At 8:15 a.m. New York time, the November ADP National Employment Report drops. Markets are walking into today's ADP print with the dollar sitting on key support, gold hovering near record highs and the S&P 500 just below all-time peaks.

Economists' forecasts for private sector job growth range from +5,000 to +40,000, both well below the pre-2024 trend of around 100,000–150,000 monthly gains.

When you overlay that with ADP's own weekly data showing employers cutting an average of 13,500 jobs per week in early November, you can see why traders are uneasy.

Why Today's ADP Report Matters More Than Usual?

A Job Print That Stands in for Nonfarm Payrolls

Over recent months:

The unemployment rate has climbed to around a four-year high of 4.3%, signalling a cooling labour market.

Job openings have drifted lower, and hiring has slowed, even as weekly jobless claims stay historically low around 216k.

Due to the government shutdown delaying the BLS jobs report, the ADP print, along with weekly jobless claims and ISM data, now carries outsized influence on expectations for the December 9–10 FOMC meeting.

For context, the Fed are debating whether to cut again in December, with officials openly acknowledging a softening jobs market.

Markets are pricing in a high probability of another rate cut, but it's not a done deal. A stronger-than-expected ADP print could reduce those odds; a weak figure could solidify the cut and spur pricing for additional easing in early 2026.

Quick Look Back: What October ADP Data Implies?

| Month 2025 |

ADP Private Jobs |

Comment |

Pay Growth (Job-stayers) |

Pay Growth (Job-changers) |

| Sep |

−29,000 |

Third month of weak hiring; revised lower. |

4.5% |

6.7% |

| Oct |

+42,000 |

First positive month since July; large firms did all the lifting. |

4.5% |

6.7% |

The October ADP report showed:

+42,000 private jobs

A revised -29,000 in September,

Annual pay growth at 4.5% year-on-year.

The upside surprise versus expectations of around +25k gave the dollar a brief lift in early November.

However, hiring levels remained soft by historical standards and aligned with a gradually weakening labour market.

New Weekly "NER Pulse": The Worrying Undercurrent

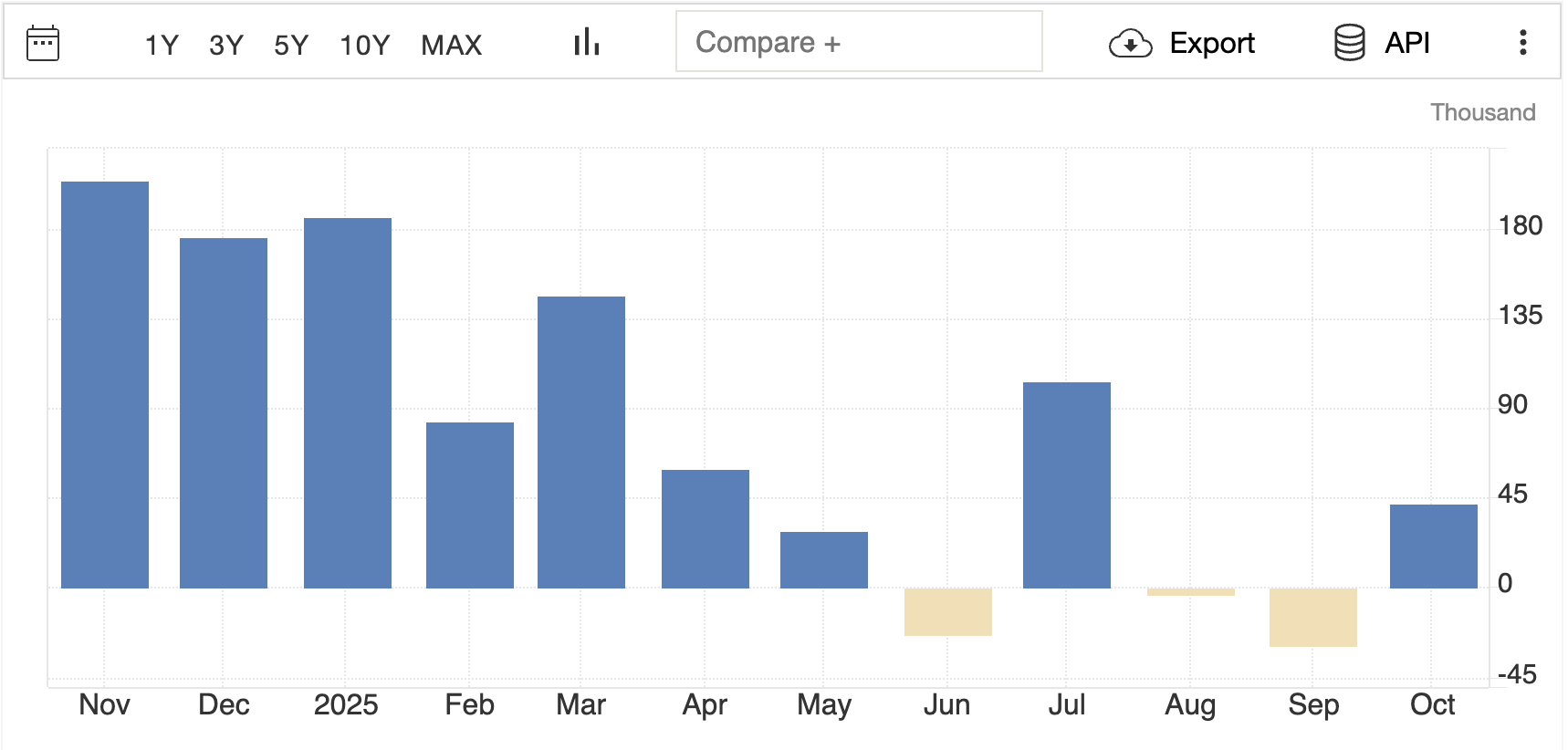

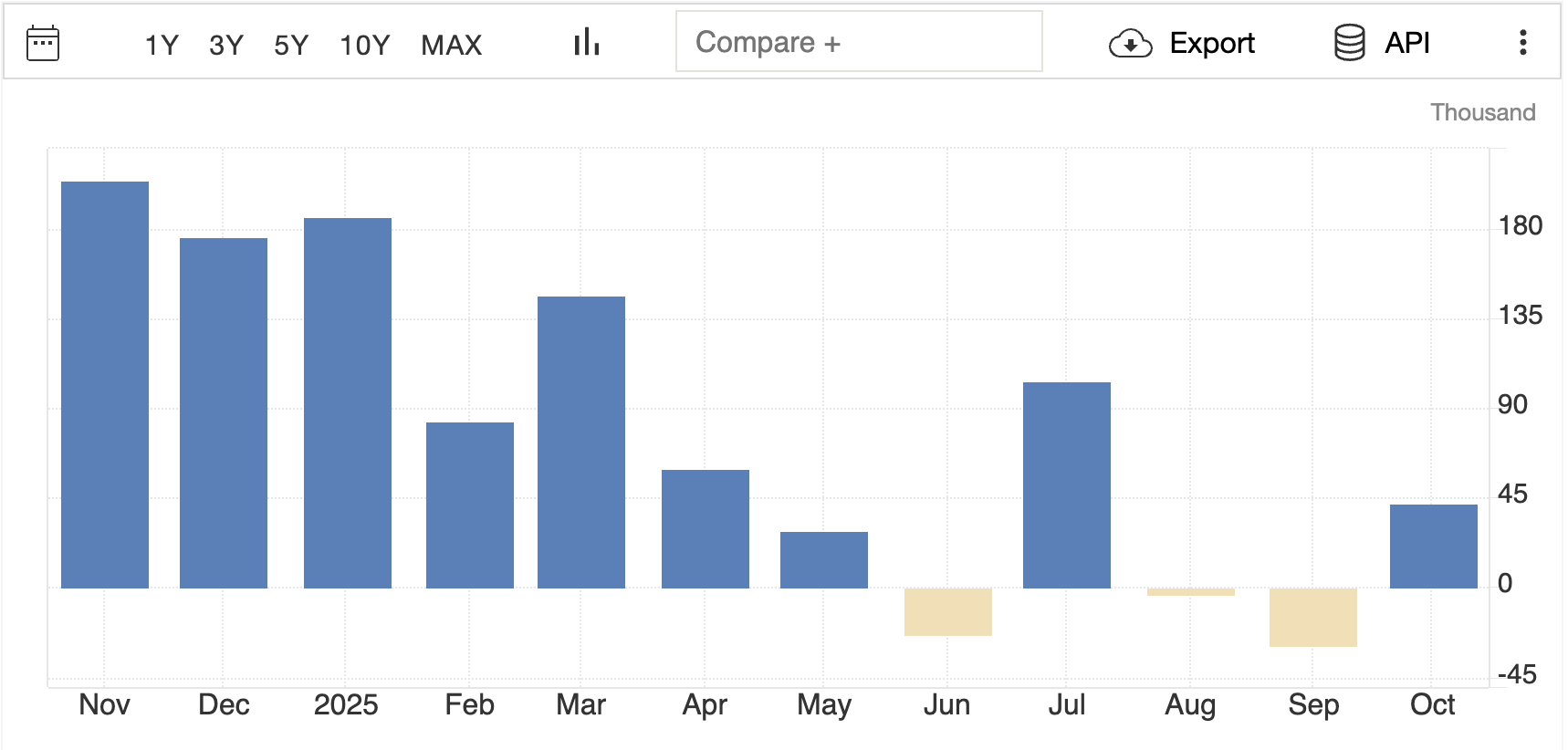

ADP now publishes a weekly NER Pulse, giving a rolling view of private payrolls:

For the four weeks ending 11 October, ADP estimated +14,250 jobs per week.

For the four weeks ending 25 October, that flipped to about -11,250 jobs per week.

For the four weeks ending 1 November, losses eased to around -2,500 per week.

For the four weeks ending 8 November, the latest ADP preliminary pulse survey indicated -13,500 jobs per week, suggesting outright private-sector job losses heading into November.

Taken together, the monthly October gain and the negative weekly readings paint a picture of a market that's barely treading water rather than adding jobs at a healthy clip.

What Economists Expect From the November ADP Report?

There's a rare amount of disagreement going into today's print. Different sources are clustered anywhere from slightly negative to modestly positive growth.

| Source / Indicator |

November ADP view* |

Comment |

| CME Econoday calendar |

+20k private jobs |

Baseline "modest growth" consensus before the release. |

| FactSet |

+40k |

Implies stabilisation after October’s +42k. |

| Bloomberg |

+5k |

Suggests hiring has nearly stalled. |

| ADP weekly NER Pulse |

Net job losses |

Latest pulse shows about -13.5k jobs per week in early November. |

*Estimates refer to change in nonfarm private employment.

The spread between +5k and +40k tells you how uncertain this print is.

With ADP's own high-frequency data skewing negative, the risk around the central +20k consensus is arguably tilted to the downside.

Three Trading Paths for Today's ADP Number

1) Strong Upside: Clear Beat Above ~50K

If ADP prints 50k or higher, particularly if the breakdown shows broad-based gains:

Fed pricing: Markets would likely trim December cut odds and push some easing expectations further into 2026.

Dollar (DXY): The DXY is currently around 99.2–99.4, sitting near the lower end of a 99–100.5 range. A strong print could trigger a bounce toward 99.8–100.5, in line with several technical notes highlighting 99 as support and 100 as a key ceiling.

US 10-year yield: Yields have been hovering just above 4%, around 4.07–4.10%. A beat could nudge that closer to 4.15–4.20% as traders back away from aggressive easing bets.

EUR/USD: Trading slightly above 1.16, with resistance around 1.1650–1.17; a strong ADP would favour a dip back toward 1.1550–1.16.

Gold (XAU/USD): Near $4,200/oz, having rallied roughly 7% over the past month. A strong labour print and firmer yields could cap price below $4,250 and provoke a pullback toward $4,150–4,100, with $4,000 as a big line in the sand.

2) Predictable Print: Near Consensus 0–40k

A result anywhere between flat and ~40k would say "slow grind lower, but no sudden crack":

Fed: Keeps December cut odds high but not guaranteed; focus shifts quickly to ISM services and core PCE.

Dollar & Yields: Likely to remain range-bound, with DXY oscillating between 99–99.7 and the 10-year yield anchored near 4%.

Risk Assets: S&P 500 and gold expected to trade within current ranges, driven primarily by positioning and options flows.

3) Clear Downside: Negative or Near-Zero Print With Weak Details

If ADP shows job losses or a minimal gain with soft wage and small-business components:

Fed: A weak print, on top of the NER Pulse losses, would cement the case for a December rate cut and could bring talk of a more dovish path in early 2026.

DXY: A break below 99 would be a clear signal that the September-to-November dollar uptrend is fading, with technical traders eyeing the 98.9 pivot and then the 98 handle.

EUR/USD: A weak ADP report could trigger a decisive break above 1.1650, paving the way toward 1.17–1.1780, as multiple technical analyses have highlighted.

Gold: The path of least resistance would be higher. A daily close above $4,250 would strengthen the case for a run toward $4,300–4,400, in line with the breakout projections some desks have laid out.

S&P 500: Initially, equities might cheer easier policy odds, but traders will quickly ask whether earnings can hold up in a labour downturn. A sharp miss could see higher intraday volatility around the 6,800 pivot.

Frequently Asked Questions

1. What Time Is the November ADP Employment Report Released?

The ADP National Employment Report is scheduled for 8:15 a.m. Eastern Time today.

2. Which Markets React Most to ADP Employment Data?

In the first few minutes, the US dollar (DXY) and Treasury yields tend to move the most. Soon after, EUR/USD, USD/JPY, gold, S&P 500 futures and high-beta equity sectors respond as traders reassess Fed cuts and growth prospects.

3. What ADP Number Would Be Considered "Bad" for the Dollar?

Given the current +20k consensus, anything near zero or negative, especially if coupled with soft wage growth and weak small-business hiring, would likely be seen as clearly dollar-negative.

Conclusion

Heading into today's ADP release, the story is simple: the US labour market is no longer running hot, but it hasn't broken either. October's modest +42k gain, the negative weekly NER pulse, and a rising unemployment rate all point to a jobs engine that's slowing, not collapsing.

The real edge today lies in knowing your levels, understanding how ADP fits into the broader soft-landing versus slowdown debate, and being disciplined enough to trade the reaction, not the headline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.