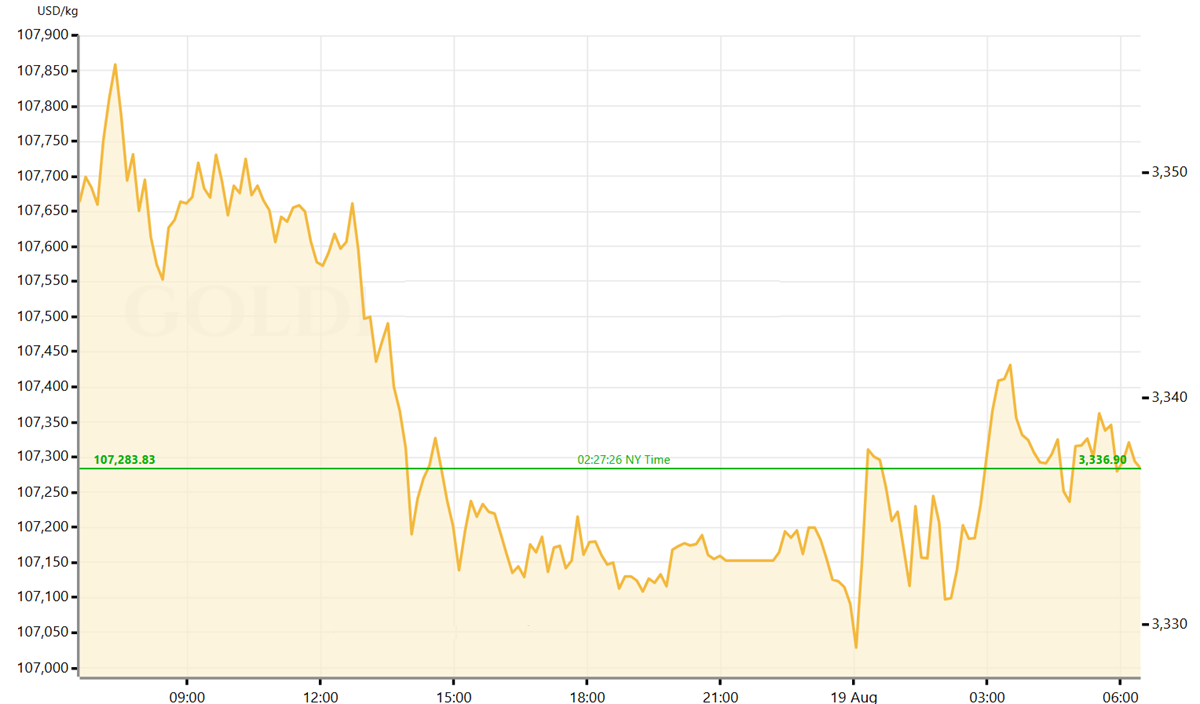

Introduction to XAU/USD

Gold, symbolised as XAU, has been a cornerstone of financial systems for centuries. When measured against the U.S. dollar (USD), the pairing XAU/USD becomes one of the most widely followed instruments in global markets. Traders, investors, and policymakers alike monitor its price closely, as gold is not only a commodity but also a monetary asset, a hedge against inflation, and a store of value in uncertain times.

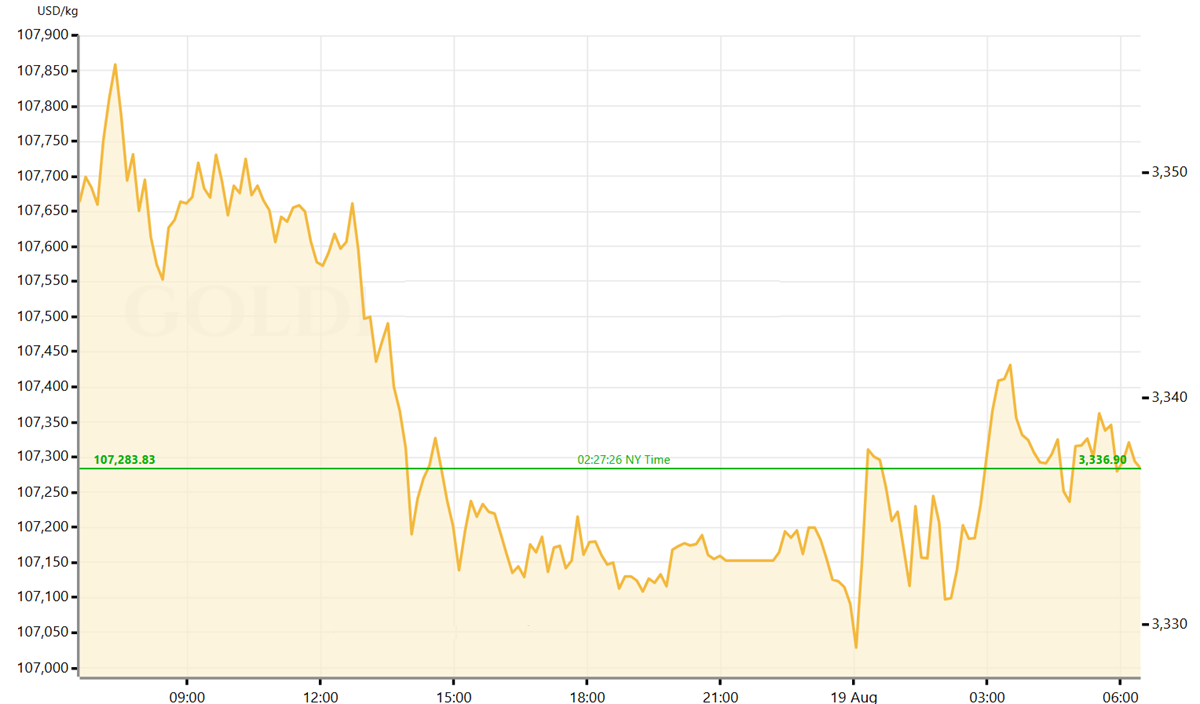

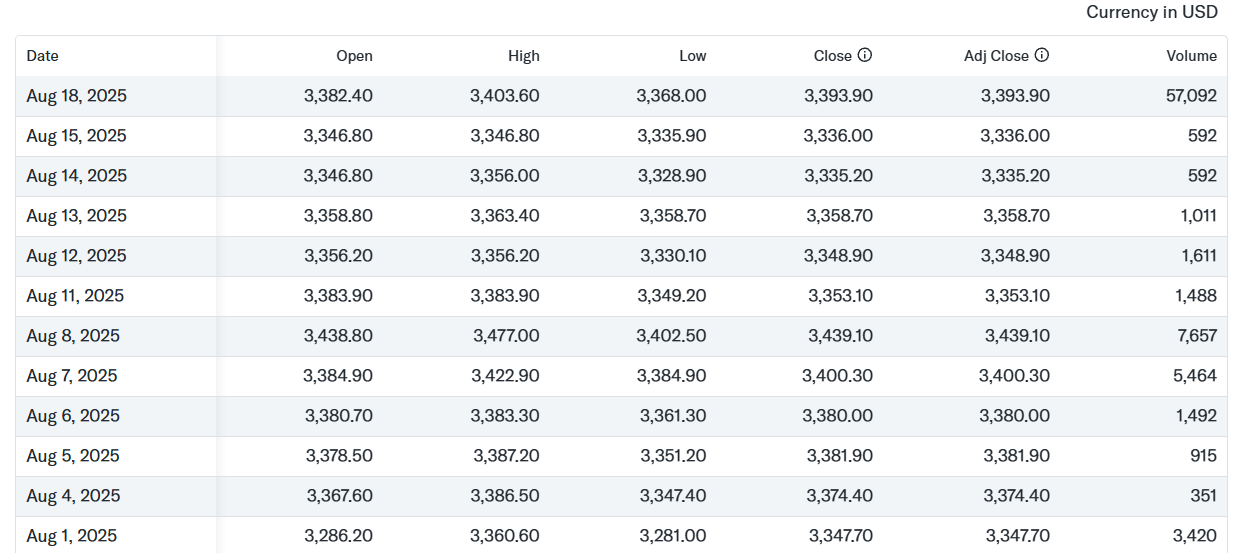

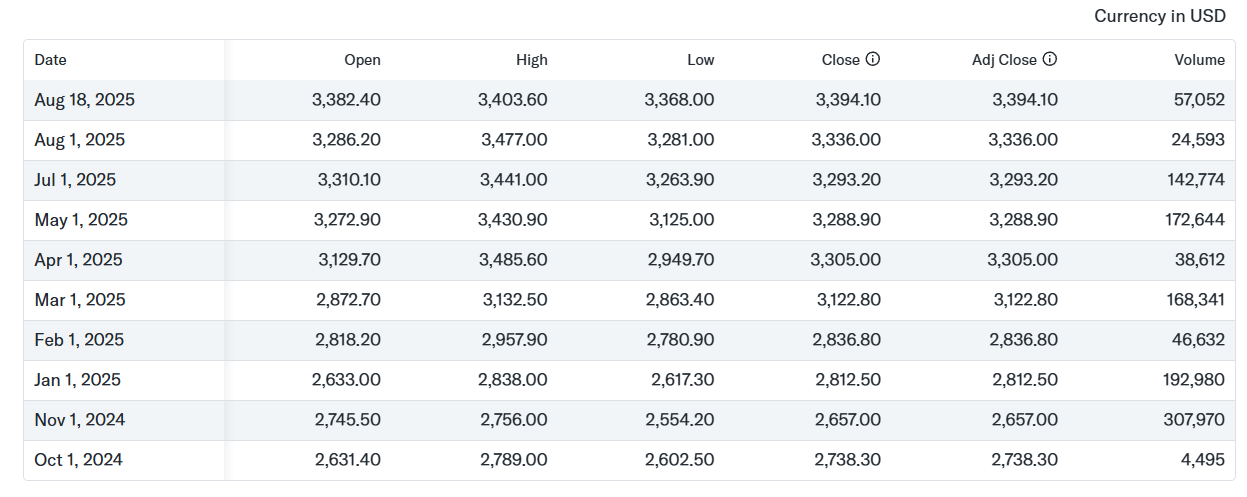

Understanding XAU/USD historical data allows us to interpret how gold has responded to major global events—economic cycles, crises, and shifts in monetary policy. For long-term investors, this historical perspective is essential for recognising patterns and anticipating potential risks and opportunities.

Milestone events in gold's price history

These waypoints align across the long-run charts and reference series widely used by researchers.

Themes and Patterns in Historical XAU/USD Data

Looking across decades of data, several consistent themes emerge:

Inflation Hedge: Gold prices tend to rise during periods of high inflation or when fiat currencies lose purchasing power.

Safe-Haven Demand: Global crises—wars, pandemics, or financial collapses—regularly trigger rallies in gold as investors seek protection.

Inverse Dollar Correlation: Since gold is priced in U.S. dollars, a strong dollar often suppresses gold prices, while a weaker dollar typically boosts them.

Monetary Policy Influence: Interest rate cycles set by the Federal Reserve play a decisive role, as higher rates reduce gold's appeal relative to yielding assets.

These recurring behaviours highlight why XAU/USD remains central to global portfolio strategies.

Macroeconomic influences captured in the history

Historical XAU/USD swings map closely to macro drivers:

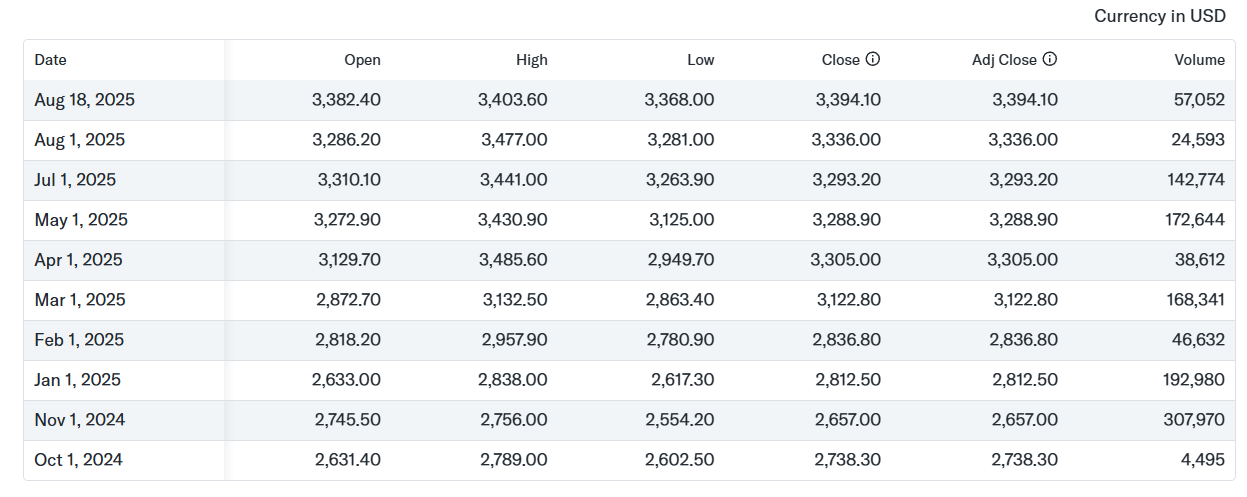

Inflation and real yields: Lower real yields typically support gold; high and rising real yields can weigh on it.

U.S. dollar: A weaker USD often corresponds with stronger gold; the relationship is visible across major episodes.

Central-bank demand: Since 2022. emerging-market reserve managers have been persistent buyers, a theme repeatedly cited around the 2024–2025 rally.

These forces, plus episodic geopolitical stress, explain why gold can decouple from equities at crucial moments, a property visible around 2008. 2011. 2020 and 2025.

Using XAU/USD historical data for strategy and research

How practitioners put the data to work:

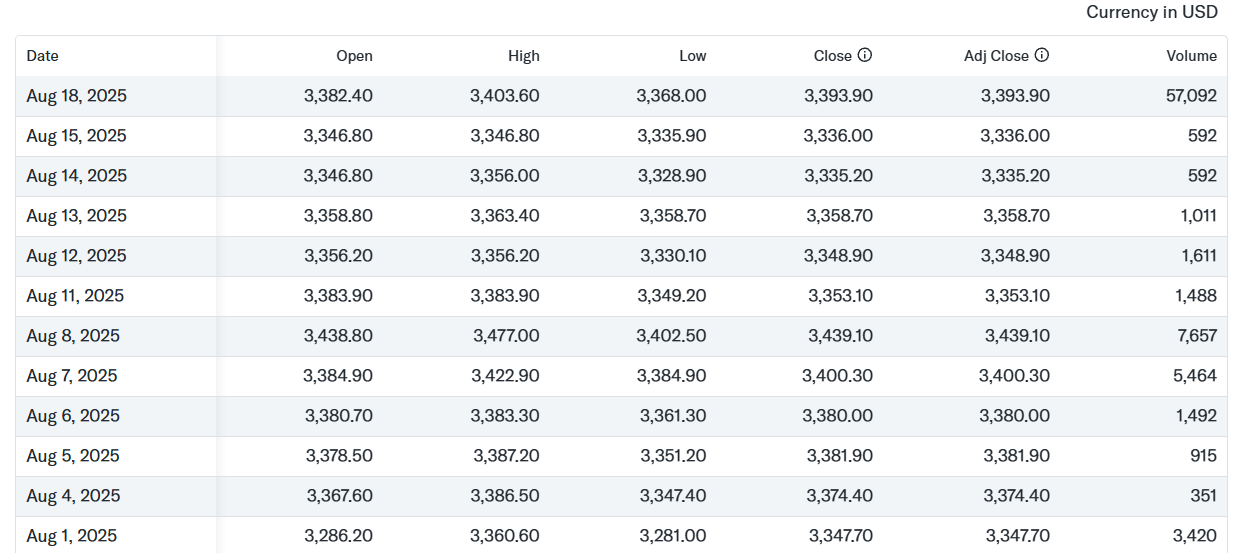

Back-testing trading rules (e.g., trend-following, mean-reversion) on clean OHLC series; use walk-forward and out-of-sample tests to avoid overfitting.

Macro overlays: incorporate real-rate proxies, USD indexes, and volatility filters to condition entries/exits.

Portfolio construction: gold is often used as a diversifier/hedge. Mainstream guidance frequently cites a 5–10% allocation range in diversified portfolios—always adapt to mandate and risk tolerance.

Scenario analysis: stress-test against shocks (policy surprises, liquidity squeezes).

Data hygiene: align time zones, holiday calendars, and fixing vs. spot conventions; document any survivorship or vendor corrections.

Data accuracy notes

The 1980. 2008. 2011. 2020. and March 2025 >$3.000 milestones are confirmed by long-standing references and reputable outlets.

Seasonality observations draw from World Gold Council research (Dec 2023) and a peer-reviewed decomposition study; both highlight tendencies rather than certainties.

Claims about data availability and format rely on information provided directly by the original sources.

Contextual insights, including long-run inflation-adjusted trends and downloadable archives, are based on authoritative publications.

Macro drivers—such as USD movements, real yields, and central-bank buying—are supported by verified reporting on reserve-manager activity.

Reminder: XAU/USD is a spot quote. If you compare it with LBMA fixes or futures (GC), expect minor differences. Always state which benchmark your analysis uses.

Conclusion: Why Diving into XAU/USD History Pays Off

Studying XAU/USD historical data isn't just number-crunching—it's a roadmap for smarter decisions:

Spot Trends Before They Hit: Long-term bull and bear cycles reveal patterns that can hint at future price swings.

Unlock Technical Insights: Past highs, lows, and congestion zones often become key levels of support or resistance.

Sharpen Risk Management: Understanding gold's reactions in different market conditions helps protect and hedge your portfolio.

Refine Your Strategies: Back-testing trading plans against historical data lets you see how they perform across market cycles.

Blending these historical insights with real-time developments gives traders and investors a clearer, more confident edge in the XAU/USD market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.