If you could make $1 billion in a single day, how would you do it? For most of us, that's the stuff of fantasy. But for George Soros, it was a regular Tuesday.

On September 16, 1992, "Black Wednesday", Soros and his fund, the Quantum Fund, made history by betting against the British pound. That single bold move not only made him a billionaire overnight but also cemented his reputation as "The Man Who Broke the Bank of England."

However, the story of Soros isn't just about one trade. It's about a way of thinking, a strategy built on understanding markets, psychology, and reflexivity. Even decades later, his principles still shape how hedge funds and global macro investors operate.

In this guide, we'll break down Soros's philosophy in simple terms, no financial jargon or complex math, just timeless ideas that reveal how he views risk, conviction, and market chaos as unique opportunities.

Who Is George Soros?

George Soros was born in Budapest, Hungary, in 1930, and survived the Nazi occupation during World War II. He later emigrated to London, where he studied philosophy under Karl Popper at the London School of Economics, a key influence that would shape his entire investment worldview.

After working as an analyst and trader in New York, Soros launched the Quantum Fund in 1973 with Jim Rogers. Over the next two decades, that fund would average annual returns of around 30%, an almost unbelievable figure even by hedge fund standards.

But what truly set Soros apart was his macro vision, the ability to see the big picture of how economies, politics, and psychology interact.

And nowhere was that more visible than in his famous British pound trade.

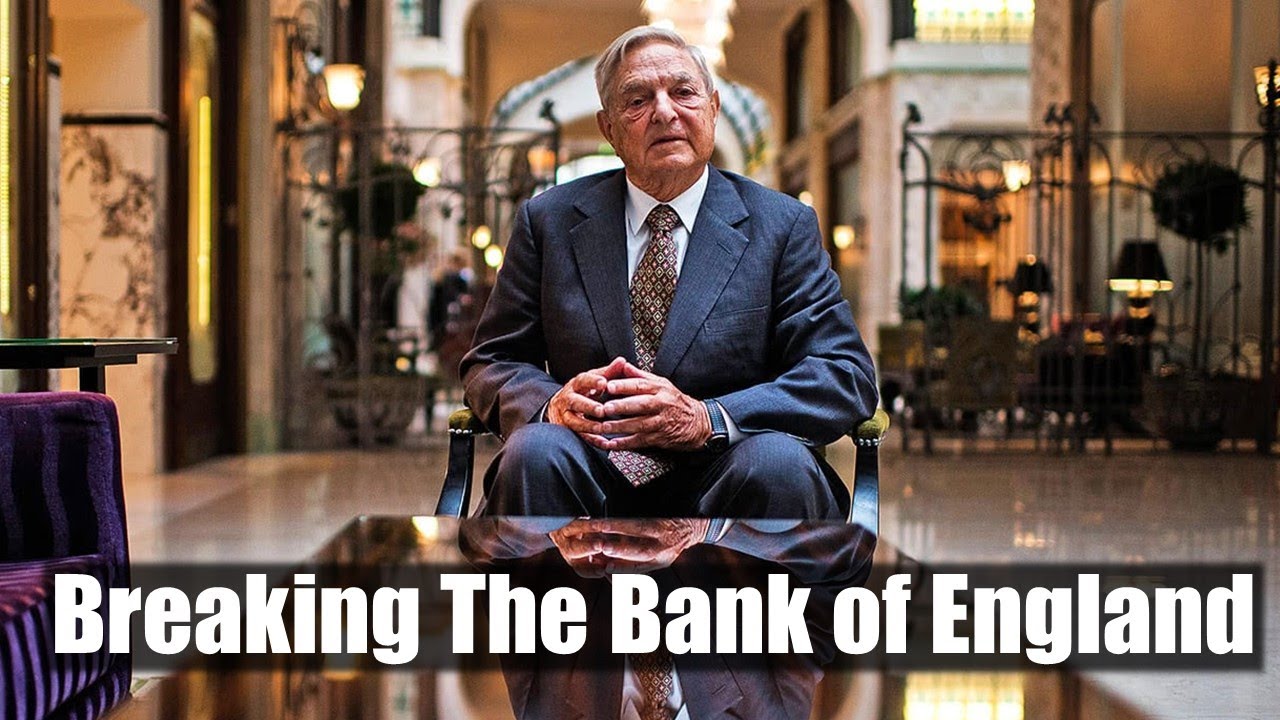

How George Soros Broke the Bank of England

1. Setting the Scene: Europe in 1992

In the early 1990s, Britain was part of the European Exchange Rate Mechanism (ERM), a system meant to stabilise exchange rates in preparation for a common European currency (which later became the euro).

Under the ERM, the British pound was pegged to the German Deutsche Mark, meaning its value could only move within a limited band.

But there was a problem:

Soros noticed what others ignored: the peg was artificial and unsustainable.

2. The Bet

Soros's Quantum Fund borrowed billions of pounds and sold them for German marks, expecting that when the British government was forced to devalue the currency, he could buy back the pounds at a much cheaper price.

He wasn't just guessing. He was betting on economic inevitability. And he was right.

3. Black Wednesday: September 16, 1992

The British government attempted to support the pound by utilising billions from reserves and increasing interest rates to 15%. However, the market was too powerful.

By the end of the day, the UK withdrew from the ERM and devalued the pound. Soros made over $1 billion in profit.

That day redefined what a "macro trade" meant and showed the world how understanding psychology and policy pressure could lead to generational profits.

The Core of Soros's Philosophy: Reflexivity

If there's one concept that explains Soros's thinking, it's reflexivity. In most economic theory, markets are assumed to be rational. Prices reflect all available information.

However, Soros disagreed. He believed that markets are driven not just by fundamentals, but by people's perceptions of those fundamentals, and that those perceptions can influence reality.

In short, market prices don't just reflect reality; they shape it.

Modern Example of Reflexivity in Action

| Market Loop Example |

Investor Belief |

Market Reaction |

Reality Shift |

| Tech Stocks (2021–2022) |

"AI will grow forever" |

Stocks surge |

Valuations overheat, correction follows |

| Housing Market (2025) |

"Prices only rise" |

Demand spikes |

Policy tightens, growth cools |

Imagine investors think tech stocks are unstoppable. Prices go up. Companies raise more money, hire more people, and grow faster, which makes investors even more confident.

The belief becomes self-fulfilling, until it breaks. That feedback loop between perception and reality is reflexivity. And Soros's genius was recognising when that loop was near a breaking point, like when the UK could no longer maintain the illusion of a strong pound.

George Soros's Core Trading Rules

1. Be Bold When the Odds Align

1. Be Bold When the Odds Align

Soros famously said: "When I see a bubble forming, I rush in to buy it."

Contrary to conventional wisdom, he didn't avoid bubbles; he rode them early and got out before they burst. The key was timing and conviction.

When his analysis suggested an asymmetry, where potential reward was vastly higher than the risk, he would bet big.

2. Cut Losses Quickly

Even Soros didn't always get it right. In fact, he often reversed trades rapidly when his thesis failed.

He said: "It's not whether you're right or wrong that matters, but how much money you make when you're right and how much you lose when you're wrong."

This mindset made him adaptable with a critical trait for surviving volatile markets.

3. Think Globally

Soros was one of the first truly global macro investors. He connected dots across currencies, interest rates, commodities, and geopolitics.

For him, the world was one giant chessboard, and each move by central banks or governments created opportunities elsewhere.

In today's context, his style resembles how hedge funds track global liquidity, Fed rate cycles, and currency pressures to anticipate shifts across markets.

4. Embrace Uncertainty

Soros's background in philosophy gave him a unique edge. He didn't seek absolute truth; he sought probabilities.

He understood that being uncertain isn't a weakness; it's the foundation of risk management.

This flexibility helped him thrive in chaotic environments, something especially relevant in today's post-pandemic, AI-driven, high-volatility markets.

Applying Soros's Strategy in Modern Markets

Although Soros's hedge fund is inactive now, his methodology continues to inspire leading investors.

Here's how you can apply the George Soros strategy in your current repertoire:

Lesson 1: Understand the Macro Environment

In 2025, central banks and geopolitics dominate markets more than ever.

Soros would likely study:

Understanding this macrocontext is essential for predicting significant shifts.

Lesson 2: Use Reflexivity to Spot Market Extremes

Markets still swing between irrational optimism and fear.

Reflexivity helps explain bubbles like:

Soros would look at how narratives drive prices, and then ask: "When does the story stop making sense?"

That's often when opportunity appears, either to ride the wave early or exit before the collapse.

Lesson 3: Stay Adaptive

Soros was famous for changing his mind fast. He didn't marry a trade; he married the data.

In today's algorithm-driven markets, flexibility is more critical than ever. The best investors aren't the smartest, but the quickest to adjust when the story changes.

The Takeaways for Beginners Wanting to Try George Soros' Trading Strategy

1. Challenge the consensus. Don't accept what everyone believes and question the underlying assumptions.

2. Be disciplined. When you're wrong, admit it fast. When you're right, press your advantage.

3. Look for feedback loops. Ask how beliefs might be shaping reality, as that's where opportunities often hide.

4. Study policy and psychology together. Economics is not just numbers; it's people reacting to each other's expectations.

Frequently Asked Questions

1. What Is George Soros's Core Investment Strategy?

Soros's strategy centres around global macro trading by analysing currencies, interest rates, commodities, and geopolitics, underpinned by his concept of reflexivity.

2. Is George Soros Still Actively Trading Like He Did Formerly?

Soros has scaled back his public hedge fund operations and shifted to philanthropic work via the Open Society Foundations.

3. Can Retail Investors Follow George Soros's Strategy?

Yes, but with adaptation. For retail investors, adapt Soro's strategy in focusing on the macro context, understanding when market narratives may be breaking, sizing positions prudently, and being willing to reverse when your thesis fails.

4. How Do Macroeconomic Trends in 2025 Reflect Soros-Style Opportunity?

In 2025, several macro themes, such as potential shifts in global interest, U.S. dollar weakness, China's stimulus pivot, and commodity cycles, provide the kind of broad inflexion points Soros looked for.

Conclusion

In conclusion, George Soros didn't become legendary by following the herd. He made his fortune and his mark on history by seeing through illusions.

In a world where markets are more emotional, algorithmic, and interconnected than ever, his lessons feel timeless.

The truth is, you don't have to "break the Bank of England" to learn from Soros. You only need to see the world as it is and have the courage to act when others can't.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

1. Be Bold When the Odds Align

1. Be Bold When the Odds Align