Many investors are looking for the best REIT ETF to buy in 2026. The practical approach is to separate core exposure (broad, liquid U.S. REIT funds that can anchor an allocation) from satellites (global REITs, mortgage REITs, ESG-tilted, active, or income-enhanced strategies designed to target more specific outcomes).

In a year where real estate performance may hinge on the direction of interest rates, refinancing conditions, and property-level fundamentals, the “right” ETF is the one that matches your objective: steady income, diversified real estate beta, or targeted yield/thematic exposure.

Quick Comparison Table

Data below is from ETF Database’s Real Estate sector list as of 01/22/2026. “Dividend yield” refers to the annual dividend yield (%) shown there; “Risk” is Beta (a standard market-risk proxy).

| Ticker |

ETF |

Exposure / angle |

Dividend yield |

Risk (Beta) |

| VNQ |

Vanguard Real Estate ETF |

Core, broad U.S. real estate/REITs |

3.80% |

1.03 |

| SCHH |

Schwab U.S. REIT ETF |

Core, low-cost U.S. REIT exposure |

2.94% |

0.99 |

| XLRE |

Real Estate Select Sector SPDR ETF |

U.S. large-cap real estate sector tilt |

3.35% |

1.00 |

| REET |

iShares Global REIT ETF |

Global listed real estate diversification |

3.58% |

0.99 |

| RWR |

SPDR Dow Jones REIT ETF |

Established U.S. REIT benchmark approach |

3.67% |

1.05 |

| FREL |

Fidelity MSCI Real Estate Index ETF |

Broad U.S. real estate index exposure |

3.48% |

1.03 |

| VGSR |

Vert Global Sustainable Real Estate ETF |

ESG-tilted global real estate |

3.33% |

0.71 |

| JPRE |

JPMorgan Realty Income ETF |

Income-oriented real estate allocation |

2.55% |

0.85 |

| CSRE |

Cohen & Steers Real Estate Active ETF |

Active real estate selection |

2.63% |

0.98 |

| IYRI |

NEOS Real Estate High Income ETF |

High-income, rules/derivatives-based approach |

11.54% |

0.91 |

Interpretation note: Beta ~1.0 means the ETF has historically moved broadly in line with the equity market; below 1.0 has tended to be less sensitive; above 1.0 more sensitive. Beta can change over time.

Best REIT ETF to Buy Now: Top Picks for 2026

1) Vanguard Real Estate ETF (VNQ)

VNQ is a broad, core U.S. equity REIT ETF spanning major property types, making it a simple “one-ticket” way to access the sector. If 2026 brings more stable (or easing) financing conditions, VNQ is positioned to capture a broad-based REIT normalization without needing to pick niches.

VNQ remains highly tradable at scale, with AUM of ~$34.8B and an annual dividend yield of ~3.80%.

2) Schwab U.S. REIT ETF (SCHH)

SCHH is a low-cost, index-style U.S. REIT allocation that closely tracks the “beta” of the domestic REIT market. It works in 2026 for investors who want diversified REIT exposure without thematic tilts, especially if the cycle shifts from rate shock to fundamentals. Liquidity is supported by AUM of ~$9.1B, with an annual dividend yield of ~2.94%.

3) Real Estate Select Sector SPDR Fund (XLRE)

XLRE concentrates on large-cap U.S. real estate names drawn from the S&P 500, creating a more “quality/megacap” real estate profile than broader funds.

Today, that tilt can matter if capital continues to reward balance-sheet strength and scale among listed property companies. XLRE combines strong tradability (AUM of ~$7.1B) with an annual dividend yield of ~3.35%.

4) iShares Global REIT ETF (REET)

REET provides diversified listed real estate exposure across regions, helping reduce reliance on a single country’s rate cycle. It’s compelling for 2026 if global real estate recoveries diverge (for example, different timing of rate cuts or growth rebounds). The fund has an AUM of ~$4.44B and an annual dividend yield of ~3.58%.

5) SPDR Dow Jones REIT ETF (RWR)

RWR is a long-running U.S. REIT ETF tied to a traditional benchmark, offering a balanced, plain-vanilla REIT allocation. It earns a spot for 2026 as a “steady core” option if you expect a broad REIT recovery rather than one narrow niche dominating.

Current profile: AUM of ~$1.71B and annual dividend yield of ~3.67%.

6) Fidelity MSCI Real Estate Index ETF (FREL)

FREL tracks a broad U.S. real estate index and is designed for straightforward, diversified exposure with minimal complexity. For 2026, it fits investors who want the sector’s income plus potential re-rating if conditions improve, without layering in active or options risk. FREL has an AUM of ~$1.36B and an annual dividend yield of ~3.48%.

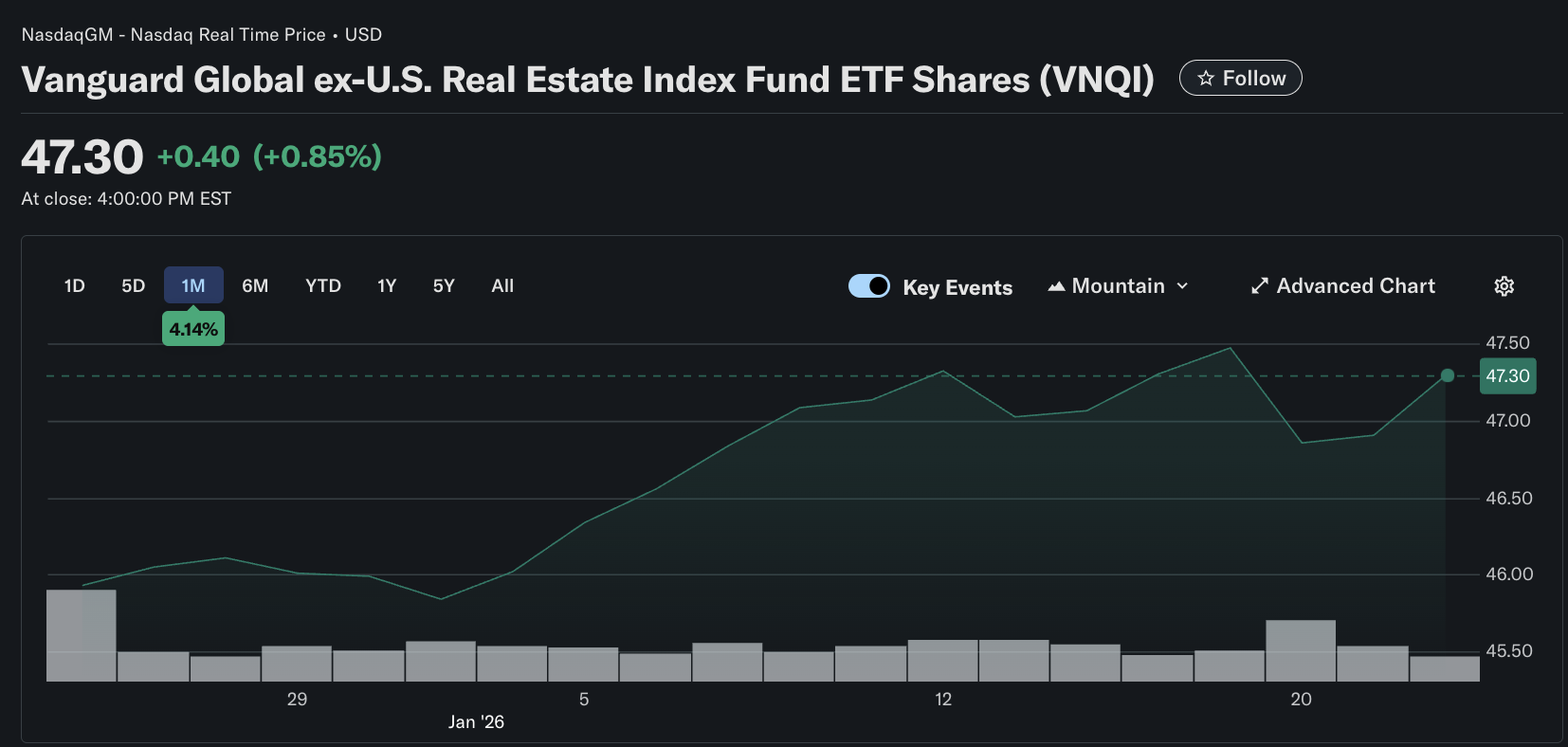

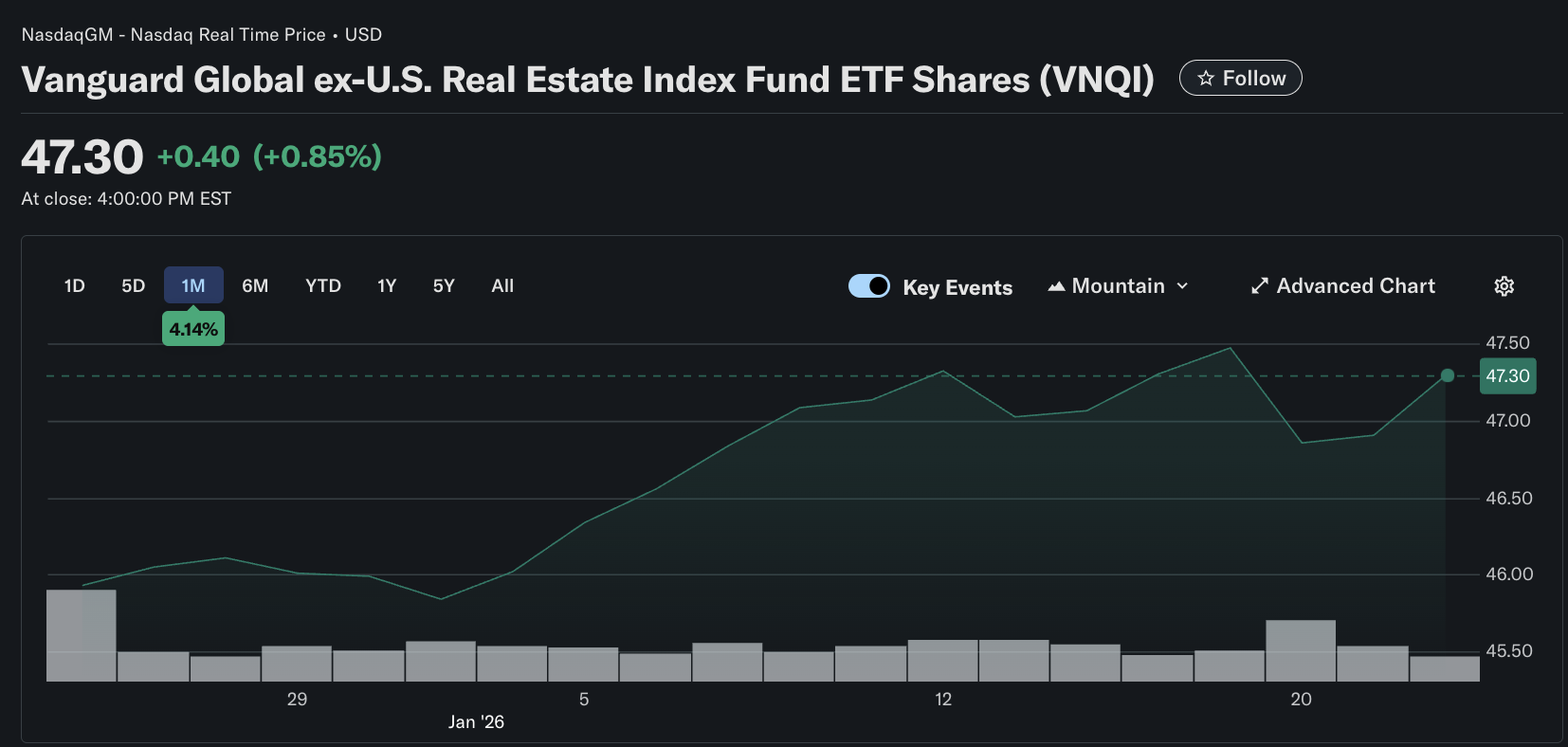

7) Vanguard Global ex-U.S. Real Estate ETF (VNQI)

VNQI excludes the U.S., focusing on international-listed real estate, which can be helpful if non-U.S. property cycles (and currencies) become the incremental driver in 2026.

It’s a clean diversification tool when you want global real estate exposure without doubling up on U.S. REIT risk already held elsewhere. Scale remains meaningful (AUM of ~$3.57B), and the dividend yield is ~4.58% (recently reported).

8) iShares Mortgage Real Estate ETF (REM)

REM targets mortgage REITs, where returns are driven more by funding costs and interest-rate spreads than by property rents, making it structurally higher volatility than equity REIT baskets. In 2026, it can work as a tactical income allocation if spreads normalize and the curve becomes less hostile to leveraged spread businesses.

It offers a higher payout profile (annual dividend yield of ~8.18%) but is smaller, with AUM of ~$664M.

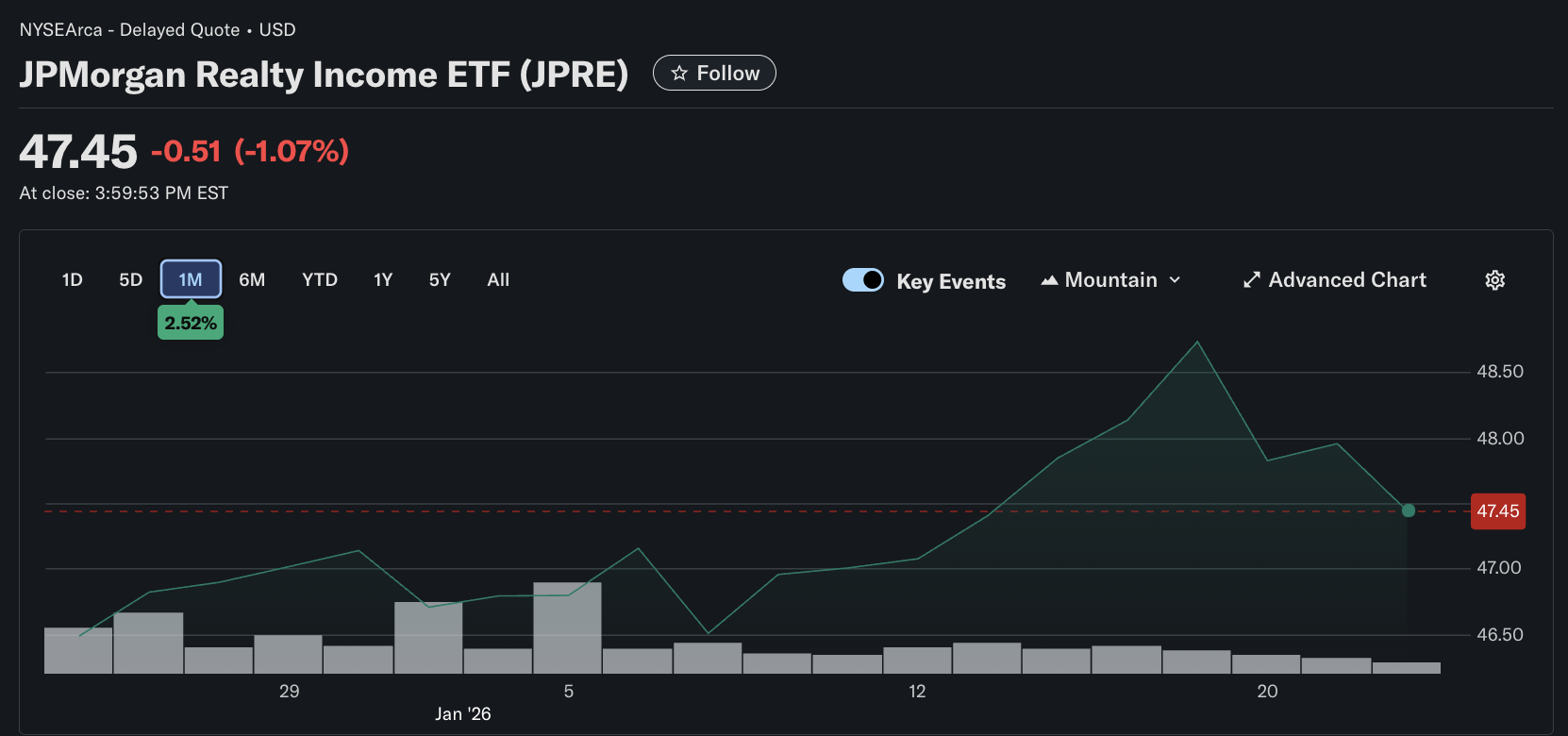

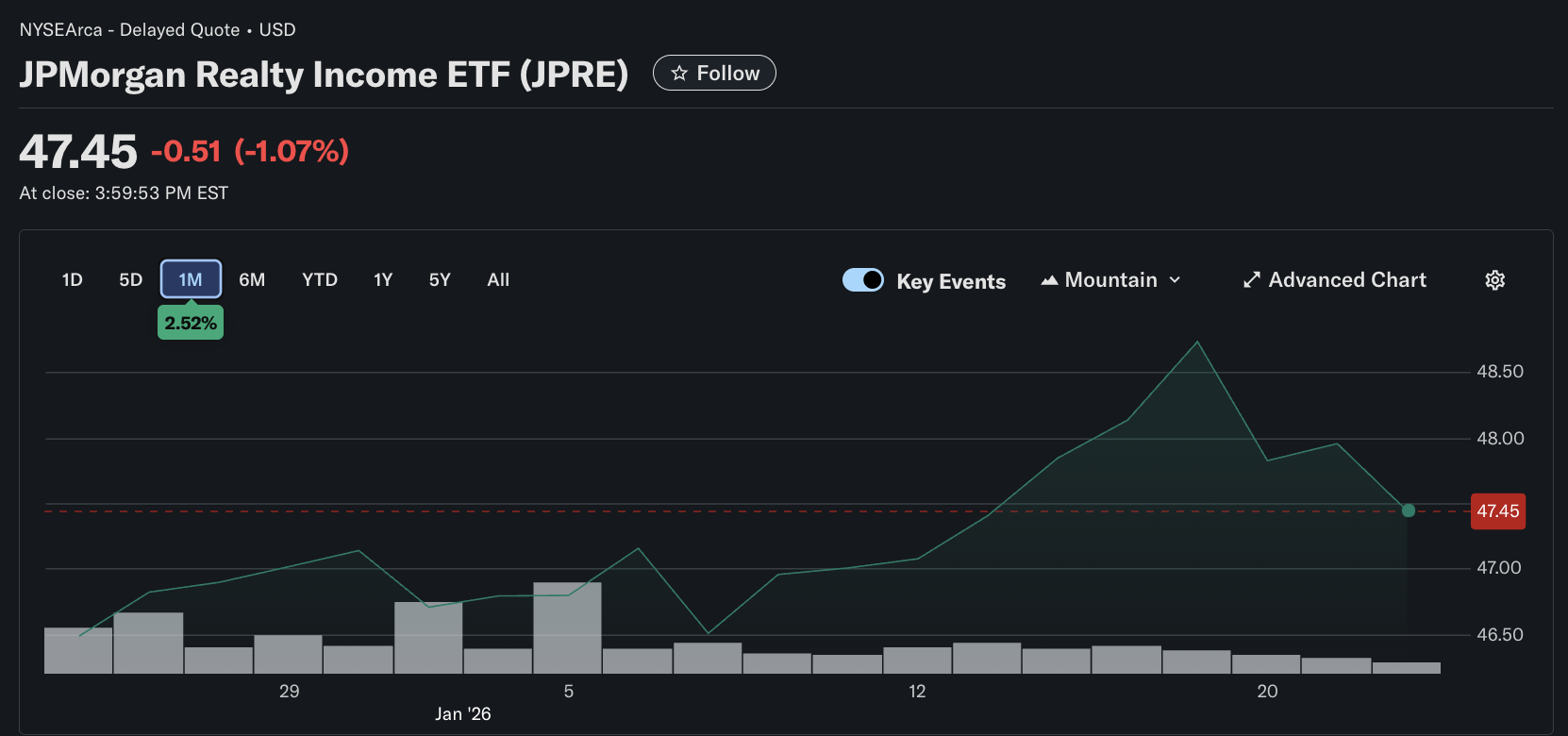

9) JPMorgan Realty Income ETF (JPRE)

JPRE is an actively managed real estate income ETF, useful for investors who want a manager’s approach to balancing income and risk rather than purely tracking an index.

It can be relevant in 2026 if dispersion inside real estate remains high and security selection matters more than broad beta exposure. It is still developing scale (AUM of ~$426.7M) and shows an annual dividend yield of ~2.55%.

10) NEOS Real Estate High Income ETF (IYRI)

IYRI is designed for high monthly income, using a data-driven call option strategy alongside REIT exposure, aiming to monetize volatility rather than relying solely on REIT dividends.

That’s why it’s on this list for 2026: if REITs grind sideways or recover unevenly, an options-overlay approach may support a higher distribution profile than pure-beta REIT funds.

As of the latest data shown, NEOS has an AUM of ~$200.6M and an annual dividend yield of ~11.54%, with NEOS also reporting a distribution rate of 10.83%.

How To Trade REIT ETFs With EBC Financial Group

EBC provides ETF trading, which lets you trade ETF price movements without owning shares, and typically supports both long and short strategies.

Step 1: Register your profile

Go to EBC’s official site and click Register.

Enter the required details (email/phone), request a verification code, set your password, and submit.

Step 2: Complete KYC verification

Step 3: Create a demo or live trading account

From the portal, select Create an Account.

Choose your trading platform, account type, currency, leverage, and set your master/investor passwords, then click Create Now.

EBC provides MetaTrader 4 (MT4) and MetaTrader 5 (MT5); download/install via EBC’s official website.

Step 4: Find and trade the ticker you want

Use the ETF instrument list and/or your platform’s symbol search to confirm the exact symbol naming used in your environment.

Key product mechanics to understand before trading:

No ownership required (you speculate on price).

Costs typically include the bid-ask spread and overnight financing charges (as displayed on the platform).

Short-selling is supported for ETF CFDs.

Risk Considerations (Read Before Trading REIT ETFs)

1) Interest-rate sensitivity

REIT valuations can react sharply to changes in interest-rate expectations because financing costs and capitalization rates influence property values and cash flows.

2) Refinancing and credit conditions

Even with improving rates, refinancing risk can remain material if credit spreads widen or lenders tighten standards, particularly for highly leveraged REITs or weaker property types.

3) Property-type concentration risk

Broad funds diversify across sectors, but concentrated funds (or index methodologies) can still end up overweight in specific areas (e.g., industrial, residential, towers, data centers). Sector leadership can rotate quickly.

4) Mortgage REIT risk (REM)

Mortgage REIT strategies can be more sensitive to yield-curve shape, funding costs, and spread volatility. They may experience larger drawdowns than equity REIT ETFs in stressed markets.

5) Global and currency risk (REET/VNQI)

International real estate introduces country risk, regulatory differences, and FX effects that can amplify or offset local-market performance.

6) Yield is not a guarantee

Dividend yields fluctuate with prices and distributions. Higher yields can reflect higher risk, and distributions can change materially during downturns.

7) Options-overlay risk (IYRI)

Income-enhanced funds using options may sacrifice some of the upside in strong rallies and exhibit risk/return behavior different from that of traditional REIT index funds.

Frequently Asked Questions (FAQ)

1) Can I trade REIT ETFs with EBC Financial Group?

Yes, you can trade the Vanguard Real Estate ETF (VNQ) on EBC Financial Group. Availability can vary by entity/region and platform, so confirm the specific REIT ETF ticker in your MT4/MT5 symbol search or in EBC’s product listings.

2) Do I need to own the ETF shares to trade REIT ETFs on EBC?

No. EBC’s ETF CFD trading allows you to trade ETF price movements without owning ETF shares.

3) Can I short REIT ETFs on EBC?

Yes. ETF CFD trading typically supports short-selling, enabling strategies in both rising and falling markets.

4) Are REIT ETFs “safe” because they pay dividends?

Not necessarily. REIT dividends can be attractive, but REIT prices can still be volatile, especially when interest-rate expectations shift or when property fundamentals weaken. Treat yield as one input, not a guarantee of safety.

5) Why can REIT ETF dividend yields vary so much across funds?

Yield differences can come from portfolio composition (equity REITs vs. mortgage REITs), distribution policies, and market price changes (price down = yield up, all else equal). High yield can signal higher risk, not higher quality.

Conclusion

In 2026, the best REIT ETF is the one that matches your objective and risk tolerance. Core funds such as VNQ, SCHH, XLRE, RWR, and FREL can anchor a diversified real estate allocation.

At the same time, satellites like REET/VNQI (global diversification), REM (mortgage REIT income), and IYRI (options-enhanced income) can be used tactically. If you plan to trade via EBC’s website, understand spread and overnight financing costs, and size positions conservatively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.