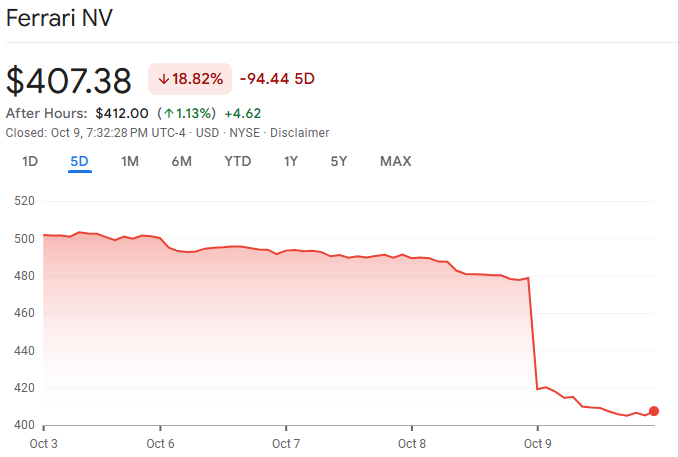

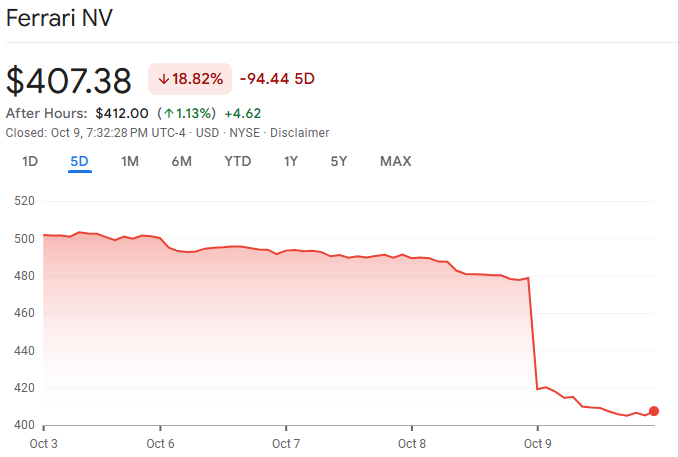

Ferrari stock suffered its worst single-day collapse since the company's 2015 initial public offering, plunging 15% to close at $407.38 on 9 October after executives slashed the company's electric vehicle ambitions and delivered 2030 profit guidance that fell sharply below Wall Street expectations.

The crash occurred during Ferrari's Capital Markets Day event in Maranello, where the luxury automaker unveiled its first electric vehicle—the Elettrica—but simultaneously cut its 2030 EV production target in half to just 20% from a previous goal of 40%, whilst lowering long-term earnings forecasts that implied growth well below historical rates.

The selloff erased all of Ferrari's 2025 stock gains and wiped roughly €13 billion ($15 billion) from the company's market capitalisation in a single session. [1]

Ferrari Stock Price Collapse: The Numbers

The magnitude of Thursday's crash stands out even against broader market weakness and luxury sector headwinds.

| Metric |

Data |

| NYSE closing price |

$407.38 (down 15.0%) |

| Milan closing price |

€354.00 (down 15.4%) |

| Previous close (8 Oct) |

$479.21 |

| Intraday low |

$403.00 |

| Previous worst day |

−12% (2018) |

| YTD performance |

Now −4% for 2025 |

| Volume |

4.24 million shares (10× normal) |

| Market cap lost |

€13 billion ($15 billion) |

| Peer comparison (Oct 9) |

|

| S&P 500 |

−0.3% |

| BMW |

−1.2% |

| STOXX 600 |

−0.6% (Ferrari dragged index) |

The stock had traded near all-time highs at $519 in July 2025 before beginning a four-day losing streak that culminated in Thursday's collapse. Ferrari now trades at 42x forward earnings, down from 50x, but still commands a significant premium to mass-market luxury automakers despite slower projected growth.

Ferrari Stock Crash: 4 Capital Markets Day Failures

Ferrari executives gathered investors on 9 October to outline the strategic plan through 2030, but four major disappointments triggered the selloff.

EV target halved (40% → 20%): The biggest shock came as Ferrari slashed its fully electric vehicle target for 2030 to just 20% of production, down from 40% set in 2022, raising questions about the company's ability to navigate industry electrification. [2]

2030 revenue guidance: €9 billion: Implies only 6% compound annual growth rate versus the 10% trajectory outlined at the 2022 Capital Markets Day, signalling a meaningful deceleration.

EBITDA growth slows to 6% CAGR: The 2030 EBITDA target of at least €3.6 billion implies limited operational leverage and potential margin pressure over the next five years—well below the 12% EBITDA growth achieved from 2022-2025.

2025 guidance tepid: Revenue of at least €7.1 billion barely beat prior forecasts, whilst adjusted EBIT of €2.06 billion and EPS of €8.80 both missed consensus expectations.

Citi analysts wrote that the new guidance "does not meet 'lower case' from our preview and reflects a cautious stance from management," adding that the conservative outlook suggests "limited operational leverage throughout the upcoming cycle".

RBC Capital Markets noted that the 6% growth rate represented a "downshift in EBIT growth from prior history" that disappointed investors expecting Ferrari to maintain its premium trajectory.

Ferrari Stock Sinks on 50% EV Cut

The decision to halve Ferrari's electric vehicle ambitions represented a dramatic reversal that called into question the company's electrification strategy.

| Powertrain type |

2030 target |

Previous 2030 target |

Change |

| Fully electric (EV) |

20% |

40% |

−50% |

| Hybrid |

40% |

40% |

No change |

| Internal combustion (ICE) |

40% |

20% |

+100% |

The real story behind the table is the doubling of pure internal combustion vehicles from 20% to 40% of the 2030 lineup, signalling that Ferrari does not yet believe battery technology can deliver the performance and driving experience its customers demand.

CEO Benedetto Vigna defended the shift, stating it reflected "customer focus, current market conditions, and expected future evolution," but analysts interpreted the move as an admission that the company cannot yet build an electric supercar competitive with its petrol-powered models.

This strategic retreat raises existential questions about whether European combustion engine bans tighten or if rivals like Porsche and Rimac deliver superior electric performance by mid-decade.

Ferrari Elettrica: $535K Price, Late 2026 Delivery

Ferrari unveiled the production-ready chassis and electric motors of the Elettrica, its first fully electric model, but the reveal failed to generate excitement as investors focused on delayed timelines and limited details about future EV plans.

Key specifications:

Power: 1,000 HP from in-house electric motors

Range: 530 kilometres (approximately 330 miles)

Architecture: 800-volt system for fast charging

Price: €500,000 ($535,000) before options

Deliveries: Late 2026 (second half) [3]

The company admitted that a second EV model remains in early planning stages with no confirmed launch date, whilst acknowledging struggles to overcome battery weight and performance trade-offs.

This revelation underscored the challenges facing even premium manufacturers in the electric transition and contributed to the negative market reaction.

Ferrari Stock Falls on Weak Profit Guidance

Ferrari's financial targets for both 2025 and 2030 fell short of expectations across multiple metrics, with the long-term outlook representing the biggest disappointment.

| Guidance metric |

Ferrari target |

Consensus estimate |

Result |

| 2025 revenue |

≥€7.1 billion |

€7.09 billion |

Beat by €10M |

| 2025 adj. EBIT |

≥€2.06 billion |

€2.07 billion |

Miss by €10M |

| 2025 adj. EPS |

≥€8.80 |

€8.90 |

Miss by €0.10 |

| 2030 revenue |

~€9 billion |

Higher expected |

Disappointing |

| 2030 EBITDA |

≥€3.6 billion |

€3.2B+ expected |

Conservative |

UBS analyst Tom Narayan pointed out that the 2030 EBITDA target implies only a 6% CAGR from current levels, well below the 10% revenue growth and 12% EBITDA expansion that management had delivered from 2022-2025.

That deceleration suggests Ferrari sees limited pricing power or volume growth opportunities over the next five years, contradicting the premium brand narrative that had supported the stock's valuation above 50 times forward earnings.

Luxury Auto Sector Under Pressure

Ferrari's crash occurred against a backdrop of broader challenges facing luxury automotive manufacturers.

BMW (Oct 7): Trimmed 2025 guidance citing weaker China performance; cut automotive EBIT margin to 5–6% from 5–7%; shares fell 3%

Porsche and Aston Martin: Both delayed EV plans in recent months, reflecting tepid demand for electric supercars across the luxury segment

STOXX 600 index: Fell 0.6% on Thursday, dragged lower by Ferrari's steep losses

Chinese EV competition: Continues to pressure Western luxury brands on technology and pricing, reducing margin outlooks industry-wide

The confluence of sector headwinds with Ferrari's specific disappointments created conditions that triggered the massive selloff.

What Analysts are Saying

Wall Street research teams rushed to reassess Ferrari's investment case following the Capital Markets Day revelations.

Citi: "The guidance falls below expectations and reflects a cautious stance from management. Given limited operational leverage, we see risk to both consensus EPS and near-term multiples."

RBC Capital Markets: "We were expecting a conservative 2030 EBIT guide, but the 6% CAGR is well below the 10% implied at the 2022 CMD. Investors are likely to interpret a downshift in EBIT growth from prior history."

UBS: "The underwhelming 2030 forecast disappointed investors. Management forecasted revenue and EBITDA, implying a CAGR well below the growth trajectory forecasted in 2022."

No major firms raised price targets following the event, and several are reviewing ratings with potential downgrades pending deeper analysis of the revised business plan.

Ferrari Stock Recovery: 3 Scenarios to Nov 4 Earnings

The path forward depends on management's ability to address investor concerns at the third-quarter earnings call scheduled for 4 November.

Scenario 1: Bull case (25% probability)

Scenario 2: Base case (50% probability)

Catalyst: Q3 earnings in line, no major guidance changes, cautious tone persists.

Ferrari stock reaction: Trade $380-$420 range, digest losses sideways.

Scenario 3: Bear case (25% probability)

Catalyst: Q3 miss, 2025 guidance cut, analysts slash targets and downgrade.

Ferrari stock reaction: Break below $380, test 2024 lows near $350.

Key Dates for Ferrari Stockholders

Upcoming events will determine whether the stock can stabilise or faces further pressure.

| Date |

Event |

Potential impact |

| Nov 4, 2025 |

Q3 2025 earnings call |

Management must address EV strategy concerns |

| Late 2026 |

Elettrica deliveries begin |

First EV revenue contribution |

| H1 2027 |

Second EV details expected |

Timeline uncertain after cuts |

| 2030 |

Target mix: 20% EV, 40% hybrid, 40% ICE |

Final assessment of strategy |

Conclusion

The November 4 earnings call represents the first opportunity for executives to address the strategic questions raised by Thursday's guidance cut, making it the key near-term catalyst for recovery or further decline.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.cnbc.com/2025/10/09/ferrari-unveils-first-electric-vehicle-and-cuts-2030-ev-sales-target.html

[2] https://www.telegraph.co.uk/business/2025/10/09/ferrari-halves-targets-for-electric-cars/

[3] https://paultan.org/2025/10/09/ferrari-elettrica-stage-one-official-details/