Ever wondered why EUR/USD barely moves late at night but suddenly spikes during the New York morning? The answer is simple: forex time zones dictate when markets are most active.

The forex market runs 24 hours a day, but not all hours are equal. The London-New York overlap (8 a.m.-12 p.m. New York time) is consistently the most active window, with tight spreads and high volatility, while the overlaps between Tokyo-London and Sydney-Tokyo are also essential for JPY and AUD pairs.

In this guide, we'll break down how forex time zones really work, how Daylight Saving Time (DST) shifts your trading clock, and the best trading hours for each major currency pair, no matter where you live.

24-Hour Global Forex Time Zones

| Session |

UTC Time (Year-Round) |

New York (EST/EDT) |

London (GMT/BST) |

India (IST) |

Philippines (PHT) |

Sydney (AEST/AEDT) |

| Sydney |

21:00 - 06:00 |

4:00 p.m. - 1:00 a.m. |

9:00 p.m. - 6:00 a.m. |

2:30 a.m. - 11:30 a.m. |

5:00 a.m. - 2:00 p.m. |

7:00 a.m. - 4:00 p.m. (AEST) / 8:00 a.m. - 5:00 p.m. (AEDT) |

| Tokyo |

00:00 - 09:00 |

7:00 p.m. - 4:00 a.m. |

12:00 a.m. - 9:00 a.m. |

5:30 a.m. - 2:30 p.m. |

8:00 a.m. - 5:00 p.m. |

10:00 a.m. - 7:00 p.m. (AEST) / 11:00 a.m. - 8:00 p.m. (AEDT) |

| London |

07:00 - 16:00 |

2:00 a.m. - 11:00 a.m. |

7:00 a.m. - 4:00 p.m. |

12:30 p.m. - 9:30 p.m. |

3:00 p.m. - 12:00 a.m. |

5:00 p.m. - 2:00 a.m. (AEST) / 6:00 p.m. - 3:00 a.m. (AEDT) |

| New York |

13:00 - 22:00 |

8:00 a.m. - 5:00 p.m. |

1:00 p.m. - 10:00 p.m. |

6:30 p.m. - 3:30 a.m. |

9:00 p.m. - 6:00 a.m. |

11:00 p.m. - 8:00 a.m. (AEST) / 12:00 a.m. - 9:00 a.m. (AEDT) |

Unlike stocks, the spot FX market runs 24 hours a day, five days a week. Liquidity follows the sun as regional dealing hubs open and shut: Sydney → Tokyo → London → New York.

Because majors trade across continents, you get rolling liquidity, with overlaps producing the thickest order books and tightest spreads.

At a high level (in UTC, year-round reference):

Sydney session: ~21:00-06:00 UTC

Tokyo session: ~00:00-09:00 UTC

London session: ~07:00-16:00 UTC

New York session: ~13:00-22:00 UTC

These are widely used "training-wheels" times; actual bank/ECN liquidity rises and fades around them, and DST in the U.K. and U.S. shifts the local clocks by one hour for part of the year, which is why UTC is your safest anchor.

What Are The Three Big Forex Time Zones that Overlap?

1) London-New York (LDN-NY)

Roughly 8:00 a.m.-12:00 p.m. New York time (four hours).

Europe and America interact closely; USD, EUR, and GBP flows peak during these hours, and most U.S. data releases occur at this time.

Historically, the busiest and often most directional block of the trading day for pairs like EUR/USD, GBP/USD, USD/CAD, and USD/CHF.

2) Tokyo-London (TKO-LDN)

Brief but punchy around the European open; JPY crosses can get a volatility pop as London dealers take over risk from Asia.

3) Sydney-Tokyo (SYD-TKO)

Establishes the tone for Asia, providing clearer technicals and tighter spreads for AUD, NZD, and JPY crosses compared to the quiet end of NY.

What Are The Best Trading Hours By Currency Pair

There's no one "official" best time to trade every pair, but we can rank windows by liquidity, typical news cadence, and historical market participation.

1) EUR/USD

Best: LDN-NY overlap, especially U.S. data at 8:30 a.m. ET (CPI, payrolls, retail sales) and 10:00 a.m. ET (ISM, sentiment) when volatility spikes but spreads remain tight.

Avoid: the dead zone late in New York after 5 p.m. ET unless you're scalping ranges.

2) GBP/USD (Cable)

Best: Optimal trading occurs in the London morning through early overlap; U.K. releases during the early London session combined with later U.S. data can lead to clear two-leg movements (Europe sets the tone while America extends or reverses).

Note: DST makes U.K. data arrive one hour "earlier" vs UTC in summer, plan your alerts accordingly.

3) USD/JPY

Best: Tokyo opens for flow-driven movements, then London takes over for repricing; the LDN-NY handover introduces U.S. event risk that often dictates the day's final direction.

Bonus: Japan has no DST, so Tokyo timing never shifts,a relief for scheduling.

4) AUD/USD & NZD/USD

Best: Sydney-Tokyo hours for spread quality and news flow; commodities headlines can hit any time, but Asia tends to deliver cleaner fills in these pairs.

Caution: Australia's DST changes (Sydney) shift local clocks; keep your watch set to UTC in the calendar.

5) USD/CHF & EUR/CHF

6) Crosses (EUR/JPY, GBP/JPY, EUR/GBP, AUD/JPY)

Daylight Saving Time (DST) in 2025: Why Your "Best Hours" Keep Moving

| Trading Hub |

Standard Time Zone |

DST Start (2025) |

DST End (2025) |

DST Trading Hours (Local) |

Impact on Forex Trading |

| New York (USA) |

EST (UTC -5) |

March 9, 2025 |

November 2, 2025 |

8:00 AM - 5:00 PM EDT |

Moves the overlap with London earlier by 1 hour during DST. |

| London (UK) |

GMT (UTC +0) |

March 30, 2025 |

October 26, 2025 |

8:00 AM - 4:00 PM BST |

Extends overlap with New York in spring/summer, shrinks it in autumn. |

| Sydney (Australia) |

AEST (UTC +10) |

October 5, 2025 |

April 6, 2025 |

8:00 AM - 4:00 PM AEDT |

Market opens 1 hour earlier in global terms during Aussie summer. |

| Tokyo (Japan) |

JST (UTC +9) |

No DST |

No DST |

9:00 AM - 5:00 PM JST |

Always stable; overlaps shift only due to US/Europe changes. |

Takeaway: The LDN-NY overlap (always 8 a.m.-12 p.m. New York time) translates to 12:00-16:00 UTC in the summer and 13:00-17:00 UTC in the winter. Your broker charts may label bars in your local time; thus, double-check against these UTC blocks.

For traders in India (IST) or the Philippines (PHT), the London-New York overlap occurs in the evening, making it convenient for part-time traders after work.

How to Build a Practical Forex Time Zones Trading Strategy?

1) Anchor in UTC

Put the four sessions on your wall in UTC. That "stops the DST pain" once and for all. Use the current Daylight Saving Time (DST) schedule for 2025 to convert the times to your local clock.

2) Pick Two Pairs and Two Windows

Begin with one major USD pair for the LDN-NY overlap and one Asia-centric pair for the Sydney-Tokyo overlap. Consistency is more important than FOMO.

3) Tie Your Setup to Releases

If you trade the overlap, you'll live around 8:30 a.m. and 10:00 a.m. ET. Build a ruleset: what constitutes a trade before data, on the release, and after the dust settles.

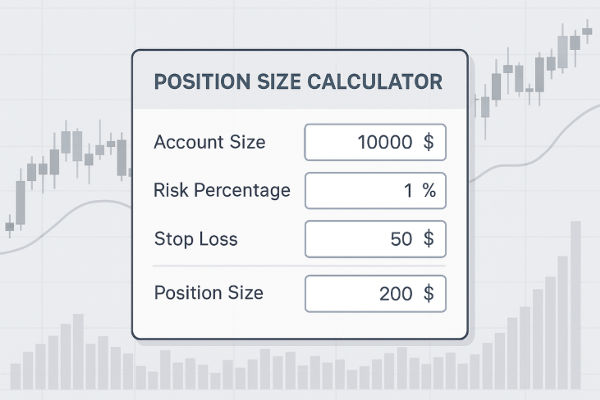

4) Respect the Quiet

Thin hours widen spreads and increase the risk of slippage. If you must trade late New York or illiquid Asia tails, plan for smaller size and wider stops.

5) Keep a One-Page "Time Sheet"

List your pairs, the two best windows for each (in UTC and your local time), and the top three data releases you trade. Update twice a year for DST and forget the rest.

Frequently Asked Questions

1. What Are the Main Forex Trading Sessions?

The four major trading sessions are Sydney, Tokyo, London, and New York. Each session overlaps with others, creating periods of higher liquidity and volatility.

2. What Is the Best Time of Day to Trade Forex?

The peak activity period typically occurs during the London-New York overlap (12:00-16:00 GMT) when both markets are operational, resulting in increased volatility and volume.

3. Do Forex Brokers Adjust Automatically for My Local Time Zone?

Yes, most trading platforms, such as EBC Financial Group, adjust session times to your local time zone. However, during DST transitions, traders should double-check session hours manually to avoid confusion.

Conclusion

In conclusion, forex is a 24-hour market, but not all hours are equal. The biggest opportunities lie in the session overlaps, particularly the London-New York session. For traders in India, the sweet spot is evening hours (6:30 p.m.-9:30 p.m. IST), while in the Philippines, it's late night.

By aligning your trading hours with these high-activity windows, you can maximise efficiency and trade smarter across global markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.