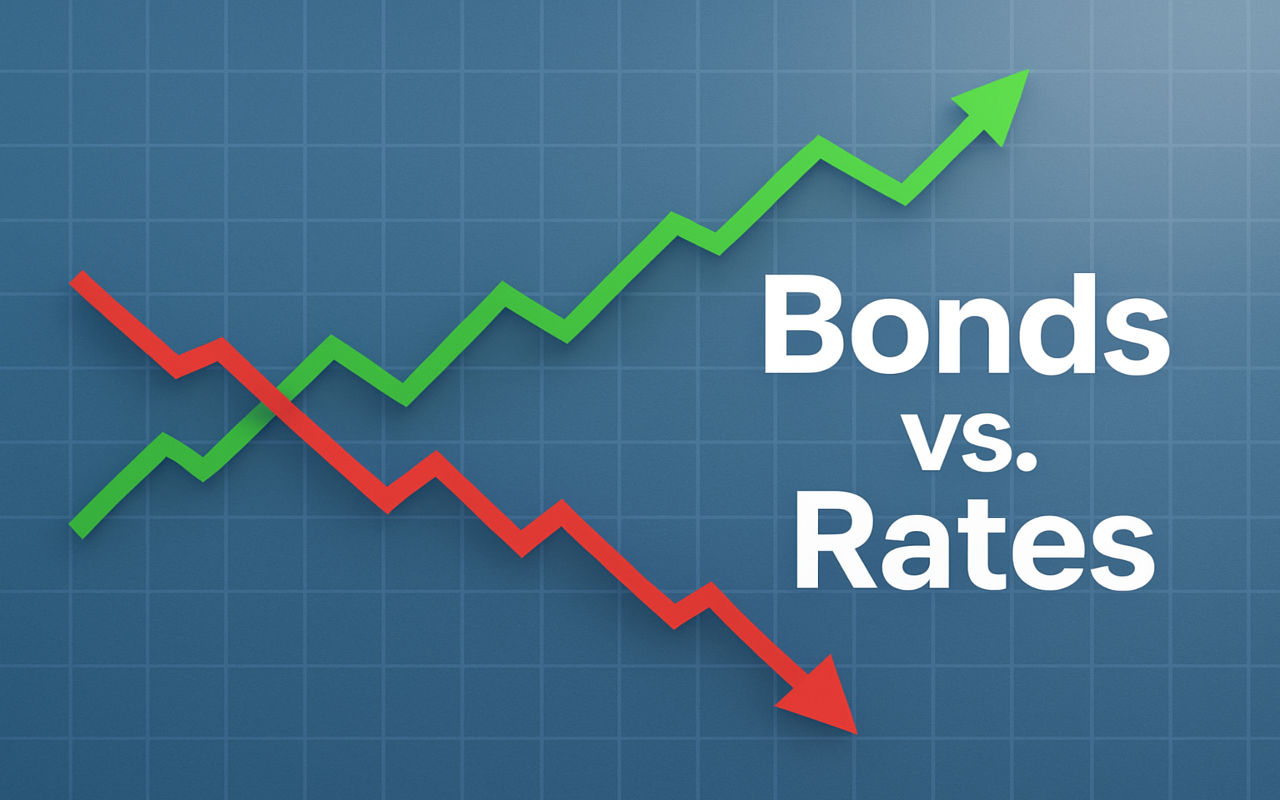

How Falling Interest Rates Impact Bonds?

As mentioned above, there is an inverse relationship between bond prices and interest rates. When interest rates fall, existing bonds with higher coupon rates become more attractive, driving up their prices; conversely, when rates rise, bond prices decline as newer issues offer higher yields, reducing demand for older bonds.

The magnitude of price sensitivity varies by bond maturity and coupon rate, as longer-duration bonds react more strongly to rate changes.

Thus, investors earn returns from both regular interest payments (coupon) and capital gains/losses from trading bonds as prices fluctuate.

Investor Takeaway: Falling interest rates typically lead to higher bond prices, benefiting investors holding longer-term bonds with higher coupon rates as these securities become more attractive relative to new issuances.

Current Interest Rate and Bond Market Environment

| Country / Instrument |

10-Year Yield (Nov 2025) |

Change vs Oct 2025 |

Year-to-Date Trend |

| U.S. Treasury |

4.07% |

▼ -0.50% |

Down from 4.6% |

| UK Gilt |

3.60% |

▼ -0.45% |

Gradual decline |

| German Bund |

2.10% |

▼ -0.25% |

Stabilised |

| Japan JGB |

0.80% |

▼ -0.05% |

Near YCC cap |

| South Korea 10Y |

3.35% |

▼ -0.40% |

Lower with Asia peers |

1. U.S. 10-year Treasury Yield

Firstly, the U.S. 10-year Treasury yield has moved lower in recent weeks and is hovering around the low-to-mid 4% area. For example, the 10-year read on November 5, 2025, was ~4.07%.

This indicates a significant decline from earlier highs this year and shows altered expectations following the Fed's action in late October.

2. Federal Reserve Rate Cut

Moving on, the Federal Reserve cut the funds rate by 25 basis points at its late-October meeting (bringing the range down toward 3.75–4.00% by the end of October 2025), and policymakers signalled that more easing may be possible depending on incoming data.

It is a key reason front-end and nominal yields fell. Markets are pricing in further cuts over the next 12 months, though the pace and timing remain uncertain.

3. Global Bond Market

Other major bond markets (UK gilts, German Bunds, Japanese yields) also moved lower in late October, as global fixed-income markets saw a pronounced rally in October 2025 as inflation indicators cooled and central banks started to pivot. [1]

What Falling Yields Bought Investors in 2025?

1) Capital Appreciation in Government Bonds:

With yields declining, benchmark bond indices and long-duration ETFs delivered strong positive returns in late 2025. Long-duration U.S. Treasuries and government bond ETFs posted notable capital gains as markets increasingly priced in additional Federal Reserve rate cuts.

2) Outperformance of High-Quality Credit Against Equities During Stress:

During risk-off periods, high-quality sovereign debt and investment-grade corporate bonds often outperform equities due to their lower correlation with growth shocks.

Investors seeking safety tended to buy high-quality fixed income in late 2025.

3) Opportunity in Selected Em Local-Currency Bonds and Convertible Bonds:

When global yields drop and risk sentiment improves, some higher-yielding segments like EM local debt and convertible bonds can deliver above-average returns (but with more volatility).

ETF screens in 2025 showed strong YTD returns among certain bond categories.

Are Bonds a Good Investment Right Now in Falling Rate Environments?

1. Preservation of Capital & Income (Conservative Investors)

If your priority is capital preservation and steady income, high-quality short- to intermediate-term government and investment-grade bonds continue to offer an attractive balance of safety and reliable returns in 2025 and beyond.

Falling rates have improved near-term total-return prospects and risk-adjusted income relative to money markets. Laddering maturities reduce reinvestment risk.

2. Total-Return / Tactical (Balanced Investors)

Conditional yes. Bonds can still provide strong total-return potential if you combine duration exposure (to capture price gains if yields fall further) with credit exposure (to pick up extra spread).

However, be careful with duration if you believe rates may reprice higher later. Diversification across sectors helps.

3. Income Chase / Speculative (Yield-Seeking Investors)

Apply caution. Chasing higher yields in junk bonds or long EM debt can produce returns, but these segments are more correlated with growth and risk sentiment.

If the Fed's easing is paired with growth deterioration, credit performance can suffer. Assess credit fundamentals and liquidity before leveraging into these areas.

Where to Look for Bond Value Now?

1. Short-To-Intermediate Government Bonds (U.S. Treasuries, Sovereigns)

Pros: Low credit risk, liquid, good as dry powder and hedges.

Cons: Lower yields than longer maturities; reinvestment risk if yields keep falling.

Who it fits: Conservative investors and cash managers.

Data: U.S. 2–5 year yields have dropped with the Fed easing expectations, supporting short-term bond prices.

2. Intermediate & Long Government Bonds

Pros: Bigger capital gains if yields fall further.

Cons: Higher sensitivity to future rate rises.

Who it fits: Investors who want total-return exposure and can tolerate volatility.

3. Investment-Grade Corporate Bonds

Pros: Higher yields than Treasuries and generally strong liquidity; spreads can compress in a stable growth environment.

Cons: Vulnerable to corporate fundamentals if growth disappoints.

How to implement: Use diversified IG ETFs or laddered individual bonds; prefer stronger balance sheets and shorter durations in uncertain environments.

4. High-Yield (HY) and Subordinated Debt

Pros: Materially higher yields offering attractive income.

Cons: Higher default risk and correlation to economic cycles; spreads widen quickly under stress.

Who it fits: Yield-seeking investors with longer horizons and risk tolerance.

5. Emerging-Market Debt (USD Sovereign & Local)

Pros: Attractive yields and diversification.

Cons: FX, geopolitical and liquidity risks. Selectivity is crucial. EM local yields also benefit if global rates fall and currencies stabilise.

What Could Go Wrong? 3 Main Risks to Monitor

1. Lower Forward Yields and Return Expectations

As rates fall, newly issued bonds pay lower coupons, compressing future income streams.

Investors buying late in the rate-cut cycle may sacrifice long-term returns due to the reduced yield baseline.

2. Market Volatility and Economic Uncertainty

Inflation remains sticky in many regions, creating uncertainty about the future path of rates.

Geopolitical tensions, fiscal deficits, and quantitative tightening measures add risk premiums that could unexpectedly push yields higher and prices lower.

3. Duration Risks

Long-dated bonds are particularly sensitive; if inflation spikes or central banks reverse course, these bonds can suffer sharp losses.

Active management and diversified duration exposure are recommended for mitigating these risks.

Frequently Asked Questions

Q1: Are Bonds a Good Investment When Rates Are Falling?

Generally, yes, because bond prices rise as rates fall, benefiting current investors with capital gains and fixed income.

Q2: Should I Only Buy Short-Term Bonds Now?

Not necessarily. A blend of short and intermediate maturities can optimise yield and manage duration risk.

Q3: Are Bonds Better Than Cash Now?

Generally, yes, as many short-term bonds and short-duration funds beat cash yields while offering modest capital preservation.

Q4: Can Bond Prices Fall Even if Rates Are Falling?

Yes, due to credit concerns, inflation surprises, or shifts in market sentiment.

Q5: How Do I Protect My Bonds Against Inflation?

Seek inflation-protected securities or diversify across asset classes.

Conclusion

As interest rates are set to gradually decline through 2025 and into 2026, bonds are regaining their traditional role as a reliable income source and a portfolio stabiliser.

While yields may compress, existing bonds can deliver a mix of income and capital appreciation. However, investors must remain vigilant in managing duration, inflation, and geopolitical exposure.

Adopting diversified bond allocations, following central bank signals, and maintaining liquidity will be key to success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/asia-pacific/an-october-remember-bruised-global-bond-markets-2025-10-30/