Investors often chase growth, yet stability is equally vital. Could the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) be the missing piece for your portfolio? Designed to provide steady income and moderate risk exposure, VCIT offers a gateway to investment-grade corporate bonds with intermediate maturities.

This article breaks down its mechanics, benefits, and considerations for savvy investors.

Key Takeaways

VCIT is a low-cost, highly diversified ETF for investment-grade corporate bonds.

Ideal for investors seeking steady income and moderate interest-rate exposure.

Works best as part of a balanced portfolio rather than a growth-only strategy.

Offers a simple, liquid, and cost-effective way to access corporate bond markets.

What is VCIT? Understanding the Basics

VCIT is an exchange-traded fund managed by Vanguard that tracks the performance of U.S. investment-grade corporate bonds with maturities of 5–10 years.

Key points:

Ticker: VCIT

Asset Class: Investment-grade corporate bonds

Maturity: Intermediate-term (5–10 years)

Objective: Deliver steady income while limiting volatility relative to equities

In short, VCIT provides exposure to large, creditworthy corporate issuers, positioning it between high-yield risk and government bond safety.

How VCIT Works: Mechanics and Features

Benchmark Index: Tracks Bloomberg U.S. 5–10 Year Corporate Bond Index.

Credit Quality: Primarily AAA to BBB-rated corporates—offering yield with low default risk.

Diversification: Holds thousands of corporate bonds across multiple sectors, reducing concentration risk.

Expense Ratio: Exceptionally low at 0.03%, meaning more of your returns stay in your pocket.

Liquidity: Trades like a stock, making it easy to buy or sell intraday.

VCIT's structure is designed to balance return, safety, and accessibility for investors seeking a predictable income stream.

Why Investors Consider VCIT

1. Steady Income:

Unlike equities, VCIT generates consistent interest payments from its underlying corporate bonds.

2. Moderate Interest-Rate Exposure:

Intermediate-term bonds reduce the sensitivity to interest-rate changes compared to long-term bonds, providing a smoother performance profile.

3. Credit Premium Advantage:

Corporate bonds offer higher yields than comparable government bonds, enhancing total returns.

4. Portfolio Diversifier:

For investors heavily exposed to equities, VCIT introduces a stabilising element, dampening volatility and helping navigate uncertain markets.

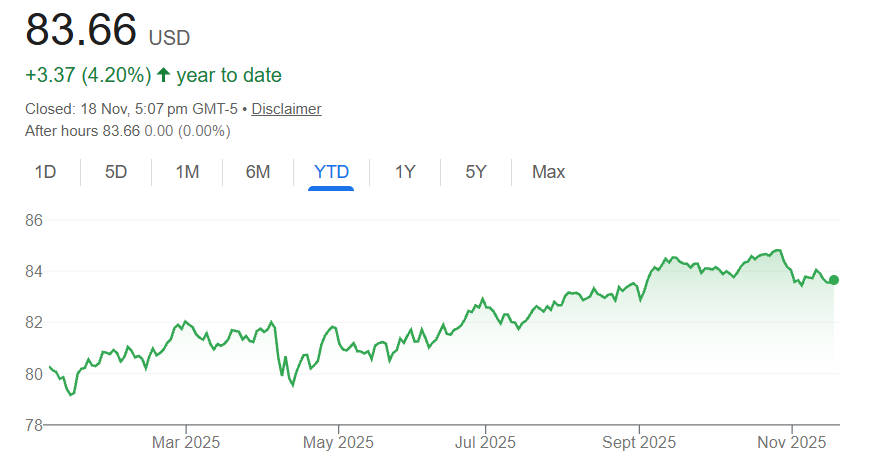

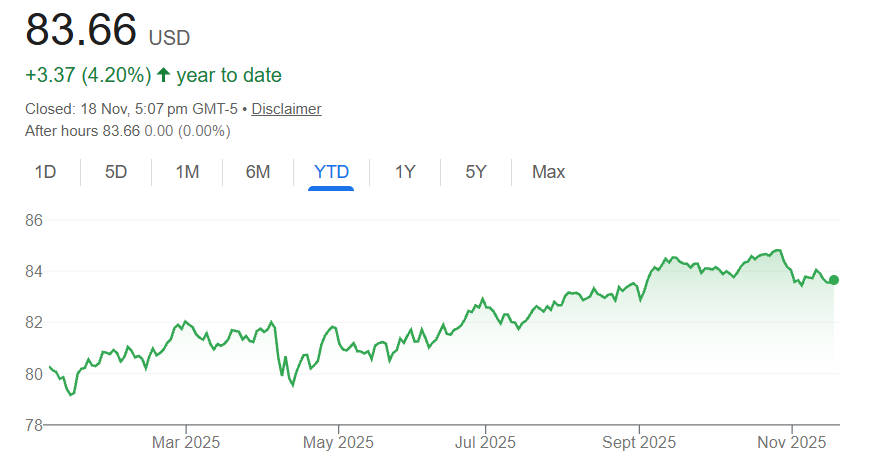

VCIT Performance Snapshot: Yield, Returns, and Costs

| Metric |

Value |

| Expense Ratio |

0.03% |

| Recent Yield |

~4.5% (annualised) |

| 1-Year Return |

~8.2% |

| Assets Under Management |

Tens of billions USD |

| Holdings |

2,000+ corporate bonds |

VCIT's low cost, broad diversification, and reliable yield make it a strong candidate for both income-focused and balanced portfolios.

Risks You Should Know Before Investing VCIT

Interest-Rate Risk: Rising rates can lower bond prices.

Credit Risk: Defaults or downgrades in underlying corporates can impact returns.

Liquidity Risk: Some bonds may trade infrequently, affecting NAV under stress.

Inflation Risk: High inflation can erode real returns.

Currency Risk: For non-USD investors, exchange rate fluctuations may affect returns.

Opportunity Cost: Lower growth potential compared to equities over long horizons.

Understanding these risks ensures VCIT is used strategically, not as a substitute for growth assets.

How VCIT Fits Into Your Portfolio

For long-term investors like you:

Stabiliser: Provides reliable income and dampens equity volatility.

Diversification Tool: Reduces overall portfolio risk while maintaining liquidity.

Rebalancing Asset: Use VCIT to maintain target allocations between growth and income.

Complement to Higher-Risk Funds: Pairs well with tech or resource-focused investments, smoothing returns in down markets.

Example strategy: Allocate 10–20% of your liquid investing capital to VCIT while keeping higher-risk equities for growth potential.

Conclusion

VCIT ETF offers a rare combination of stability, income, and cost-efficiency, making it a compelling choice for investors seeking to balance growth and risk.

While it may not deliver the high returns of equities, its diversified portfolio of investment-grade corporate bonds provides steady income, moderated volatility, and a reliable complement to higher-risk assets.

For disciplined investors, incorporating VCIT into a portfolio can act as a stabilising anchor, smoothing returns in turbulent markets while preserving capital. In an environment of uncertainty, VCIT stands out as a strategic tool for building resilience and long-term financial confidence.

Frequently Asked Questions

Q1: Who should consider investing in VCIT?

Investors seeking predictable income, moderate risk exposure, and portfolio diversification without taking on high equity volatility will find VCIT appealing.

Q2: How does VCIT differ from government bond ETFs?

VCIT invests in corporate bonds, offering higher yields and credit exposure, while government bond ETFs are generally safer but provide lower income.

Q3: What is the risk of interest-rate changes on VCIT?

Intermediate-term bonds have moderate sensitivity. Rising rates may reduce NAV, but the impact is lower than long-term bond ETFs.

Q4: How much of a portfolio should be allocated to VCIT?

Allocation depends on risk tolerance, but many investors use 10–20% of liquid assets to stabilise their portfolio.

Q5: Does VCIT provide growth or only income?

Primarily income-focused, but the underlying bond price movements can provide modest capital gains in certain interest-rate environments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.