When investing in treasury securities, the focus is usually on their current yield and yield to maturity, which, after all, directly reflect the actual return an investor can earn when purchasing Treasury securities. The coupon rate of Treasury bonds is intentionally or unintentionally ignored by everyone and seems to be not important at all. But is it really unimportant? Of course not; this small interest rate associated with something is very important, but the general public is not too concerned about it. So now let's take a look. What is the impact of changes in Treasury rates?

What are the Treasury rates?

It is the interest rate offered on bonds issued by the government and indicates the return that investors can expect to receive when they purchase Treasury bonds. Treasuries are a debt instrument issued by the government to raise funds, and they usually have a fixed interest rate, which means that it is set at the time of issuance and remains the same throughout the term of the bond.

Interest rates on Treasury bonds are usually categorized according to the maturity of the bond, and these maturities may include short-term, medium-term, and long-term. Short-term Treasury rates usually refer to bonds shorter than one year, which usually do not have a fixed interest rate but are offered at a discount, with investors receiving the face value at maturity.

Intermediate-term Treasuries are bonds with maturities between one and ten years; these bonds usually have a fixed interest rate, and investors receive the principal amount at maturity. Long-term Treasury bonds usually have a maturity of more than ten years, with the most common being 10-, 20-, and 30-year bonds. These bonds also have a fixed interest rate, and investors receive their principal at the maturity of the bond.

This division by maturity allows investors to choose Treasury bonds with different maturities based on their risk appetite and investment objectives. Short-term Treasury bonds are usually lower-risk, but they also offer lower returns, making them suitable for short-term investments or capital preservation. Long-term Treasury rates may offer higher returns but also come with greater risk of interest rate and price volatility, making them suitable for long-term investment and asset allocation.

Treasury rates and interest rates may vary by maturity. Generally, long-term Treasury bonds have relatively higher interest rates because they require investors to bear interest rate risk for a longer period of time. The government usually issues Treasury bonds with different maturities based on market demand and financial needs. Investors can choose Treasury rates with appropriate maturities according to their investment objectives and risk tolerance.

They are usually regarded as approximate risk-free interest rates, but they are not completely risk-free. Treasury bonds are considered relatively low-risk investment instruments because they are issued by national governments and usually have high credit ratings and repayment capacity. National governments have the ability to meet their obligations through taxation and other means, so the credit risk of Treasury bonds is relatively low.

However, despite the low credit risk of Treasury bonds, there are still other types of risks that can affect investor returns. One of the main risks is interest rate risk. If an investor purchases fixed-rate Treasury bonds, the market value of these bonds may decline when market interest rates rise because new bonds are issued at higher rates, making the fixed rates on older bonds less attractive. Investors may face losses if they sell their Treasury bonds at this time.

In addition, inflation risk is a factor to consider. Even though Treasury bonds offer a fixed interest payment, if inflation is higher than the interest rate on Treasury bonds, real purchasing power may decrease.

What is the interest rate on treasury bonds

|

Characterization

|

Description

|

Examples

|

|

Definition

|

Government bond interest rate. |

3.0% annual interest on government Treasury bonds. |

|

Source of Income

|

Annual bond interest. |

$1,000 Treasury bond at 3% yields $30 annual interest. |

|

Security

|

Gov-issued, low-risk investment. |

A secure government-backed investment. |

How Are Treasury Rates Determined?

It is determined by a number of factors, which include market supply and demand, economic conditions, monetary policy, and national fiscal needs.

The relationship between the demand for and supply of Treasury bonds in the market is one of the important factors in determining it. If the demand for Treasury rates in the market is high, investors are willing to buy more Treasury rates, which may lead to an increase in the price of Treasury rates and a decrease in interest rates. Conversely, if the demand for Treasury securities is low in the market, the price of Treasury securities may fall and interest rates may rise.

Economic conditions have a direct impact on it. In times of strong economic growth and favorable job market conditions, the central bank may tighten monetary policy and raise the benchmark interest rate, causing it to rise. Conversely, in a recession, the central bank may adopt an easy monetary policy and lower the benchmark interest rate, and the interest rate on Treasury bonds may fall.

The central bank implements monetary policy by adjusting the benchmark interest rate. If the central bank raises the benchmark interest rate, the interest rate on Treasury bonds may rise; conversely, it may fall if the central bank lowers the benchmark interest rate. The government's fiscal position and financing needs also affect it. If the government needs to raise more funds to meet its fiscal expenditures, it may issue more Treasury bonds, which may lead to an increase in the interest rate on Treasury bonds.

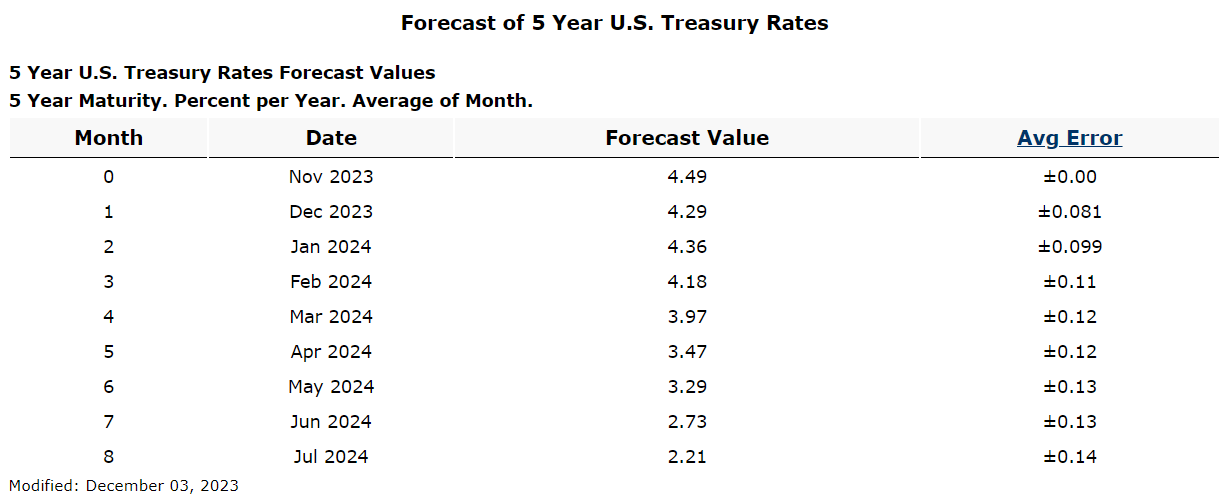

Investors usually focus on inflation expectations because inflation has an impact on the real return on investments. If the market expects inflation to rise, investors may demand higher real interest rates, causing them to rise. The international economic environment, global market conditions, and changes in monetary policy in other countries may also have an impact on it. The behavior of international investors and global capital flows have a significant impact on the Treasury bond market.

Sometimes it is finalized through auctions and other means. The government sells Treasury bonds through issue tenders or auctions, and the highest price (i.e., the lowest interest rate) that investors are willing to pay determines the Treasury rates. This process reflects the market's demand for Treasury securities and expectations about future economic conditions.

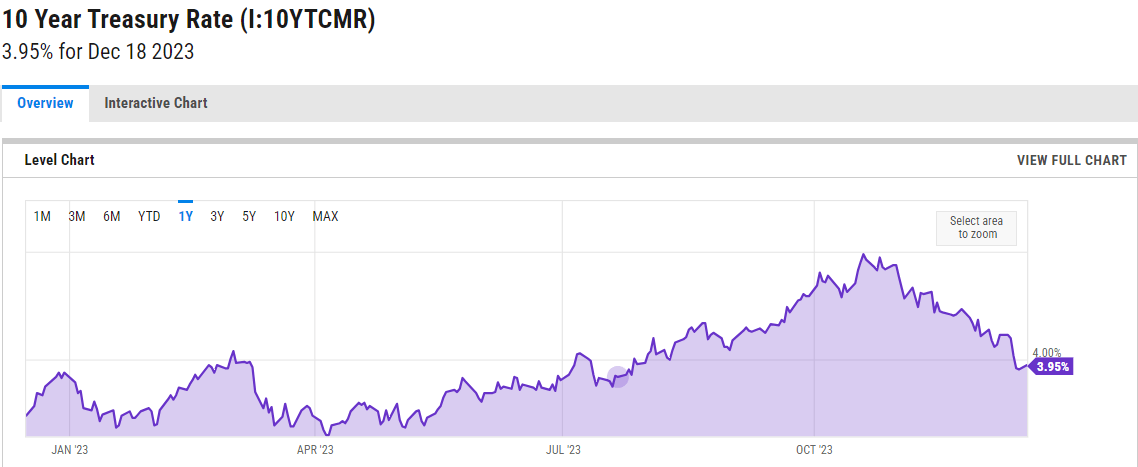

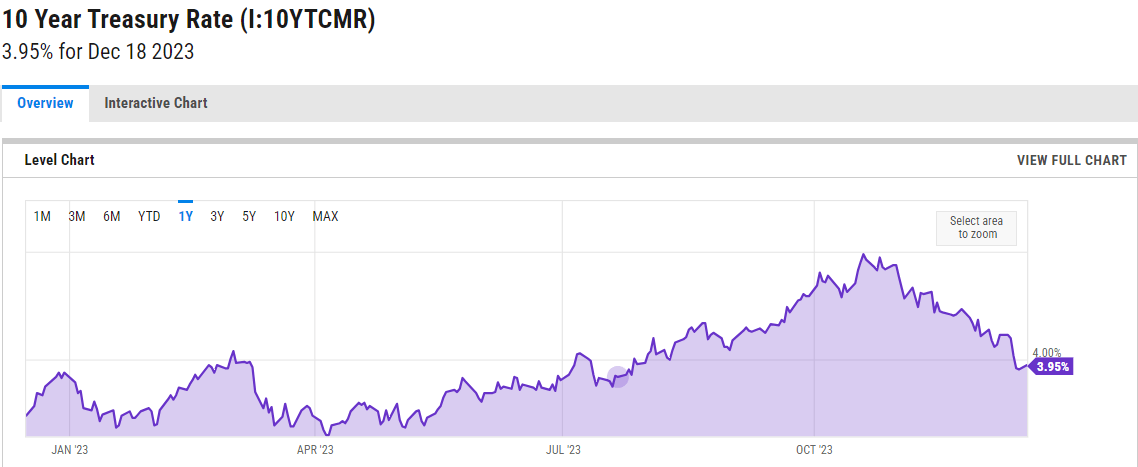

Rising and Falling

Rising Treasury rates can be influenced by a number of factors. If inflation rises, the central bank may tighten monetary policy and raise the benchmark interest rate. This may lead to an increase in interest rates on Treasury bonds in the bond market to reflect higher market rates. If the central bank announces an increase in interest rates or implements other tightening measures, this may lead to an increase in interest rates in the market, including those on Treasury bonds.

Faster economic growth is usually accompanied by an increased demand for capital. Investors may seek higher returns, so interest rates in the Treasury bond market may rise. If a country is in poor financial condition, investors may demand higher returns to compensate for potential risks. This may lead to an increase in interest rates on Treasury bonds.

Instability in the global economy or changes in monetary policy in other countries may also affect interest rates on Treasury bonds. The behavior of international investors and global capital flows have an impact on the Treasury bond market. If investors expect inflation to slow, they may be more inclined to purchase fixed-income assets, which could lead to higher interest rates in the Treasury bond market.

A fall in Treasury rates can be influenced by a number of factors. If the central bank adopts an accommodative monetary policy, lowers the benchmark interest rate, or implements other measures to promote economic growth, this could lead to a decline in interest rates in the market, including those on Treasury bonds. If the market expects the economy to face a recession, investors may seek relatively safe assets, such as Treasury rates. This demand for risk aversion may cause the price of Treasury securities to rise and interest rates to fall.

If investors expect the level of inflation to decline, they may prefer to purchase fixed-income assets, which may include Treasury bonds. This rising demand could lead to higher prices for Treasury bonds and, thus, lower interest rates. Instability in the global economy or changes in monetary policy in other countries may also affect it. Global capital flows and investor sentiment may cause international investors to purchase Treasury securities, which could affect interest rates on Treasury securities.

If the government adopts a stimulative fiscal policy by increasing spending or cutting taxes, this may have an impact on it. Some governments may issue bonds to finance fiscal spending, which may affect the supply and demand in the Treasury bond market.

Note that its rise is not always a negative sign; sometimes it reflects the health of the economy and the market's expectations of future economic conditions. Its falling is not necessarily always a good thing; sometimes it may reflect a sluggish economy or other uncertainties. Because it will have a great impact on the financial markets and the economy, investors usually pay close attention to these changes.

Impact of Changes in Treasury Rates

Impact of Changes in Treasury Rates

The impact is very broad, such as the fact that its change directly affects the overall cost of borrowing. When it rises, banks and other borrowers may face higher financing costs, which can lead to higher lending rates, which can affect consumer and business borrowing activity.

Changes in it have an impact on portfolio returns. For example, when it rises, bond prices may fall, leading to potential capital losses that bond investors may face. Conversely, when it falls, bond prices may rise, raising the market value of bond investments.

It also has a relationship with the real estate market. Lowering it means cheaper mortgage rates, which could stimulate demand for home purchases. Conversely, it being higher could lead to higher mortgage rates, which could affect home buying activity. Its movement may affect investor confidence in the state of the economy and the market. For example, falling interest rates in the bond market may be seen as a response to economic uncertainty, while rising rates may be seen as a concern about economic growth and inflation.

Central banks usually use interest rates to implement monetary policy. Changes in them may be affected by adjustments in the benchmark interest rate by the central bank. For example, an increase in the prime rate may lead to an increase in the interest rate on Treasury bonds, while a decrease in the prime rate may lead to a decrease in the interest rate on Treasury bonds. Its movement also affects the country's currency exchange rate. Higher interest rates usually attract international investors and may lead to an appreciation of the national currency. Conversely, lower interest rates may lead to an outflow of funds, which may affect the currency's depreciation.

Treasury Rate Curve

Known in English as the Yield Curve, it shows the relationship between the interest rates on Treasury securities of different maturities and their maturity periods. It is usually a line graph, with the horizontal axis representing the maturity period of the bond and the vertical axis representing the interest rate for the corresponding maturity period. It has three basic shapes: a positive slope curve, a negative slope curve, and a flat curve.

A positive slope curve is the most common case and indicates that the interest rate on long-term Treasury bonds is higher than the interest rate on short-term Treasury bonds. This curve shape reflects the market's expectations of future economic growth and inflation. Investors usually demand higher returns to hold longer-term bonds, so long-term Treasury bonds have higher interest rates.

In the case of a negatively sloped curve, the interest rate on short-term Treasury bonds is higher than the interest rate on long-term Treasury bonds. A negative slope curve is often seen as a precursor to a recession, as investors may expect a slowdown in economic growth in the future, leading to the possibility of central banks adopting a policy of cutting interest rates. In this case, investors prefer to buy long-term Treasury bonds to lock in higher interest rates.

A flat curve is one in which the difference in interest rates between short-term and long-term Treasury securities is small and the curve is relatively flat. A flat curve may reflect market concerns about future economic uncertainty, or it may be a transitional phase in the economic cycle.

The shape of its curve shifts in response to changes in the market economy and monetary policy. Factors such as the central bank's interest rate policy, inflation expectations, and market confidence may affect the shape of this curve. It is often regarded as an economic indicator, and by analyzing it, investors can observe information about future economic conditions and market expectations.

Treasury Rates Inverted

This is when the interest rate on long-term Treasury bonds is lower than the interest rate on short-term Treasury bonds, causing the short end of the bond yield curve to rise and form an inverted shape. This phenomenon is considered an important signal in the financial markets and may signal a recession.

Under normal circumstances, the returns required for investors to demand longer-term investments are usually higher because longer-term investments are usually accompanied by more risk and uncertainty. As a result, a normal yield curve should be trending upward, i.e., interest rates on long-term Treasury bonds are higher than interest rates on short-term Treasury rates.

However, the opposite is true when the yield curve inverts. This can happen when the market is concerned about the future economic outlook. An inverted yield curve is considered a forward-looking economic indicator because, historically, inversions tend to occur months to years before a recession.

Investors and economic observers often pay close attention to inversions as a signal of a potential recession. An inversion may suggest that the market expects economic growth to slow in the future, so demand for long-term Treasury rates rises, driving up their prices and interest rates.

It is important to note that an inversion is not an absolute recession prediction but rather a potential risk signal. Other factors and market conditions need to be taken into account, so while an inversion may raise concerns, it does not alone determine the trend of the economy.

3-Month Treasury Bond Issue Rates 2023 China

|

Issue Date

|

Interest rates on 3-month treasury bond issues

|

| 2023/12/15 |

2.24 |

| 2023/12/8 |

2.37 |

| 2023/12/1 |

2.34 |

| 2023/11/24 |

2.34 |

| 2023/11/17 |

2.28 |

| 2023/11/3 |

2.24 |

| 2023/10/27 |

2.28 |

| 2023/10/20 |

2.25 |

| 2023/10/13 |

1.92 |

| 2023/9/22 |

1.7 |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Impact of Changes in Treasury Rates

Impact of Changes in Treasury Rates